China’s VAT Reform and its Implications for RO Tax Structure

By Dezan Shira & Associates

By Dezan Shira & Associates

Editor: Mia Yiqiao Jing

The finalization of value-added tax (VAT) reform on May 1, 2016 was China’s biggest tax overhaul within the last 20 years. Changes include the tax rate on business activities conducted by representative offices (ROs) in China, which has been reduced from five percent to three percent. The reduced tax liability on ROs may cause foreign investors to completely restructure their business practices to capitalize on the benefits of the reform. Currently, there is no written regulation on the applicable tax rates or tax payment methods for ROs. Taxpayers must contact the tax bureau in charge prior to filing taxes. In this article, we provide a brief introduction to China’s taxation rules on ROs, and look at the potential impact of the VAT reform on ROs’ tax structure.

ROs in China

In China, ROs are offices established by foreign enterprises who wish to conduct marketing operations and test the water in the Chinese market. ROs are oftentimes considered the most efficient entry strategy compared to forming a wholly foreign-owned enterprise (WFOE). This is because ROs do not have registered capital requirements and have a relatively simple set-up process. Although they carry the smallest administrative burden, ROs are not capitalized legal entities and thus are restricted to conducting non-profit making activities such as business liaison, promotion, market research, and auxiliary functions for their parent companies.

RELATED: Tax and Compliance Services from Dezan Shira & Associates

RELATED: Tax and Compliance Services from Dezan Shira & Associates

Even though ROs have no operational income, the value created by them is still subject to taxes in China. In the past, the continually heightened tax burden on ROs has led to foreign investors’ concerns about ROs’ overall efficiency, resulting in an increased number of ROs being converted to WFOEs. Under the VAT reform, the tax breaks may create incentives for foreign investors to further develop ROs established in China.

Taxation Regulations on ROs

According to China’s State Administration of Taxation (SAT), ROs are required to file tax on commission fees, service charges, and price differences between import and export of goods generated from liaison or agency business both within and outside of China. Additionally, income from market research, business intelligence collection, and coordination and consulting services for clients resided in China are also subject to tax filing.

The three tax calculation methods used by ROs are the Actual Taxable Income method (if ROs maintain accurate and adequate accounting books and records of income and expenses), the Expenses-plus Method (if ROs cannot provide sufficient documents on income sources but have maintained verifiable records of expenses), and the Actual-income & Assessed-profit method which may apply for ROs who have verifiable proof of income, but no complete records of expenses. Since it is difficult for ROs to determine the accurate amount of annual turnovers due to the nature of their businesses, the expense-plus method is the easiest way to calculate their tax payable.

VAT Reform and its Impact on ROs’ Tax Structure

As of May 1st, ROs are now deemed as small-scale VAT taxpayers and subject to a single three percent VAT rather than to both BT and VAT, with other applicable taxes rates remaining the same. Meanwhile, ROs who were previously registered as VAT taxpayers may deduct some of the input VAT incurred on the purchase or construction of fixed assets from output VAT.

Before the VAT reform, ROs were subject to corporate income tax (CIT) at a 25 percent rate, VAT at various rates across industries, and a five percent BT which applies to the sales of fixed assets, land and natural resources usage rights, and other services that do not fall into the VAT regime. Following the VAT reform, ROs are now required to file CIT and a three percent VAT based on deemed revenue, a two percent tax reduction compared to the previous tax scheme. In addition, the equation used to calculate deemed revenue is now changed to “Cost or Expenditure/(1-Assessed profit rate).”

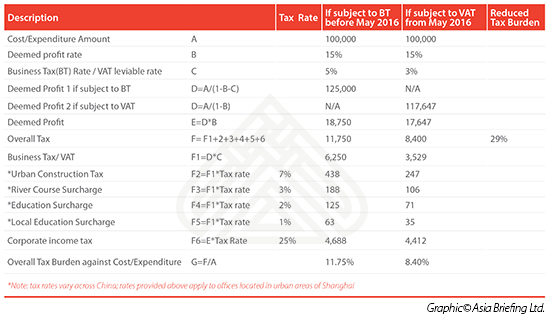

Here, we summarize the general equations used to calculate ROs’ taxes and brief the taxation change based on the assumption of tax professionals in Dezan Shira & Associates into the table below. The expense-plus method is used to better describe the overall reduced tax liability on ROs.

Please note that the deemed profit rate is determined by local tax authorities and should be no less than 15 percent. Based on the example given, the overall reduced tax burden has reached 29 percent.

Challenges Ahead

Ever since the promulgation of the “Measures for the Administration of Taxation on Representative Offices of Foreign Enterprises”, ROs have gradually lost their status as an efficient investment vehicle in China from a tax perspective. Effective from 2010, the minimum assessed profit rate has increased from 10 to 15 percent and is facing a potential risk of a higher rate determined by local tax authorities. In addition, Chinese tax authorities have abolished tax exemptions applied to non-profit government organizations or ROs engaged in performing market research and consulting.

The taxation rules on ROs are further complicated by the VAT reform. This is because previously, VAT only applied to the sale of goods – a business activity prohibited for ROs. Such contradictions may create legal obstacles while implementing VAT on ROs. BT and VAT originally applied to distinguishable services; the unification of the two creates ambiguity – all services used to be categorized in BT will now be classified into VAT regulated regime, making VAT a rather abstract definition. The VAT reform may make ROs one of the biggest beneficiaries from tax cut, but how to transfer directly from BT to VAT remains a difficult task for taxpayers. Since VAT reform is still at the early stages of implementation, no regulations governing the tax cut have been publicized, leaving the actual tax benefits a mystery.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Tax, Accounting, and Audit in China 2016

Tax, Accounting, and Audit in China 2016

This edition of Tax, Accounting, and Audit in China, updated for 2016, offers a comprehensive overview of the major taxes that foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China-based operations.

Annual Audit and Compliance in China 2016

Annual Audit and Compliance in China 2016

In this issue of China Briefing, we provide a comprehensive analysis of the various annual compliance procedures that foreign invested enterprises in China will have to follow, including wholly-foreign owned enterprises, joint ventures, foreign-invested commercial enterprises, and representative offices. We include a step-by-step guide to these procedures, list out the annual compliance timeline, detail the latest changes to China’s standards, and finally explain why China’s audit should be started as early as possible.

Managing Your Accounting and Bookkeeping in China

In this issue of China Briefing, we discuss the difference between the International Financial Reporting Standards, and the accounting standards mandated by China’s Ministry of Finance. We also pay special attention to the role of foreign currency in accounting, both in remitting funds, and conversion. In an interview with Jenny Liao, Dezan Shira & Associates’ Senior Manager of Corporate Accounting Services in Shanghai, we outline some of the pros and cons of outsourcing one’s accounting function.

- Previous Article China-Israel Relations: Why the Tech Industry is Key to Bilateral Trade and Investment

- Next Article 2016 Best China Law & Business Blogs