Establishing a Company in the Shanghai FTZ

By Yao Lu

Since first opening in September 2013, investors and businesses have flocked to the Shanghai FTZ. According to local media reports, more than 4,600 new companies, including 280 foreign-invested enterprises (FIEs), were established in the Zone as of January 14, 2014. This surge can be attributed to the Zone’s relaxed requirements and streamlined approval procedures for company establishment, which we will further describe below.

Relaxed Incorporation Requirements

The Zone cancels out the minimum registration capital of RMB30,000 for limited liability companies, the RMB100,000 minimum for single shareholder companies, and the RMB5 million minimum for joint stock companies. Moreover, the Shanghai FTZ has implemented a new capital registration system under which foreign investors are no longer required to contribute 15-percent capital within three months and full capital within two years of the FIE’s establishment.

Shareholders of companies established in the Zone may agree upon the contribution amount, forms, and period of contribution at their own discretion. However, shareholders are still liable for the authenticity and legality of capital contributions and will be held accountable to the company within the limits of their respective subscribed capital or shares. The new system has been proven feasible, with the Zone receiving substantial actual capital contribution in the past three months, and was rolled out nationwide on March 1, 2014.

Negative List

The Shanghai FTZ adopts a Negative List approach towards foreign investment management, which specifies restrictions or bans on certain types of foreign investment. Under this approach, foreign investment projects on the Negative List are subject to pre-approval procedures, while foreign investors wishing to set up an FIE in a field not listed need only undergo record-filing procedures with the authorities. The list covers 1,069 businesses in 89 divisions under18 industries, including agriculture, forestry, animal husbandry and fishery; mining; manufacturing; production and supply industries for power, gas and water; construction; and wholesale and retail industries.

This is a big step forward compared to the current Foreign Investment Industrial Guidance Catalogue (positive list) implemented outside of the Zone, under which the procedures for setting up an FIE are complicated and time consuming, involving verification, approval, and registration with the National Development and Reform Commission, the Ministry of Commerce, and the State Administration for Industry and Commerce or their local branches, respectively.

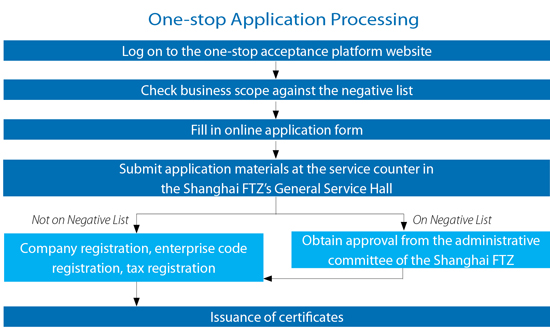

One-stop Application Processing

Similar to procedures for setting up a company elsewhere in China, investors in the Shanghai FTZ must first carry out a company registration in order to obtain a business license. To unburden investors from long and tedious administrative approval procedures, the Shanghai FTZ has established unique to the Zone a “one-stop application processing platform” for company establishment. Under this platform, all application materials will be submitted and handled through the industry and commerce authority (AIC) in the Zone. The approval and filing procedures will be conducted via inter-departmental circulation, after which the various licenses and certificates (including the business license, enterprise code certificate, and tax registration certificate) will be issued to the applicant(s) altogether by the AIC. This means applicants may obtain all necessary documents for company establishment in one place, contrasting with outside the zone where applicants must run around between different authorities for the issuance of various certificates. This effectively reduces the time taken to establish a company in the zone.

The one-stop acceptance platform generally works in the same way for both domestic and foreign investors. The only difference is that foreign investors are required to check their business scope against the negative list to see which procedure they have to go through. According to the local government, the business license, enterprise code certificate, and tax registration certificate can be issued in four working days once an application is accepted. However, due to the large number of company establishment applications in the zone, the actual process may take more than a month.

This article is an excerpt from the March edition of China Briefing Magazine, title “Guide to the Shanghai Free Trade Zone.” In this issue of China Briefing, we introduce the simplified company establishment procedure unique to the zone and the loosening of capital requirements to be applied nation-wide this March. Further, we cover the requirements for setting up a business in the medical, e-commerce, value-added telecommunications, shipping, and banking & finance industries in the zone. We hope this will help you better gauge opportunities in the zone for your particular business.

This article is an excerpt from the March edition of China Briefing Magazine, title “Guide to the Shanghai Free Trade Zone.” In this issue of China Briefing, we introduce the simplified company establishment procedure unique to the zone and the loosening of capital requirements to be applied nation-wide this March. Further, we cover the requirements for setting up a business in the medical, e-commerce, value-added telecommunications, shipping, and banking & finance industries in the zone. We hope this will help you better gauge opportunities in the zone for your particular business.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam in addition to alliances in Indonesia, Malaysia, Philippines and Thailand as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download our brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Foreign Exchange FDI Regulations Loosened in the Shanghai FTZ

Shanghai FTZ Launches Cross-Border E-Commerce Platform

China’s VAT Reform and Its Impact on the Transportation Industry

Shanghai Free Trade Zone Allows Offshore RMB Borrowing

- Previous Article China’s VAT Reform to be Expanded to Telecom Sector

- Next Article China Implements New Annual Reporting System