China’s Tax and Fee Cuts Extended or Released After 2021 Two Sessions

Following China’s 2021 Two Sessions, the State Tax Administration (STA) and the Ministry of Finance (MOF) extended a package of expired or to-be-expired preferential tax and fee policies as well as rolled out new structural tax and fee cut measures, aiming to offset the impact of the government’s post-pandemic economic policy adjustments.

On April 7, 2021, the two authorities released the STA Announcement [2021] No.8 and the MOF STA Announcement [2021] No.12, which further lower corporate income tax (CIT) liability of small and low-profit enterprises and of individual businesses.

On March 31, the MOF STA Announcement [2021] No.13 was announced and raises the ratio of the additional pre-tax deduction for research and development (R&D) expenses incurred by eligible manufacturing firms. The same day, the STA Announcement [2021] No.5 increases the taxable threshold for sales turnover of small-scale taxpayers.

In mid-March, the MOF STA Announcement [2021] No.6) extended tax breaks in 25 documents to December 31, 2023 or December 31, 2025, including the favorable measures on the one-time pre-tax deduction for newly purchased equipment and the additional pre-tax deduction for enterprises’ R&D expenses, which are of great concern to most businesses.

And in the MOF STA Announcement [2021] No.7, an interim VAT concession for small-scale taxpayers and some pandemic-related preferential policies have been extended until December 31, 2021, to continue to support businesses to weather the COVID-19 pandemic.

In addition to the above, to offer targeted aid to seriously affected sectors, the MOF and National Development and Reform Commission (NDRC) recently waived the port construction fee for the import-export sector and enabled further cuts in the payment to the civil aviation development fund by aviation companies. Also, registration fees for anti-COVID drugs and medical instruments will be waived this year.

This article enumerates and explains the key preferential tax and fee policies extended or newly rolled out since the 2021 Two Sessions, which apply to foreign-invested enterprises (FIEs) as well.

Which key preferential tax and fee policies have been extended or announced?

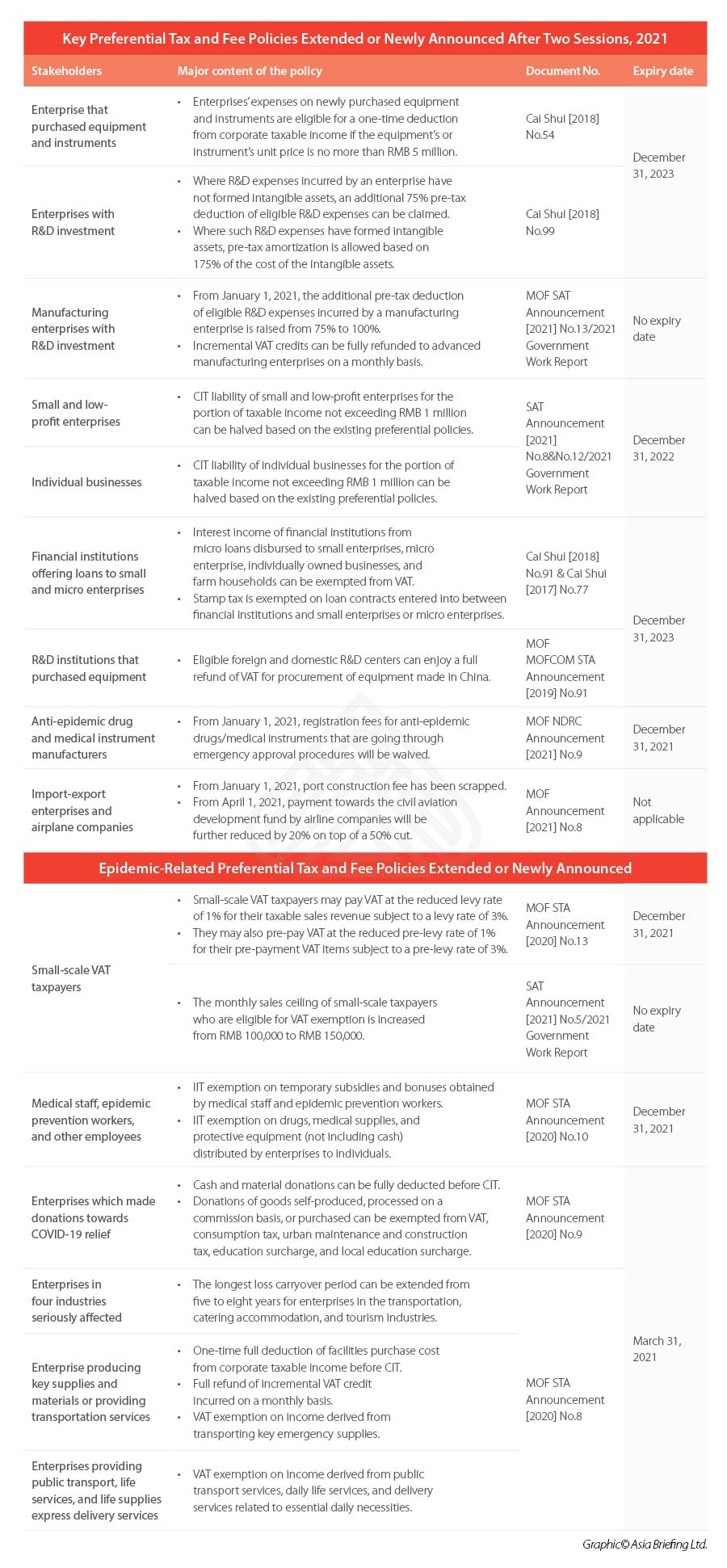

Here, we summarize the key preferential tax and fee policies extended or newly rolled out this month in one table for your quick browsing and we will explain these policies in the following text.

Lump-sum pre-tax deduction for new equipment

According to Cai Shui [2018] N.54, from January 1, 2018 to December 31, 2020, newly purchased equipment and instruments with unit value (price) not exceeding RMB 5 million (approx. US$760,000) are allowed to be included in the costs and expenses of the current period, can be deducted when computing then enterprise’s taxable income amount, and are not required to be depreciated over the years.

This is to say, enterprises can choose to deduct the expenses on purchasing eligible equipment and instruments on a lump-sum when calculating corporate taxable income.

Although this policy expired at the end of last year, the MOF STA Announcement [2021] No.6 has extended it for three more years until December 31, 2023.

Additional pre-tax deduction for R&D expenses

According to Cai Shui [2018] No.99, from January 1, 2018 to December 31, 2020, for the R&D expense actually incurred by an enterprise in research and development activities, which has not yet formed intangible assets but has been accrued in current profits and losses, based on deduction of the actual amount as stipulated, 75 percent of the actual amount of the expenses is allowed for additional pre-tax deduction.

If the R&D expense has formed intangible assets, such intangible assets can be amortized based on 175 percent of the cost incurred.

This policy expired at the end of last year but has now been extended until December 31, 2023.

It must be noted that this policy does not apply to several industries, such as tobacco manufacturing, lodging and catering, wholesale and retail, real estate, leasing and commercial services, and entertainment.

Additional pre-tax deduction for R&D expenses of manufacturing firms

For manufacturing enterprises, the 2021 Government Work Report proposed to increase the additional pre-tax deduction from 75 percent to 100 percent. The official announcement, the MOF STA Announcement [2021] No.13, was rolled out on March 31.

According to the announcement, effectively January 1, 2021, for R&D expenses actually incurred by manufacturing firms, if they have not formed intangible assets, nor have they not been included into the current profits and losses, such expenses can be additionally deducted before tax at 100 percent of the actual deductions; if they have formed intangible assets, they can be amortized before tax at 200 percent of the actual cost of intangible assets.

One more preferential policy worth to be mentioned here for manufacturing enterprises is that the Government Work Report also reiterated that VAT incremental credit balance will be refunded to advanced manufacturing taxpayers on a monthly basis.

In fact, this September, the MOF and STA already issued the Announcement [2019] No.39. According to it, advance manufacturing taxpayers producing and selling four types of products – non-metallic mineral products, general equipment, special equipment, and computer, communication, and other electronic devices – will be refunded the VAT incremental credit balance on the daily basis. It is well-worth noting whether the scope of the advanced manufacturing sectors would be expanded this year.

Reduced CIT for small and low-profit enterprises

In March, the 2021 Government Work Report proposes to halve the corporate income tax (CIT) liability of small and low-profit enterprises for the portion of taxable income not exceeding RMB 1 million (approx. US$150,000) based on the preferential policies already in force. On April 7, 2021, the STA released the official document, the STA Announcement [2021] No.8, to clarify the policy.

With the new policy in effect, all small and low-profit enterprises can enjoy:

- a 20 percent CIT rate on 12.5 percent of the taxable income amount for the proportion of taxable income not exceeding RMB 1 million (approx. US$ 152,800) (effective from January 1, 2021 to December 31, 2022).

- a 20 percent CIT rate on 50 percent of their taxable income amount for the proportion of taxable income of more than RMB 1 million (approx. US$ 152,800) but not exceeding RMB 3 million (approx. US$ 458,500) (effective from January 1, 2019 to December 31, 2021).

As a result, the effective CIT rate for the portion of taxable income not exceeding RMB 1 million for small and low-profit enterprises, will be reduced from five percent to only 2.5 percent.

Here, small and low-profit enterprises refer to enterprises engaged in industries that are not prohibited or restricted by the government and reporting an annual taxable income not exceeding RMB 3 million (approx. US$461,100), number of total employees not exceeding 300 persons, and total assets not exceeding RMB 50 million (approx. US$7.7 million).

VAT exemption on interest income of financial institutions

According to Cai Shui [2018] No.91 and Cai Shui [2017] No.77, interest income of financial institutions from micro loans disbursed to small enterprises, micro enterprises, individually-owned businesses, and farm households, are allowed to be exempted from VAT.

The Cai Shui [2017] No.77 also stipulated that stamp tax is exempted on loan contracts entered into between financial institutions and small enterprises or micro enterprises during the period from January 1, 2018 to December 31, 2020.

Both policies, which either expired in 2019 or 2020, have now been extended to December 31, 2023.

VAT refund to R&D centers

According to the MOF MOFCOME STA Announcement [2019] No.91, eligible foreign and domestic R&D centers can get a full refund of VAT on the procurement of domestically made equipment.

This policy expired in 2020 but is now extended to December 31, 2023.

Port construction fee and civil aviation development fund cuts

To lower financial burdens of enterprises in foreign trade and aviation industries, which were seriously hit by the pandemic, on March 24, 2021, the MOF released the MOF Announcement [2021] No.8 scrapped the port construction fee and cut the civil aviation development fund.

Starting January 1, 2021, port construction fee has been scrapped. Overdue port construction fees for previous years shall continue to be collected and be fully transferred to government coffers.

From April 1, 2021, payment toward civil aviation development fund by airline companies will be further reduced by 20 percent on top of a 50 percent reduction that has been implemented pursuant to the Cai Shui [2019] No.46.

Reduced VAT for small-scale taxpayers

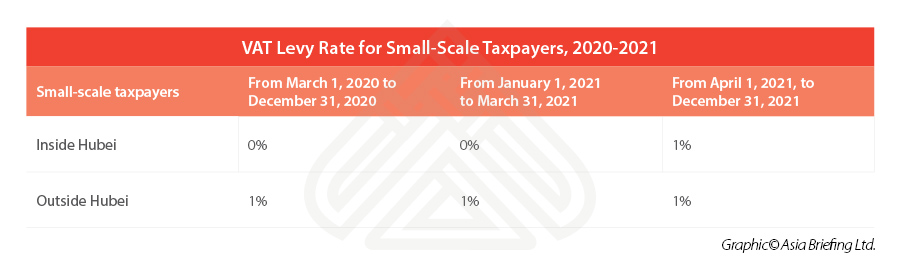

Since the COVID-19 virus attacked Wuhan, the government announced the MOF STA Announcement [2020] No.13 to grant the VAT exemption for small-scale VAT taxpayers in Hubei province and the VAT cuts for those outside Hubei, to help small businesses to combat the epidemic:

- Small-scale VAT taxpayers in Hubei Province, to which a VAT levy rate of 3 percent is applicable, are exempted from VAT; the pre-payment VAT on items subject to a pre-levy rate of 3 percent is suspended.

- Small-scale VAT taxpayers outside Hubei Province, to which a VAT levy rate of 3 percent is applicable, may pay VAT at the reduced levy rate of 1 percent; they may also prepay VAT at the reduced pre-levy rate of 1 percent for their items subject to a pre-levy rate of 3 percent.

For small-scale taxpayers outside Hubei, this policy was originally effective from March 1, 2020 to December 31, 2020. But it is now extended to December 31, 2021, according to MOF STA Announcement [2021] No.7.

For small-scale taxpayers in Hubei, until March 31, 2021, they can still enjoy the VAT exemption. But from April 1, 2021 until December 31, 2021, they will be treated the same as small-scale taxpayers in other areas and may pay a reduced VAT of one percent.

Aside from this, the 2021 Government Work Report proposed to increase the monthly sales ceiling of small-scale taxpayers who are eligible for VAT exemption from RMB 100,000 (approx. US$15,400) to RMB 150,000 (approx. US$23,000). This policy is effective starting January 1, 2021.

In China, individual VAT taxpayers and individually owned business who do not register as general VAT taxpayers are treated as small-scale taxpayers. They should therefore also be eligible for this more beneficial VAT threshold.

Registration fee exemption for anti-COVID medical devices and drugs

On March 24, the MOF and NDRC rolled out the MOF NDRC Announcement [2021] No.9.

From January 1, 2021 until December 31, 2021, registration fees for medical instruments that are related to COVID-19 and are going through emergency approval procedures will be waived; registration fees for medicines that are going through emergency approval procedures and are used to treat and prevent COVID-19 will also be waived.

As China’s economic growth got back on track, Beijing is taking an ambidextrous approach to its policy – withdrawing some stimulus programs with one hand but continuing to offer bailouts to serious affected sectors and small businesses which are large in number and extensive in scope. In addition, in the post-COVID era, the country will also shift its efforts on boost high-tech development and secure the country’s supply chain. This means that tax and fee cuts for R&D expense and manufacturing might be extended in a long run, even though this could place financial strains on the government.

China Briefing will keep you updated on the most recent tax news. Our parent company, Dezan Shira & Associates, have an experienced team of tax accountants, lawyers, and ex-tax officials who can help your business on a wide spectrum of tax service areas across all major industries. For more information and assistance, please email us at China@dezshira.com.

This article was originally published on March 30, 2021. It was last updated April 13, 2021.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Key IT Considerations and Solutions for Your Back Office Automation in China – Part 1

- Next Article China Raises Pre-Tax Additional Deductions for R&D Expenses of Manufacturing Firms