China Facing Increasing Competition from Asian Neighbors On Tax Rates and Costs

Op-Ed Commentary: Chris Devonshire-Ellis

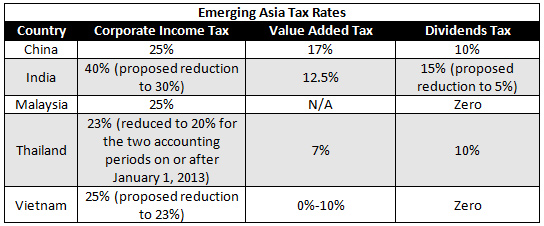

Dec. 21 – China is facing pressures concerning its foreign direct investment inflows as other Asian countries reposition themselves to take advantage of its increasing labor costs. China’s minimum wages are rising at an average 22 percent per year, while employers have to part with as much as 40 percent of that salary again through social welfare payments that are directly linked to wages. China’s corporate income tax rate is currently 25 percent, yet foreign investors are also subject to a further 10 percent tax on profits (dividends tax) should these be repatriated out of the country. Concerns are growing among many multinationals over the ongoing and increasing costs of doing business in the country.

Many, however, assert that the creation of wealth in China is a positive issue, pointing out that the current middle class in China estimated at roughly 250 million is expected to rise to 600 million by 2020. The view is that foreign investors will be able to share in a mass consumer boom for products on a gigantic scale as increasing numbers of Chinese enjoy higher levels of disposable income. The key to this potential bonanza, though, relates to where these products will actually be made – and part of this conundrum relates to the continuing rise of Chinese labor.

Other Asian neighbors are eying China’s middle class consumer boom versus increasing labor costs predicament with their own strategic views. The Vietnamese Ministry of Planning and Investment has indicated that in 2013 it will employ a far more aggressive approach to attracting foreign investment. German, Japanese, Taiwanese and South Korean investors have all been lobbying for reductions in taxes, and the government appears to have been taking their cases seriously.

Vietnam’s corporate income tax rate is currently 25 percent, the same as China’s, yet moves expected to be ratified by Vietnam’s National assembly next year could see these reduced to 23 percent – a significant discount. In addition to this, the Vietnamese government has reduced corporate income tax rates to 10 percent for foreign investors increasing their existing investments in Vietnam. On a trial basis, Samsung has been given a 10 percent CIT level for profits arising from a new factory investment of US$830 million following an increase of this amount in their Vietnamese registered capital. Again, this policy is expected to be adopted as an FDI incentive by Vietnam at the National Assembly in the spring next year. Unlike China, Vietnam does not levy any dividends tax.

Taiwanese companies too are eying the potential. Foxconn, for example, has thousands of employees in China, and has invested heavily in strategic hubs of component manufacturers all based in one themed industrial park. Yet with those labor costs increasing, and a de facto (repatriated) profits tax rate of 35 percent, Vietnam’s lower labor costs, CIT rates and lack of dividends tax are starting to appear very alluring.

It is not just Vietnam that is aggressively looking at exploiting China’s labor, tax and consumer boom squeeze. Thailand and Indonesia are beginning to provide lower tax bases to attract FDI. India too, with its rather high corporate income tax rate of 40 percent is examining this situation. India’s politicians realize their CIT rate is too high, and significant tax reforms are expected to come in due course with a top rate of 30 percent CIT anticipated.

On top of facing competition from other Asian countries offering significantly lower income tax rates and incentives, the ASEAN free trade zone will unify in 2015. Existing and anticipated free trade agreements between ASEAN and China, such as the Regional Comprehensive Economic Partnership, will wipe out tariffs across the region on thousands on products come January 1, 2015. By that time, the costs of manufacturing in China may well have begun to look highly uncompetitive. Foreign manufacturers wishing to reach out to the Chinese consumer will have options regarding where to position that manufacturing capacity. It is to countries such as Vietnam and other ASEAN locations that the bean counters at corporate head offices will start to reach out to, as competition for foreign direct investment in the global manufacturing arena places China’s dominance thus far in some question.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to The China Advantage, our complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

The Asia Tax Comparator

The Asia Tax Comparator

Here we discuss corporate income tax, value-added tax, business tax, goods and service tax, withholding tax, and individual income tax as these apply in China, India, and Vietnam, and in the popular holding company destinations of Hong Kong and Singapore. This includes tax rates, descriptions, incentives, and deadlines, as well as main FDI source countries/regions and industry-specific notes.

Letters from America: Vietnam as a Manufacturing Destination for U.S. Companies

Vietnam Set to Lower Corporate Income Tax

- Previous Article China to Speed up Fiscal and Taxation Reform

- Next Article China Releases Annual Report on Advance Pricing Arrangements