China Two Sessions 2022 – What to Watch

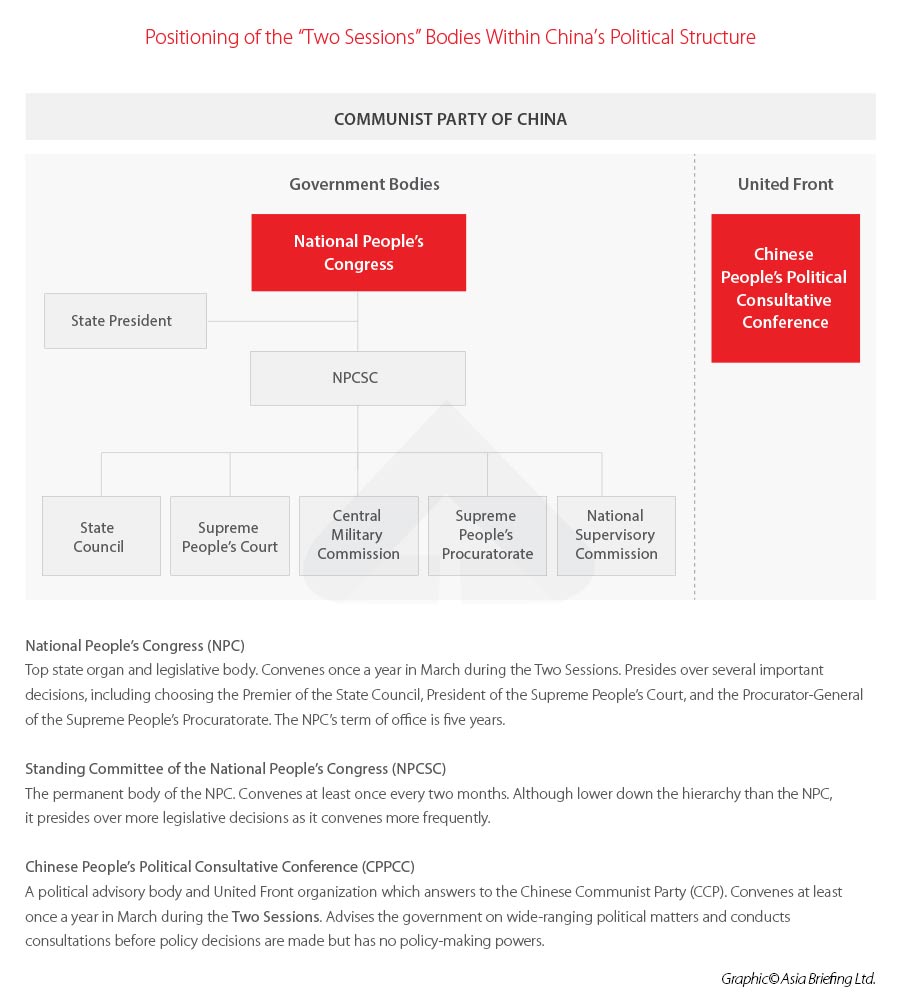

The annual meetings of two of China’s top political bodies will commence this weekend. Amid growing economic uncertainty, a continued fight against COVID-19, and a complex international landscape, the “Two Sessions” meetings of the National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference (CPPCC) have a lot on their plate.

The economic and legislative decisions made at these meetings will provide a roadmap for China’s economic and social development in 2022 and are therefore of high importance to any player in the China market.

Below we provide an overview of what the Two Sessions are and what policies to look out for over the coming weeks.

What are the China Two Sessions?

The Two Sessions, known as Lianghui in Chinese, is the name given to the back-to-back annual meetings of two of China’s major political bodies – the Chinese People’s Political Consultative Conference (CPPCC) and the National People’s Congress (NPC).

The CPPCC is a consultative body that includes over 2,000 members from various aspects of Chinese society, ranging from business entrepreneurs to movie stars. The NPC is China’s top legislative body. The Two Sessions are particularly significant as they are the only fixed annual meetings of these two political bodies. They are also always of interest to foreign investors, as they serve as a valuable window into China’s politics, reveals Beijing’s priorities for the coming year and the overall policy direction of the country.

When will the 2022 Two Sessions convene?

When will the 2022 Two Sessions convene?

The Two Sessions have been confirmed to start on March 4 and 5, with the CPPCC convening on March 4 and the NPC convening on March 5.

The end date of the meetings has not yet been revealed, but they are expected to continue until March 10 and 11.

What will the 2022 Two Sessions discuss?

Below are some things to watch out for in the coming two weeks.

2022 economic targets

One of the most anticipated pieces of information to come out of the Two Sessions will be China’s 2022 GDP target. This will be revealed through the State Council’s Government Work Report, which the NPC will decide upon when it convenes on March 5.

China’s yearly GDP growth target is of high significance as it will dictate the economic strategies and policies of both the central government, as well as provincial and municipal governments throughout the country, who will be expected to work towards meeting that goal.

China’s provincial governments announced their 2022 economic targets in February 2022. All provinces set GDP targets that were significantly lower than their 2021 growth rates, with the average totaling at around 6 percent.

China comfortably hit its target for 2021 GDP growth, which was up 8.1 percent, well above the target of above 6 percent. However, GDP growth in 2021 was highly uneven and driven in large part by the acceleration seen at the beginning of 2021 (18.3 percent in the first quarter), aided in part by a low base effect due to the slow growth rate in the first quarter of 2020. The growth rate slowed significantly throughout the year and finished at just 4 percent in the fourth quarter.

The government has previously indicated it would set a GDP target of between 5 and 5.5 percent. However, analysts have argued that this may be too ambitious as the country continues to face headwinds from COVID-19, a struggling property market, and US sanctions. In January, the International Monetary Fund (IMF) reduced its GDP growth forecast for China from 5.6 to 4.8 percent.

It is also worth noting that the government’s previous statements on GDP growth targets and the IMF’s revision both predate the outbreak of the Russia-Ukraine war, which adds another element of uncertainty and could further slow economic growth.

Given the domestic and international macroeconomic issues facing China, a higher GDP target would likely mean local governments spending beyond their means on infrastructure and the central government loosening fiscal and monetary policy beyond its preferred limits. And although high growth is ultimately desirable, this would cut into Beijing’s other priorities, such as curbing local government debt and focusing on high-quality and high-value investments and growth.

Economic policy

Stability has been the top priority for policymakers going into the latter half of 2021, and this will almost certainly continue in 2022.

At the annual Central Economic Work Conference (CEWC) held in December 2021, which sets an economic roadmap for the country for the following year, the government repeated its mantra that it would adhere to “a proactive fiscal policy and a prudent monetary policy.”

This means providing more targeted and sustainable fiscal incentives and support, in particular for micro, small, and medium-sized enterprises (MSMEs) and individuals, while maintaining a ‘reasonable’ level of liquidity without flooding the market.

Banks will be encouraged to increase support for the most important industries and businesses, such as MSMEs, companies engaged in green development, technological innovation, and those serving the ‘real economy’.

This has already begun to happen. In February, the National Development and Reform Commission (NDRC) released a raft of relief policies to shore up support for MSMEs in the service industry, which included extensions of tax reductions and exemptions, fiscal support measures, and help with implementing COVID-19 prevention measures. Later in March, the State Taxation Administration (STA) and Ministry of Finance (MOF) extended tax deferral policies for MSMEs in the manufacturing sector, with effect on February 28, 2022.

We, therefore, expect further extensions to tax relief policies, and possibly new tax relief policies, especially for MSMEs in economically and strategically important industries such as technology, telecommunications, and agriculture.

COVID-19 policy

An important topic of discussion will be China’s continued efforts to contain the COVID-19 pandemic. China has long stood by its zero-tolerance policy toward COVID-19, which involves adhering to strict containment policies such as snap lockdowns and travel restrictions to keep cases to a minimum.

The strategy has been highly effective in keeping infection and death rates low but has of course had an impact on local economies and spending, and has kept China’s borders effectively closed since early 2020. There has been much discussion about when China will reopen to the world, but the government has given no indication that it would relax its policy.

That is, until March 2, 2022, when epidemiologist and member of the High-level Expert Panel of the National Health Commission (NHC) Zeng Guang posted an extensive message on his official Weibo account discussing the different countermeasures to the COVID-19 pandemic that China and western countries had taken.

In it, he wrote, “In the near future, at an appropriate time, China will present a roadmap for coexisting with the virus in the Chinese style”, while acknowledging that western and Chinese scientists agree that the Omicron variant of COVID-19 is less deadly than previous variants. The Omicron variant is the cause of China’s most recent outbreaks.

However, it is highly unlikely that this means a fast reversal of the zero-COVID policy. As Zeng Guang said in his post, despite a high vaccine uptake, China has low herd immunity due to the low prevalence of cases. In addition, there is reason to be concerned that China’s healthcare system would be overwhelmed if restrictions are lifted quickly, and the country will therefore need to make considerable preparations to handle a rise in cases.

Instead, he said that China should calmly observe the “living with COVID” strategy of western countries to learn from their experiences and adopt the strategies that would work for China.

Although there was no indication of when the roadmap will be released, it will doubtlessly be a topic of discussion at the Two Sessions, and we expect some more clarity on what China’s COVID-19 strategy will be for the coming year.

Carbon targets and energy

China has set two major carbon emissions goals: reaching peak carbon emission by 2030 and carbon neutrality by 2060.

Since then, it has begun setting out policy measures to achieve these targets, which have not been entirely without their setbacks. Measures to reduce the production of coal in 2021 resulted in power shortages in some parts of the country and led to the decision to build more coal plants to ensure a stable power supply.

Following the energy crunch, presiding over a meeting of the National Energy Commission, Premier Li Keqiang reiterated the importance of ensuring energy supply. A statement released after the meeting said, “It is necessary to deal with the contradiction between supply and demand of electricity and coal […] and study and propose a timetable and roadmap for carbon peaking.”

Some have said this suggests China will revise its carbon emissions goals. However, this is by no means certain, given that China tends to be extremely careful to only set targets it believes it can meet.

On the other hand, it is possible that China will provide more details on its plans to meet its goals, including revisions of specific industry goals for the years leading up to 2030. We also expect to see more pressure on market entities and local governments to do their part in reducing carbon emissions, such as through measures to increase the transparency of emissions data and better compliance with existing environmental laws.

Common prosperity

In August 2021, President Xi Jinping first proposed the principle of “common prosperity” to tackle inequality by redistributing wealth and providing more equality of opportunity.

This has since led to several policies to tackle inequality, including a crackdown on for-profit tutoring, which was seen to tip the scales unfairly in favor of children of wealthier families, and the authorization to implement a pilot property tax scheme in selected regions to curb speculation in the housing market.

Common prosperity is also an economic strategy, as the country hopes to rely more on domestic consumption for growth in the future. This will require putting more cash in the hands of ordinary people.

Although it is a long-term strategy that will likely take many years to see any results, policies to improve the living standards of lower-income people, particularly those living in rural areas, are expected to be discussed during the Two Sessions. These may include further policies to level the playing field in education, policies surrounding China’s rural revitalization campaign – such as improvement of rural logistics and e-commerce – and more support for small businesses.

Population aging and childbirth

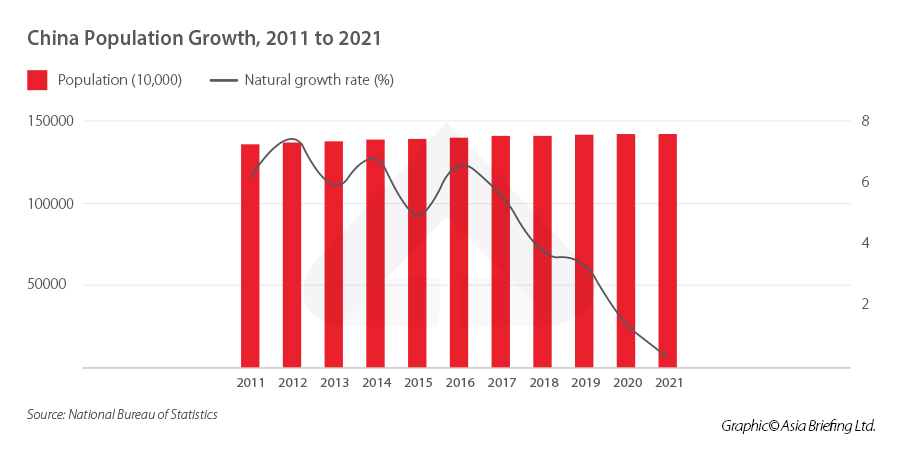

Another item high on the agenda will be tackling China’s rapidly aging population and declining birth rates. Birth and fertility rates slowed to historic lows in 2021, with the natural growth rate falling to just 0.34 per one thousand, down 1.11 percentage points from 2020.

The government passed a number of measures to increase birth rates in 2021. These included raising the maximum number of children to three and extensions to childcare and maternity leave.

We expect more incentives for couples to have more children will be rolled out in 2022, which could include further extensions to maternity and paternity leave and support for education and childcare costs. In July 2021, the CPPCC held a special consultative conference on the topic of population aging, in which it proposed extending paternity leave, and it is possible more such discussions will be had during the Two Sessions.

Women’s and children’s rights

The issue of women’s and children’s rights has received renewed attention in China in recent years, especially following recent stories about women subjected to trafficking and forced marriage that have come out over the past few weeks. These led to widespread public outcry and the launching of a campaign to tackle trafficking.

In December 2021, China released a proposal to revise its women’s rights law in an effort to strengthen the protection of women, including bans on discrimination in the workplace and better protection against harassment.

With increasing public scrutiny over the treatment of women and children, we expect lawmakers to focus more on issues surrounding their protection and take steps to improve their standing within society.

Ukraine-Russia conflict

Although certainly not something Chinese officials would have hoped for, there will be no escaping the topic of the ongoing Russia-China conflict. As the war appears likely to continue throughout the duration of the meetings, the world will be waiting eagerly to hear if China will take a stronger position on the conflict or take steps to mediate negotiations.

China has thus far maintained a neutral stance, stating that it respects all countries’ sovereignty and calling for resolution through dialogue and negotiation.

It is not clear whether China will be able to maintain this neutral stance as the situation continues to unfold, especially as more and more countries around the world join the west in imposing sanctions on Russia and condemning its actions in Ukraine.

However, given China’s close ties with Russia, we do not expect it to fundamentally change its position on the issue. It is possible it will make attempts to broker a peace deal, especially if pressure from European countries on China to act continues to mount; although China wants to maintain relations with Russia, it will not want to completely alienate European countries.

The agenda of the 2022 two sessions can be found in our article: China’s Two Sessions 2022: What’s on the agenda?

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Hong Kong Budget 2022-23: All You Need to Know

- Next Article China’s Two Sessions 2022: What’s on the Agenda?