Common Errors in Accounting, Tax, Forex Management of FIEs in China

By Amber Liu, Dezan Shira & Associates’ Shenzhen Office

Editor: Qian Zhou

For foreign-invested enterprises (FIEs) operating in China, it is not rare to see that a host of problematic issues get disclosed in the year-end audit. Accounting, tax treatment, and foreign exchange management are among the most mistake-prone areas for such entities.

In this article, we list out some of the most common errors observed in FIEs, to help companies optimize their internal finance processes, get the most out of their annual audit, and why it is necessary to secure advice from qualified service providers.

Tax treatment

Maximizing tax efficiency while maintaining compliance with tax laws and regulations is always one of the priorities for foreign investors. However, FIEs may still suffer due to underpayment or overpayment of taxes due to negligence or incomplete information.

In the case of tax underpayment, the FIE will have to make supplementary tax payments with potential late fees and fines. The tax rating of the FIE might also get affected. The invoice application and other tax matters might be affected as well.

Examples of common errors

Some typical examples observed are discussed below.

1) Errors caused by lack of comprehensive understanding of China’s tax system: Some FIEs have underpaid tax because their accountants do not have an adequate understanding of China’s tax laws and regulations, especially when cross-border transactions are involved. For example, when an overseas shareholder of the Chinese subsidiary transfers the equity of the company to others, the transferor may fail to pay income tax in China for the gain obtained from the share transfer. Another example is, when the domestic company pays royalties or service fees abroad, it fails to deduct withholding value-added tax (VAT) and income tax according to the tax laws.

2) Failing to pay stamp tax: Stamp tax is charged at a relatively low rate of 0.005 percent to 0.1 percent on legal documents, such as contracts, certificates, and accounting books, and all signing parties associated with a contract are legally obliged to pay stamp duty. However, some FIEs often fail to declare stamp tax for rental contracts, transportation contracts, etc.

3) Failing to file VAT for non-invoiced income: Companies are required to declare VAT in the form of “uninvoicing revenue” when they have done business and confirmed revenue, even if the invoices haven’t been issued.

4) Failing to file tax returns before deadlines: For example, the deadline for paying corporate income tax (CIT) is within 15 days of the end of each month or quarter. Tax declaration made later than that will directly lead to a late fee at 0.05 percent on less-paid tax per day and a separate fine, the amount of which is decided by the tax bureau case by case. At the same time, the enterprise’s tax credit score will decrease, and when it is reduced to a certain level, the tax credit rating of the FIE will be downgraded by the tax bureau.

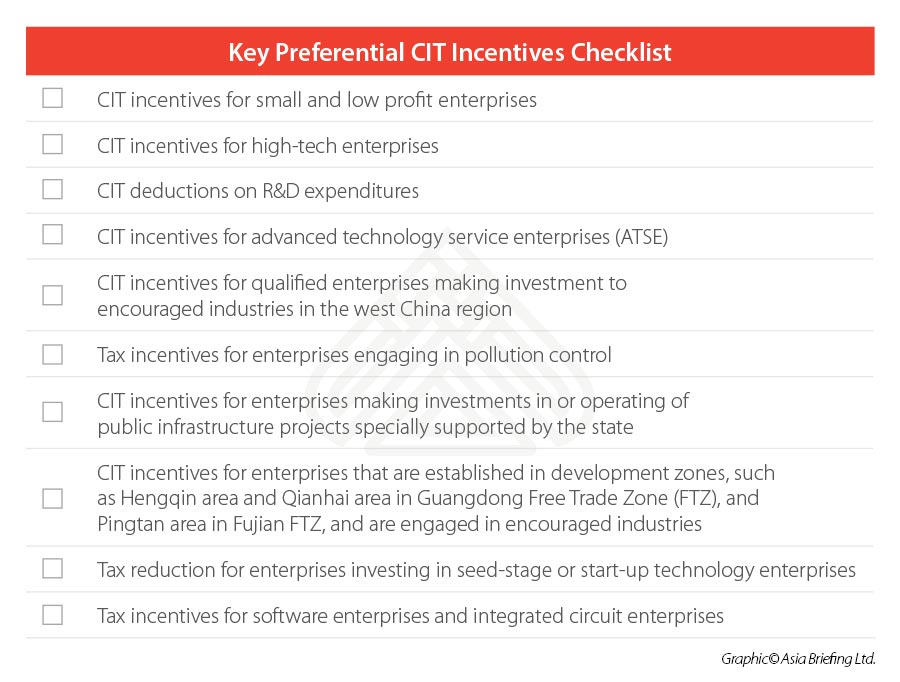

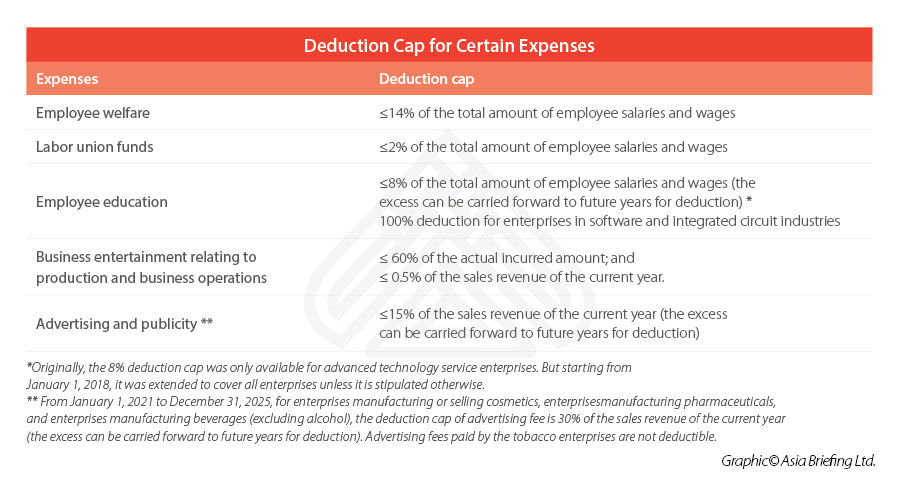

5) Failing to fully enjoy the tax incentives: China provides several tax and fee reduction policies to support businesses, such as the income tax preferential policy for small and low-profit enterprises, the reduced CIT rate for high-tech enterprises, CIT deductions for R&D expenditures, etc. Besides, China allows a certain amount of expenses to be deducted before paying tax. And FIEs are often found not having fully used these incentives.

6) Failure to establish a reasonable tax plan for the FIE: In other words, increasing the FIE’s tax burdens or leading to high tax risks due to inadequate planning or excessive planning. For example, during a share transfer, there are proper ways to reduce the overall tax cost, and tax deferral is also available for certain companies, all of which might be totally neglected by inexperienced service providers who are not familiar with the matter. The example of aggressive tax planning can be found as follows – an imprudent service provider may wrongfully apply the preferential tax rate for the FIEs’ profit distribution to foreign shareholders, while the FIE, in reality, fails to meet the criteria for enjoying the preferential tax policies. This is easy to establish in the regular investigations conducted by respective tax bureaus, and can lead to late fee charged at 0.05 percent of the payable amount.

Bookkeeping

Accounting and bookkeeping in China are governed by the Chinese Accounting Standards (CAS), also known as the Chinese Generally Accepted Accounting Principles (Chinese GAAP). When preparing financial reports in annual audit, some typical errors are commonly observed in FIEs’ accounting books and financial documentation that are not in line with the Chinese GAAP, which will affect the later financial reporting and data analysis, and may lead to tax losses indirectly when unable to deduct certain expenses due to unqualified accounting and bookkeeping.

Examples of common errors

Some examples of common errors in this area are discussed below:

1) Failing to maintain complete original documents that should be attached to the accounting vouchers, leading to failure in pre-tax deduction of relevant expenses. For example, some accounting entries are not supported by relevant fapiao/invoices, or the fapiao attached does not match the amount shown on the accounting books; or, only the bank statements are maintained, whereas the bank memos/slips are missing. According to the tax rules, without complete and proper fapiao and other supporting documents, the expenses accrued by enterprises cannot be deducted from revenue when calculating gross profit, which will directly affect the CIT calculation.

2) Failing to follow the accrual basis of accounting principles in performing recognition, measurement, and reporting for accounting purposes. For example, some expenses are not recorded in a timely manner, or some revenue is not recognized in time.

3) Unable to convert and implement the new accounting standards for financial statements in the prescribed time. In recent years, China has constantly been revising its accounting standards to minimize discrepancies with International Financial Reporting Standards (IFRS). For example, the revised CAS No.16 on “government subsidy” came into effect in January 2017, and the revised CAS No.7 on “exchange of non-monetary assets” took effect in June 2019.

Moreover, three revised CAS standards on revenue, leases, and financial instruments will take effect in January 2021 – for all entities that have already adopted the Chinese Accounting Standards for Business Enterprises. In these cases, where the local finance team fails to catch up with the latest developments, the new CAS standards may not be applied properly.

4) Failing to make clear explanations to the headquarters (HQ) due to insufficient or poor communication when HQ conducts data analysis and consolidates statements, thereby resulting in the group’s inability to have a clear understanding of China’s financial situation.

Foreign exchange

All foreign exchange transactions in and out of China are strictly controlled by the State Administration of Foreign Exchange (SAFE), the bureau under the central bank of China – the People’s Bank of China. And there are a series of formalities for FIEs to comply with when involving foreign currencies. Failing to comply with relevant requirements may trigger an additional inspection from SAFE or lead to the failure to receive the funds in foreign exchange.

Examples of common errors

Some common errors in the area of foreign exchange management are noted below:

1) Failing to correctly categorize the nature of the foreign funds received by the FIE from overseas, declaring the foreign exchange funds that should be put under capital account into trade account, or vice versa.

China divides foreign currency transactions into two separate categories: those under the current account (trade and service items) and those under the capital account (investment, loans, etc.). It is crucial for FIEs to correctly define the nature of funds and proceed with relevant formalities accordingly.

In some cases where the overseas investors want to remit a large amount of foreign exchange to their China subsidiaries in a short period of time, they may wrongfully declare the fund as advance payment, which will be categorized under the trade account instead of the capital account, to avoid the formalities of increasing registered capital with the market regulation department, SAFE, and the banks.

Theoretically, the foreign exchange collection/payment records and the import/export declaration records should be generally consistent, and the difference should be kept within a reasonable range. If the funds are declared as advance payment, they will be regarded as sales amount, which will usually far exceed the regular sales of the Chinese entity in normal months. This will get reflected as abnormal records in the foreign exchange collection and payment system maintained by SAFE.

In such cases, the SAFE may conduct on-site investigations on the FIE and pass the information to the tax authority at the same time. And the tax authority may consider the larger-than-usual advance payment as hidden income of the FIE, requiring the FIE to record it as sales income, and paying CIT, late fee, and penalties accordingly.

It is thus suggested that the overseas finance team should communicate with China’s finance team in advance when making cross-border funds arrangements for Chinese subsidiaries. The Chinese finance team should carefully understand the background and the nature of the funds, and make necessary preparations to meet regulatory formalities to make sure it can be received in time, and cause no additional tax burdens, trigger penalties, or result in incompliance.

2) Failing to comply with the formality requirements posed by the banks and the SAFE. There are formalities to go through for receiving certain funds, which FIEs may fail to follow when managing foreign exchange. For example, when overseas funds need to be paid to China in the form of loans, the Chinese subsidiary needs to go through procedures, such as foreign exchange registration with SAFE, before the bank can receive the funds. The FIE will not be able to get the funds otherwise.

To avoid being guilty of committing these commonly observed errors or becoming incompliant due to negligence or circumventing rules due to time taken to meet formalities, FIEs are advised to provide high-quality training to their internal finance team regularly or use qualified professional third-party services who are familiar with these error-prone areas.

For more information, you are welcome to download our brochure on Internal Audit, Risk, and Compliance, or email us at china@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China Extends Pretax Deductions for Companies’ Advertising Expenses by Five Years

- Next Article China Releases 2020 Negative List for Market Access