Credit Suisse – China and Global Economic Perspectives

Sept. 6 – I’ve just attended the semi-annual Credit Suisse Private Banking event in Beijing, held today at the Park Hyatt. Speaking were Giles B. Keating, head of research for the Private Banking and Asset Management division, and Dong Tao, well-known in China as the managing director and chief regional economist for Credit Suisse China. I have highlighted the key points and made my own suggestions in italicized text below.

China growth

Dong Tao, in his opening remarks, stated that in 17 years of dealing with the Chinese economy, this current period was the most uncertain about the mid-term outlook. In evaluating China’s economic cycles, he presented a chart showing three major and three minor areas of growth since 1978 to date. The three main areas of growth had been at rates of 10 percent annually lasting for five years at a time: being the rural land reform of the mid 1980s, the opening up of the Chinese economy and the development of foreign direct investment in the mid-1990s, and the WTO-fueled boom of the early part of this century.

The three lesser areas of growth had come after relatively slower periods, after each of the above cycles had finished. These, he said, had been the period leading up to the boom in FDI, a further boom in the period after the Asian Financial Crisis leading up to WTO admission, and a boom now, caused by the reemergence of the global economy after the Global Financial Crisis and China’s own move towards domestic consumption. He said that he thought we were in the early stages of the latter cycle.

On this, he stated that growth would be about 7 percent from now, which was a reflection of a slow-down in China, being the result internally of a move towards developing domestic consumption. He also noted that domestic consumption alone would not be capable of allowing China to reach growth levels of 10 percent plus, but that it would “prevent growth from falling below 5 percent.” This period, he suggested, was likely to last for about five years, or until 2016.

- China’s economic restructuring equates to a slower growth cycle, expected to last another four to five years.

Market liquidity

In terms of monetary conditions, he suggested that it was in fact better in China than during what he termed the “pre-Lehman” era, with new lending currently at 20.4 percent of GDP this year, as against 17.8 percent in 2008, and that this had been achieved despite a tightening of the required reserve banking ratio from 17.5 percent to 21.5 percent at banks. This was creating a situation where more money was being provided to SOEs, and that these were now well-liquidated, and beginning to provide financing for other business loans. In short, SOEs and some of China’s listed companies have been taking over some of the pressure in getting money supply to China’s SMEs. That’s a point also raised in today’s Wall Street Journal.

- Investors in China stocks may want to keep an eye on the extent of non-core loans made by such businesses.

China meanwhile has gone through a period of slowing down, as the impact of its stimulus in 2009 has faded, while liquidity has drained from the market. Investment in fixed assets has declined by nearly 75 percent since 2009, he stated.

Purchasing stable, but beware short-term downward trend

There were signs ahead that China would continue to face a bumpy road for the rest of this year. The Purchasing Managers Index had shown the weakest set of results YTD since 2008, and was forecast to remain at just above 50 points (above 50 points means confident and below 50 shows a lack of confidence in sales). China, therefore, is expected to experience relatively flat growth for the rest of 2011 leading into 2012. This was also exemplified by data showing a significant fall in orders of machinery. Orders in transport machinery and specialized equipment machinery have fallen significantly, and this is expected to continue.

- Manufacturers wishing to sell machinery to China would be advised to take this into consideration and possibly expect cancellations on some projects.

Additionally, accounts receivable may rise as Chinese manufacturers and domestic companies continue to feel the pinch.

- Keep cash on hand in order to defer any potential bad debt/extended cash flow coming from China.

Concerning the possibility of a hard landing, Dong thought this unlikely, although with the caveat that much remained to be seen about the transition period of the outgoing Chinese administration next year. Suggesting that the new government would need at least a couple of years to find its feet, the implication was that this would continue to dampen China’s growth. However, he felt that a hard landing would not be permitted by the Communist Party, and that if things did start to look as if they could turn sour, the government had plenty of ammunition to provide additional stimulus if required. What was in fact occurring was both a governmental and economic transition, which would understandably result in lower growth. However, the party would not allow matters to get too negative for investors or Chinese nationals.

Chinese inflation

In terms of inflation, Dong suggested that a predicted and long-term rate of about 5 percent should be expected to be the longer term norm for China. He noted that, in the past, low wages paid to migrant workers had kept salaries low, but this trend had changed. Stating that inflationary pressures such as food were temporary blips on the RPI, he stated quite categorically that wage increases were the main driver in inflation in China today. As the government intended to increase wages across the board in China, this would have an on-going inflationary effect, and stated that he felt the government was comfortable holding this at 5 percent for the longer term.

He also said that in terms of previous inflation figures, these had in fact been artificially low over the past decade, but were now coming back to emerging market norms. This 5 percent inflation, he said, should be considered normal.

- Build minimum inflationary costs of 5 percent into 2012 budgets

Property

The key issue here was the fact that Dong thought the Chinese property market was “embarrassing” and contained potential risks. However, he reckoned that although prices were high and there was significant property in banks in various cities, this would be sorted out by a rash of M&A activity within China’s property sector later this year and continuing into 2012. Again, he stated that there would be no major change in property prices during 2012, as China ushered in its new premier. Simply put, the government would not allow a major correction.

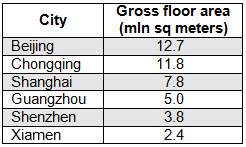

There were some interesting statistics here. In terms of cities with most available gross floor area (GFA) these were:

Dong accordingly predicted a managed correction in property occurring sometime around 2015-16, once the government had the tools at hand to deal with it. Until this time, the government would be protective of the current environment and not want to see too much volatility within it.

That said, he did mention that Wenzhou traders, who operate effectively as the bankers for much of Shanghai’s real estate, were seeing some damage caused to their trading businesses as a result of the current export markets and were beginning to sell off some investments in Shanghai to support their longer term ventures.

- Slow for property value increases. Hang on for now unless wanting to realize gains now for more lucrative investments.

To summarize, Dong suggested that while China was going through a period of growth relatively slower than had been the case the previous decade, this was still far better a performance than the markets in the United States, European Union and elsewhere. The government, he said, would not permit volatility in markets, and the policies likely to be utilized for much of the next three to four years could reasonably be expected to be conservative. China still offers better growth returns than most other markets.

- I’d agree with that synopsis. It is also going to be a calm before the storm. FDI made into China now will reap dividends that will likely be accelerated from 2015 onwards. Now is the time to be making inroads into China to take advantage of what will become a large consumer market.

In terms of the presentation by Giles Keating, he dealt with the bigger global picture, and stated in his opening remarks:

“We are in a highly volatile investment environment, with the continuing risk of significant declines. Two-way risk will remain, and policy makers in the United States and European Union still have a lot of work to do to reduce uncertainty. However, value is being created in the stock and bond markets, where many companies where undervalued. Key would be diversity in portfolios, and lower risk elements.”

I won’t go into the entire aspect of his presentation, but will comment on key issues that affect China, Emerging Asia, the United States and Europe.

European sovereign debt

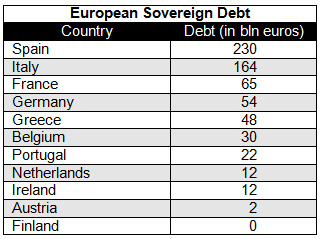

The key issues concerning sovereign debt are concerns about Europe. These are the net direct sovereign debt positions of European banks:

He suggested that these problems could be contained, and dealt with, but much of the issue was political in-fighting. For example, he indicated that the German government was not supportive of a Spanish bailout by the European Central Bank, but that such a bailout was necessary. It would only be when things got worse, he suggested, that Europe’s politicians could be relied upon to make the correct moves to stabilize the European Union. He felt that Greece may default “within” three weeks, and that if this looked increasingly likely, it would in fact spur greater collaboration.

Emerging markets

In terms of new orders, the Eurozone was weakening, providing data that showed both Japan, on the back of tsunami recovery, and the United States, on the back of economic recovery, both just above the expansion mark. Concerning emerging markets, he showed that new orders were slowing across the board.

Emerging Market New Orders in order of growth:

- India – positive

- Mexico – positive

- China – flat

- Russia – negative

- Brazil – negative

He mentioned the big areas for growth continue to be in emerging market infrastructure, the water industry, alternative energy, resource efficiency and nanotechnologies, all of which had out-performed the global stock market for the past two years.

- Investment in Indian infrastructure still a good bet for growth. U.S. liquidity is investing in Mexico for supplies closer to home than China and Asia.

The U.S. economy

Keating provided financial analysis demonstrating that several areas of the U.S. economy were much healthier, and that in terms of corporate businesses, many were in very strong health. The profit share of GDP was the highest ever, while the levels of cash/assets recorded by American corporations was also at a record high. In short, there is a lot of cash floating around U.S. companies at present. He also stated that the United States still possesses some economic risks, but that there were no signals of the United States going into recession.

In terms of trade with China, both retail sales and trade growth remained strong, however it is expected that the U.S. dollar will continue to decline against most Asian currencies, including the Chinese yuan. That is good for Asian economies buying American equipment for infrastructure purposes, and very good for American companies selling goods in Asia.

- U.S. companies with cash on hand should be looking to China, India and Mexico for securing supplies (Mexico), or developing infrastructure to both sell to China and India’s consumer markets, or to sell equipment and infrastructure machinery to India. U.S. corporations can win both ends by selling to Asia from the United States, and then setting up retail outlets in Asia to receive appreciating currencies.

Global markets

In short, he suggested that political disputes within the Eurozone would continue to create turmoil within the markets for the next two to three months, but that they could not afford to fail. The Eurozone politicians would, he said, eventually have to agree. Once this was achieved, we could then see a potential strong recovery.

- It seems, from Credit Suisse at least, that much of the current global risk is politically driven and can be absorbed as long as the Eurozone can get itself in agreement. This is expected to take several months, and may involve some volatility along the way that will impact elsewhere. The corporate United States seems to be cash-rich at present, and once the global situation quiets down this should lead to an increase in FDI into China as well as the rest of Emerging Asia, and India especially once their tax reforms are passed into law. China will remain stable, and yield better growth rates than the United States or European Union, however the days of double digit growth are probably gone for the foreseeable five years.

- From an FDI perspective, Asia remains a viable and strong growth market, and once the Eurozone problems can be sorted out, investment levels into Asia are likely to increase and remain high for the next decade.

Chris Devonshire-Ellis is the principal of Dezan Shira & Associates, a foreign direct investment practice handling FDI legal and tax issues for the foreign investor in Asia. The firm was established in 1992, and possesses twelve China offices, five in India, and two in Vietnam. Please email info@dezshira.com for enquiries, visit www.dezshira.com or download the firm’s brochure here.

Credit Suisse Private Banking can be reached here.

- Previous Article China Lifts Tariff on CBM, Oil and Gas Equipment Imports

- Next Article China Renewable Energy Industry Report: Sept. 6