China Takes Top Spot on Asia Manufacturing Index 2025

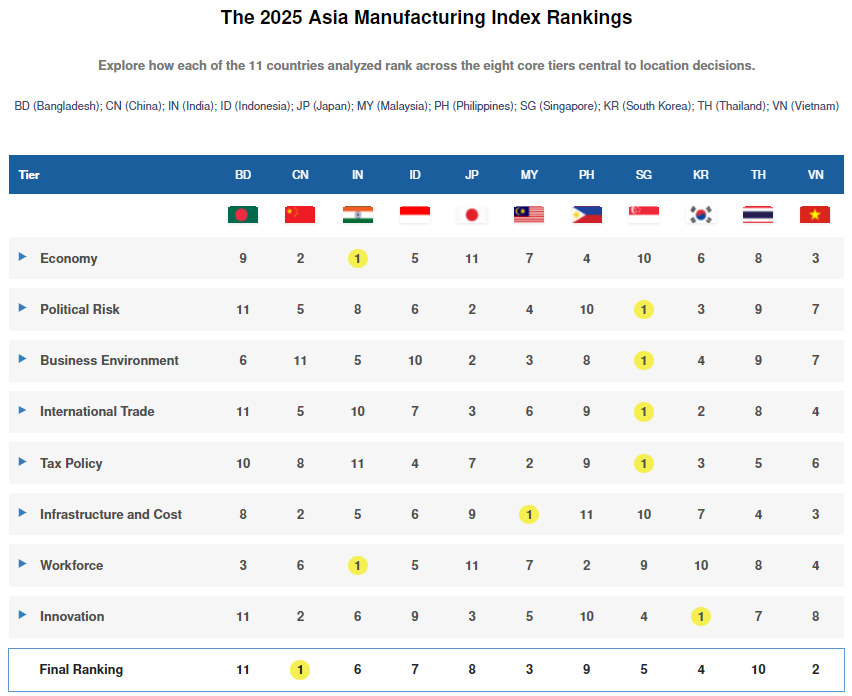

The second edition of the Dezan Shira & Associates‘ Asia Manufacturing Index is now out. The 2025 index provides essential insights into Asia’s dynamic industrial landscape, ranking eleven countries across eight categories, including tax policies, infrastructure, and innovation. Explore the rankings here.

For the second consecutive year, China ranks first in the Asia Manufacturing Index, maintaining its leadership despite significant shifts in its production landscape and traditional markets. The country’s industrial output remains robust, with export-oriented enterprises adapting to changes, most notably in the electric vehicle (EV) sector. Although challenges such as tariffs and accusations of overcapacity persist, China’s dominance as a global hub for efficient, high-quality manufacturing across various industries continues to be evident.

About the Asia Manufacturing Index

Previously known as the Emerging Asia Manufacturing Index, the Asia Manufacturing Index is a report created to assess growth risks, measure the potential of key Asian economies, and identify specific factors affecting the current manufacturing landscape.

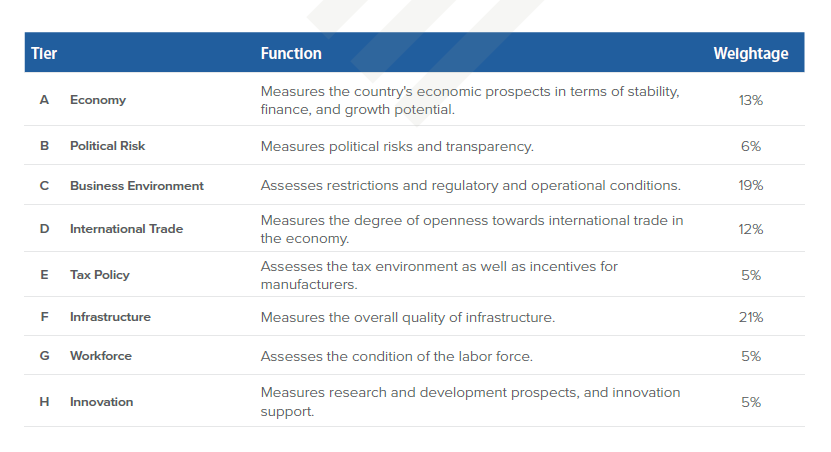

The report evaluates 48 distinct parameters organized into eight core criteria: economy, political risk, business environment, international trade, tax policy, infrastructure, workforce, and innovation.

The rankings are based on real-world consulting experience and reflect the actual business environment. Instead of relying on theoretical metrics, such as capital requirements or timelines provided by investment promotion agencies, the Asia Manufacturing Index 2025 measures the actual time and cost it takes to set up operations. This approach provides a more accurate picture of what businesses can expect when entering these markets. For qualitative factors like political risk and the foreign investment climate, the Asia Manufacturing Index 2025 uses insights from clients and partners.

Compared to the 2024 version, the Asia Manufacturing Index 2025 has added Singapore, South Korea, and Japan, bringing the total number of countries evaluated to 11.

Why China tops performance indicators

Known as the “World’s Factory”, China has held the title of the world’s largest manufacturer for 14 consecutive years, starting from 2010. Its factories churn out approximately one-third of the global manufacturing output, a testament to its industrial might and capacity.

Despite facing challenges due to global geopolitics and competition from other emerging economies, China’s manufacturing sector continues to thrive. In the first three quarters of 2024, the value-added by China’s manufacturing reached an impressive RMB32.09 trillion (US$4.49 trillion), up 10.6 percent on the same period in 2023 and accounting for around 39.0 percent of total GDP.

China’s retention of the status as a ‘dominant manufacturing powerhouse’ leverages its push for innovation supported by updated policies and regulatory incentives, expanding trade networks, mature infrastructure, and a skilled workforce. The China+1 strategy essentially involves supply chain restructuring and risk diversification while not wholly divesting from the China market.

Key advantages

Despite the economic fluctuations and challenges international companies have faced in recent years, China’s manufacturing industry continues to attract significant foreign investment. Due to its unique advantages, the country remains a preferred destination for many multinational companies. These include a vast and skilled labor force capable of producing a wide range of goods at competitive costs, comprehensive and efficient supply chains, and advanced infrastructure. Additionally, strong government support through policies, subsidies, and incentives further enhances China’s appeal as a manufacturing hub.

While some businesses are exploring re-shoring, near-shoring, or diversifying their global footprint by moving capital elsewhere, those with established operations in China are committed to the medium to long term.

That’s because many recognize the unfolding opportunities and incentives within China, thereby positioning the market as a core base in their broader Asia investment strategies.

|

Top Reasons to Invest in China |

||

| 1. | Incentives for doing business | China has several preferential tax policies—attracting a large number of foreign capital and foreign-invested enterprises. |

| 2. | Location advantage: Economic development zones (EDZs) | Over 2,000 EDZs, each with unique investment incentives and accreditation at different levels of government. |

| 3. | Ease of doing business | Fair and improving business environment for foreign investors with government officials receptive to feedback. |

| 4. | Network of trade, investment, and tax treaties | China has signed off 22 FTAs with 29 countries or regions, 107 BITs, and DTAAs with 114 countries or regions. |

| 5. | Ongoing market reforms | Relaxing market access restrictions and continuously introducing improvements to the business and regulatory environment. |

| 6. | Super city clusters | City clusters support China’s economic growth, promote coordinated development among high-performing regions, and enhance international competitiveness. |

| 7. | World’s largest labor market | The labor force in China stood at around 733.5 million people at the beginning of 2022, with the number of employed people at around 402 million. |

| 8. | Prime position in global supply chains | China’s sophisticated manufacturing and logistics infrastructure ensures its importance across global supply chains. |

| 9. | World’s second-largest economy | China’s rising purchasing power, expanding middle class, and a population over 1.4 billion, touts it to become the largest retail market in the near future. |

| 10. | Thriving services industry | China’s services sector is the main driver of economic growth and the basis for the next stage in its development. |

Challenges

Nevertheless, Emerging Asia countries face various challenges, especially in the current phase of increased volatility, uncertainty, complexity, and ambiguity (VUCA). In China’s case, rising labor costs, persistent intellectual property concerns, and a complex regulatory environment can be daunting for new investors.

The US-China trade war and trade tensions with other major economies such as the EU and Canada have caused supply chain disruptions, making many foreign manufacturers wary. To avoid tariffs on China-made products, foreign companies are shifting production away from China, particularly in sectors affected by these trade measures.

Additionally, climate action and decarbonization targets have pushed environmental and sustainability issues higher on government and shareholder agendas. This can add to operational complexity due to regulatory oversight and ESG reporting obligations, thereby raising costs. Foreign investors also frequently complain about China’s evolving data regulations.

Other challenges for China-bound investors include language and cultural barriers, access to a level playing field with domestic enterprises, and quality control issues.

Overall, while China remains attractive for its market size, skilled workforce, and infrastructure, careful assessment of the various pros and cons is crucial for informed decision-making and business success.

For latest data and information on China’s manufacturing industry that help foreign investors and analysts stay up-to-date with the latest economic indicators, resources, and policies impacting this vast industry, please read our China Manufacturing Tracker: 2024-25.

Key findings of the Asia Manufacturing Index 2025

Among the eight areas, China ranks high in terms of economy, innovation, and infrastructure. However, it still faces challenges related to the business environment and tax policy.

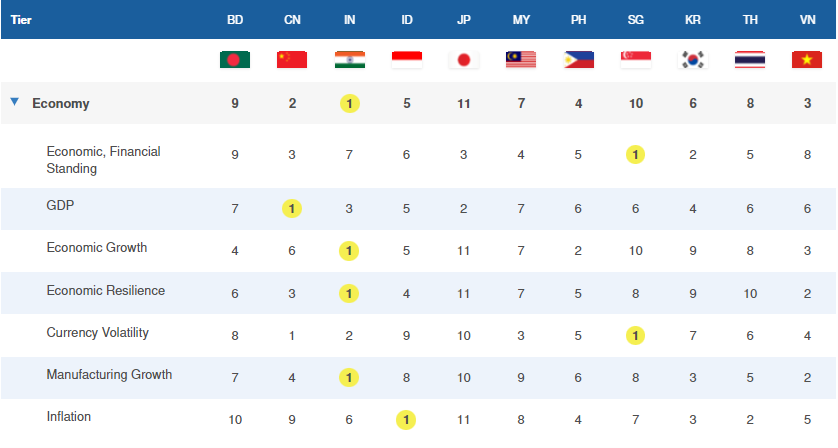

Economy (2nd)

Among the 11 countries, China ranks first in terms of GDP and currency volatility. In the first three quarters of 2024, China’s GDP reached RMB 94,974.6 billion (US$13,004.3 billion), up by 4.8 percent year-on-year on constant price.

However, China’s economic ranking is negatively impacted by its low inflation level, placing it second in this parameter, following India.

Infrastructure and cost (2nd)

China ranks second in this parameter due to its excellence in port performance, infrastructure investment, Internet speed, and energy cost. However, there is room for improvement in terms of water availability, gasoline cost, energy stability, and Internet freedom.

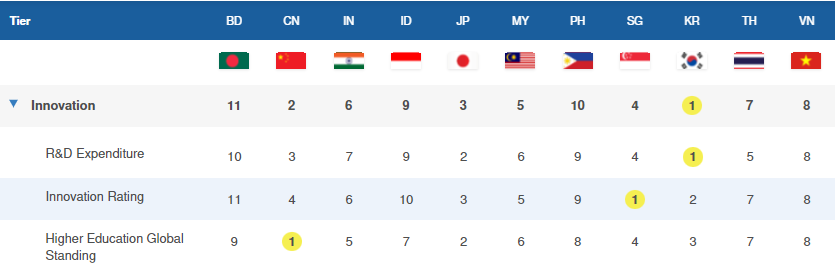

Innovation (2nd)

China ranks second in this parameter, just behind Singapore. The country’s research and development (R&D) expenditure increased over 35 times between 1991 and 2018. As of 2023, China’s R&D expenditure ranked second in the world, following the US. This remarkable growth has made China an innovation powerhouse, attracting significant foreign direct investment (FDI) from international investors. Notably, China’s higher education system ranks first among 11 countries globally.

Political risks (5th)

China ranks fifth in this parameter, following Singapore, Japan, Korea, and Malaysia. The country has maintained a high level of political stability through a complex and multifaceted policy system. Its corruption perception and public safety indices are also commendable, ranking 5th and 4th among 11 countries, respectively.

International trade (5th)

China ranks fifth in this parameter, following Singapore, Japan, Malaysia, and Korea. The country excels in trade balance, domestic suppliers, and trade and customs facilities/transparency. However, its ranking is negatively affected by trade openness levels and tariff barriers resulting from tensions with other economies.

Workforce (6th)

China ranks sixth in this parameter, following India, the Philippines, Vietnam, Thailand, and Indonesia. Despite having one of the world’s largest populations, which offers diverse opportunities for a sizable workforce, China is currently experiencing minimal population growth. Additionally, the aging population, with a median age of 39, poses challenges, particularly for manufacturers, as this higher median age may not align with the optimal workforce cohort.

Moreover, increasing labor costs have affected China’s attractiveness to manufacturing investors. However, its high labor productivity partly mitigates this concern.

Tax policy (8th)

China ranks eighth in this parameter, ahead of only the Philippines, Bangladesh, and India. Its corporate tax rates and tax incentives for manufacturers are commendable, ranking 4th and 3rd, respectively. However, its overall ranking is negatively impacted by its tax efficiency level.

Business environment (11th)

China faces significant challenges in its business environment, ranking last in this category. From a FDI perspective, many international businesses continue to express concerns over the lack of a level playing field. Common complaints include complex regulatory requirements, high capital barriers for SMEs, and the lengthy process of setting up wholly foreign-owned manufacturing operations.

China has been working to improve its business environment since 2015. However, according to the Asia Manufacturing Index 2025, there is still considerable room for improvement.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Leveraging Chinese Social Media for E-Commerce Growth on Shopify

- Next Article China New Pilot Program Removes Foreign Ownership Caps on Telecom and Data Centers