China’s Rising Manufacturing Costs: Challenges and Opportunities

By Chris Devonshire-Ellis, Matthew Zito and Eunice Ku, Dezan Shira and Associates

The recent decades of China’s export-driven economic growth has come at the cost of severe pollution to the environment, which has in turn posed a threat to the health of its inhabitants. The downturn in the global economy also led China to realize the vulnerability of its economic model due to its dependence on the demands of its overseas markets. To transform and rebalance its economy, China has been actively promoting the development of its service sector, high-tech industries and domestic consumption so as to ensure sustainable growth. In this regard, the government has driven up minimum wages, allowed the yuan to appreciate, aggressively enforced labor and environmental regulations, thus increasing the costs of manufacturing in China and driving out low-end businesses.

In China’s rush to wean itself from being an export-driven economy and into a consumer-based economy, it is State policy to place more money in the hands of Chinese nationals. This means that China has a specific agenda of raising workers’ salary levels on an annual basis. Annual increases in Chinese worker salaries and the increasing mandatory welfare costs associated with this are making some local governments in China have to strike a fine balancing act between making companies happy (with no further raises to labor cost) and workers demanding higher salaries — which will attract more workers and increase local consumption.

Wage Increases in China

For some time now, rising labor costs in China have been setting off alarms among foreign investors. According to China’s Employment Promotion Plan, the minimum wage in each jurisdiction must be increased at least once every two years; meanwhile, the 2011-15 Five- Year Plan stipulates an average increase of 13 percent per year. Based on 2014 figures, however, it looks like China’s wage increases have begun to slow down, as the Central Government exerts pressure on maintaining economic growth targets.

RELATED: Costs of Running a WFOE in China

Wage standards in China are set for individual cities, provinces and other administrative units by their respective local governments, rather than on a nationwide basis. As of June of this year, wages had been hiked in a total of eleven areas–Beijing, Chongqing, Gansu, Guangdong (Shenzhen), Qinghai, Shaanxi, Shandong, Shanxi, Shanghai, Tianjin and Yunnan–at an average of 11 percent for monthly minimum wage increases. Most recently, an additional wage increase for Sichuan took effect on July 1, 2014. Based on the date of their last respective updates, wages will also be increased in Hebei, Heilongjiang and Tibet before the year is up. If this trend continues through the remainder of 2014, some 26 regions may be on track for increases to their minimum wage. This is slightly better news for foreign investors when compared with last year’s total of increased wages in 27 provincial-level jurisdictions at an average of 17 percent.

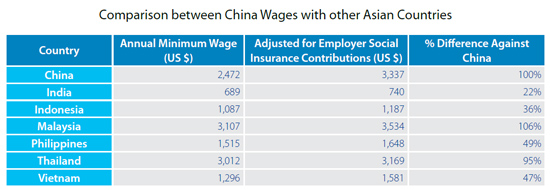

Many China commentators have been focusing on the increasing labor costs in China, and noting how many China-based businesses are now struggling in the face of rising wages. The China-ASEAN free trade agreement (FTA), which was signed off in 2002 and came into effect more than three years ago, offers a way out by allowing companies to reposition manufacturing to other low cost areas of Asia, yet still be able to service the China market via the duty-free imports permitted under the FTA. With ASEAN including the vibrant economies of Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam, together with smaller regional players such as Brunei, Cambodia, Laos and Myanmar, this single agreement is reshaping the coordinated development of China-ASEAN manufacturing.

Many China commentators have been focusing on the increasing labor costs in China, and noting how many China-based businesses are now struggling in the face of rising wages. The China-ASEAN free trade agreement (FTA), which was signed off in 2002 and came into effect more than three years ago, offers a way out by allowing companies to reposition manufacturing to other low cost areas of Asia, yet still be able to service the China market via the duty-free imports permitted under the FTA. With ASEAN including the vibrant economies of Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam, together with smaller regional players such as Brunei, Cambodia, Laos and Myanmar, this single agreement is reshaping the coordinated development of China-ASEAN manufacturing.

The ASEAN–China Free Trade Area is the world’s largest free trade area in terms of population and third largest in terms of nominal GDP after the European Union and NAFTA. The original FTA reduced tariffs on nearly 8,000 product categories, or 90 percent of imported goods, to zero. The average tariff rate on Chinese goods exported to ASEAN is now only 0.6 percent, down from 12.8 percent, while the tariff rate on ASEAN goods exported to China also fell from 9.8 percent to 0.1 percent.

These favorable terms have taken effect in China and original ASEAN members, Brunei, Indonesia, Malaysia, the Philippines, Singapore and Thailand. Cambodia, Laos, Myanmar and Vietnam will implement these terms in 2015. Details of the China-ASEAN FTA can be found on ASEAN Briefing, which also includes regular updates on China’s tax treaties throughout the region.

This article is an excerpt from the July-August 2014 edition of China Briefing Magazine, titled “Adapting Your China WFOE to Service China’s Consumer.” In this issue, we look at the challenges posed to manufacturers amidst China’s rising labor costs and stricter environmental regulations. Manufacturing WFOEs in China should adapt by expanding their business scope to include distribution and determine suitable supply chain solutions. In this regard, we will take a look at the opportunities in China’s domestic consumer market and forecast the sectors that are set to boom in the coming years.

This article is an excerpt from the July-August 2014 edition of China Briefing Magazine, titled “Adapting Your China WFOE to Service China’s Consumer.” In this issue, we look at the challenges posed to manufacturers amidst China’s rising labor costs and stricter environmental regulations. Manufacturing WFOEs in China should adapt by expanding their business scope to include distribution and determine suitable supply chain solutions. In this regard, we will take a look at the opportunities in China’s domestic consumer market and forecast the sectors that are set to boom in the coming years.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Using China WFOEs in the Service and Manufacturing Industries

Using China WFOEs in the Service and Manufacturing Industries

In this issue of China Briefing Magazine, we provide a detailed overview of the WFOE establishment procedures as well as outline the typical costs associated with running these entities in China. We hope that this information will give foreign investors contemplating entry into the Chinese market a better understanding of the time and costs involved.

Strategies for Repatriating Profits from China

Strategies for Repatriating Profits from China

In this issue of China Briefing, we guide you through the different channels for repatriating profits, including via intercompany expenses (i.e., charging service fees and royalties to the Chinese subsidiary) and loans. We also cover the requirements and procedures for repatriating dividends, as well as how to take advantage of lowered tax rates under double tax avoidance treaties.

- Previous Article Clean Energy Investing in China

- Next Article Guanxi Writ Large: China and Germany’s “Special Relationship”