China Employment and Labor Disputes: Anticipate the Unexpected, Act to Prevent Disruption

Chinese family members entered the offices of the foreign trading firm and refused to leave. A China-based employee on assignment in Southeast Asia had suffered a severe injury in a motorcycle accident and lay hospitalized in a coma. The family sought tangible assurance of financial support.

Evening approached. The employers called Shanghai police, but the police refused to intervene, dismissing the matter as a non-criminal dispute. Around 8 p.m., the employers made a frantic call to advisors: “What do we do?”

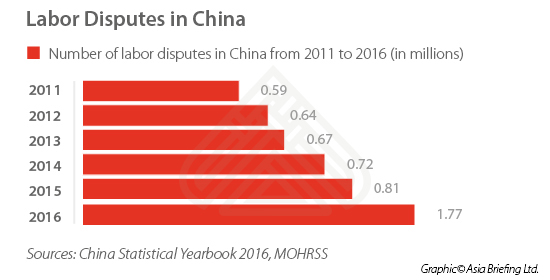

According to Chinese statistics, the likelihood of a labor incident has grown dramatically. Officially recorded disputes increased to nearly two million in 2016, double that of 2015.

Because foreign managers in China lack knowledge of how disputes may play out, they often fail to imagine how they could escalate nor anticipate how they could disrupt business. While the vast majority are resolved without incident, foreign managers must be imaginative and learn to spot high-risk situations, then respond proactively.

We review three real life labor dispute scenarios and comment on proactive steps that could have been taken to lower the risk of business disruption.

![]() HR & Payroll Solutions from Dezan Shira & Associates

HR & Payroll Solutions from Dezan Shira & Associates

Asset, record, and chop seizures for leverage in employment severance

It is reasonable to assume that an employee can sense a worsening employment relationship, anticipate eventual termination, and that he or she may then respond negatively. However, how employees in China may respond is where foreign managers lack experience and imagination.

It should not come as a surprise if a disgruntled employee, or employees, given the opportunity, move preemptively to seize control of corporate assets to bolster a negotiating position in anticipation of severance.

The targeted assets are frequently corporate chops, because they are easy to steal, and because it gives the holder near total corporate decision-making authority, but they include assets like financial and banking records, computer or safe box passcodes, and keys for access to infrastructure. The effort may also include occupying physical premises as a form of seizure and, in some extreme cases, may even involve forms of physical detention.

Those with opportunity to seize corporate assets are normally senior officers or managers. However, this is not always the situation, as demonstrated by the introductory example, where control of physical premises was effectively seized by family members.

Disgruntled employees: how to spot high-risk managers

High levels of autonomy and lack of supervision increase the risk of a malicious seizure, as there are fewer barriers to acting out, and abundant opportunity. However, foreign investors in China often feel they have little or no choice but to place deep and wide-ranging authority in the hands of a few go-to managers. While understandable, risks then dramatically increase.

When extensive autonomy and wide authority have been granted over an extended period of time, a senior manager’s sense of entitlement may grow. The manager may come to feel responsible for company success, and could become disgruntled with his financial remuneration or a perceived lack of recognition.

Here is where foreign human resources and operations managers fail. Although the employer may recognize the red flags, they delay serious and imaginative consideration of the situation and do not act soon enough. The employer simply stumbles forward, hoping for the best, fearing premature action could worsen the situation. They fear provoking the employee.

The disgruntled employee, on the other hand, may feel mistreated, which justifies their actions. The employee may conclude there is little to lose in the China context, where police may entirely ignore such incidents.

In worst case scenarios, fraud and other abuses may have already occurred, and their discovery may be of much greater concern to the disgruntled employee than fallout from a surprise seizure of assets. The employee may even see seizure of financial records as having a collateral benefit, because it prevents initiation of investigation into fraud or abuse.

Strong internal controls and fraud training reduce risks

Effective internal control policies and practices will reduce the risks of such incidents occurring. All foreign investors in China are strongly advised to review and bolster their internal control policies, practices, and culture. These would include, for example, redundant authorization for access to key corporate assets, specifically including the company chops.

Training senior managers in fraud and internal controls, and obtaining their personal commitment to these standards, is also highly advisable. Sadly, employers often neglect or ignore internal controls in China, sometimes never implementing them to begin with.

Yet the fact remains, good internal control policies and practices cannot entirely eliminate the risks. Senior officers and managers will eventually need singular access to key corporate assets (and the company chops); it is incumbent on HR or operations managers to stay sharp, be imaginative, and prepare to act preemptively to prevent disruption.

In particular, employers must prepare plans to prevent singular access and control of key corporate assets by employees when red flags arise, most critically during the period between the deterioration of an employment relationship and the termination.

![]() RELATED: Labor Disputes in China: Prepare for Aggressive Negotiating, Uncomfortable Concessions

RELATED: Labor Disputes in China: Prepare for Aggressive Negotiating, Uncomfortable Concessions

Proactively manage and resolve disputes: become culturally aware to see what’s coming

Our introductory scenario differs slightly from the discussion so far because there was no disgruntled senior manager acting to seize corporate assets on the cusp of termination. Rather, it was a regular employee’s family occupying office premises during a medical emergency.

But take a closer look: it is essentially a seizure of corporate assets in the context of an employment dispute as leverage to negotiate financial compensation. The example highlights the need for foreign managers to stay sharp and think imaginatively in the context of a Chinese dispute.

In the example, the employer, firstly, did not fully grasp that matters of health and finances are of concern to the whole family, not just to an individual and his or her spouse. The extended Chinese family has long needed to shoulder the burden of family members’ illness and care; it was to be expected that they would take a very keen and direct interest in this accident and a family member’s needs.

Furthermore, the family understood that they were directly exposed to financial burdens. Because Chinese social insurance would likely not cover the cost of care outside China, and they could not know what support a new, potentially “flaky” foreign employer might provide.

That the Chinese family would physically occupy the offices of the trading firm to seek support was the surprise. But it shouldn’t have been. It was a simple failure of imagination on the part of the employer, arising from their lack of China experience, worsened by the fact they were probably distracted by the urgent medical crisis at hand.

Had the employer understood the common practice of seizing assets as leverage in labor disputes, they could have foreseen what might happen and could have taken precautions. The employer could have proactively contacted the family at a neutral site to assure them of support. Simultaneously, they could have secured their corporate facilities and limited family access.

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

China’s Investment Landscape: Identifying New Opportunities

China’s Investment Landscape: Identifying New Opportunities

China’s foreign investment landscape has experienced pivotal changes this year. In this issue of China Briefing magazine, we examine how foreign investors can capitalize on China’s latest FDI reforms. First, we outline new industry liberalizations in both China’s FTZs and the country at large. We then consider when an FTZ makes sense as an investment location, and what businesses should consider when entering one. Finally, we give an overview of China’s latest pro-business reforms that streamline a wide range of administrative and regulatory measures.

- Previous Article Двусторонняя торговля между Китаем и Россией является самым быстрорастущим коридором в мире

- Next Article Investment Opportunities in China Open Up Following Regulatory Changes