Closing a Company in China: General Deregistration vs. Simplified Deregistration

In addition to the general deregistration procedures, China has been promoting simplified deregistration as one of the key measures to enhance its business environment. This article highlights the differences between the general and simplified procedures, explains the eligibility criteria, and clarifies common misunderstandings about these processes.

Foreign investors may decide to close their business for multiple reasons. To legally wind up a business, investors must complete a series of procedures involving multiple government agencies, such as market regulatory bureaus, foreign exchange administrations, customs, tax authorities, banking regulators, and others. In this article, we outline the company deregistration process overseen by the local Administration for Market Regulation (AMR), comparing the general and simplified procedures.

Developments of company deregistration procedures

Before 2016, companies could only deregister through the general procedure. However, on December 26, 2016, the Guidance on Fully Promoting the Reform of Simplified Company Deregistration Procedures was released. Effective March 1, 2017, simplified deregistration procedures were implemented nationwide. Since then, there have been two options: general procedures and simplified procedures.

On August 28, 2018, the State Administration for Market Regulation (SAMR) released the Circular on Further Promoting Simplified Corporate Registration and De-registration to support further optimization of the simplified corporate deregistration procedures. On August 2, 2021, the SAMR released the Circular on Further Improving Simplified Deregistration to Facilitate the Withdrawal of Micro, Small, and Medium-Sized Enterprises from the Market, expanding the scope of application for simplified deregistration, which is no longer limited to the original four types of companies (that is, limited liability company/LLC, non-corporate legal person, sole proprietorship, and partnership enterprise).Differences between general deregistration and simplified deregistration

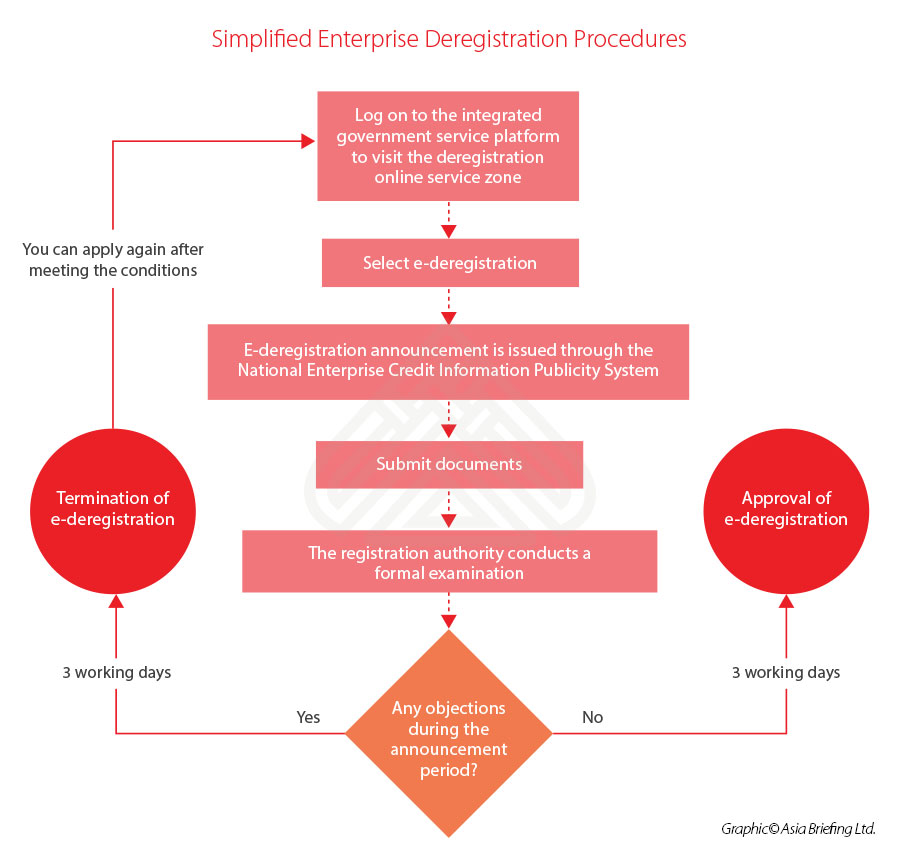

Under the general business deregistration procedures, a company must first establish a liquidation committee. Following the committee’s formation, a creditor notification must be published, with a statutory notice period of 45 days (or 60 days for sole proprietorships). After completing the liquidation of all debts and liabilities and once the notice period has expired, the company can apply to the registration authority for deregistration. In contrast, the simplified deregistration procedure streamlines the process significantly. Companies eligible for simplified deregistration are not required to issue liquidation committee notices or creditor announcements. Instead, they only need to publish a simplified deregistration announcement, which shortens the notice period from 45 days to 20 days. The documentation requirements are also reduced. Companies applying for simplified deregistration are not required to submit a liquidation report, shareholders’ resolution, or tax clearance certificate. Instead, they only need to provide the Application for Company Deregistration, a Letter of Commitment from All Investors for Simplified Deregistration, and the original and duplicate copies of the business license. Moreover, simplified deregistration procedures provide a one-stop government service platform (which is why it is also called “e-deregistration”) for businesses to deregister a company online, without physically visiting local bureaus (although in practice this may depend on the level of local implementation). The distinctions between the two processes are summarized in the below table:

|

General Deregistration vs. Simplified Deregistration |

|||

| Criteria | General deregistration | Simplified deregistration | |

| 1 | Pre-conditions |

|

|

| 2 | Deregistration announcement | General deregistration requires two announcements:

|

Simplified deregistration requires investors to commit to the following:

|

| 3 | Announcement period |

|

|

| 4 | Deregistration filing |

|

|

| 5 | Documents for signature |

|

|

Eligibility of general deregistration and simplified deregistration

General procedures

Companies must follow the general deregistration process if any of the following conditions apply (hereinafter referred to as “existing issues”):

- The company is listed in the AMR’s abnormal business directory or the list of entities with serious violations and dishonest conduct.

- Equity (or property shares) is frozen, pledged, under chattel mortgage, or the company has investments in other market entities.

- The company is subject to administrative enforcement, litigation, or arbitration.

- The business license has been revoked, the company has been ordered to close, or administrative deregistration has been imposed.

- The company has fines or other administrative penalties that have not been fully executed.

- There are unresolved creditor or debtor claims.

- Outstanding obligations exist, including expenses, employee wages, social insurance fees, statutory compensations, or taxes (including overdue payments and related fines).

Simplified procedures

Companies not facing the above issues may choose either the general or simplified deregistration process.

Key takeaways

In summary, simplified deregistration is a faster process and requires fewer documents compared to general deregistration. Companies that meet the criteria typically would typically opt for simplified deregistration. Those that do not meet the criteria may choose this route after resolving outstanding issues. For companies with unresolved issues but seeking urgent closure, they can first publish a deregistration announcement. Once the announcement period ends and all issues are addressed, they can proceed with general deregistration. Some companies may question the legitimacy and compliance of simplified deregistration. This is a misconception. “Simplified” does not mean non-compliant, just as “general” does not imply greater legitimacy. Both processes are lawful and compliant. The AMR provides these options to enable companies ready for closure to complete the process efficiently while granting those with unsolved issues the necessary time to address them after publishing the deregistration announcement. Companies can select the most suitable process based on their specific circumstances.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article China’s Economy in November 2024: Mixed Signals amid Persistent Challenges

- Next Article