Navigating China’s Evolving Labor Market in 2025

China’s labor market is transforming rapidly in 2025, driven by demographic shifts, evolving workplace preferences, and technological advancements. This article explores the trends and challenges in maintaining a sustainable workforce.

China’s labor market is undergoing a period of significant transformation as it adapts to the changing dynamics of 2025. Driven by demographic shifts, evolving workplace preferences, and rapid technological advancements, the country is experiencing a contraction in its working-age population coupled with an aging workforce. At the same time, rising educational levels, increased urbanization, and shifting attitudes toward work are reshaping the nature of employment in China. These changes are placing growing pressure on businesses to rethink their talent strategies.

As the demand for highly skilled professionals intensifies across key sectors, companies face increasing competition to attract and retain the right talent. In such a competitive environment, a well-defined and adaptable talent strategy is more crucial than ever for sustaining long-term business growth.

Organizations must not only focus on effective recruitment practices but also ensure that their workplace culture, compensation packages, and training opportunities align with the expectations of the modern workforce. This article delves into the key challenges and trends shaping talent recruitment in China and outlines strategies for employers to stay ahead in the evolving labor landscape.

Changing workforce dynamics

Aging workforce and shrinking working age population

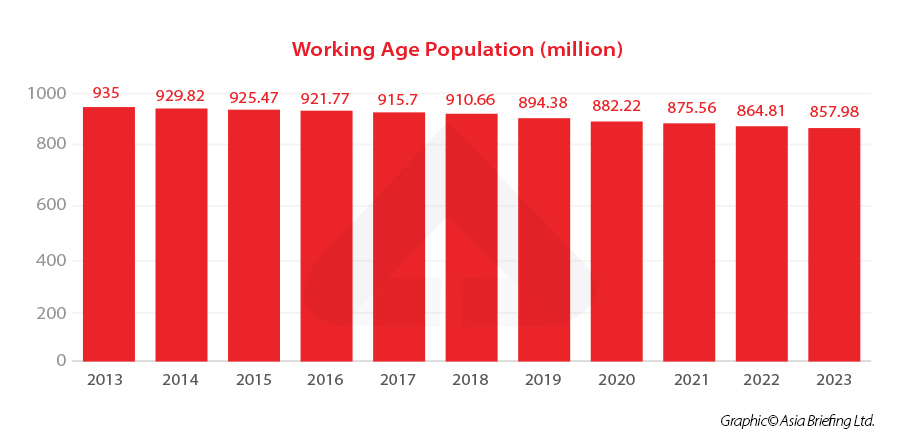

China is currently experiencing significant demographic shifts with profound implications for the country’s labor force. Due to falling birth rates and a rapidly aging population, the size of China’s working-age population is declining. In 2023, the working-age population (ages 15 to 59) stood at 857.98 million, 6.83 million fewer than in 2022 and 77.02 million fewer than in 2013.

Additionally, the average age of workers has risen substantially over the past few decades, from 32.25 years in 1985 to 39.72 years in 2022. As of 2022, around 54.11 percent of the population was between the ages of 25 and 45, according to the 2024 Human Capital Report from the Center for Human Capital and Labor Market Research at the Central University of Finance and Economics. The provinces with the highest proportion of people in this age group were Shanghai, Beijing, Guangdong, Tianjin, and Fujian, while the lowest proportions were found in Sichuan, Guizhou, Jiangxi, Hunan, and Heilongjiang. This suggests that younger working-age individuals continue to gravitate toward China’s wealthier provinces and municipalities for employment, while poorer and less developed areas are seeing their working-age populations shrink more rapidly due to declining birth rates.

This ongoing trend has several implications for China’s labor force. As the working-age population declines and the average worker’s age increases, labor shortages are emerging in certain industries, particularly those that rely on younger, more physically capable workers, such as manufacturing, construction, and logistics.

Meanwhile, the concentration of younger workers in the developed urban centers suggests that these regions will continue to benefit from a more dynamic, skilled, and adaptable workforce, driving innovation and economic growth. However, this will come with increased labor competition and rising wages.

Conversely, poorer and less developed provinces with a shrinking proportion of younger workers face a growing labor gap, which could lead to slower economic growth, declining productivity, and difficulties in attracting new businesses. In efforts to foster economic revitalization and reduce regional disparities, both local and central governments are introducing various incentive policies to attract businesses and skilled workers to these areas.

By the end of 2024, there were 734.39 million people in employment, with 64.5 percent working in urban areas. This represented a decrease of 6.02 million from the previous year. However, the country added 12.56 million new urban jobs in 2024, an increase of 120,000 compared to 2023.

The total number of migrant workers reached 299.73 million, an increase of 0.7 percent from the previous year. Of these, 178.71 million worked outside their township, while 121.02 million were employed in non-agricultural, non-self-employment jobs within their own townships.

Although China’s labor force is shrinking, productivity has increased. In 2024, the productivity rate reached RMB 173,898 (US$23,982) per person, marking a 4.9 percent increase from the previous year. The proportion of women in the workforce is also steadily rising. In 2023, there were 320 million female workers, accounting for 43.3 percent of the total workforce, up by 0.1 percentage points from 2022.

The average length of education of workers has significantly increased in recent decades, reaching an average of 11.05 years, three years longer than in 1982. Among new entrants to the labor force in 2023, the average length of education was 14 years, and 250 million people were enrolled in higher education.

These trends highlight China’s evolving labor market dynamics and its efforts to offset the impact of a shrinking and aging workforce. The rise in productivity per worker suggests that technological advancements, automation, and skill development are helping to sustain economic output.

A higher proportion of women in the workforce may also contribute to labor market stability by expanding the talent pool. Additionally, the significant increase in educational attainment indicates that China is shifting toward a more knowledge-based economy, with a labor force better equipped for high-skilled industries. This can help to mitigate the challenges of an aging workforce by ensuring that fewer, more highly skilled workers can maintain or even enhance economic productivity.

Rising wages and income

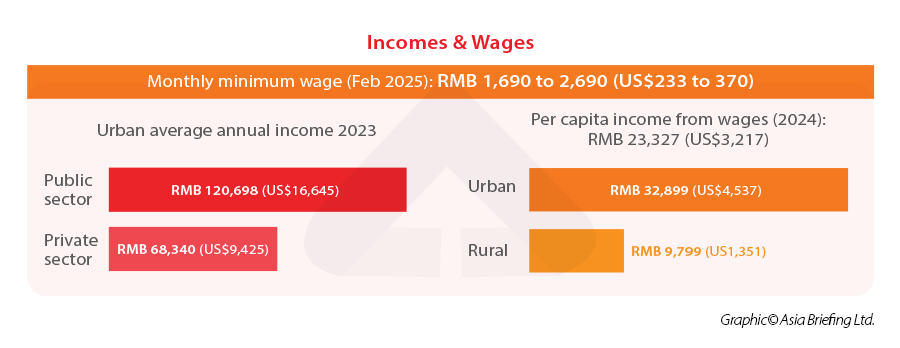

As China’s GDP has grown over the decades, so too have the incomes and wages of its residents and workers. In 2024, the average per capita income from wages reached RMB 23,327 (US$3,217), marking a 5.8 percent increase from 2023. For urban residents, this figure rose to RMB 32,899 (US$4,537), while for rural residents, it was RMB 9,799 (US$1,351).

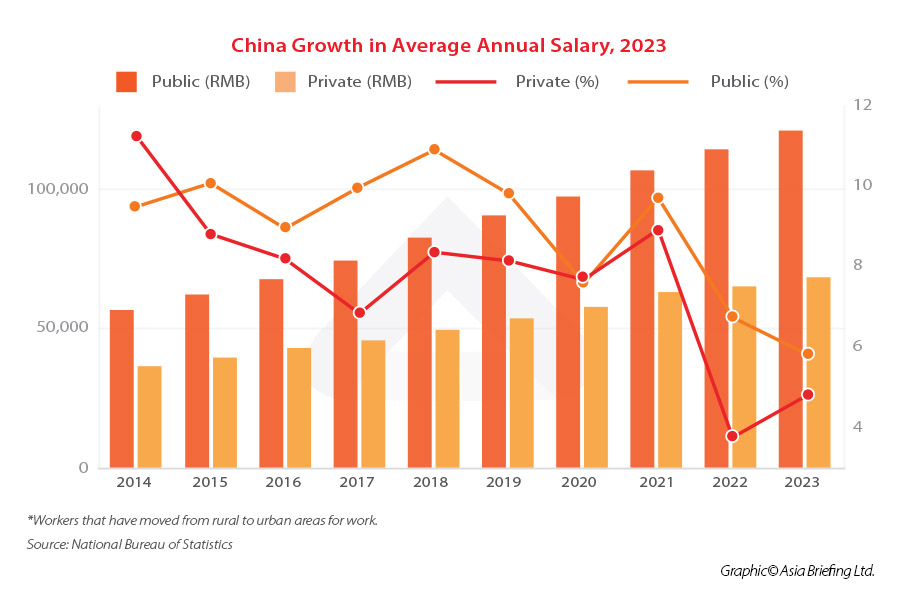

Average wages have more than doubled over the past decade, though significant wage disparities remain between the public and private sectors. In 2023, the average annual urban wage in the public sector was RMB 120,698 (US$16,645), up from RMB 56,360 in 2014. In comparison, the average urban wage in the private sector was RMB 68,340 (US$9,425), up from RMB 36,390 (US$5,019) in 2014.

Foreign-invested companies also offer higher wages. In 2023, the average annual wage in these companies was RMB 149,130 (US$20,567).

The highest wages in both the private and public sectors were found in the information transmission, software, and IT industries. In the public sector, average wages reached RMB 231,810 (US$31,969), while in the private sector, they were RMB 129,215 (US$17,820), with year-on-year increases of 5.2 percent and 4.3 percent, respectively. The second-highest earning industry was finance, where workers earned RMB 197,663 (US$27,260) in the public sector and RMB 124,812 (US$17,213) in the private sector.

China’s minimum wage has also seen significant increases. In Shanghai, which currently has the highest monthly minimum wage in the country, the minimum wage has risen by 66 percent from RMB 1,620 in 2013 to RMB 2,690 (US$370) as of February 2025. In Guangxi Province, which has the lowest minimum wage, the rate has increased by over 40 percent, from RMB 1,200 (US$165) per month in the largest cities to RMB 1,690 (US$233) as of February 2025.

Urbanization and domestic movement of workers

The movement of workers across China has fluctuated significantly in recent years. During the pandemic, migration to the country’s largest cities slowed, with the permanent populations of major cities such as Shanghai declining. This was due to a combination of falling birth rates and reduced net migration. Meanwhile, smaller provincial and prefecture-level cities, like Nanchang, saw population increases, suggesting that people were increasingly opting to relocate to smaller cities closer to their hometowns.

However, this trend appears to have reversed over the past two years. In 2023, Shenzhen’s population reached a record 17.8 million, growing by 128,300 people and reversing the population decline of 2022. Similar patterns were observed in Shanghai and Beijing, despite these cities experiencing negative natural population growth (birth rate minus death rate). This indicates that the established economic centers in eastern and southern China remain attractive destinations for work and living. In contrast, Chongqing, which saw population growth during the pandemic, experienced a decrease of 219,100 people.

At the same time, many smaller cities across China are also seeing population growth, despite low birth rates. Some fast-growing provincial and regional capitals, known as “new first-tier cities,” like Hefei, Zhengzhou, and Hangzhou, have seen some of the largest population increases in the country.

In 2023, their populations increased by 219,000, 180,000, and 146,000 people, respectively. These cities are benefiting from efforts to develop industrial clusters and attract businesses, which has led to an increase in job opportunities.

It is also important to note that China is continuing its process of urbanization, driven by both natural factors such as better living standards, job opportunities, and higher incomes, as well as national and local policies aimed at attracting talent and relaxing household registration restrictions. By 2024, China’s urbanization rate reached 67 percent, an increase of 0.84 percentage points from 2023. With urbanization remaining a key priority to boost citizens’ income levels, further migration into cities is expected to continue for many years.

Changing attitudes and work preferences

Beyond demographics and wages, China’s workforce has undergone significant cultural shifts over the past few decades. Although the overall labor force is aging, younger cohorts entering the workplace are reshaping workplace culture, job preferences, and attitudes toward work-life balance, which has profound implications for the future of labor dynamics and organizational practices.

Among lower-income workers, a major change among younger cohorts is the rejection of the types of manual jobs in construction and manufacturing that were once primary employers of previous generations. Instead, younger workers are gravitating toward the service sector and gig economy jobs, such as couriers and delivery drivers.

While these positions are generally lower-paying, they offer greater flexibility and are less physically demanding compared to work in manufacturing and construction.

An important development in China’s work culture over the past few years is the growing awareness of work-life balance and an increasing backlash against overwork. This trend is especially evident in white-collar professions, likely due to the higher visibility of these positions within society. A number of high-profile incidents at tech companies, in particular, have sparked widespread criticism and resistance against the notorious “996” work culture, where employees are expected to work from 9 am to 9 pm, six days a week.

In relation to this shift, government and public sector positions are becoming more desirable once again. These roles, once known as the “iron rice bowl” for their stability, had lost appeal as many sought the higher pay potential and prestige of the rapidly growing private sectors, particularly in tech and digital industries.

However, the allure of these industries has diminished amid reports of overwork and instability, as some companies face financial difficulties, layoffs, or closures.

The increasing appeal of government jobs among younger workers reflects a broader desire for job stability and regular hours, a trend that has only intensified in the wake of the pandemic. This shift highlights a growing preference for secure, balanced work environments over the unpredictable demands and pressures of the private sector.

Competition for high-skilled talent

Due to the various demographic and cultural shifts discussed above, China is facing significant talent shortages across key sectors such as technology, manufacturing, and finance. In response, companies must adopt proactive strategies to attract and retain top-tier talent in this increasingly competitive landscape.

The technology sector is particularly affected as China continues its push toward high-end automation, artificial intelligence, semiconductor development, and related fields. According to the 2023 Artificial Intelligence Talent Insight Report from recruitment platform Maimai, the talent supply-demand ratio in the AI field dropped to 0.39 between January and August 2023, meaning that five open positions were competing for two candidates.

Additionally, the China Semiconductor Industry Association predicts that by 2024, the total number of professionals in China’s chip industry will reach about 790,000, with a talent gap of 230,000. Within this gap, the design and manufacturing industries will face a shortage of approximately 100,000 professionals.

In intelligent manufacturing, the Ministry of Human Resources and Social Security (MOHRSS) projects that demand will reach 9 million by 2025, with a talent shortfall of approximately 4.5 million. Talent shortage is thus emerging as a major limitation for the sector’s growth.

With government initiatives emphasizing innovation and self-reliance, there is a growing demand for highly specialized engineers and researchers. However, many professionals seek employment opportunities that offer flexibility and competitive compensation. To remain attractive, companies need to offer not only financial incentives but also career development programs and pathways for professional growth.

To address these labor shortages, companies are leveraging multiple strategies, beginning with strong employer branding. A positive workplace culture, clear career progression paths, and competitive compensation packages are critical in attracting skilled professionals.

Organizations are also increasingly utilizing recruitment agencies to tap into specialized talent pools and streamline hiring processes. Moreover, training and upskilling initiatives have become essential in retaining employees and enhancing their long-term value within the company.

Beyond financial incentives, non-monetary benefits play a crucial role in talent retention. Companies that provide healthcare benefits, flexible work arrangements, housing assistance, and family-oriented support, such as childcare options, are more likely to retain employees. Additionally, fostering a work culture that prioritizes employee well-being and engagement can lead to higher job satisfaction and loyalty.

Tackling key challenges in talent recruitment in China

As China’s labor market evolves, companies face several challenges in recruiting and retaining talent. These challenges are shaped not only by demographic shifts but also by cultural, regulatory, and technological factors. Understanding and addressing these challenges is crucial for employers to attract top talent in a competitive environment.

Cultural adaptation issues: Aligning values and corporate culture

According to the Talent Trends 2024 – Mainland China report from Michael Page, one of the most pressing issues in talent recruitment is finding candidates who align with a company’s culture and values. Organizations must, therefore, clearly articulate and communicate their corporate culture throughout the recruitment process to ensure a good cultural fit. Failure to do so can lead to mismatches that hinder long-term success and employee retention.

Employers must also strike a balance between meeting candidates’ salary and benefits expectations while keeping compensation costs under control. Competitive salary packages are essential, but they must align with the company’s financial capabilities and market standards. By proactively addressing these cultural and compensation challenges, employers in Mainland China can more effectively attract and retain the best talent in an ever-changing market. Developing a deeply ingrained corporate culture, offering competitive salaries, and focusing on skills development and training are key factors for success.

Navigating China’s labor policies and regulations

China’s labor law landscape has undergone significant reforms, especially in 2024, as part of the government’s broader efforts to address demographic challenges, improve workforce sustainability, and streamline regulatory compliance.

Notable changes included the phased increase in the statutory retirement age, adjustments to pension contribution requirements, and the introduction of simplified rules for cross-border data transfers. These changes have directly impacted workforce management, social security policies, and compliance requirements for both domestic and foreign-invested enterprises.

As China moves into 2025, further reforms are expected in areas such as illness and disability benefits under the basic pension system, flexible retirement options, and updates to public holiday policies. Employers will need to stay up-to-date with these evolving regulations to ensure compliance while maintaining business continuity and protecting employee welfare.

These ongoing adjustments present both a challenge and an opportunity for businesses to refine their human resources strategies.

Digital recruitment gap: Local platforms versus traditional channels

The recruitment landscape in China has rapidly shifted from traditional methods to digital platforms, which offer unique advantages and challenges. Prominent Chinese job portals such as 51job, Zhaopin, BOSS Zhipin, and Liepin cater to a broad range of recruitment needs. 51job and Zhaopin are recognized as major national platforms, while Liepin targets the middle to high-end job market, making it ideal for sourcing skilled professionals. BOSS Zhipin, a platform that facilitates direct communication between job seekers and employers, is revolutionizing the recruitment process by streamlining hiring and improving efficiency.

For international recruitment, platforms like HiredChina cater specifically to foreign talent, bridging the gap between global professionals and Chinese companies. These platforms offer tailored services, including language support and filters for roles that require specific international expertise.

While these digital platforms play a significant role in modern recruitment, they are most effective when complemented by traditional recruitment methods. Local networks and agencies remain valuable tools in many regions across China, where local job websites provide access to regional talent pools.

Additionally, the messaging app WeChat serves as a dynamic tool for job postings and recruitment, especially in cosmopolitan areas. By integrating both digital and traditional recruitment methods, companies can enhance their hiring processes and ensure access to the best talent.

(This article was originally published in our latest issue of China Briefing Magazine, “From Recruitment to Retention: Talent Trends and Strategies in China“. which is is now available as a complimentary download on the Asia Briefing Publication Store.)

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article US-China Relations in the Trump 2.0 Era: A Timeline

- Next Article