Exploring China’s Leading AI Hubs: A Regional Analysis

China’s artificial intelligence (AI) industry is experiencing unprecedented growth, driven by significant advancements and investments in key cities. Beijing, Shanghai, and Shenzhen are at the forefront of this transformation, each contributing uniquely to the AI revolution. This article explores the distinct opportunities and strategic advantages these cities offer to investors, highlighting their roles in shaping the future of China’s AI industry landscape.

In recent years, the Chinese government has demonstrated a strong commitment to advancing research and development (R&D) in big data and artificial intelligence (AI), particularly through the promotion of AI+ initiatives. By the first quarter of 2024, the Chinese mainland hosted over 4,500 AI companies, representing 15 percent of the global total. To accelerate the industry’s growth and maturity, China is actively integrating AI technology across various sectors, including healthcare, education, finance, and urban management, thereby fostering innovation and enhancing efficiency in these fields.

Leading the charge in AI development are China’s major cities, particularly Beijing, Shanghai, and Shenzhen. These cities benefit from vast downstream markets and numerous applicable sectors, positioning them at the forefront of the AI boom that has surged since 2020. China’s AI industry has experienced rapid expansion, consistently achieving an annual growth rate of over 10 percent between 2018 and 2022. According to the China Academy of Information and Communications Technology (CAICT), the added value of core AI industry in China reached RMB 508 billion (US$75 billion) in 2022, marking an 18 percent year-on-year growth.

This growth aligns with China’s broader economic goals, as outlined in the 14th Five-Year Plan (2021-2025), which aims for the data industry to comprise 10 percent of the country’s GDP, underscoring the strategic importance of AI in driving China’s future economic development. Relevant institutions predict that China’s AI industry is expected to reach a scale of RMB 1.73 trillion (US$257 billion) by 2035, accounting for 30.6 percent of the global market.

In this article, we will closely examine how Beijing, Shanghai, and Shenzhen lead in AI industry development. We’ll break down the AI value chain, showing how each city excels in different segments—from foundational research in Beijing to cutting-edge applications in Shanghai and intelligent manufacturing in Shenzhen. We’ll also highlight the crucial role of government support and AI industrial parks in driving innovation.

Mapping the AI industry value chain

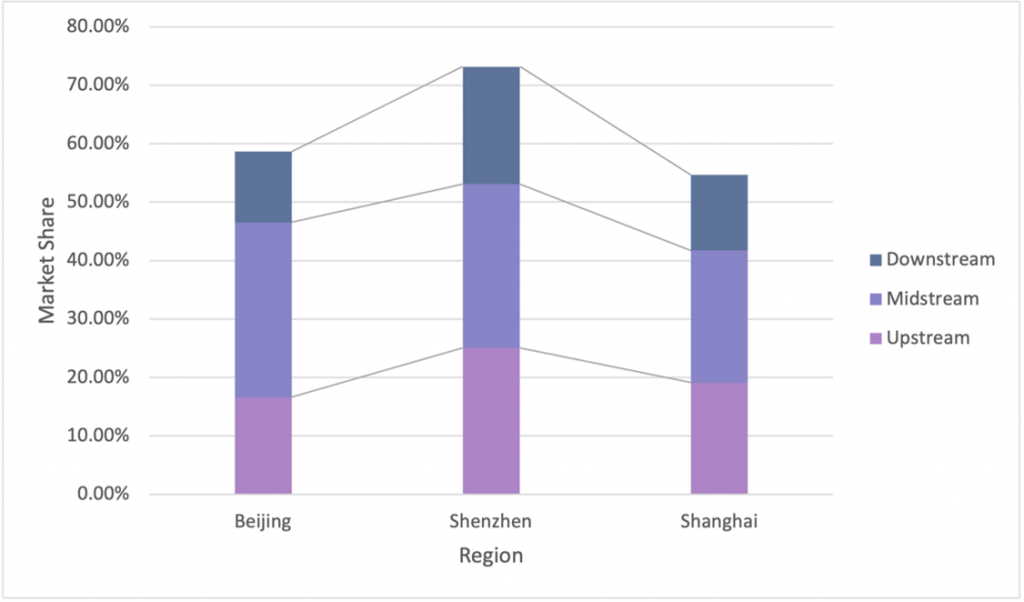

The AI industry chain in China is divided into three critical segments: upstream, midstream, and downstream layers.

The upstream segment, or foundational layer, includes data and computation resources—such as data collection and analysis—along with hardware infrastructure like R&D and manufacturing of sensors, AI chips, and computing platforms. Companies in this segment typically enjoy strong profitability, with gross profit margins exceeding 30 percent.

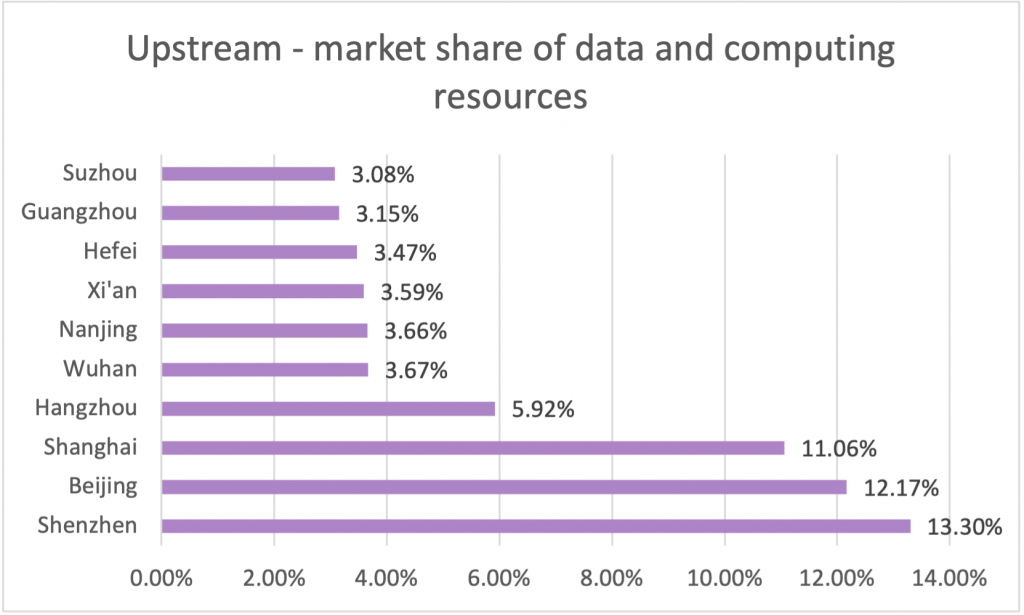

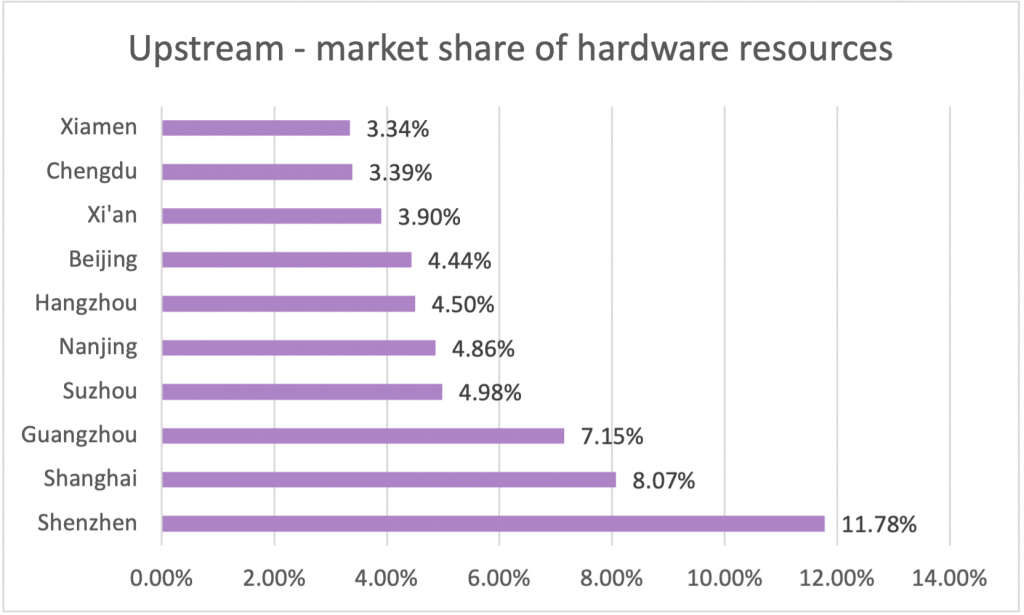

In 2023, Shenzhen led the upstream market in both data and computation resources and hardware infrastructure, accounting for 13.33 percent and 11.78 percent of the national total, respectively. Beijing and Shanghai ranked second and third in data and computation resources, with 12.17 percent and 11.06 percent of the national total, respectively. Shanghai also ranked second in hardware infrastructure, accounting for 8.07 percent of the national total.

Additionally, smart manufacturing powerhouses, such as Guangzhou, Suzhou, and Xiamen, are prominent players in this sector. Notable products driving upstream application development include Suzhou Menxin Co., Ltd.’s MEMS chips, and Wuhan Zhongke Kouyuan’s quantum precision measurement sensors.

Looking ahead, the AI industrial market is expected to see increased attention to upstream data collection due to the increasing volume of demand from the downstream. The computational power and advanced hardware infrastructure in these leading cities will likely attract new, emerging companies, fostering further growth in these regions.

The midstream segment, known as the technology layer, acts as a crucial bridge between the foundational and application layers. This segment encompasses general algorithms (including the development and application of machine learning, knowledge graphs, and other intelligent algorithms) and domain-specific technologies (referring to various technical research areas, such as computer vision, natural language processing, speech processing, human-computer interaction, and virtual/augmented reality technologies).

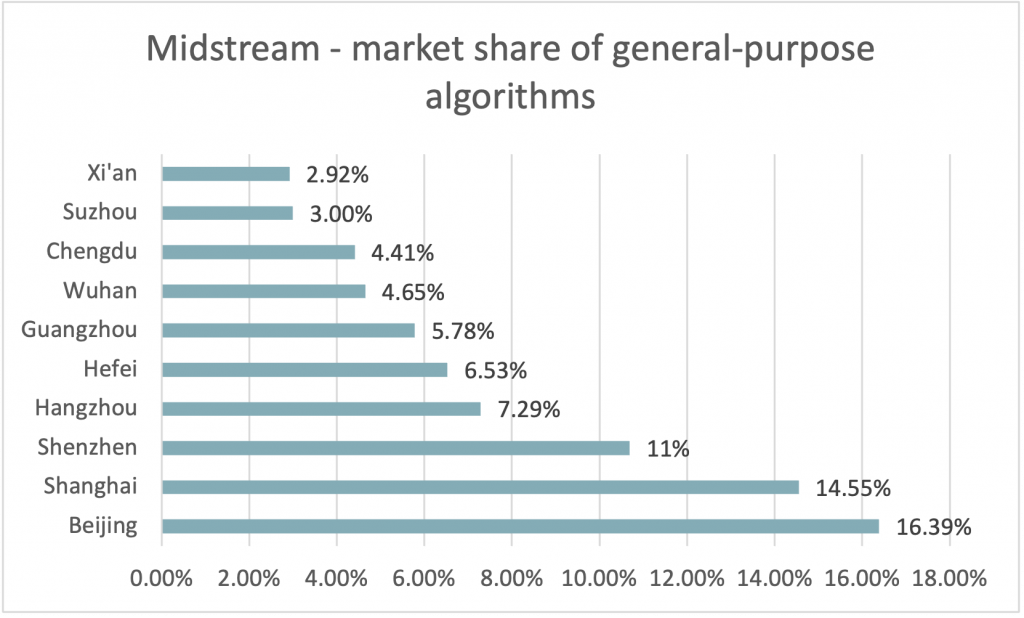

Beijing and Shanghai significantly outperformed other cities in general algorithms. In 2023, Beijing led this sector with a market share of 19.29 percent, followed by Shanghai’s share of 14.55 percent. Shenzhen ranked third in this sector, with a share of 10.69 percent. By the end of 2023, 41.11 percent of financing projects centered on deep learning algorithms were based in Beijing. Beyond these three primary hubs, Hangzhou and Hefei are emerging as significant growth centers.

Regarding domain-specific technologies, Shenzhen has recently secured the top position in this sector by nurturing a series of unicorn companies, such as IHS Intelligent Haptronic Solutions, Evolution Dynamics, and Deep Future. Additionally, Hefei’s “China Voice Valley” is at the forefront of the nation’s advancements in Natural Language Processing (NLP) and speech processing technologies. Shanghai’s “Zhangjiang AI Island” is also a notable industrial cluster in this segment.

In the AI industry chain, the midstream segment is the most significant in terms of innovation and industry value. Currently, China’s market profit margins in this segment vary widely, ranging from 25 percent to 80 percent. Consequently, strengthening capabilities in the midstream segment has become a central strategy for improving the overall industry chain in these cities and other emerging AI regions.

The downstream segment, or application layer, is focused on industry-specific solutions and product services. With its large population base, China is experiencing rapid and robust growth in this sector. From smart homes and autonomous driving to AI-supported city management systems, industry solutions in this segment command higher gross profit margins than product services due to their customized applications and value-added nature. Across all AI industry segments, profit margins remain strong, highlighting the sector’s lucrative potential.

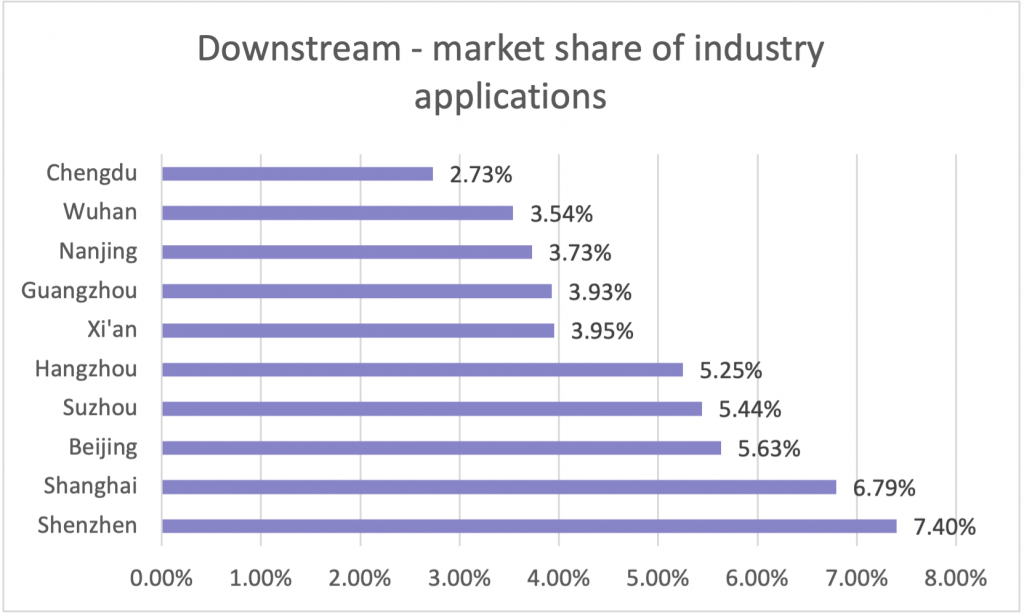

Shenzhen continues to lead in this segment. The Shenzhen New Generation Industrial Park emphasizes smart and digital technologies, with a particular focus on 5G applications and fintech. Additionally, many new first-tier cities have developed leading companies in specialized fields, such as Suzhou’s Yuan Ye Technology in wearable robotics and Wuhan’s Oupai in smart home technology.

Compared to upstream and midstream segments, the concentration of downstream industry applications is lower. This presents an opportunity for more cities to leverage the “AI+” concept and drive AI industrial development. China holds significant potential for expanding businesses in the downstream segment.

AI developments in key technology hubs

The distribution of upstream, midstream, and downstream segments in the AI industry across China reveals the comparative regional advantages in AI development. Beijing, Shanghai, and Shenzhen stand out in all three segments have collectively provided the thrust to lead China’s AI industry development.

Beijing leads with its strong emphasis on core algorithm development and foundational technology R&D. Its robust talent pool and mature industrial ecosystem make it a prime location for advanced technology projects and midstream development. Beijing will be an ideal location for investors seeking opportunities in comprehensive and high-tech urban projects.

Shanghai and Shenzhen have well-established industrial ecosystems. Shanghai is a significant hub for industrial concentration and downstream application development in sectors, such as manufacturing, healthcare, and finance. It offers a balanced environment for integrating AI into existing industries and overcoming regulatory challenges, which makes it suitable for businesses looking to build and scale AI solutions in a regulated market.

Shenzhen’s dynamic corporate culture and focus on electronic information and communication leads the completed ecosystem of AI technology innovation with strong growth potential in specific fields like smart robotics and autonomous systems. The city’s emphasis on emerging technologies and its “leading goose” effect highlights its potential for high-growth investments in next-generation AI applications.

In the following sections, we will provide a closer look at each city, with a balanced analysis of their advantages and development goals.

Beijing

Beijing boasts robust academic institutions and world-class research facilities. Its focus on integrating AI into key sectors, such as healthcare, finance, and public security, is driving significant advancements and positioning the city at the forefront of AI technology.

Government initiatives and policy support:

The Beijing city government has enacted comprehensive policies to bolster the AI industry. These measures include substantial funding for AI research and development and initiatives aimed at fostering collaboration between academia, industry, and government. The city has outlined a roadmap to position Beijing as a global AI leader by 2030. The strategic goals, detailed in the Implementation Plan of Beijing Municipality for Accelerating the Building of an Artificial Intelligence Innovation Hub with Global Influence (2023-2025), focus on advancing AI research, enhancing AI infrastructure, and promoting AI applications across various sectors. This includes breakthroughs in key technologies, development of domestic AI chips, and fostering an innovation-friendly environment. These objectives are designed to support Beijing’s ambition of becoming a global AI innovation hub by 2025.

AI industrial parks and innovation zones:

Beijing is home to several AI-focused industrial parks, such as the Zhongguancun Science Park, often referred to as China’s Silicon Valley. These parks are hubs for AI innovation, hosting a concentration of AI startups, research institutions, and technology companies. The Haidian District is a hotspot for AI development, with numerous AI labs, incubators, and tech companies driving advancements in machine learning, natural language processing, and computer vision. These zones provide investors with access to cutting-edge research and a collaborative ecosystem that supports the growth of AI enterprises.

The city’s extensive network of universities and research institutions, including Tsinghua University and Peking University, produces a steady stream of AI talent. Beijing is also home to leading AI research centers and labs, such as the Beijing Academy of Artificial Intelligence (BAAI), which are at the forefront of AI research globally. The concentration of AI talent in Beijing makes it an attractive destination for companies and investors looking to tap into one of the world’s most vibrant AI ecosystems.

For potential investors, Beijing offers a rich landscape of opportunities in the AI sector. The city’s leadership in AI research and its strategic focus on AI applications in key sectors, such as smart cities, autonomous vehicles, and AI-powered healthcare, create significant investment potential. Beijing’s commitment to building a world-class AI infrastructure, including the development of AI supercomputing centers and AI cloud platforms, further enhances its attractiveness to investors. The city’s proactive approach to supporting AI startups, through funding, incubation, and market access, makes it a prime location for venture capital and private equity investment.

Beijing’s AI development outlook is exceptionally strong, with the city well-positioned to lead global advancements in AI technology. The combination of government support, a rich talent pool, and a thriving AI ecosystem provides a fertile ground for investment and innovation. As Beijing continues to advance its AI capabilities and integrate AI into various sectors, it presents a compelling case for businesses and investors looking to engage with one of the most dynamic AI markets in the world.

Shanghai

Shanghai is currently recognized as the world’s first “All-Optical Network Smart City,” having fully established gigabit optical networks across various sectors, including the digital economy, industrial internet, remote work, contactless economy, and comprehensive e-commerce. By the end of the 14th Five-Year Plan in 2025, Shanghai aims to surpass US$350 billion in the AI core industry scale, with the total industry scale expected to reach US$560 billion.

Government support and incentives:

Since 2019, the Shanghai municipal government has introduced over a hundred policies to protect and encourage the development of the AI industry. Shanghai has introduced China’s first provincial-level regulation for AI development and developed the first local Five-Year Plan and standard system for AI. Shanghai has also implemented the nation’s first algorithm innovation action plan and continuously updates its supportive policies for Intelligent Connected Vehicles (ICVs). These comprehensive measures highlight Shanghai’s commitment to becoming a global leader in AI and create a supportive environment that drives innovation and attracts investment in this cutting-edge sector.

By 2025, Shanghai aims to grow its AI industry to US$55.11 billion, reflecting an annual growth rate of over 12 percent. The government has established a US$13.8 billion parent fund to support key sectors, including AI, semiconductors, and biomedicine. Additionally, the city collaborates with banks to provide substantial line of credit amounting to US$14 billion to enterprises including small and medium-sized enterprises, further enhancing the financial support available to businesses in the AI sector.

Investment opportunities in AI parks:

Shanghai is developing AI industrial parks, including Zhangjiang AI Island (home to innovative and renowned companies such as Alibaba), Xuhui West Bund Wisdom Island (which houses top-tier companies and research institutions like Huawei and Tencent), and Minhang Maqiao AI Innovation Experimental Zone (focused on intelligent transportation and robotics R&D). These parks provide unique opportunities for businesses to establish a presence in Shanghai, benefiting from the city’s advanced infrastructure and strategic location.

The government is continuously providing additional support and policy benefits in areas such as intellectual property protection, public listings, investment and financing, and rent reductions for these parks.

Growing AI ecosystem:

The primary strengths of Shanghai’s AI industry include a highly developed AI ecosystem with over 1,100 core AI companies and more than 100,000 professionals working in the sector. This concentration of talent and resources creates an environment ripe for innovation and growth. Most employees in the AI industry are young professionals, offering Shanghai immense potential for growth in the AI sector. Furthermore, Shanghai’s status as a leading “dual-gigabit city” enhances its capability to support large-scale AI applications and development.

In addition to the established companies, Shanghai is home to emerging projects in intelligent chips, autonomous driving, and intelligent robots. Notable companies and projects in these fields are contributing to Shanghai’s reputation as a global leader in AI innovation. For investors, these projects offer opportunities to engage with cutting-edge technology that is shaping the future of multiple industries.

Compared to the upstream and midstream sectors, Shanghai’s downstream industries have a higher number of enterprises, particularly in industry-specific solutions (e.g., AI + healthcare, AI + education) and product services (e.g., autonomous driving, drones). The midstream sector, with only five companies, indicates significant potential for growth in software frameworks and algorithm models in Shanghai.

For potential investors and business owners, Shanghai presents a dynamic environment with significant opportunities in the AI sector. With strong government support, a robust AI ecosystem, and rapidly growing market demand, Shanghai is poised to remain at the forefront of AI development, making it an attractive destination for investment. The city’s long-term vision for AI, combined with its strategic initiatives and thriving industrial parks, offers investors a promising landscape for sustained growth and innovation in the AI industry.

Shenzhen

Shenzhen, often referred to as China’s Silicon Valley, is rapidly establishing itself as a leading force in the field of AI. Leveraging its robust technology ecosystem, spearheaded by prominent tech giants such as Huawei, Tencent, and DJI, Shenzhen is poised to become a global leader in AI innovation. The city’s strategic emphasis on intelligent manufacturing, AI-driven services, and cutting-edge research underscores its commitment to spearheading the next wave of AI development in China.

Government support and incentives:

The city government unveiled a comprehensive action plan on July 30, 2024, to advance next-generation AI technologies and seize emerging opportunities in the sector. This plan prioritizes four critical areas: ecosystem innovation, intelligent products, application scenarios, and smart connected vehicles. A centerpiece of this initiative is the establishment of a high-performance intelligent computing center boasting 4,000 PFLOPS of computing power. Shenzhen aims to drive AI innovation through targeted core technology development, the creation of a key research platform, and the establishment of an ecosystem innovation hub.

Shenzhen’s AI industrial zones are pivotal to its strategy, serving as epicenters for research, development, and application. The city has established three major AI industrial clusters in Shenzhen Bay, Qianhai Bay, and Futian District, as announced during the Beijing-Shenzhen Industrial Cooperation Meeting. These clusters are part of a broader strategy that includes seven additional AI-focused areas: Xili-Shiyan, Bantian, Universiade area in Longgang, Longhua Central Axis, Qingshuihe in Luohu, Pingshan’s high-tech zone, and Guangming Science Town. This strategic distribution underscores Shenzhen’s commitment to becoming a global leader in AI technologies. These zones offer advanced infrastructure, access to top-tier talent, and a collaborative environment that nurtures innovation.

Dynamic ecosystem and investment opportunities:

Shenzhen has been recognized as a leader in software development, as evidenced by its top position in the China Software Development Index released by the Ministry of Industry and Information Technology. The city’s software sector is robust, with numerous software parks spread across Nanshan, Longgang, Futian, Luohu, Bao’an, and Longhua districts. Collectively, these parks host approximately 400 national-level software enterprises, reflecting Shenzhen’s strength in this critical industrial pillar.

Shenzhen’s AI ecosystem benefits from a robust network of universities, research institutions, and technology companies that drive technological advancement. The city leads in AI-related patent filings, underscoring its dedication to pioneering research. Shenzhen’s integration of AI with other advanced technologies, including 5G and the Internet of Things (IoT), is generating new application opportunities across diverse sectors such as healthcare, finance, and transportation.

For investors, Shenzhen presents a vibrant environment with abundant opportunities in the AI sector. Positioned strategically within the Greater Bay Area, the city offers access to a large and expanding market for AI products and services. Shenzhen’s focus on AI-driven intelligent manufacturing and smart city initiatives provides lucrative prospects in fields such as robotics, autonomous vehicles, and AI-powered urban management systems. Moreover, the city’s proactive stance on fostering innovation and entrepreneurship makes it a compelling destination for venture capital and private equity investments.

Shenzhen’s trajectory in AI development is exceptionally promising. The synergy of strong government support, a flourishing tech ecosystem, and strategically designed industrial zones positions Shenzhen as an ideal location for businesses and investors aiming to engage with the burgeoning AI market. Shenzhen’s software ecosystem is thriving, with leading enterprises like Huawei and Kingdee establishing a strong presence. The city’s industrial parks nurture both large and specialized small to medium-sized software companies, creating a dynamic environment for innovation and growth in the software sector.

Conclusion

Beijing, Shanghai, and Shenzhen represent the forefront of China’s AI revolution, with each city offering distinct advantages and opportunities. Investors and businesses looking to engage with China’s AI market will find compelling prospects in these hubs, each contributing to a rapidly evolving and highly lucrative sector. As China continues to push the boundaries of AI technology, these cities will undoubtedly play crucial roles in shaping the future of artificial intelligence on a global scale.

Investors can explore diverse opportunities across China’s AI hubs:

- Beijing’s AI development focuses on enhancing the autonomous innovation capabilities of large models and promoting standardized, large-scale, and cross-disciplinary application pathways. Leveraging the capital’s industry resources and technological innovation capabilities, Beijing has organized and implemented a series of comprehensive and benchmark major application projects in fields such as robotics, education, healthcare, culture, and transportation. Through these benchmark applications and demonstration projects, Beijing aims to achieve breakthroughs in core technologies of large models and improve the technological level and service quality of key industries.

- As one of Shanghai’s three leading industries, AI has formed a relatively complete industrial cluster. Shanghai promotes AI technology innovation and application by leveraging the leading and demonstrative roles of key enterprises. In advancing the “AI+” development, Shanghai emphasizes the coordination of innovation entities, innovation resources, regional industries, and regional markets. Additionally, Shanghai is accelerating the construction of intelligent computing clusters, with key deployments in areas such as Songjiang and Lingang, to support large model training.

- Shenzhen focuses on developing intelligent products around high-frequency application scenarios, including smartphones, smart computers, and extended reality (XR) intelligent interaction terminals. Additionally, Shenzhen is promoting the research and application of cutting-edge technologies such as digital humans and AI agents.

The long-term goals and strategic plans of these innovation hub cities indicate a commitment to sustaining growth and innovation in the sector, enhancing the potential for continued returns on investment.

About Us

China Briefing is one of five regional Asia Briefing publications. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong in China. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in Vietnam, Indonesia, Singapore, India, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to China Briefing’s content products, please click here. For support with establishing a business in China or for assistance in analyzing and entering markets, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article China’s New Quality Productive Forces: An Explainer

- Next Article China’s State Council Passes Key Data Security Regulations