China Profit Repatriation Techniques

Getting your China subsidiary audited now, before the 2012 year-end, may offset expected U.S. dividends tax increases

Nov. 21 – As we noted yesterday, the George W. Bush-sanctioned U.S. dividends tax cuts are likely to come to an end early in 2013 under current U.S. President Barack Obama’s second term. Although details have not yet been formally announced and the decision not to extend the breaks has not yet been ratified, considered corporate opinion states that these changes are highly likely to come into effect. This may result in U.S. dividends tax being raised from the current level of 15 percent to somewhere in the region of 40 percent. Accordingly, there is some urgency in getting dividends realized in overseas subsidiaries, such as those in China, back to the United States before the U.S. domestic dividends tax ceiling is raised.

Fortunately, China permits the repatriation of dividends from foreign-invested companies registered in China at any time, providing the correct procedures have been gone through. Although typical audit and dividend repatriation cycles naturally fit into the annual Chinese fiscal audit year of January 1 to December 31 (with audited accounts for the preceding year required to be filed by end of March the following year at the latest), the urgency concerning the expiration of the U.S. dividend tax breaks may result in a necessity to bring this process significantly forward. In doing so, the foreign investor needs to ascertain:

- Is the increased audit cost – in terms of requesting an immediate, non-cyclical audit – worth the dividends tax saving?

- Can I get the China audit and repatriation carried out prior to the US dividends tax break expiring?

In terms of answering the first point, this is a business-specific financial equation that the U.S.-based CFO should be able to ascertain. In terms of the second, this falls into the “it depends” category as Washington has not given any clues yet as to when, and indeed, if, the U.S. dividends tax break will cease. Discussions over this matter should be held immediately with corporate tax counsel in the United States familiar with the subject for an opinion.

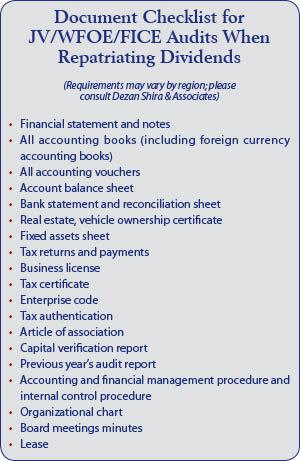

Helpfully, the audit procedures for a foreign-invested subsidiary in China are fairly straightforward, and especially so if it is well-managed as this is not a statutory audit with applicable Chinese deadlines and additional fund and license renewal requirements. The documents required by foreign investors to go through an audit process for a typical FIE can be seen in the graphic below.

Assuming these are in order and financial records have been accurately maintained with no inherent problems, an internal audit team will be able to provide an interim audit report for the purposes of assessing profits, the corporate income tax due on these and arrange to file the report with the China tax bureau for approval and clearance. The main aspects to consider when performing an interim audit for the purposes of facilitating profits repatriation are the cost justifications of performing a non-statutory audit purely for repatriation means (a statutory annual audit will still be due for the full 2012 fiscal year, although most of the figures can be derived from the interim report) while the time spent in conducting the report in order to beat the potential U.S. dividend tax cut-off dates also becomes important. This subject should be discussed with your China-based audit advisers, who will be able to assess the work required, provide a time-frame estimate for its completion, and will be able to handle the materials at hand to produce the required audit.

Once the interim audit report has been completed, submitted and approved, the dividends repatriation process can commence. Note that China in any event levies its own dividends tax on repatriated profits, with the amount varying from between 5 percent to 10 percent depending upon whether any double tax treaties have been included into your China corporate structuring. Once both the corporate income tax and dividends tax applicable to the profits element is paid, the money can then be transferred directly to the United States, in U.S. dollars, at the daily conversion rate against the RMB issued by the People’s Bank of China from the FIE’s bank account. Interestingly, there is no need usually to go specifically to SAFE as in the past, since guidelines applied by SAFE are executed by the bank. This has the benefit of cutting out a previously time-consuming administrative hurdle.

Depending upon case specifics, this process can be completed from a minimum of six weeks, although this may take longer if DTA benefits need to be claimed. Assuming this can be conducted prior to the U.S. dividends tax breaks being cut off, the savings could be substantial. Time is of the essence here, and U.S. companies with profitable subsidiaries in China should be looking at this matter with urgency.

This article was written by Chris Devonshire-Ellis with additional assistance from Hannah Feng and Chet Scheltema, all from Dezan Shira & Associates. The firm can assist American companies assess the potential for an immediate non-statutory audit and a speedy China dividends repatriation, and can also assist with the China audit. Please contact the firm at tax@dezshira.com for China advice, or contact Jessica Tou at the firm’s U.S. liason offices at usa@dezshira.com for immediate assistance in U.S. real time. Dezan Shira & Associates are an approved U.S. Department of Commerce service provider, and maintain offices throughout China, India, Vietnam, Hong Kong and Singapore. Please visit www.dezshira.com for details.

Related Reading

Internal Control and Audit

Internal Control and Audit

This issue of China Briefing Magazine is devoted to understanding effective internal control systems in the Chinese context and the role of audits in detecting and preventing fraud.

Annual Compliance and Audit for Expatriates and Foreign-Invested Entities

Annual Compliance and Audit for Expatriates and Foreign-Invested Entities

Prior to distributing and repatriating profits, foreign-invested enterprises must complete annual compliance, involving an audit, tax filing and inspection. These procedures are not only required by law, but are a good opportunity to conduct an internal financial health check. Also in this issue, we take a look at individual tax filing procedures for expatriates living and working in China.

Double Taxation Avoidance Agreements

Double Taxation Avoidance Agreements

In this issue, we look at the evolution of the legal framework of double taxation agreements in China, including the foundations of anti-avoidance, obligations in reporting offshore transactions, how to qualify as a beneficial owner and how to claim treaty benefits. We also outline the interpretations given in Circular 75 of the China-Singapore DTA, which was the first time that the Chinese tax authorities really opened up about DTA interpretations.

- Previous Article Obama’s Re-Election Triggers China-U.S. Dividend Rush

- Next Article China’s Transfer Pricing Obligations