How China’s Population Decline Will Impact Doing Business in the Country

China’s demographic shift is worrying policymakers but in the short term, the labor force remains sufficient and business opportunities are emerging in new subsectors.

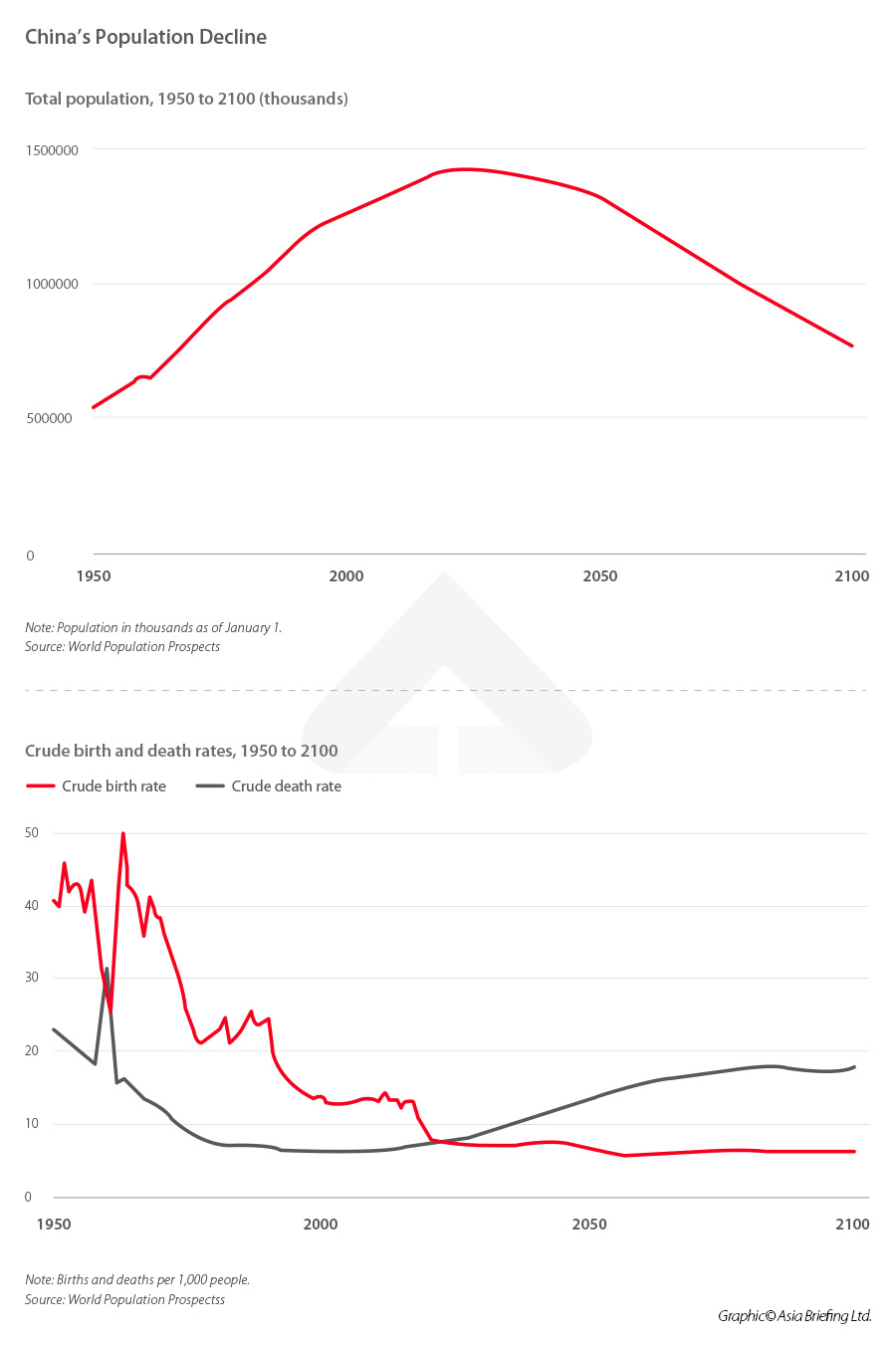

China is the world’s most populous country, but its population growth has been slowing down in recent years. In 2022, China’s population declined for the first time in 60 years, which could mark the start of a long-term decline – thereby affecting the country’s economy and business environment. Among others, the long-term economic impact of an aging population and a declining workforce are key concerns.

In this article, we will examine the extent of China’s population decline, the potential economic consequences of this demographic shift, and how businesses can cope with relevant challenges.

How much has China’s population declined?

China’s population has declined for the first time in six decades. In 2022, mainland China’s overall population fell to 1.4118 billion, down from 1.4126 billion a year earlier, with a decline of 850,000 people, according to the National Bureau of Statistics (NBS). The UN’s demographic modeling reveals that China’s population may drop to 1.313 billion by 2050 and fall below 800 million by 2100.

The demographic shift is caused by the decreasing birth rate, coupled with a rapidly aging population. In 2022, the national birth rate fell to a record low of 6.77 births for every 1,000 people, down from 7.52 in 2021. Meanwhile, China had 280.04 million people aged over 60 at the end of 2022, up from 267.36 million in 2021. Corresponding to these changes, China’s working-age population – those between 16 and 59 years old – decreased from 62.5 percent in 2021 by 0.5 percent and stood at 875.56 million at the end of 2022.

Why is China’s population declining?

One of the key drivers behind China’s declining population is its one-child policy, which was introduced in 1979 and had been strictly implemented until 2015. Originally designed to control population growth, the policy resulted in a reduced number of births and a significant imbalance in gender ratios. This has led to a decline in the number of women of childbearing age. And the smaller size of this demographic, combined with the rising costs of raising children, may continue and accelerate in the coming decade.

Another factor is the country’s rapidly aging population. China’s life expectancy has increased significantly in recent decades, resulting in a rising number of elderly individuals. This trend is expected to continue, with the population of individuals over 65 years old projected to double by 2050.

Has the Chinese government done anything to reverse the population decline?

To reverse the trend of population decline, and mitigate socioeconomic challenges, China has released a set of measures to encourage childbirth and support childcare and eldercare.

Three-child policy and supporting measures

In recent years, childcare policies in China have gradually shifted towards pronatalism. Chinese couples have been allowed to have up to two children since 2016, while parents from single-child families have been able to have two children since 2013. And then on May 31, 2021, China announced that couples in China will now be allowed to have up to three children, i.e., the so-called “three-child policy”.

To further boost birth and address the country’s demographic imbalance, China also released a series of supporting measures for the three-child policy, which include tax deductions, affordable childcare service and education, and the introduction of childcare leave.

Moreover, local governments have started to provide financial subsidies to encourage childbirth. For example, couples in Shenzhen who have one to three children are eligible for subsidies totaling up to RMB 19,000 (US$2,800) (one-time payments of 10,000 yuan and an additional 3,000 yuan per year until the child turns three).

Despite these widespread shifts towards pronatalist policies, the desired results have yet to materialize. China’s population decline has been further exacerbated by several other factors, including high living costs, shifting attitudes among the younger generation towards family and marriage, and the economic slowdown caused by the COVID-19 pandemic and the country’s stringent measures to contain it. It’s yet to be seen how effective China’s pronatalist policies could be in the years to come.

Eldercare

The rising share of elderly people in China’s population also has far-reaching implications beyond just economics. It will alter the social fabric of Chinese society. Elderly parents, with extended life expectancy, will require financial, emotional, and social support for longer. Many of them only have one child to rely on. This dynamic may impose additional pressure on the children, who face burdens from their careers, caring for their own children, and supporting their aging parents simultaneously.

To support eldercare, China has also developed a set of supporting measures, including tax deductions, eldercare leave provided in some cities, as well as supporting policies to the eldercare service industry. Most recently on August 29, 2022, the National Development and Reform Commission (NDRC) and 12 other authorities jointly released Several Policy Measures to Support the Elderly Care and Childcare Service Industries to Overcome Difficulties. The measures consist of a number of policies that lower costs for eldercare and childcare service providers, including exemptions on rent, reductions on taxes and fees, and the provision of financial support.

Why should businesses care about China’s population decline?

China’s deepening demographic shift has far-reaching implications for its economic growth. Previously, the country’s rapid development was fueled by its “demographic dividend”—a large proportion of citizens of working age. Over the last four decades, China’s labor-intensive, export-led model has enabled the country to transition from an agrarian economy to an industrial society with higher living standards and income levels. However, China’s demographic shift has put a question mark on its continued growth path and future labor force and market potential.

Will China be short of labor force?

One direct consequence of a declining population is the loss of human capital. This means fewer entrepreneurs, innovators, and skilled workers to fuel the economy and spur further economic growth. The aging workforce and a shortage of younger workers because of the declining population may make it difficult for businesses to find the labor they require to meet demand. As some businesses rely more on physical labor than others, the shrinking labor force affects certain industries more severely than others. For example, manufacturing and construction industries will likely bear the brunt of this labor shortage. Such a decline will also lead to an increase in labor costs, which could make it more difficult for Chinese companies to compete in the global marketplace.

Nevertheless, a significant labor shortage is not expected in the short term as China has a large pool of workers already in the workforce. China’s labor force was estimated to be around 791 million in 2021. In certain parts, there are still large numbers of unemployed or underemployed workers. According to the most recent available data, provinces such as Jilin, Inner Mongolia, and Tianjin, have unemployment rates of 6.8 percent, 6.1 percent, and 6.0 percent, respectively, significantly higher than the national average of 5.5 percent in 2022. Taken together, these data points suggest that in the short term, China may not face a substantial labor shortage.

Will the Chinese market shrink?

The declining population may result in a shrinking market with fewer customers, which will have a direct impact on the market size. This might result in a decline in demand for goods and services, potentially harming the country’s business growth. An aging society may result in a decrease in consumer expenditure, as the elderly are less inclined to spend money than the young – also called the “age structure effect”.

However, the market size depends on a number of factors, such as the country’s economic growth, consumer spending, and the ability of businesses to innovate and adapt to changing market conditions. On the positive front, a decline in population size can enhance per capita income, lower unemployment rates, and elevate the level of disposable income, all of which foster a strong domestic market.

Meanwhile, the Chinese government has geared the economy toward its domestic market with the dual circulation strategy and has invested in higher-value-add products. More efforts are being made to grow the domestic market in addition to overseas consumption; China’s per capita income is about six times lower than that of the US. While China is not guaranteed to eventually achieve GDP per capita on par with the US, there is still significant room for economic activity, household wealth, and domestic consumption levels to continue to grow.

Will China’s demographic shift create new business opportunities?

Despite the challenges posed by a declining population, there may also be new opportunities. It will be important for businesses to adapt to changing social trends and seize opportunities to ensure a prosperous and sustainable future.

Healthcare, eldercare, and silver economy

As China’s population ages, there will be increasing demand for healthcare, eldercare services, and related products, which will require significant investments.

Healthcare was already among the highest priority investment area for the Chinese government after the COVID-19 pandemic exposed gaps in the system, and the country’s aging population only adds more pressure to improve service provisions.

According to China’s National Bureau of Statistics, the proportion of the population aged 60 and overreached 18.7 percent in 2020 and is projected to rise to 34.9 percent by 2050. Increasingly affluent working-age adults may turn to private sector services, such as long-term care facilities, to tend to their parents and grandparents due to limitations in the public healthcare system. In addition to eldercare services, the aging population will require products, such as pharmaceuticals, medical devices, and disability aids, in greater numbers.

It is estimated that the value of China’s eldercare market is expected to reach US$3 trillion by 2030.

Higher education and vocational training

The popularity of higher education and the importance of education in Chinese culture present significant opportunities for investment and growth. The proportion of China’s population that is 14 years or younger increased from 16.6 percent in 2010 to 17.95 percent in 2020. The size of the youth cohort also presents opportunities for growth in multiple areas, such as education, entertainment, and consumer goods. The demand for education services in China is driven by the country’s rapidly expanding middle class and their aspirations for upward mobility and better job opportunities.

On the other hand, China is facing a shortage of highly skilled workers, particularly in the technology, healthcare, and engineering sectors. This is due to a combination of factors, including the declining population, a preference among young people for non-manufacturing jobs, and a growing demand for highly skilled workers in these industries. Against this background, while most education industries in China are becoming more restrictive to private investment, vocational education continues to be encouraged by the government. China believes upskilling its workforce is key to the country’s continued economic growth. Those focusing on training and development are advised to explore talent-based and higher-tech opportunities in the China market.

How can businesses prepare for future challenges?

The declining population will present several challenges to businesses in the long term, including a shortage of labor, rising labor costs, and a shrinking consumer base. To prepare for these challenges, businesses will need to be innovative and adaptable. To prepare, businesses can consider the following:

- Invest in automation and technology: As the labor force declines, companies may need to invest in automation and technology to compensate for the shortage of workers. This will require investment in research and development, as well as training for employees to operate and maintain new technologies.

- Invest in training and development: To remain competitive in the changing business landscape, companies will need to invest in the training and development of their employees. This will help to build a skilled and adaptable workforce, capable of adapting to changing market conditions.

- Diversify products and services: With a shrinking consumer market, companies may need to diversify their products and services to appeal to a wider range of consumers. This could mean expanding into new markets, developing new products, or adapting existing products to meet changing market demands.

- Offer flexible work arrangements: To attract and retain workers in a competitive labor market, companies may need to offer flexible work arrangements, such as telecommuting, flexible hours, and remote work options.

- Develop strong local partnerships: Foreign companies in China can benefit from developing strong partnerships with local companies and organizations, which can provide access to local knowledge and resources.

To succeed in this changing landscape, companies will need to be flexible, innovative, and proactive in their approach to the market.

Summary

China’s declining population has the potential to have a significant impact on the country’s economy in the coming years. An aging population and declining workforce could lead to increased social security costs, a slowdown in economic growth, a shortage of skilled workers, a loss of human capital, and increased labor costs. However, it is yet to be seen how the Chinese government will address these challenges and whether the policy package can mitigate these to ensure the country remains competitive in the global economy.

While the decline in China’s population is a cause for concern, it also creates opportunities in areas such as education, healthcare, innovation, technology, and more. In fact, these sectors are expected to be further encouraged by the Chinese government. Prospective investors should pay close attention to regulatory and market trends in these sectors.

- Previous Article The ChatGPT Gold Rush: Everything You Need to Know

- Next Article 5 industrias claves a tener en cuenta en China en 2023