China’s Changing Labor Market – Trends and Future Outlook

China’s labor market – the largest in the world – is undergoing a period of rapid change. As the population ages, the working-age population shrinks, and new forms of employment become more prevalent, China is seeking to upskill its workforce to increase value and efficiency. We look at the latest data on China’s labor force and discuss how demographic shifts, changing work attitudes and preferences, and industry trends will impact the trajectory of the country’s economic development.

In March 2023, the All-China Federation of Trade Unions (ACFTU) issued its quinquennial labor survey, titled the Ninth National Workforce Survey (the “ACFTU survey”). The ACFTU survey, which was conducted from January to September 2022, gathers a wide range of data on China’s labor market, including the size and make-up of its workforce, changing attitudes toward work, and new employment trends.

Since the last ACFTU survey was first conducted in 2017, China’s labor force has undergone further changes, which will have long-term effects on the development of China’s industry and economy.

In this article, we look at the state of China’s current labor market and examine some of the new trends and developments that will impact the future of doing business in China.

Overview of China’s labor force

According to the ACFTU survey, China’s total number of laborers has grown to 402 million people at the beginning of 2022, up from 391 million recorded in 2017 when the last workforce survey was conducted. The National Bureau of Statistics (NBS) places the number of people who are engaging in some form of social labor in return for remuneration or income who are over the age of 16, or the total size of the workforce, at around 733.5 million, dropping from 746.5 million in 2021.

There were around 293 million “migrant workers” in 2022, people who have left rural areas to find work in urban areas. Migrant workers therefore account for around 72 percent of the total number of laborers.

Age and education

The average worker age in China has increased to 38.3 years in 2022 from 37.1 in 2017. The average age of industrial workers was 38.29, while the majority of professional technical personnel were between 30 and 50 years old, and were mostly working in the education, manufacturing, and healthcare and social work industries.

The average length of education of workers has also increased slightly to 13.8 years in 2022, up from 13.6 in 2017. Over 85 percent of workers had a high school diploma or above, and 35 percent had a college degree. Workers in tertiary industries, or services industries, had the highest average education length at 14.5 years. Workers in the secondary industry (such as industry and manufacturing) had an average of 13 years of education. Finally, those in the primary industry (such as agriculture and resource extraction) had received the lowest average length of education, at 12.5 years.

Industrial workers (a broad term referring to a wide range of workers who engage in collective productive labor across all three industrial sectors in exchange for wages) had received on average 13.16 years of education, and 29.3 percent of them had professional and technical titles.

New laborers tended to have a high school education or below, with 70.7 percent of truck drivers having a junior high school education (which is a total of nine years) or below. Meanwhile, 38 percent of online car-hailing drivers have a college education or above, while couriers and delivery drivers have a high school (total of 12 years) or below.

Industries

One of the new major changes to China’s labor force is an increase in the proportion of people working in “new forms of employment”. This concept is similar to that of “gig workers” in the West, referring to people who provide various services through internet platforms on a flexible to-order basis, such as online car-hailing drivers, couriers, takeaway delivery drivers, and others.

There are currently around 84 million people doing this type of work, around 20.9 percent of the total workforce. Although the ACFTU survey did not give specific numbers, the Q&A stated that the majority are young to middle-aged men, with a relatively large proportion coming from rural areas.

The vast majority of industrial workers – 82.7 percent – work in secondary industries, and 77.6 percent work in manufacturing and construction. The proportion of industrial workers in the tertiary industries is also growing, according to the survey, though no specific figures were given.

Labor costs

Labor costs have continued to rise in China, due primarily to rising costs of living and income levels as the economy grows and moves up the value chain.

According to data from the NBS, the per capita income from wages was RMB 20,590 (approx. US$2,993) in 2022, an increase of 4.9 percent from the previous year, which accounted for 55.8 percent of disposable income. The average monthly wage of a migrant worker was RMB 4,614 (approx. US$671), up 4.1 percent from 2021.

Minimum wages have also continued to rise across all regions of China. Monthly minimum wages range from a low of RMB 1,420 (approx. US$206) in some areas of Liaoning Province to a high of RMB 2,590 in Shanghai. 14 regions in China now have a minimum monthly wage of over RMB 2,000 (approx. US$308), including Beijing, Hebei, Jiangsu, Zhejiang, Guangdong, and Sichuan.

The average yearly income of urban residents in 2021, per the latest available data, was RMB 106,837 (approx. US$15,529), breaking the RMB 100,000 mark for the first time. The industry with the highest average income was information transmission, computer services, and software industries, with an average annual income of RMB 201,506 (approx. US$29,290), while the lowest was in the accommodation and catering industry, with an average annual income of RMB 53,631 (approx. US$7,795).

The increasing labor costs in China correspond with an overall increase in spending and costs of living. According to data from the NBS, China’s disposable income per capita grew to RMB 36,883 (approx. US$5,361) in 2022, a nominal increase of 5 percent year-on-year. Meanwhile, costs of living have increased, in particular in manufacturing hubs, such as Shanghai and Guangdong Province.

In addition to rising wages and living standards, the increase in costs is also being driven by the increase in employees’ education and training. As China strives to move its economy up the value chain by modernizing traditional industries and focusing on the production of high-value goods, so does its need for higher-skilled labor, which comes at a higher cost.

Trends in China’s labor market

Aging population

China’s changing demographics are expected to significantly change the makeup of the country’s workforce over the coming decades.

One important change is the steady increase in its working age population. As mentioned above, the average age of China’s labor force increased from 37.1 in 2017 to 38.4 in 2022.

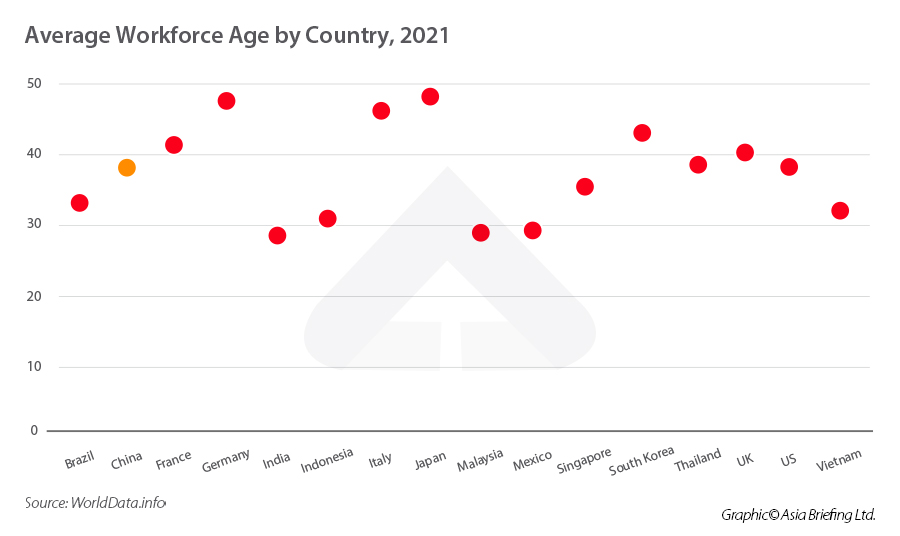

This puts the average worker age in China above that of other developing markets, such as Mexico and Vietnam (which in 2021 had average workforce ages of 29.3 and 31.9, respectively), but significantly lower than that of most developed countries, such as Germany and Japan, which are further along in their demographic shifts.

China’s population dropped for the first time in decades in 2022, dropping by around 850,000 people. Demographic modeling by the UN suggests China’s population will decrease to 1.313 billion by 2050 and to below 800 million by 2100.

The fast rate of population decline will also mean that China’s labor force will begin to shrink. This poses a significant threat to China’s economy, which has been fueled over the last few decades by the large and active workforce. Primary and secondary industries are expected to feel the brunt of the population decline as younger generations eschew traditional manufacturing in favor of higher-paid and more comfortable service sector jobs.

In fact, the ACFTU survey found that there is a structural gap in traditional manufacturing fields, and there is a demand for upskilling employees. This is driven in part by the fact that younger generations are less willing to work in factories.

While China’s aging population poses a long-term challenge to China’s economy, it is still likely to be many decades before significant labor shortages emerge across different sectors. In fact, over the past few years, China has struggled more with unemployment rather than labor shortages. In January and February 2023, the surveyed unemployment rate of the general population was 5.6 percent, while youth unemployment (those aged 16 to 24) was 18.1 percent.

China is currently focusing on upgrading its traditional industries and mitigating the risks of a shrinking workforce by investing in further automation and digitalization. In the future, China’s value will produce value increasingly from skill rather than volume, and the training and upskilling of existing employees will become ever more important.

Improving labor rights

Although the ACFTU survey acknowledges the difficulty in establishing and protecting the rights of gig workers due to the flexible and irregular nature of the work, the government has made efforts to enforce labor protection rules on the internet companies that operate the platforms.

For instance, in 2021, China’s State Administration of Market Regulation (SAMR) issued policy guidelines that ordered internet platforms providing food delivery services to ensure workers are paid the minimum wage, are not subject to excessive working hours, and adhere to certain safety standards, among other requirements.

In March 2022, the Cybersecurity Administration of China (CAC) issued regulations on the application of recommendation algorithms on service platforms that, among other things, requires the algorithms to guarantee “workers’ legal rights and interests, such as remuneration, rest time, and holidays”.

In 2022, China’s Trade Union Law was amended to ostensibly enable gig workers to form unions, although due to China’s strict laws on the activity of trade unions, it is unclear how much power workers will have to lobby for change.

China has made major in-roads into the protection of the rights of women in the workforce. In October 2022, China passed the Law on the Protection of Women’s Rights and Interests (“Women’s Protection Law”), which incorporates gender discrimination in the workplace into the scope of labor security supervision. The law explicitly prohibits gender discrimination in the hiring process, which includes discrimination against an applicant on the basis of gender, and prohibits requiring a certain maternal or marital status. It also further clarifies the definitions of sexual harassment in the workplace, thus strengthening the enforcement of other laws and regulations.

China has also made an effort to curb the so-called “996” work culture that is prevalent in many white-collar workplaces, in which employees are expected to work from 9 am to 9 pm, six days a week. In September 2021, China’s top court ruled that the “996” work schedule was illegal under Chinese labor law.

Work-life balance and technical upskilling

An important development in China’s work culture over the past few years is a greater awareness of work-life balance and an increasing backlash against overwork. This is particularly true in white-collar professions, perhaps due to the higher level of visibility of these positions within society. A number of high-profile incidents at tech companies in particular have renewed criticism and backlash against the “996” work culture.

This sentiment is reflected in the ACFTU survey, which found that 20 percent would like to have more leisure time.

The survey also found that employees are also placing higher importance on their long-term development, with 95.3 percent of workers interested in learning new vocational skills or knowledge. This proportion is particularly prominent among employees aged 18 to 40 and employees with a bachelor’s degree or above.

Upskilling China’s labor force for the future

China’s labor force remains highly competitive when compared to other markets. When taking into account the total number of people engaged in some form of work, China continues to have the world’s largest workforce, which remains a significant draw for companies. It also still has a very large workforce in key industries, such as manufacturing, and a growing number of people working in high-value industries, such as technology, finance, and professional services.

Due to the long-term shrinking of China’s working-age population, ensuring that China’s labor force remains competitive will rely on increasing efficiency and the skill level of workers. The Chinese government is already making efforts to achieve this with the release of various policies aimed at advancing vocational training, such as the “14th Five-Year Plan” Vocational Skills Training Plan released in 2021. This plan aims to improve the employment and entrepreneurship capabilities of workers and alleviate structural employment conflicts by improving the vocational skills training system, enhancing the supply capacity of vocational skills training, improving the quality of vocational skills training, promoting standardization, and improving the vocational development channels of skilled personnel.

In October 2022, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council released the Opinions on Strengthening the Construction of High-Skilled Talent Teams in The New Era. These opinions, among other targets, call for increasing the proportion of skilled workers in employment to 30 percent by 2025, up from 26 percent in 2021.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s Economy in 2023: GDP Grew by 4.5% in Q1

- Next Article Brazilian Coffee Exports to China Expected to Surge by 65 Percent in 2024