Getting Growth into Asia – the ASEAN Option

As I examined last week, China’s GDP growth can be expected to be at an actual rate of about 3 percent nationally for 2015. Based on statistics provided by China’s own National Statistic Bureau and the China Economic Times, the data provides strong evidence that the slowdown in China is real, has been happening for some time, and is likely to stay for perhaps the next five years and beyond.

That this coincides with an increasingly expensive, competitive and non-level playing field also exacerbates the problems for foreign investors in China charged with getting growth and profitability back into their bottom lines. Consequently, an issue facing many manufacturing directors in Asia is this – how much business is dependent upon China? It is rapidly becoming obvious that a 100 percent China dependency is going to cause problems. In this article, I look at ASEAN as a China option.

Option ASEAN

The ASEAN nations of Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam are something of a mixed bag. There are opportunities in all of them, yet several, and Cambodia, Laos and Myanmar especially, are at a very early stage of their development; a miss-match that effectively terminated discussions over the proposed ASEAN-EU Free Trade Agreement back in 2009.

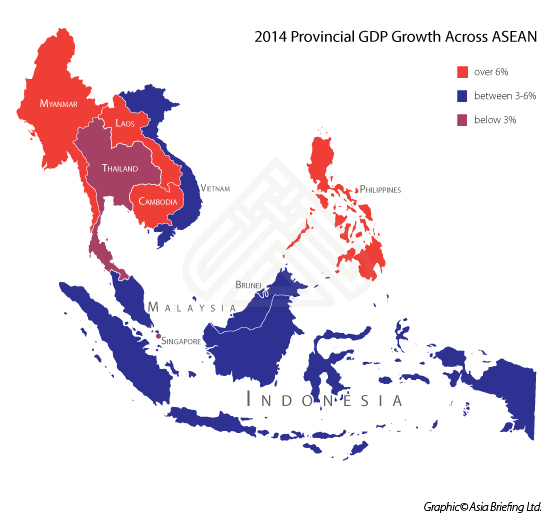

In the map below, we can see the average GDP growth rate across ASEAN for 2014.

There is no doubt that the larger economies have also been affected by the China slowdown. Although the nations of Cambodia, Laos and Myanmar have grown at rates of 6 percent and above, this belies the fact that they come from a very low base and have extremely low human capital rankings. We can also compare them with China’s neighbouring Yunnan Province (GDP Value USD209 billion) as follows:

These three countries alone, although showing high GDP growth rates, have a collective GDP of less than half of China’s Yunnan Province. This goes hand in hand with poor infrastructure, poor labor quality, and low productivity levels. This isn’t to say that smaller industries and entrepreneurs can’t get something out of these countries, because in smaller cottage industries, local arts and crafts can be very good quality. However, on a more industrial scale, they are still not yet up to speed.

Of the remaining nations, Brunei, Malaysia, Singapore and Vietnam are all members of the recently announced United States backed TPP agreement, while Indonesia has given a strong indication that it also wishes to join.

Brunei

Because of the TPP agreement, Brunei will see increased opportunities in the oil and gas industry sectors. The country will continue to support these industries and provide processing and refining facilities for ASEAN members producing crude oil.

Although small, with a population of just 420,000, Brunei still needs to import most other products. Its membership of both the ASEAN and TPP blocs provide opportunities for exporters and importers that qualify.

Given that it is a wealthy country with a high GDP per capita level of US$72,220 (higher than Singapore), opportunities exist for exporters trading high value items. Products such as high quality fashion items geared towards the Islamic fashion industry have specific value for Brunei, while global fashion brands may also consider this small yet lucrative market – especially if their products are manufactured within the ASEAN or TPP blocs. Brunei doesn’t need assistance with its oil and gas industry, and all the MNC players in this field are already there, but selling to this market, as well as developing new industries in Brunei, could be a lucrative option.

![]() RELATED: Business Advisory Services from Dezan Shira & Associates

RELATED: Business Advisory Services from Dezan Shira & Associates

Malaysia

Malaysia’s performance has been erratic and may be problematic in 2016. This is mainly due to its bodged conversion to a GST tax based regime, and allegations of corruption at the highest levels of government. Yet the inclusion of Malaysia into the TPP bloc has finally made up for the aborted attempts to reach an FTA with the United States, which were cancelled in 2006 amidst accusations of Malaysian negotiation naivety.

While domestically the government is somewhat disjointed, the TPP agreement effectively opens up the U.S. markets to Malaysian companies. This means that examining the extent of the TPP deal is of use, as it can be expected that machinery and tooling upgrades will be required to manufacture goods to the standard that Japanese and U.S. consumers demand. This is especially so in the textiles industry, where I discussed the Yarn Forward provision yesterday. However, armed with both membership of ASEAN and TPP, the future should be positive for Malaysia in terms of attracting FDI from Australia, Japan and the U.S., who will all be looking for a combination of inexpensive productivity and processing facilities combined with some manufacturing prowess. Equipment suppliers should take note.

Per Capita GDP: USD10,538

Singapore

Singapore will have to make some changes as a result of the TPP agreement. One of the largest ports in the world, it is also a major source of transhipped pirated or other illegally sourced products entering North America. The Singaporean government will be looking at technologies that improve the monitoring of cargo.

The Singaporean banking sector can expect to boom, as will the overall services sector. Singapore has an existing and highly successful FTA with the United States; savvy American investors looking at setting up operations in Malaysia or Vietnam will be looking at Singapore’s low tax rates and position as a regional hub.

Per Capita GDP: USD55,182

Vietnam

Vietnam is expected to add 15 percent growth to its GDP via membership of the TPP. However, to do so it has to pass through a number of structural changes impacting both its regulatory regime and government control, and will have to upgrade its banking, communications and IP standards. It also needs to undertake a massive upgrade of its entire manufacturing and processing industries. To achieve this, the Vietnamese government knows that they need foreign investment.

The benefit of selling to the highly lucrative Japanese and U.S. markets will drive this, but much of this investment will be geared towards processing raw materials, such as cotton, silks, linen and wool from other TPP members, then re-exporting them. The government is also providing encouragement by reducing corporate income tax to 22 percent, with a further reduction to 20 percent scheduled for 2020. Armed with its ASEAN and TPP memberships, Vietnam is now looking to be a major recipient of FDI over the next five years.

Per Capita GDP: USD1,910

The remaining three ASEAN members of Indonesia, Philippines and Thailand are all significant economic players, but may be somewhat overshadowed in the next few years as they are not part of the TPP bloc. That said, the idea of having a “TPP + 3” has already been raised – the Indonesian President, Joko Widodo, is an advocate of free trade and expressed high interest in Indonesia joining the TPP at meetings with American President Obama in late October. We can compare these ASEAN giants with China’s GDP size by province as follows:

Indonesia

Indonesia is close to becoming a trillion dollar economy and is likely to do so once infrastructure work currently underway is completed. Its worker age demographic dividend is also now starting to take effect, with the average cost of an Indonesian worker about 40 percent of that in China. It also has a large population of 256 million and a rapidly growing middle class of about 74 million, expected to rise to 141 million by 2020. That alone makes Indonesia a suitable target for expansion and exports. This is best achieved from an ASEAN base in order to take advantage of the intra-ASEAN agreement, or from China, India and Australia, all of which have their own FTA with ASEAN. Infrastructure problems remain, yet are being tackled. Getting an early ticket into a market this size should be on the radar of all Asian executives.

Per Capita GDP Indonesia: USD3,475

Per Capita GDP Shandong: USD9,911

Philippines

The Philippines has been quietly transforming its economy into one that is largely service-based. It may yet start to become a major regional player in this, assuming it too can get much needed infrastructure upgrades in place. It is already attracting large numbers of Chinese tourists into its casinos at Makati, away from the prying eyes of China’s Public Security Bureau in Macau.

With English widely spoken and a relatively well educated workforce, the Philippines is an economy in transition at present, yet it has already become one of the world’s largest recipients of FDI in the Business Process Outsourcing (BPO) industries. Service based industries on a multinational scale should be looking at the Philippines as an affordable, adaptable and sustainable market. Key to this is tax reform, and attention to how this develops will dictate the optimum time to invest.

Per Capita GDP Philippines: USD2,828

Per Capita GDP Shaanxi: USD5,708

Thailand

Thailand is getting itself back on track under Military supervision following the coup in 2014. Possessing relatively good infrastructure and access to cheap imported labor from borders with Laos and Myanmar, it remains a major player in ASEAN and one of its most wealthy nations.

The onus at present is on getting political and social stability into the country and, although trade remains buoyant, it will not achieve this until a civilian government can be elected to re-energize the country’s economy. That said, it does possess a wealthy middle consumer class and has a worker age demographic. Thailand’s relatively low key performance cannot be expected to be terminal.

Per Capita GDP Thailand: USD5,774

Per Capita GDP Fujian: USD10,333

ASEAN offers plenty to think about for the Asia investor, but the newly signed TPP agreement can be expected to give these member countries a significant boost. When looking at alternatives to China and new growth potential, Vietnam, Singapore and, to a lesser extent, Malaysia all show excellent promise. Brunei too, although a relatively small market, may prove of interest to Muslim traders and especially to those in the high end fashion, accessory and related hi-tech industries. Indonesia is a nation to watch if it successfully concludes TPP negotiations; this will grant the country access to the North American and Japanese markets, and will also add pressure to China to either reform or risk being left behind.

The Philippines has quietly been pursuing its own path towards developing a significant services sector, while Thailand can also be expected to bounce back in time. In the next part of this series, I look at the potential for generating growth in India.

|

Chris can be followed on Twitter at @CDE_Asia. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

|

![]()

Doing Business in ASEAN

Doing Business in ASEAN

Doing Business in ASEAN introduces the fundamentals of investing in the 10-nation ASEAN bloc, concentrating on economics, trade, corporate establishment and taxation. We also include the latest development news in our “Important Updates” section for each country, with the intent to provide an executive assessment of the varying component parts of ASEAN, assessing each member state and providing the most up-to-date economic and demographic data on each. Additional research and commentary on ASEAN’s relationships with China, India and Australia is also provided.

Investing in Vietnam: Corporate Entities, Governance and VAT

Investing in Vietnam: Corporate Entities, Governance and VAT

In this issue of Vietnam Briefing Magazine, we provide readers with an understanding of the impact of Vietnam’s new Laws on Enterprises and Investment. We begin by discussing the various forms of corporate entities which foreign investors may establish in Vietnam. We then explain the corporate governance framework under the new Law on Enterprises, before showing you how Vietnam’s VAT invoice system works in practice.

The Asia Sourcing Guide 2015

The Asia Sourcing Guide 2015

In this issue of Asia Briefing, we explain how and why the Asian sourcing market is changing, compare wage overheads, and look at where certain types of products are being manufactured and exported. We discuss the impact of ASEAN’s Free Trade Agreements with China and India, and highlight the options available for establishing a sourcing model in three locations: Vietnam, China, and India. Finally, we examines the differences in quality control in each of these markets.

- Previous Article The U.S. TPP “Yarn Forward” Program and Implications for China & Vietnam

- Next Article The TPP – Good for U.S., Australian and New Zealand Exports and Malaysia & Vietnam’s Processing Trade