China’s Ministry of Finance Releases Tax Revenues for Q1 2012

Total tax revenues near RMB2.6 trillion for Q1 2012, but growth is significantly slower than Q1 2011

By Xiaolei Gu

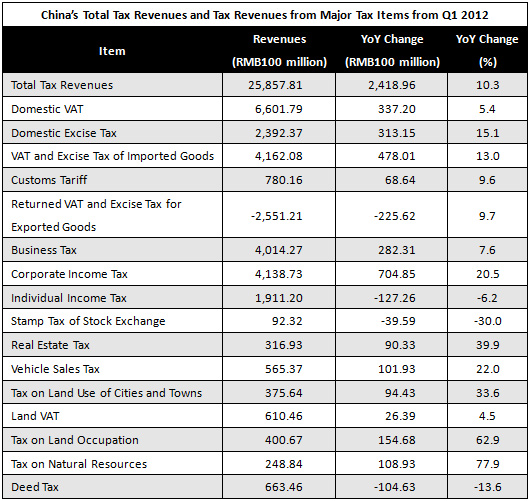

Apr. 25— China’s Ministry of Finance released the country’s tax revenues for the first quarter of 2012 on Tuesday, with highlights including year-on-year (y-o-y) growth in total revenues of 10.3 percent to RMB2.59 trillion (US$410 billion).

However, the 10.3 percent y-o-y growth rate marked the slowest pace recorded in the past three years – down 22.1 percentage points from the year-on-year growth rate recorded in the first quarter of 2011. The growth rates of domestic VAT, excise tax, business tax and corporate income tax dropped 17.8 percent, 6.4 percent, 18.7 percent and 17.4 percent, respectively, compared to the y-o-y growth rates seen in the first quarter of 2011.

That being said, the majority of China’s key tax items still saw positive (albeit moderate) y-o-y growth this past quarter. One notable exception is total individual income tax revenues, which failed to hit the levels recorded in the first quarter of 2011, decreasing by 6.2 percent y-o-y.

Besides a slowdown in the growth rate of domestic tax revenues, the growth rate of tax revenues from imports also plunged in the first quarter of this year. The y-o-y growth rate of VAT and excise tax of imported goods stood at 13 percent while customs tariffs grew by 9.6 percent, down a respective 35.8 percent and 37.9 percent compared to 2011’s y-o-y growth rates for the first quarter.

Tax revenue growth rates related to real estate fell sharply in the first quarter as well, with deed tax and real estate sales tax experiencing drops of 13.6 percent and 17.5 percent, respectively, year-on-year. The y-o-y growth rate of land VAT stood at 4.5 percent this past quarter, down 108.4 percentage points from the y-o-y growth recorded in Q1 2011.

There are four major reasons for the slowdown this quarter, as summarized in the statement on MOF’s website.

- First of all, the slow down in economic growth has led to a slow down in growth of related tax revenues.

- Secondly, as the tax revenues are calculated at current prices, the fall of CPI in the first quarter of 2012 has had certain influence.

- Thirdly, the fall in sales of real estate greatly affected the tax revenues in Q1.

- Lastly, the government has carried out a series of tax reduction measures since the fourth quarter of 2011, including the individual income tax reform, wage increase, reduced custom tariffs, and VAT trials. All those measures have reduced the total tax revenues in Q1 to some degree.

China’s tax revenue details issued by the Ministry of Finance for the first quarter of 2012 can be found in the table below:

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China, Hong Kong, India, Singapore and Vietnam. For further information, please visit the firm’s web site, E-mail china@dezshira.com, or download their brochure here.

Related Reading

The China Tax Guide (Fifth Edition)

The China Tax Guide (Fifth Edition)

This popular book, fully updated with all recent tax changes and amendments, details all taxes in China affecting businesses and individuals, how to calculate the amounts due, tax registration and filing procedures, tax minimization techniques, and claiming VAT rebates. It also details good financial management techniques, handling negotiations with the tax bureau and annual audit and compliance procedures.

Six Key Points Regarding China’s Tax Reforms in 2012

China’s Economic Figures for Q1 2012

China’s Provincial Outbound Direct Investment in 2011

China’s Provincial GDP Figures in 2011

China’s Provincial Retail Statistics for 2011

Minimum Wage Levels Across China

- Previous Article China Signs Taxation Agreements with Botswana and Netherlands

- Next Article China’s SAT Issues Measures for Claiming Zero-Rated VAT