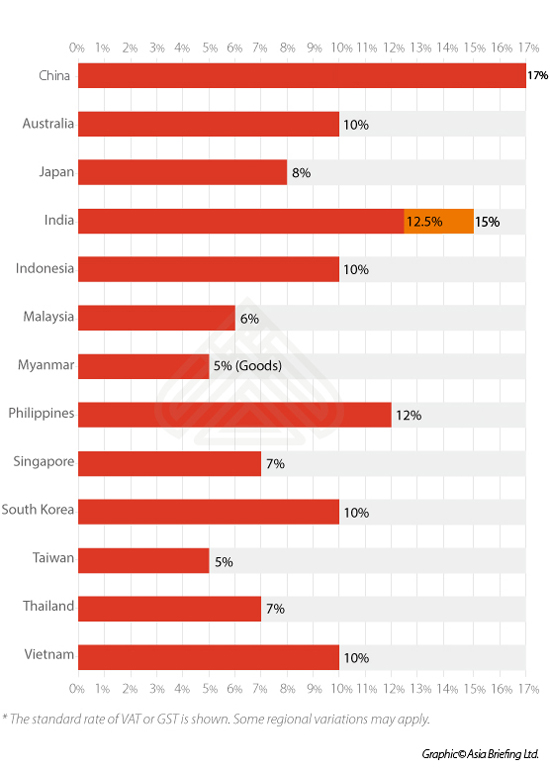

China’s VAT Amongst Highest in Asia

China’s VAT is amongst the highest in Asia, which may partially account for its sluggish approach to becoming a consumer driven economy. China’s 17 percent rate outstrips developed economies such as Japan at 8 percent, Singapore at 7 percent and India, whose rate approaches 15 percent at the higher end.

China has employed a VAT system since 1984. However, it was not until national tax reforms in 2012 that the scope of VAT was expanded and replaced the previous business tax charge. VAT rates in different countries do vary from item to item, and occasionally from region to region, but when the standard rate is compared, we can see how far down the line China has travelled in widening its tax base amongst its citizens. According to China’s tax bureau, VAT now accounts for just over 50 percent of all China’s fiscal revenues.

With such a high standard rate, it is interesting to ascertain whether or not this is actually helpful in China’s move to get its domestic economy moving. For example, Japan’s VAT increase last year from 5 to 8 percent was one of the main reasons behind its flagging economy, although the tsunami event that occurred at the same time shouldered much of the blame, possibly disguising the real impact of higher consumer taxes. China’s VAT problem is also compounded by the fact that, with the sole exception of Hainan Island, VAT in the country is not eligible for full refund at any stage of the sale/purchase supply chain. This means that, rather than creating cash flow and causing the VAT burden to eventually fall squarely on the shoulders of the consumer, tax is extracted at all levels of the supply chain – as well as the final consumer. It means China’s VAT has become a far higher burden than is usually expressed elsewhere and inhibits cash flow in the nationwide transactional process.

It is an equation China needs to get right. While a ‘wait and see’ approach is often adapted by the Chinese to measure whether or not tax burdens can be absorbed by the general population, China’s imposition of a high rate of VAT has had the effect of a black market appearing nationwide, where cash is king and no tax receipts are provided. A rampant market in the provision of fake VAT receipts has also grown exponentially over the past few years.

RELATED: International Tax Planning Services from Dezan Shira & Associates

RELATED: International Tax Planning Services from Dezan Shira & Associates

China’s imposition of high VAT rates and luxury taxes has also largely been responsible for driving mainland ‘tourists’ to Hong Kong in search of cheaper goods – where zero VAT is levied. The fact that millions of mainland Chinese are prepared to go to the lengths of travelling to another city to avoid VAT is telling. Over 22 million mainland Chinese visited the territory last year, equivalent to the entire population of Shanghai turning up in Hong Kong over twelve months. While these arrivals are classified as ‘tourists’, the reality is that the majority of them are ‘tax shoppers’ and only visiting Hong Kong to purchase cheaper goods.

With this obvious distaste for the national 17 percent VAT rate, the size of China’s VAT tax evasion through cash payments can only be estimated at being in the tens of billions of dollars per annum. Foreign investors in China can be easily duped – a quick check of VAT receipts being provided to your local accounts department is almost guaranteed to include fakes. It is certainly well worth a spot check to ascertain the depth of the problem – and ideally by a third party, not your own internal team.

![]() RELATED:China’s Fapiao System: Fapiao and Valued Added Tax

RELATED:China’s Fapiao System: Fapiao and Valued Added Tax

The inclusion of fake VAT receipts in expenses can later have repercussions at the audit stage, even if the foreign investor has unwittingly rather than deliberately included them in their accounts. China’s Tax Bureau will take a dim view, levying fines of up to 6 times any amount due, and possibly criminal charges. Yet China VAT fraud is currently at epidemic proportions.

The situation is problematic from China’s own fiscal viewpoint as well. Quite how China’s Ministry of Finance allocates its VAT collection in fiscal expenditure is unknown. However, given the amount of local resistance, avoidance and antipathy towards a 17 percent rate, coupled with an economy that stubbornly refuses to move very far, reducing the VAT rate, even on a temporary basis on selected mass consumption items, may yet prove the way ahead for China to untangle its slow consumer drive and start to generate some real traction in its own economy.

|

Chris Devonshire-Ellis is the Founding Partner of Dezan Shira & Associates – a specialist foreign direct investment practice providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam, in addition to alliances in Indonesia, Malaysia, Philippines and Thailand, as well as liaison offices in Italy, Germany and the United States. For further information, please email china@dezshira.com or visit www.dezshira.com. Chris can be followed on Twitter at @CDE_Asia. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Tax, Accounting, and Audit in China 2015

Tax, Accounting, and Audit in China 2015

This edition of Tax, Accounting, and Audit in China, updated for 2015, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

Managing Your Accounting and Bookkeeping in China

Managing Your Accounting and Bookkeeping in China

In this issue of China Briefing, we discuss the difference between the International Financial Reporting Standards, and the accounting standards mandated by China’s Ministry of Finance. We also pay special attention to the role of foreign currency in accounting, both in remitting funds, and conversion. In an interview with Jenny Liao, Dezan Shira & Associates’ Senior Manager of Corporate Accounting Services in Shanghai, we outline some of the pros and cons of outsourcing one’s accounting function.

Double Taxation Avoidance in China: A Business Intelligence Primer

Double Taxation Avoidance in China: A Business Intelligence Primer

In our twenty-two years of experience in facilitating foreign investment into Asia, Dezan Shira & Associates has witnessed first-hand the development of China’s double taxation avoidance mechanism and established an extensive library of resources for helping foreign investors obtain DTA benefits. In this issue of China Briefing Magazine, we are proud to present the distillation of this knowledge in the form of a business intelligence primer to DTAs in China.

- Previous Article Understanding China’s Accounting Practice: Chinese GAAP vs. China’s Tax System

- Next Article With New Environmental Protection Tax, the Polluter Now Pays in China too