Consolidated Audits for Holding Companies in Hong Kong: 3 Commonly Asked Questions

Contributor: Jennifer Lu

- A consolidated financial statement provides a clear and unified picture of the company’s financial status.

- This is especially important for companies operating across multiple countries, requiring compliance with tax and accounting laws in different jurisdictions.

- Even if the company is exempted from producing a consolidated financial statement – shareholders often appreciate the audit being undertaken as it strengthens the company’s position with revenue authorities and banking institutions.

- China Briefing takes you through the auditing requirements from the perspective of a Hong Kong entity, and answers some commonly asked questions on audit assessments.

Audits are among basic annual compliances that Hong Kong companies are required to complete. In simple terms, it refers to the report produced by official review and verification of financial statements, accounts, profits, and taxes payable, often completed by a third party.

The statutory report, produced at the end of an audit, must contain an audited financial statement for the current year, the balance sheet, profit and loss account, as well as a cash flow statement.

For many mid-to-large sized companies operating across multiple countries, preparing a consolidated financial statement (CFS) provides a clear and unified picture of the company’s financial status.

However, knowing when and how to prepare the CFS requires a good understanding of your company structure and the different accounting standards that are in place – in the jurisdictions you operate in.

Here, China Briefing takes you through the auditing requirements from the perspective of a Hong Kong entity, as well as the three most commonly asked questions concerning audit requirements.

1) What are the general financial reporting requirements in Hong Kong?

As a Special Administrative Region of China, Hong Kong’s accounting standards are regulated by its own Companies Ordinance (CO) and the Hong Kong Financial Reporting Standards (HKFRS), which in 2005 fully converged with the International Financial Reporting Standards (IFRS).

The IFRS are a set of global accounting standards that apply to all financial reporting, quality control, and auditing standards relating to all profit-oriented entities (although some entity types can elect to apply a different set of reporting standards).

However, in Hong Kong, certain types of entities, such as private entities and small-to-medium sized entities (SMEs), can elect to apply a different set of reporting standards, which relieve themselves of the full reporting requirements under the HKFRS.

Further, where there are inconsistencies between the CO and HKFRS, the CO will prevail.

Under section 379 of the Hong Kong Companies Ordinance, a company director must prepare a financial year statement that complies with the requirements of sections 380 and 383 of the CO. These financial statements are handed over to third-party auditors in the auditing process to form the annual statutory audit reports.

2) When is a Hong Kong company required to complete a consolidated financial statement?

If a Hong Kong company controls one or more entities at the end of the financial year, the directors must instead prepare a consolidated financial statement that comply with sections 380, 381, and 383 of the CO.

The consolidated financial statement of the group must present the total assets, liabilities, equity, income, expenses, and cash flows of the parent and subsidiary company as they make a single economic entity.

If a Hong Kong company is owned by an individual, then a consolidated financial statement is mandatory. However, if it is owned by a body corporate – there are some exemptions.

According to section 379(3) of the CO, companies can be exempt from preparing consolidated financial statements if they meet one of the following conditions:

- If a company that is the wholly owned (that is, own 100 percent shares) subsidiary of another body corporate in the financial year; or

- If the company is a partially owned subsidiary of another body corporate in the financial year, and the director meets the notification requirements provided in the CO, and no one objects to the notification given by the director.

For companies that do not prepare a consolidated financial report, and where the exemption conditions under section 379(3) of the CO do not apply, the auditor will issue a qualified opinion/disclaimer in the audit report on the company’s non-compliance with CO.

Jennifer Lu, Senior Manager at Dezan Shira & Associates’ Corporate Accounting Services explains that, “If the client decides not to conduct a consolidation audit, it is important to make sure the company’s directors and shareholders understand the related consequences [such as the audit report with a qualified/disclaimer opinion] and potential risks before the [audit] engagement. Otherwise, it will be too late to reverse to a consolidation audit at the final stage of an audit.”

An audit report with qualified/disclaimer opinion will likely prompt the Hong Kong Inland Revenue Department to ask further questions and may trigger heightened scrutiny during the review of the parent company’s financial statement.

Lu says, “in our experience, we’ve seen some clients decide to perform a consolidation audit even if the company meets the exemption conditions for having to complete a consolidation audit. The decision usually comes from the shareholders who prefer to see the audited financial position of the Hong Kong company consolidated with its subsidiaries for reasons such as the potential sales transaction of the Hong Kong company’s shares in the future.”

3) What does a consolidated audit look like in practice?

Take the following situation as an example.

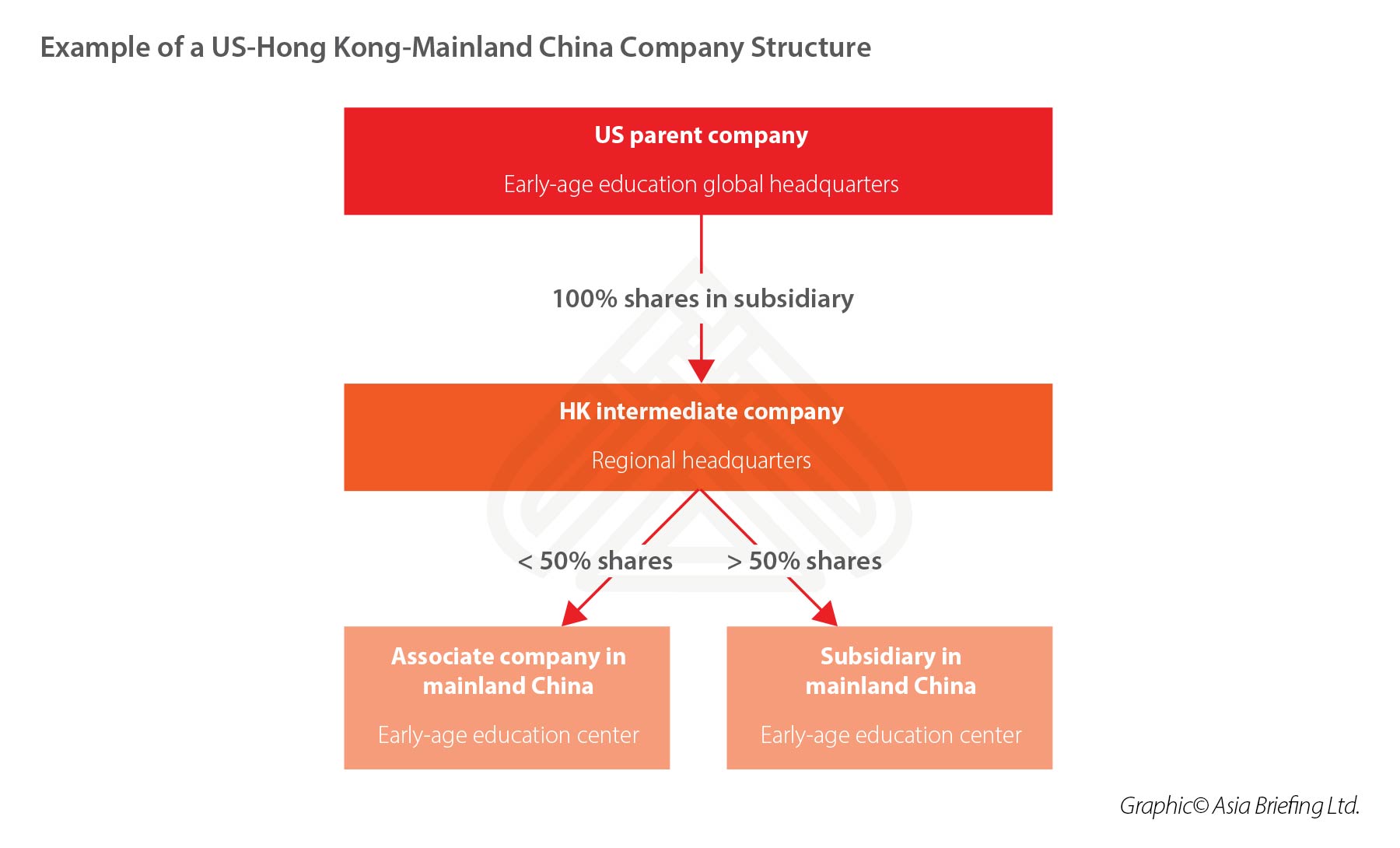

An American early-age education company operates multiple offices across the US, Hong Kong, and mainland China. The parent company is based in the US but has set up various wholly-foreign owned enterprises (WFOE) in both Hong Kong and China. The US company serves as the company’s global headquarter, the Hong Kong office acts as a regional headquarters, and its subsidiary offices acts as the operational arm of the company.

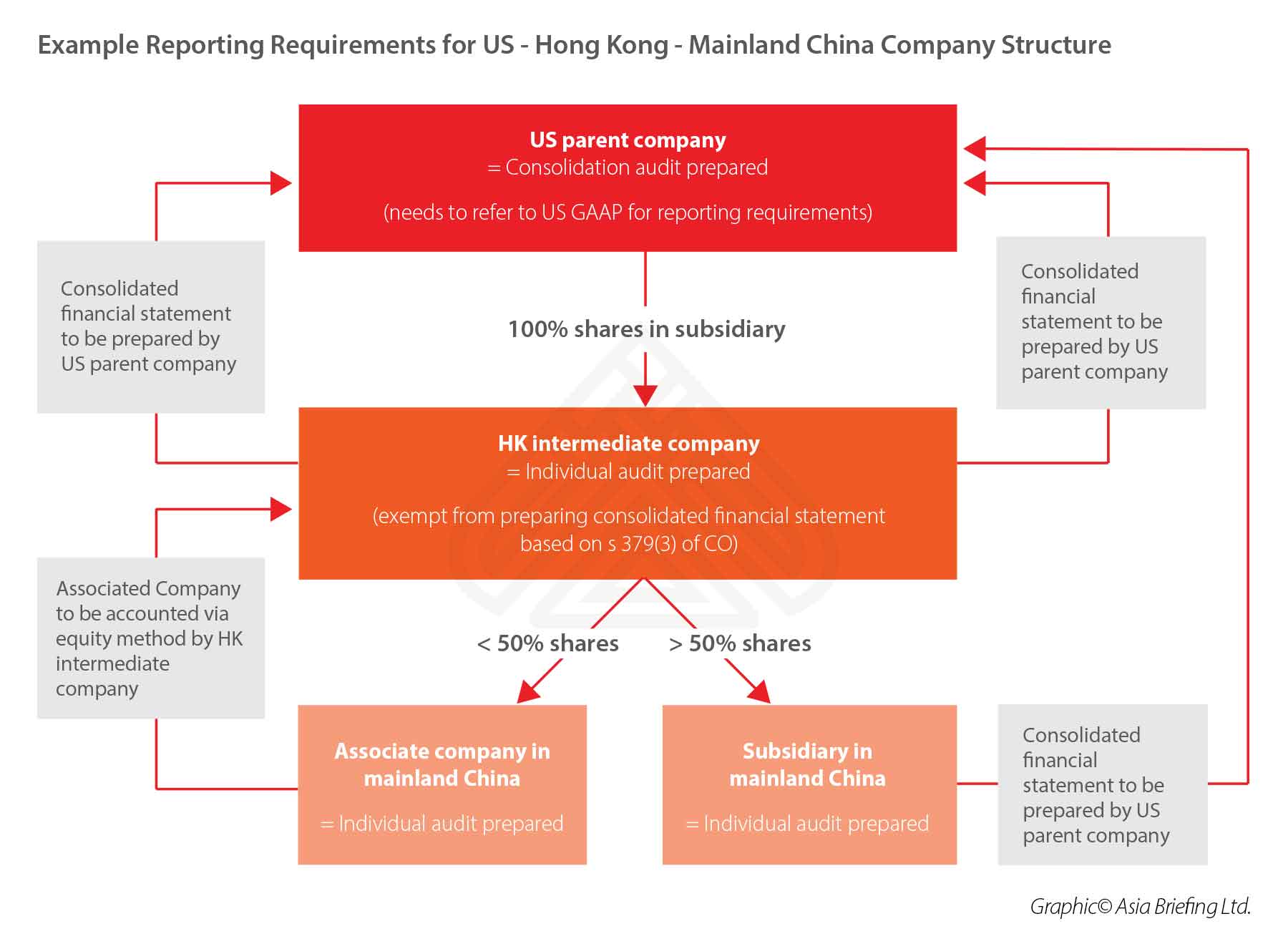

At the Chinese WFOE level, the reporting requirement will depend on the percentage of shares that is owned by the HK intermediate company.

If the Chinese associate company is not controlled by the HK intermediate company (in other words it owns less than 50 percent of shares), the associate company will need to prepare its own financial statement. The associate company will, however, be accounted for via the equity method in the HK intermediate company’s financial statement.

If the Chinese associate company is controlled by the HK intermediate company (in other words it owns more than 50 percent shares), then the financial statement can then be consolidated within the intermediate company’s statements. This will give investors a clearer picture of the overall financial performance of the China operations.

At the Hong Kong company level, a second layer of consolidation will typically need to be performed. This means consolidating the financial information from the mainland Chinese WFOE and preparing it according to PRC generally accepted accounting principles and the Hong Kong Financial Reporting Standards (HKFRS). However, where the HK intermediate company is wholly-owned by the US parent company section 379(3) exemption will apply and the reporting requirements will then bypass the intermediate company and responsibility will pass to the US parent company to consolidate all financial reports.

Finally, at the US parent company level, the HKFRS financial statements, as well as the financial statements of the Chinese WFOEs, need to be converted to US GAAP (Generally Accepted Accounting Principles), so that the in-house accounting team in the US can prepare its group reports. Here the company would need to look closely at the US GAAP reporting requirements, the contents of which are not covered by the scope of this article.

Such consolidation work requires that the chart of accounts (COA) of each company be appropriately mapped, for a seamless GAAP conversion and the timely preparation of the consolidated financial statements each month. Consolidation of the accounting across multiple jurisdictions requires a good understanding of the various local GAAPs and working with a professional services provider with teams at each location thus becomes essential.

This example is illustrated in the diagram below.

Practical steps to ensure compliance

Companies should familiarize themselves with the Hong Kong accounting standards prescribed by both the HK CO and HKFRS to ensure they are compliant with the provisions within.

If the company has the consolidation audit report from the previous year but chooses to change to a non-consolidation audit report in the current year, they will need to seek professional assistance in maintaining consistency in the various audit accounts, as the HK Inland Revenue Department will likely inquiry what is the reason for the change.

Operating a modern accounting software system may help alleviate considerable workload by automating some COA mapping and GAAP conversion tasks. Therefore, multinationals looking to consolidate financial statements across multiple jurisdictions should consider upgrading their ERP system where necessary, and appropriately configuring their accounting software to guarantee effective and compliant bookkeeping at each location.

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, and Thailand in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Harrods to Open in Shanghai, More UK Companies Focusing on China’s Consumer Market

- Next Article China’s 2019 Trademark Law Amendment: What’s New