Guangdong Adjusts Base Figure for Social Insurance Contributions

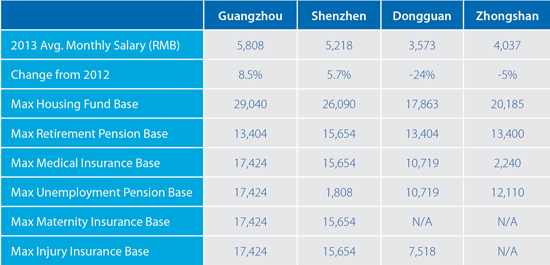

GUANGDONG— Several major cities in Guangdong, including Shenzhen, Dongguan and Guangzhou, recently released details on their average wages in 2013, which are used as the base figures to calculate the minimum and maximum contributions to social insurance and housing funds for employees. The base figure for social security contributions is usually capped at 300 percent of the average salary in the jurisdiction where the employee pays social security. Therefore, lower average salaries (or lower base figures) will lead to lower labor costs for employers.

According to the “Circular on Adjusting the Minimum Base Figure for Retirement Pension Contributions (Yue Ren She Fa [2013] No. 268)” released by the Guangzhou Municipal Human Resources and Social Security (HRSS) Bureau, the maximum base figure for employee retirement pension contributions in 2014 has been adjusted to RMB 13,404 (300 percent of Guangdong’s average salary in 2013, RMB 4,468) while the minimum base figure is set as RMB 2,408.

This means, for example, an employee in Guangdong earning RMB 14,000 per month should make pension payments based on a salary of RMB 13,404 while an employee making only RMB 2,000 would pay based on a figure of RMB 2,408. The base figure was applied to most cities in Guangdong starting on July 1, 2014 and will last until June 30, 2015.

RELATED: Social Insurance Compliance in China

The social insurance schemes of different cities vary in terms of their maximum base figure (e.g., some are based on three times the given city’s average salary, while others are based on the provincial average salary). Details of the specific changes to the social insurance schemes of three major cities in Guangdong are given below.

Shenzhen

The average monthly salary of employees in Shenzhen in 2013 was RMB 5,218. Accordingly, on June 30, 2014, the city’s Housing Fund Management released the 2014 housing fund contribution base figures. The maximum housing fund contribution base was adjusted to five times the 2013 average monthly salary figure, i.e. RMB 5,218 x 5 = RMB 26,090. The method of calculating the base figures for housing fund contributions differs based on the specific location.

Dongguan

The average monthly salary of employees in Dongguan last year was RMB 3,573 (a nearly 25 percent reduction from RMB 4,751 in 2012). Notably, Dongguan lowered its average wage in an effort to keep companies from moving outside the city. The city’s 2014 maximum housing fund contribution base was significantly lowered to 17,863 from 23,757 in 2013.

Guangzhou

The average monthly salary of employees in Guangzhou last year was RMB 5,808. Except for retirement pension contributions (which are calculated based on the provincial average salary for Guangdong), all the other types of social insurance contributions are calculated at 300 percent of the average monthly salary in Guangzhou.

Zhongshan

The average monthly salary of employees in Zhongshan last year was RMB 4,037, down five percent from RMB 4,618 in 2012.

The chart below shows the updated average salaries and the resulting social insurance and housing fund maximum contribution bases for all four cities:

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Social Insurance in China

Social Insurance in China

In this issue of China Briefing Magazine, we introduce China’s current social insurance system and provide an update on the status of foreigners’ participation in the system. We also include a comprehensive chart of updated average wages across China, which is used to calculate social insurance contribution floors and ceilings. We hope this will give you a better understanding of the system in China.

Payroll Processing Across Asia

Payroll Processing Across Asia

In this edition of Asia Briefing Magazine, we provide a country-by-country introduction to how payroll and social insurance systems work in China, Hong Kong, Vietnam, India and Singapore. We also compare three distinct models companies use to manage their payroll across various countries with external vendors, and explain the differences among three main models: country-by-country, managed, and integrated models while highlighting some benefits and drawbacks of each.

- Previous Article Stalled China-Taiwan Trade Talks to be Resumed by End of Month

- Next Article Chengdu Joins Shanghai & Pingtan in Adopting a Negative List for Foreign Investment