Cross Border e-Commerce in China: Regulatory Updates and Trends

By Dezan Shira & Associates

Editor: Qian Zhou

With cross border e-Commerce (CBEC) taking an increasing bigger share of the total import and export market, it is of no surprise that the government has taken CBEC regulations more seriously. As consumer complaints and industry speculation over unfair competition increase, regulatory authorities have taken notice.

Foreign companies seeking to pursue business opportunities in China’s booming CBEC market, especially those do not have a business entity in China, need to closely examine the fast changing CBEC rules and regulations.

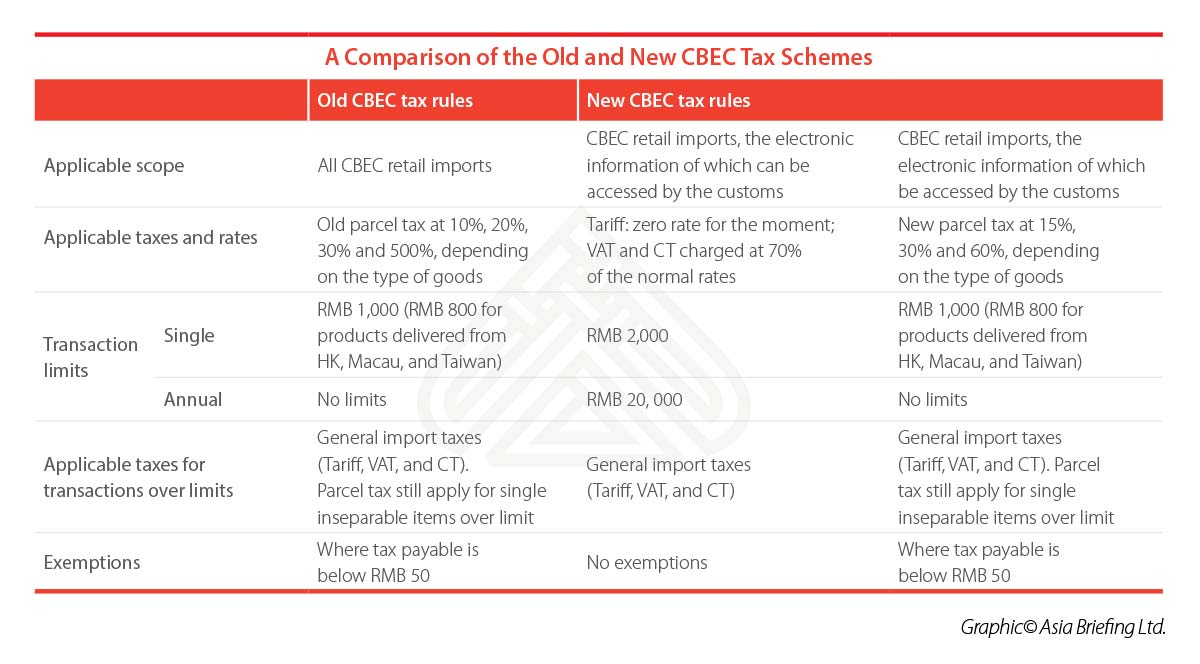

CBEC tax reforms

Prior to April 8, 2016, CBEC purchases in “reasonable quantity for personal use” would be treated as personal parcels subject to parcel tax at rate of 10 percent, 20 percent, 30 percent, and 50 percent, depending on the type of goods. And the parcel tax was exempted if the payable tax amount was lower than RMB 50 (US$7.91).

Nevertheless, on April 8, 2016, this preferential tax policy of treating CBEC packages as personal parcels was overturned, with the so called “April 8 New Policy”—Notice on Taxation Policies for CBEC Retail Imports (Cai Guan Shui [2016] No.18)—coming into force. According to the April 8 New Policy, consumers purchasing goods through CBEC, the electronic information of which can be accessed by the customs, need to pay import taxes including tariffs, value added tax (VAT), and consumption tax (if applicable), though single transactions under RMB 2,000 (around US$317) and yearly transactions under RMB 20,000 (US$3,170) enjoy a temporary zero percent tariff rate and reduced import VAT and CT rates charged at 70 percent of the taxable amount under the general trade. Tax exemptions are no longer available.

![]() RELATED: How to Advertise Online in China through Baidu, Alibaba, and Tencent

RELATED: How to Advertise Online in China through Baidu, Alibaba, and Tencent

If customs cannot access electronic information or CBEC retail goods – such as for products purchased on overseas online shops and delivered directly to China – the goods are subject to parcel tax. However, the parcel tax rates were changed to three levels – 15 percent, 30 percent, and 60 percent – with effect from April 8, 2016. According to the official explanation, the adjusted parcel tax rates would be more or less equal to the corresponding import taxes rates under the general trade model, though the exemption is still available for payable tax amount under RMB 50.

Generally speaking, the overall tax burden is higher for consumers after the switch to the new CBEC tax schemes, especially for transactions that were tax exempted previously where payable tax amount was below RMB 50. However, this may be not true for transactions of certain types of goods.

Generally speaking, the overall tax burden is higher for consumers after the switch to the new CBEC tax schemes, especially for transactions that were tax exempted previously where payable tax amount was below RMB 50. However, this may be not true for transactions of certain types of goods.

![]() RELATED: China Cuts Import Duties on Consumer Goods

RELATED: China Cuts Import Duties on Consumer Goods

For example, a bottle of wine bought through CBEC platforms at RMB 300 (US$47.50) would be subject to parcel tax at rate of 50 percent, or RMB 150 (US$23.80), before April 8, 2016. No exemption was available since the tax amount was over RMB 50 (US$7.90). Nevertheless, after April 8, 2016, the same bottle of wine should be subject to imported taxes of RMB 56.7 (US$9) (tariff at zero for the moment, VAT = RMB 300 × 17% × 70% = RMB 35.7, and CT = RMB 300 × 10% × 70% = RMB21), which means the tax burden in this case is actually lower under the new CBEC tax scheme.

The trend towards a fairer CBEC tax system is inevitable, as authorities wish to balance the competitive advantage of CBEC over traditional general import business. With the abolition of the price advantages, investors that want to engage in this sector should focus more on the quality of their goods and services, the management of their supply chains, and customer satisfaction.

CBEC positive lists and the delayed implementation

Right after the new CBEC tax policy came out, the MOF issued the first “List of CBEC Retail Imports” (the “positive list”), restricting the scope of goods that can and be sold over CBEC.

Accordingly, only goods with the HS code shown on the list can be imported and sold through CBEC platforms – all other goods must be imported under the general trade model.

The following custom clearance and quarantine requirements were also added:

- Registration or record-filing certificates are required for infant formula, first imported cosmetics, medical devices, and special food transacted through CBEC; and

- An AQSIQ clearance form is required for goods imported through the CBEC bonded warehouse model when entering into the bonded warehouse from outside; goods imported through direct shipping model would be exempted from this requirements.

On April 15, 2016, the MOF issued the second positive list. While custom clearance and quarantine requirements are still the same as stipulated in the first list, the second positive list added some popular products that were left out by the first positive list and clarified certain items.

![]() Pre-Investment, Market Entry Strategy Advisory Services from Dezan Shira & Associates

Pre-Investment, Market Entry Strategy Advisory Services from Dezan Shira & Associates

If fully implemented, the scope of goods that can be imported through CBEC would be significantly reduced. Further, the newly added custom and quarantine requirements would substantially increase operation costs and become a major barrier for those who want to enter the CBEC market.

Facing pushback, the government has delayed the implementation of the custom clearance and quarantine requirements in the positive lists again and again over the last two years:

- On May 24, 2016, China officially decided to delay of the custom clearance and quarantine requirements in the positive lists until May 11, 2017 in the 10 CBEC pilot cities;

- On November 17, 2016, China again delayed of the implementation until the end of 2017 in the 10 CBEC pilot cities;

- On September 20, 2017, China delayed the implementation once more until the end of 2018 in the 10 CBEC pilot cities; and

- On December 7, 2017, China decided to expand the delayed implementation scope to cover another five cities – Hefei, Chengdu, Dalian, Qingdao, and Suzhou – starting from January 1, 2018.

CBEC import models: new trends

There are two models for foreign companies engaging in CBEC business: the direct shipping model — under which goods are stored at overseas warehouse and delivered by international courier service to customers directly after they make the order online, and the bonded warehouse model — where goods are temporarily stored at the bonded warehouse established in the CBEC pilot cities under the Customs supervision before they are delivered to domestic customers.

Previously, the bonded warehouse model used to be more popular due to the more convenient real-time custom clearance, faster logistics, as well as availability of after-sale services. However, with the new CBEC tax policies and positive lists coming out, the popularity of the bonded warehouse started to diminish.

On the one hand, the bonded warehouse model is not available for exemptions under the current import taxes scheme, which will inevitably affect the CBEC purchase at relatively low prices. On the other hand, goods purchased through the bonded warehouse model would be required to obtain the AQSIQ clearance form if the positive list is finally implemented, while goods bought through direct shipping model could be exempted from this requirement. In 2017, many foreign companies moved out of the bonded warehouse and started to focus more on the direct shipping model.

|

About Us

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here.

Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, accounting, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

- Previous Article Withholding Corporate Income Tax in China

- Next Article The Robotics Industry in China

This article is adapted from “Cross Border e-Commerce in China.”

This article is adapted from “Cross Border e-Commerce in China.”