China Imposes New Tariffs on US Goods from September 1, ASEAN and BRI Suppliers Now Preferred

New China tariffs on US products to make impact in five working days.

Op/Ed by Chris Devonshire-Ellis

China has imposed additional tariffs on US $75 billion worth of goods in two tranches. The first tranche takes effect on September 1 – five working days away from today – and the second from December 15. The tariffs will range from between an additional 5 to 10 percent depending upon the product. Clarification on what these products are and the tariffs that will apply to them can be expected to be published by Monday, yet they are believed to be aimed mostly at the agriculture, especially soy beans, and auto industries, including parts. The announcement was made by the State Council Tariff Commission in Beijing this afternoon.

The new tariffs represent an overall total value of about 10 percent of all US-China bilateral trade, which reached US $737 billion in 2018. Of that, about US $180 billion were US exports to China, which now means that another US $75 billion of that US $180 billion is about to have new or additional tariffs imposed upon them – a significant burden for US suppliers to China.

The reaction from Washington DC thus far has been to provide grants to US farmers caught up in this. President Trump announced a US$16 billion aid package in May, with policies appearing to be based on bailing out businesses affected by the trade war with government aid. The US has been a major source of soy bean and grain supplies to China, and the US farming community has been unhappy with the latest developments in the dispute. That community is also a major source of Trumps voting base, which is why Beijing is targeting it.

China, on the other hand, appears to have a rather stronger hand. It has been far more active over the years in agreeing free trade deals around the world, most noticeably with the full ASEAN bloc in 2015, and more recently with Belt and Road Initiative (BRI) countries. Major suppliers in ASEAN include Indonesia, Malaysia, Philippines, Thailand and Vietnam, while Russia is a major partner in the Belt and Road. Chinese businesses have also been active in Africa and South America, which also have developing substantial agricultural supply bases. It means that Beijing has prepared itself for the eventuality of a trade war, and has been busy making alternative supply arrangements should this eventuality arrive. That time has now come.

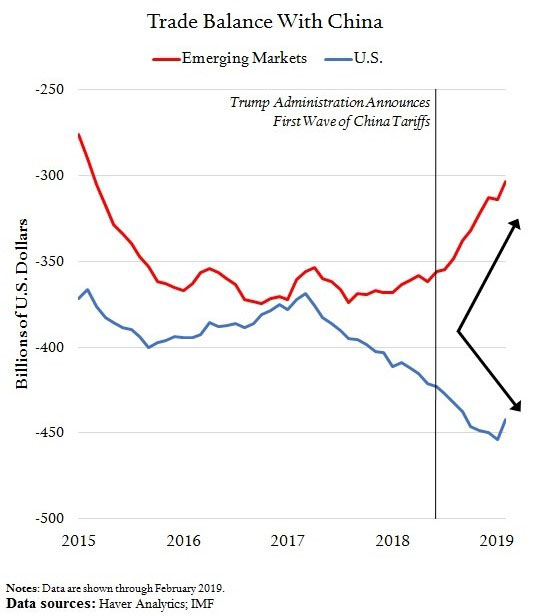

The trade dispute between the US and China has indeed impacted on trade flows. The graph below shows China’s trade purchases this year in emerging markets rise considerably, while those from the US are in steep decline.

The impact on ASEAN has also been noticeable, with GDP growth rates in healthy shape for 2019, partially supported by China diverting trade away from the US and to suppliers closer to home.

Apart from ASEAN, BRI partners have also been finding new opportunities to sell to China. Russia is already the world’s largest grain supplier, and has been ramping up production to fill the gap left by China exiting the American supply chain.

The issue that President Trump now faces is how to continue to obtain funding to sustain American farmers and other suppliers of products to China, and how long this financing can be sustained. The US budget deficit is expected to reach US $1 trillion and its highest share of debt to GDP since the end of World War Two. China, meanwhile, has reacted by shifting its supply chain away from the US and does so without having to spend huge amounts of national reserves, or raise debt.

The message appears to be this: China seems to have been better prepared for this eventuality, and is now using its supply chain options. The question for the US is now not just about the trade war, it is this: will US manufacturers and farmers ever get China back as a customer now that Beijing is in the process of buying from different suppliers that are considerably closer to home?

Related Reading

- Trump Blinks In US-China Trade War – But The New World Trade Order Is Already Here

- Chinese Ambassador – Russia-China Trade Set To Double To US$200 Billion By 2024

- The US, Huawei And The Belt & Road’s New 5G Supply Chains

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write china@dezshira.com for more support on doing business in China.

- Previous Article CSR in India, Vietnam’s Rules of Origin – China Outbound

- Next Article Changes in China’s Purchasing and Import Trends between 2019 and 2024