China’s COVID-19 Vaccine Development and Availability

Op/Ed by Chris Devonshire-Ellis

- China’s COVID-19 vaccines expected to be rolled out soon; bulk manufactured and exported in 2021.

- China could likely mass inoculate citizens in any outbreak that crosses a certain threshold; country expected to develop herd immunity over longer term.

- Sinovac vaccine (in limited roll-out) costs RMB 400.

China’s need to both develop and introduce a COVID-19 vaccine has differed from other countries as it has effectively halted the spread of the virus. Although borders are only partially open, and international travel seriously restricted, the Chinese government has been able to get an early handle on the pandemic and has consequently been able to take its time over vaccine development. This contrasts with Russia, which has been criticized in the West for rushing vaccines into development without adequate testing. While outbreaks still occur – most recently in Inner Mongolia – population control and swift lockdowns to prevent mass spreading has worked. This means that other countries have rapidly overtaken China in numbers of cases and have a higher need for a vaccine.

This does not mean that China hasn’t been busy with producing a vaccine; it just means that it has been able to be more precise about it. Four main producers are in the race in China – CanSino based in Tianjin, CNBG of Wuhan, Beijing’s Sinovac, and ZFLongkema based in Anhui.

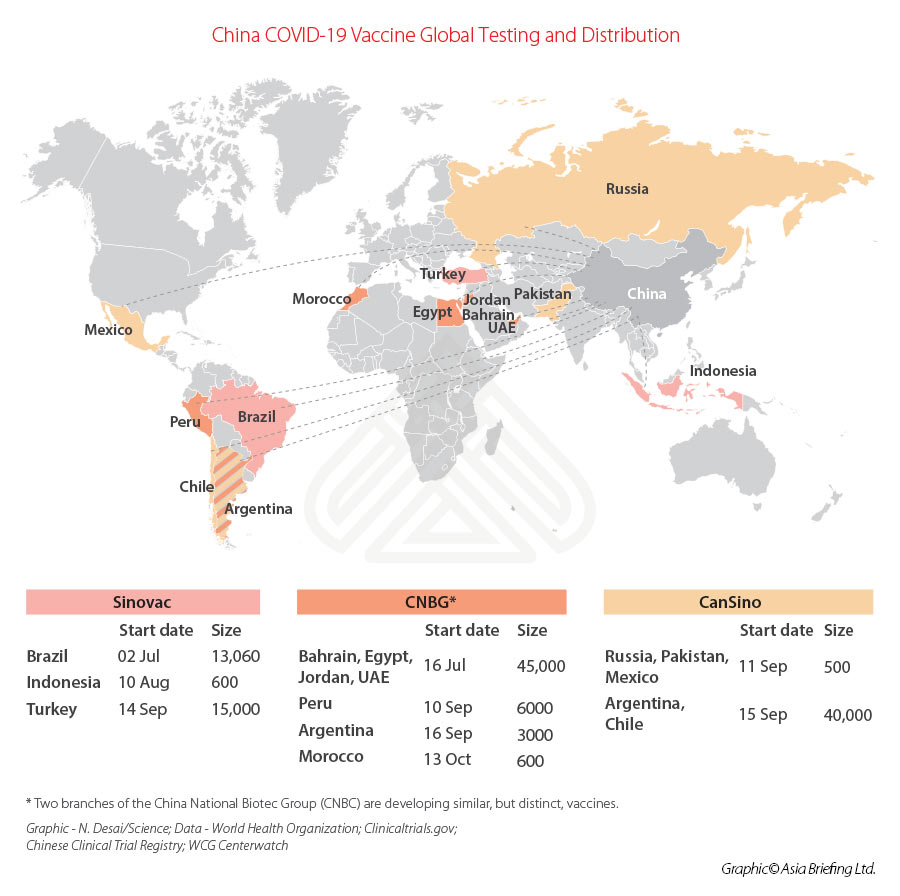

With few COVID-19 cases at home, Chinese vaccine makers have had to test the effectiveness of their products overseas; five candidates are in efficacy (phase 3) trials in at least 16 countries. We can examine this testing in the map below.

There have been differing approaches to achieving a viable vaccine. CanSino has developed its product by using a widespread and largely harmless virus known as adenovirus 5 (Ad5), into which they stitched a gene for the surface protein of Covid-19. Back in March the company launched the world’s first COVID-19 vaccine trial, in Wuhan, to test its safety and ability to provoke immune responses, the first company in the world to do so.

Sinovac Biotech and CNBG have taken a different approach: vaccinating people with the whole, “killed” virus. This requires no sophisticated protein or RNA design or genetic engineering. Scientists simply inactivate the virus with a chemical (beta propiolactone) and mix it with an adjuvant (alum) that effectively puts the immune system on full alert by irritating it. In theory, such vaccines can produce broader antibody and T cell responses, because they contain the full set of viral proteins, rather than a single one, such as spike. And unlike mRNA vaccines, which have to be stored at subzero temperatures, inactivated viruses require no more than ordinary refrigeration. This is similar to the Russian Sputnik V vaccine, and has advantages as sub-zero refrigeration and storage can be problematic in many tropical and sub-tropical countries. But, there can be problems too; these vaccines require two doses to be administered, while a small minority of patients can suffer chronic reactions to such vaccines and even develop the disease, something that the CanSino vaccine is less prone to induce.

Most of the Western COVID-19 vaccines are using the CanSino approach. But again, storage in sub-zero conditions is problematic in warmer climates.

All, however, are gearing up for production to be sent overseas. Sinovac has signed deals to provide 46 million doses of its COVID-19 vaccine to Brazil and 50 million doses to Turkey, and will also supply 40 million doses of vaccine bulk – the vaccine concentrate before it is divided into little vials – to Indonesia for local production.

CanSino will deliver 35 million doses of its vaccine to Mexico, while CNBG has been looking at markets in the Middle East and South America. The UAE is to jointly produce with CNBG about 100 million doses in 2021, negotiations with other countries are ongoing. CNBG has stated it can produce more than one billion doses in 2021.

China has also joined the COVID-19 Vaccines Global Access (COVAX) facility, an effort led by the World Health Organization (WHO) and the global Coalition for Epidemic Preparedness Innovations (CEPI) to make sure that any products are proven to be safe and effective and quickly reach rich and poor countries alike.

Back in China, the regulators appear to be satisfied with studies from each of these three companies as concerns a China national vaccination program. In June, CanSino received authorization to vaccinate the military, and since then both Sinovac and CNBG have received the go-ahead to vaccinate large populations in China outside of ongoing clinical trials.

CNBG says “hundreds of thousands” of people in China have received its vaccines. “By doing this, we are able to build an immune barrier among specific groups of people like healthcare workers, pandemic prevention personnel, and border inspection personnel,” the company has stated in Science magazine. “We did not receive a single case report of severe adverse reaction, and no infections reported for vaccines working in high risk areas.”

Sinovac say that more than 90 percent of the company’s employees have received its vaccine because they are considered a high-risk group. In October, the company began to sell its vaccine – RMB 400 (US$60) for two doses, in Yiwu, near Shanghai in Zhejiang province.

Chinese officials are also apparently writing guidelines should significant clusters emerge, which would likely ensure that everyone in the vicinity is vaccinated.

So, there we have it – two different types of vaccines, with different capabilities. mRNA vaccines are less likely to provoke any adverse reactions, can be delivered in just one dose, yet require sub-zero storage. These are the types being developed in the West, much of which is in the cooler parts of the Northern hemisphere and which China’s CanSino is producing.

Russia’s Sputnik V and the vaccines produced by Sinovac and CNBG are inactivated virus, require two doses to be effective, can induce a negative reaction in some patients, yet do not require sub-zero storage, making them slightly less effective over a larger population base but better suited for mass distribution in warmer climates. As for China, although it seems unlikely COVID-19 will ever be entirely eradicated, mass immunity will develop and vaccines are now available and will increasingly be so across China – and overseas as we move into 2021.

Our latest COVID-19 updates for China and the business situation can be read in our latest December round up here.

Related Reading

-

-

Opportunities for Foreign Investors in China’s Service Industries After COVID-19

Opportunities for Foreign Investors in China’s Service Industries After COVID-19

In this edition of China Briefing Magazine, we focus on how key industries in the services sector have entered into a new normal in 2020. We also provide an overview of new opportunities available for foreign investors as a result of the disruption. Finally, we spotlight two major industries impacted by COVID-19 in China, healthcare and food and beverages.- Permanent Establishment Risks in China amid COVID-19: A Case Study

- Strategies for Managing Enterprise Downsizing and Salary Reduction in China After COVID-19

-

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Belt and Road Weekly Investor Intelligence #5

- Next Article Schritte zum Schutz Ihres Unternehmens vor Phishing-Angriffen