Competition with Chinese Firms Tops Challenges for American Companies in China

When nearly one year ago a US business executive received word that his company was flatly denied membership to one of China’s biggest industry specifications and standards associations, he was left with many troubling questions. Were other companies turned down also? Was his company being singled out? But what troubled him most was the reported reason his industry-leading company was rejected: foreign companies were not permitted to join.

Since then, the executive says his company—a US-China Business Council (USCBC) member—has lobbied many times for reconsideration, but its application continues to be denied.

As a result, he says that competition with Chinese firms is proving to be the greatest challenge his firm is facing in the China. And he isn’t alone: After a steady ascent in the rankings, competition with Chinese firms is now the top challenge for American companies doing business in China. According to the USCBC 2014 member survey, US businesses say that they are facing increasing numbers of Chinese competitors who often enjoy preferential treatment over foreign firms.

This is echoed by the US executive. He says that it is unequal treatment in government regulations, not competitive Chinese goods and services, that makes this challenge so difficult to tackle. He says that Chinese companies striving for international recognition—and the central government—are driving these kinds of policies. “In my opinion, China wants nothing more than to have a brand similar to Lexus or Nikon,” he said. “And it’s going to be difficult with that sort of approach.”

The top challenge

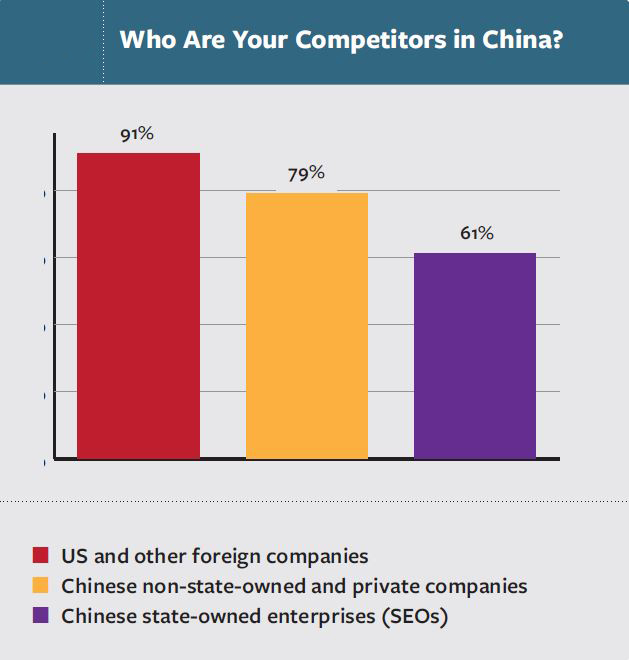

As China’s economy has grown in size and strength, so have its domestic companies—both private and state-owned enterprises (SOEs). The competition American businesses face from their advantaged Chinese counterparts has grown stronger—and more pressing due to the recent slowing of economic growth in China.

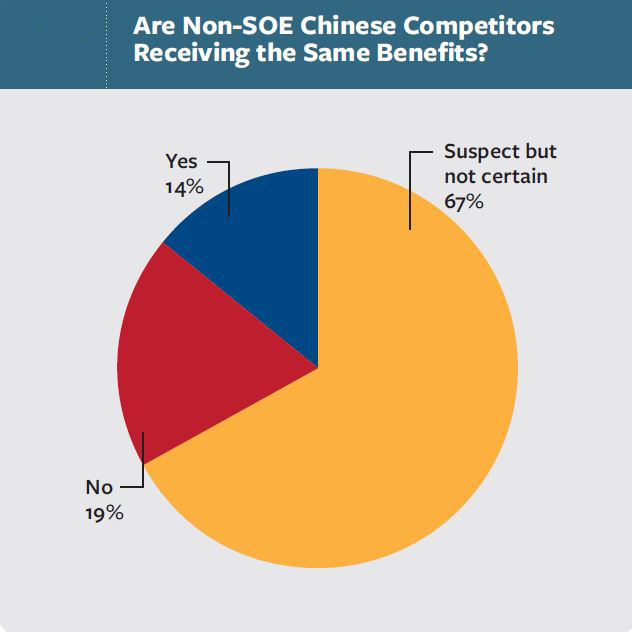

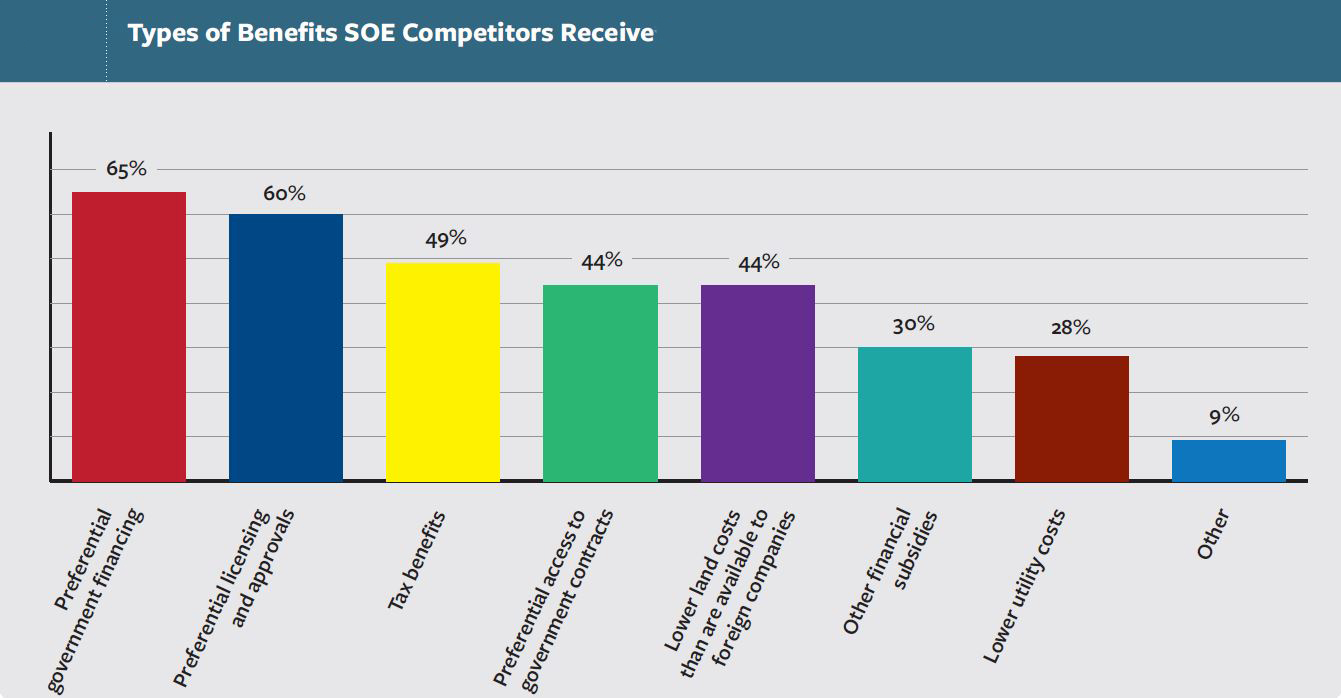

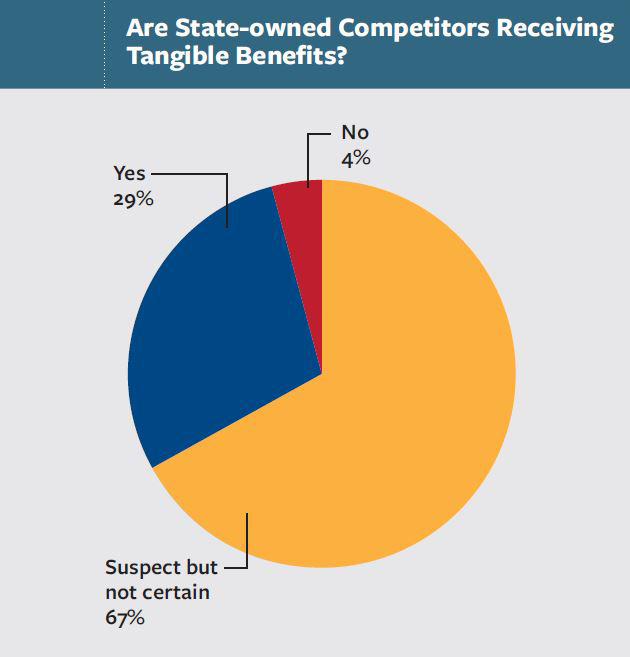

Robust competition in itself is not a concern for foreign companies doing business in China, according to the 2014 survey. American companies are accustomed to strong competitors, which they face in markets all over the world. However, competition in which one group of companies is favored over othersis a significant concern, say respondents. While many have focused on preferential treatment that Chinese state-owned enterprises (SOEs) receive, survey data show that the issue is not ownership structure, but simply nationality. Chinese companies, regardless of ownership, receive benefits that foreign companies cannot.

In addition to membership access to industry associations, the USCBC member company executive also points to the Chinese government procurement law as a stumbling block for foreign companies. He says that the law’s regulations heavily encourage the purchase of Chinese goods and services on both business-to-consumer and business-to-business levels. What hurts his company the most is a regulation that forces state-owned enterprises to purchase exclusively from Chinese companies—even if a superior option is available from a foreign firm—unless they can convince the government that they can’t purchase what they need otherwise.

One last challenge is the threat of investigation under China’s antimonopoly law. Although both foreign and domestic companies are being investigated, foreign companies appear to be facing increasing scrutiny. Eighty-six percent of survey respondents are concerned about the lack of transparency, due process, and other issues surrounding competition-related investigations.

Preferential treatment of domestic enterprise is not in the long-term interest of China or its companies, according to the survey. Access to preferential benefits does little to create the type of efficient and innovative companies that China hopes will lead its economy to the next stage of development. As senior leaders such as China’s Premier Li Keqiang have noted inpublic statements, Chinese companies will become internationally competitive only through increasing fair and robust competition in China’s market.

The list continues

This year’s top 10 challenges include many issues that have made the list in previous years, though the order changes from year to year. As with previous survey results, issues that move down in rank are not necessarily doing so because the situation has improved. Rather, those issues are most likely eclipsed by more pressing concerns. Overall, companies report that little progress has been made in addressing many of these persistent challenges.

For instance, cost increases dropped from the top slot to the fifth, despite separate survey data that indicates costs have not moderated in China. In fact, most respondents note that the challenges associated with cost increases have gotten worse over the past year. This same trend holds true of other policy related challenges.

To genuinely confront the regulatory issues that foreign companies continue to face in China, USCBC says that regulators must focus on major policy changes, such as the conclusion and implementation of a US-China bilateral investment treaty (BIT). Addressing this issue and others will help make real progress on challenges like competition, investment restrictions, uneven enforcement of laws and regulations, licensing, and national treatment. Without such bold leadership, says USCBC, the top 10 challenges are unlikely to see substantive change in the future.

Business outlook

American companies continue to view China as a top-five market, but the number of companies increasing their resource commitment in China continues to drop, according to the survey. Fifty percent of companies report plans to boost resources in China over the next 12 months, down from almost 75 percent just three years ago. Virtually no companies are cutting back on their operations in China, however. Those that are not expanding their operations in China are maintaining current levels and few are redirecting investments from China to other countries.

Almost three-quarters of companies saw an increase in revenue last year, with another 12 percent reporting flat sales. Only 15 percent of companies reported a decrease in revenue in 2013. Most companies anticipate that their revenue will increase again in 2014.

Overall, American companies remain profitable, but at lower margins, with 83 percent of companies indicating that their China operations are profitable. But companies have seen an important shift in China’s performance compared to overall company operations. Although improved from last year, the profit margin of China-based operations continues to be well below the highs that companies experienced prior to 2012.

So what’s squeezing profit margins? Along with rising costs, this year’s top challenge is the answer. Not only is this competition with Chinese companies under preferential policy unfair, says the survey, but it’s also hitting China’s foreign investors in their wallets.

How do we move forward?

The full survey report provides a detailed account of the challenges that American companies face in their China operations. USCBC says it is important to keep in mind the contrast that China presents for companies: an extremely difficult business environment along with a vital, growing market for foreign businesses.

By USCBC calculations, China is at least a $300 billion market for American companies—but it should be bigger. Depending on which source is used, US firms have invested around $70 billion dollars in China over the past 30 years. Chinese companies are only now beginning to ramp up their investments in the United States, which will create additional jobs and opportunities for the American economy as well as tax revenue for local, state, and federal governments.

It is vitally important that the United States and China get their commercial relationship right, rather than allowing these issues derail what is and will remain the most important bilateral relationship in the world, USCBC says. That will require policymakers on both sides to work toward solutions to mutual problems: those that US companies face in China and those that Chinese companies experience when doing business in the United States.

The bottom line

All of the challenges US companies face in China warrant attention and remedies, but none is more pressing than leveling the playing field with Chinese competitors, USCBC says. The business executive whose company was denied association membership agrees. He says he worries that denying companies based on nationality and not qualifications could lead to lowered standards that may hurt the industry overall and present future challenges to his business in China.

China Business Review is the official magazine of the US-China Business Council, a non-profit and non-partisan trade association that represents roughly 230 American companies doing business in China.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Revisiting the Shanghai Free Trade Zone: A Year of Reforms

Revisiting the Shanghai Free Trade Zone: A Year of Reforms

In this issue of China Briefing, we revisit the Shanghai FTZ and its preferential environment for foreign investment. In the first three articles, we highlight the many changes that have been introduced in the Zone’s first year of operations, including the 2014 Revised Negative List, as well as new measures relating to alternative dispute resolution, cash pooling, and logistics. Lastly, we include a case study of a foreign company successfully utilizing the Shanghai FTZ to access the Outbound Tourism Industry.

Adapting Your China WFOE to Service China’s Consumers

Adapting Your China WFOE to Service China’s Consumers

In this issue of China Briefing Magazine, we look at the challenges posed to manufacturers amidst China’s rising labor costs and stricter environmental regulations. Manufacturing WFOEs in China should adapt by expanding their business scope to include distribution and determine suitable supply chain solutions. In this regard, we will take a look at the opportunities in China’s domestic consumer market and forecast the sectors that are set to boom in the coming years.

China Retail Industry Report 2014

China Retail Industry Report 2014

In this special edition of China Briefing, we provide an overview of the retail industry in China and the procedures for setting up a retail shop, focusing specifically on brick-and-mortar physical retail stores. Further, we have invited our partner Direct HR to offer some insights on the talent landscape in the retail industry, as well as tips for recruiting retail personnel in China.

- Previous Article China Outbound: From New York to Shanghai, All Eyes Are on India

- Next Article Hong Kong-Chile FTA to Enter Into Force