China’s SAT Clarifies Issues Regarding Vehicle and Vessel Tax Collection

Aug. 7 – China’s State Administration of Taxation (SAT) promulgated the “Announcement Concerning Issues Regarding Vehicle and Vessel Tax Collection (SAT Announcement [2013] No. 42, hereinafter referred to as ‘Announcement 42’)” on July 26. Announcement 42 will enter into force on September 1, 2013.

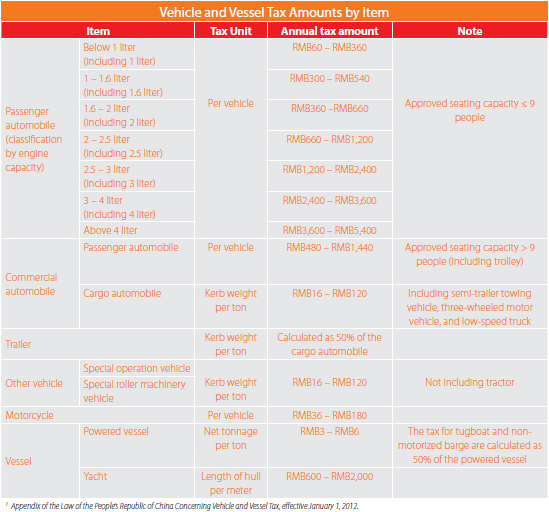

In China, owners or administrators of certain types of vehicles and vessels are subject to an annual tax in accordance with the 2012 Vehicle and Vessel Tax (VVT) Law. Announcement 42 is released as a supplementary guidance to clarify certain issues that were unclear in the 2012 VVT Law.

Specifically, Announcement 42 states that domestic organizations or individuals are not subject to VVT for renting foreign vessels. However, domestic organizations or individuals should pay VVT for renting outbound vessels.

Announcement 42 defines special operation vehicles as vehicle with technical features designed for special operations and equipped with special equipment or appliances – including auto cranes, fire engines, concrete pump trucks, wreckers, aerial cages, sprinkler cars, and sweeping cars. It clarifies that special vehicles produced with the main purpose of transporting commodities or people (e.g. an ambulance) are not considered special operation vehicles.

In terms of vehicle for dual purposes (i.e. passenger and cargo), VVT should be collected based on the tax unit and benchmark annual tax amount.

If there is mantissa in tax unit (e.g. curb weight, net tonnage, boat length), the mantissa should not be rounded off in the calculation of tax payable. However, the tax amount calculated based on the tax unit should be rounded to two decimal places. Passenger vehicles should determine the tax interval based on engine displacement indicated on the motor vehicle registration certificate, or on the driving certificate issued by the vehicle registration and administration authorities.

Vehicles and vessels that have paid VVT, but are returned to the manufacturer or dealer because of quality defects, Announcement 42 states that taxpayers could apply for a VVT return for the period starting from the return of vehicle or vessel (the return invoice day) to the tax year end at the local tax authority.

Under the circumstance that VVT has been withheld by the insurance company when the taxpayer purchased compulsory third party insurance for motor vehicles, the taxpayer does not need to pay VVT again for the same year if they present the withholding tax receipt to the local tax authority.

According to the VVT Law, the formula for calculating VVT is:

- Tax payable = Quantity × Applicable Tax Amount Per Unit

Tax exemptions may be given on diplomatic vehicles and vessels. Preferential policies are available for energy-saving vehicles/vessels or vehicles/vessels using new energy.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

This edition of the China Tax Guide, updated for 2013, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

- Previous Article Second Draft Amendment to China’s Trademark Law Sent to NPC for Review

- Next Article China’s Tax Incentives for High-Tech Enterprises