China’s Industrial Power Rates: A Guide for Investors

China’s industrial power rates depend upon the category of industry, type of electricity usage, region where it is located, time of use, as well as charging method that the company chooses to go along with. In this article, we offer a rundown of how the industrial power rates are fixed in the country.

The cost of electricity consumption is a critical factor for businesses in the industrial sector, particularly in energy-intensive industries like iron, steel, non-ferrous metals, building materials, and chemicals. As China moves up the value chain in manufacturing higher-technology products, it actively seeks to reduce costs and has implemented measures to lower general industrial power rates.

Over the past few years, the average industrial power rate in China has increased slightly, reaching approximately US$0.088/kWh in 2024, up from US$0.084/kWh in 2019. Despite this uptick, China’s electricity prices remain lower than those in most developing countries, such as India and Mexico.

In this article, we provide an overview of the evolving charging methods for industrial and commercial electricity usage in China and summarize the data on industrial and commercial power rates across major provinces.

Overview of charging methods for industrial power

China charges electricity fees according to four types of electricity usage, namely residential electricity, agriculture production electricity, general commercial and industrial electricity, and large-scale industrial electricity.

General commercial and industrial electricity mainly involves small and medium-sized enterprises (SMEs) with a total transformer capacity of no more than 315 kVA. Large-scale industry users have a total transformer capacity of above 315 kVA.

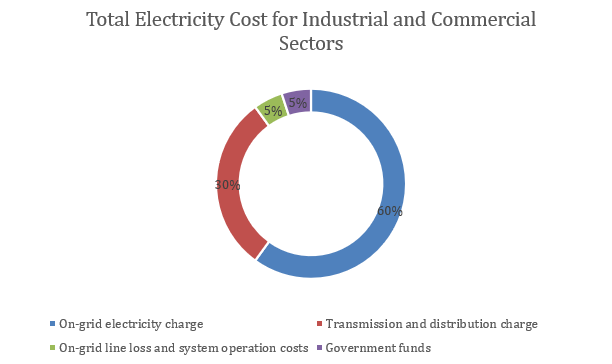

For commercial and industrial electricity usage, the total charge is divided into four parts: On-grid electricity charge, transmission and distribution charge, on-grid line loss and system operation costs, and charge to government funds.

TOTAL ELECTRICITY CHARGE = ON-GRID ELECTRICITY CHARGE + TRANSMISSION AND DISTRIBUTION CHARGE + ON-GRID LINE LOSS AND SYSTEM OPERATION COSTS + CHARGE TO GOVERNMENT FUNDS

On-grid electricity charge is the charge based on the settlement price for electricity provided by power generation companies, accounting for around 60 percent of the total electricity cost. The on-grid electricity charge is influenced by time-of-use (TOU) pricing.

China has been actively promoting TOU pricing across different regions for commercial and industrial sectors. TOU pricing differentiates electricity rates based on “peak hours” and “valley hours.” Electricity prices increase during peak hours and decrease during valley hours. This strategic adjustment aims to incentivize energy consumption during off-peak periods, encouraging more efficient energy use and effective demand management.

Transmission and distribution charge is determined based on the permitted income of the grid enterprises’ transmission and distribution business divided by voltage levels and user categories, which account for around 30 percent of the total electricity cost.

The transmission and distribution charge varies depending on whether a single-part or two-part pricing method is chosen. Previously, the general commercial and industrial sectors were charged based on the cost per unit at three voltage levels: 1kV, 10kV, and 35kV (single-part price).

For large-scale industry users, the cost of electricity consumption was divided into two parts (two-part price):

- Fixed charges based on maximum demand or transformer capacity

- Charges based on the user’s actual electricity consumption

However, as part of China’s efforts to enhance its business environment, some enterprises in the general commercial and industrial sectors now have the option to choose between the single-part price and the two-part price, providing increased pricing flexibility.

On-grid line losses are costs incurred by the grid enterprises for procuring line-loss electricity (with a comprehensive on-grid line loss rate of 3.31 percent). The procurement gains and losses are settled monthly, and the resulting gains and losses are shared among all users who follow the commercial and industrial electricity pricing. System operation costs include auxiliary service fees, pumped storage capacity electricity fees, and various gain and loss allocations, which are also settled monthly. They account for around five percent of the total electricity cost.

Government funds constituting part of the electricity charge are surcharges related to social and economic factors beyond the production and transmission of electricity itself and are used for specific purposes related to energy and power development. They account for around five percent of the total electricity cost. These fees are collected by the grid company on behalf of the government when collecting electricity fees, based on the charging objects and standards. In recent years, the overall level of government funds and surcharges has shown a decreasing trend.

TOU pricing

In simple terms, TOU pricing refers to the practice of dividing the 24-hour day into several periods based on the system’s operational status, with electricity charges for each period reflecting the system’s average marginal cost. TOU pricing encourages and incentivizes electricity users to shift their usage to off-peak times, optimizing their electricity consumption patterns.

Since the 1980s, China has gradually implemented TOU pricing mechanisms across various regions. The specific implementation of TOU pricing varies by region. For example, most regions divide the day into peak, off-peak, and valley periods, applying different rates accordingly. Some provinces have added a critical peak period on top of this. In places like Sichuan, the year is divided into wet and dry seasons, with higher rates applied during the dry season when electricity supply is tight. In some other areas, the year is divided into summer and non-summer periods, with higher seasonal rates applied during the peak summer months.

On July 29, 2021, to deepen electricity price reforms and improve the pricing mechanism, the National Development and Reform Commission (NDRC) issued the “Notice on Further Improving the Time-of-Use Pricing Mechanism” (NDRC Price [2021] No. 1093). This notice further refined the existing TOU pricing mechanism to better signal electricity costs, support the construction of a new power system dominated by renewable energy, and promote green and low-carbon energy development.

Following the requirements set in NDRC’s notice, local governments have issued the updated TOU electricity pricing policies from 2021 to 2024. Most of the newly issued pricing policies focus on refining the division of peak and valley periods, increasing the price differential between peak and valley periods, and establishing a high peak pricing mechanism. Moreover, large-scale industrial users are required to adopt TOU pricing in principle, while general industrial and commercial users have more flexibility—they can choose whether or not to apply TOU pricing based on their business nature.

| Type of TOU | Regions | Number of regions |

| 3 levels:

Peak Off-peak Valley |

Gansu, Ningxia, Guizhou, and Guangxi | 4 |

| 4 levels:

Critical peak Peak Off-peak Valley |

Beijing, Shanghai, Tianjing, Guangdong, Anhui, Hubei, Hunan, Henan, Hebei (North), Hebei (South), Shanxi, Shaanxi, Qinghai, Hainan, Heilongjiang, Jilin, Liaoning, Sichuan, Chongqing, and Yunnan | 21 |

| 5 levels:

Critical peak Peak Off-peak Valley Deep valley |

Shandong, Xinjiang, Inner Mongolia (East), Inner Mongolia (West) | 4 |

| 6 levels:

Critical peak Peak Off-peak Valley Deep valley (normal days) Deep valley (only during major holidays, like the Spring Festival, Labor Day, and National Day) |

Jiangsu, Zhejiang, Jiangxi, and Shanghai | 4 |

Two-part pricing

The single-part electricity pricing system is straightforward and easy to understand. It is calculated based on the actual electricity consumption recorded by the user’s meter and is not related to equipment capacity. Regardless of the amount of electricity used, a flat rate is applied. Users simply need to multiply their monthly electricity consumption by the unit price to calculate the total electricity bill.

SINGLE-PART ELECTRICITY CHARGE = MONTHLY ELECTRICITY CONSUMPTION ×UNIT PRICE

The two-part tariff is a pricing strategy where consumers pay a fixed fee to access the service, in addition to a variable fee based on usage. It consists of two components: Basic electricity charge and electricity charge based on consumption.

| Two-Part Electricity Charging Method | |

| Electricity Charge Under Two-Part = Basic Electricity Charge + Electricity Charge Based On Consumption | |

| Electricity charge based on consumption | The variable charge depends on the user’s actual electricity consumption. Cost per unit is based on four voltage levels –10kV, 35kV, 110kV, and 220kV, as well as the timing of the electricity usage. |

| Basic electricity charge | This fixed charge reflects the capacity costs and is calculated based on the user’s equipment capacity (kVA) or maximum demand (kW, contract maximum demand, or actual maximum demand).

|

Previously, only large-scale industries with transformer capacities exceeding 315kVA could apply the two-part pricing. Nevertheless, according to the updated document NDRC Price [2023] No.526, general commercial and industrial enterprises with transformer capacities between 100 kVA and 315 kVA can now have the option to choose between being charged based on a single or two-part price. Moreover, the notice clarifies that:

- Users with transformer capacities of 100 kVA and below, the single-part pricing mechanism applies.

- Users with transformer capacity of 315 kVA and above, the two-part pricing mechanism applies. However, if such users are currently on a single-rate pricing mechanism, they can choose between a single-rate or a two-part pricing mechanism. Some regions further specify that once two-part pricing is selected, the user will not be allowed to change back to sing-part pricing.

The choice between single-part and two-part electricity pricing depends on factors such as user voltage level, electricity capacity, contract capacity, maximum demand, and load ratio. While it may seem complex, the key comparison lies in assessing the difference between single-part and two-part electricity charges in relation to capacity (or demand) charges.

When selecting charging methods, it is important take the following factors into consideration :

- At the same voltage level, the single-part electricity price is higher than the two-part electricity price.

- At the same voltage level, under the two-part price mechanism, the basic electricity price calculated based on the user’s maximum demand (kW) is approximately 1.6 times that calculated based on the user’s equipment capacity (kVA).

- For users opting for the demand-based pricing method under the two-part pricing mechanism, if their monthly electricity consumption per kVA reaches 260 kWh or more, the demand-based price for that month will be charged at 90% of the standard rate. The monthly electricity consumption per kVA is calculated by dividing the total electricity consumption of all metering points by the contracted transformer capacity.

China’s industrial power rates by region

In this section, we present a summary of the single-part and two-part pricing data released by various provinces, factoring in the TOU pricing adjustments. Please note that power rates are regularly updated. The data in the tables below are as of April 2024 and are provided for reference purposes only.

Single-part pricing in major provinces/cities

| Power Rates under Single Part Pricing by Region | |||||||

| Region | Transformer capacity | Cost per unit (RMB/kWh) | |||||

| Non-TOU pricing | TOU pricing | ||||||

| Standard | Critical Peak | Peak | Off-Peak | Valley | Deep valley | ||

| Jiangsu | <1 kV | 0.78 | / | 1.30 | 0.78 | 0.35 | / |

| 1-10 kV | 0.75 | / | 1.25 | 0.75 | 0.34 | / | |

| 35 kV | 0.73 | / | 1.21 | 0.73 | 0.33 | / | |

| Anhui | <1 kV | 0.74 | 1.27 | 1.20 | 0.74 | 0.36 | / |

| 1-10 kV | 0.72 | 1.23 | 1.16 | 0.72 | 0.35 | / | |

| 35 kV | 0.70 | 1.19 | 1.13 | 0.70 | 0.34 | / | |

| Guangdong (Pearl River Delta) | <1 kV | 0.81 | 1.68 | 1.35 | 0.81 | 0.32 | / |

| 1-10 kV | 0.78 | 1.63 | 1.31 | 0.78 | 0.31 | / | |

| 35 kV | 0.74 | 1.54 | 1.24 | 0.74 | 0.3 | / | |

| Guangdong (Huizhou) | <1 kV | 0.78 | 1.63 | 1.31 | 0.78 | 0.31 | / |

| 1-10 kV | 0.76 | 1.58 | 1.27 | 0.76 | 0.3 | / | |

| 35 kV | 0.71 | 1.49 | 1.2 | 0.71 | 0.29 | / | |

| Guangdong (Jiangmen) | <1 kV | 0.8 | 1.68 | 1.35 | 0.8 | 0.32 | / |

| 1-10 kV | 0.78 | 1.62 | 1.3 | 0.78 | 0.31 | / | |

| 35 kV | 0.74 | 1.53 | 1.23 | 0.74 | 0.78 | / | |

| Guangdong (East and West region) | <1 kV | 0.72 | 1.5 | 1.21 | 0.72 | 0.29 | / |

| 1-10 kV | 0.7 | 1.45 | 1.17 | 0.7 | 0.28 | / | |

| 35 kV | 0.65 | 1.36 | 1.1 | 0.65 | 0.27 | / | |

| Shandong | <1 kV | 0.77 | 1.28 | 1.13 | 0.77 | 0.41 | 0.31 |

| 1-10 kV | 0.75 | 1.27 | 1.11 | 0.75 | 0.4 | 0.29 | |

| 35 kV | 0.73 | 1.25 | 1.1 | 0.73 | 0.38 | 0.28 | |

| Shanxi | <1 kV | 0.58 | / | 0.79 | 0.58 | 0.4 | / |

| 1-10 kV | 0.56 | / | 0.77 | 0.56 | 0.38 | / | |

| 35 kV | 0.55 | / | 0.76 | 0.55 | 0.36 | / | |

| Beijing | <1 kV | 0.88 | / | 1.16 | 0.88 | 0.63 | / |

| 1-10 kV | 0.86 | / | 1.18 | 0.86 | 0.58 | / | |

| 35 kV | 0.79 | / | 1.11 | 0.79 | 0.51 | / | |

| Hebei | <1 kV | 0.74 | 1.17 | 1.03 | 0.74 | 0.45 | / |

| 1-10 kV | 0.72 | 1.15 | 1.01 | 0.72 | 0.43 | / | |

| 35 kV | 0.7 | 1.13 | 0.99 | 0.7 | 0.41 | / | |

| Hebei (North) | <1 kV | 0.65 | 1.08 | 0.94 | 0.65 | 0.36 | / |

| 1-10 kV | 0.63 | 1.07 | 0.93 | 0.63 | 0.34 | / | |

| 35 kV | 0.62 | 1.05 | 0.92 | 0.62 | 0.33 | / | |

| Henan | <1 kV | 0.71 | / | 1.1 | 0.71 | 0.35 | / |

| 1-10 kV | 0.68 | / | 1.05 | 0.68 | 0.34 | / | |

| 35 kV | 0.65 | / | 1 | 0.65 | 0.33 | / | |

| Zhejiang | <1 kV | 0.83 | 1.46 | 1 | 0.83 | 0.43 | / |

| 1-10 kV | 0.01 | 1.43 | 0.98 | 0.01 | 0.42 | / | |

| 35 kV | 0.77 | 1.36 | 0.94 | 0.77 | 0.4 | / | |

| Shanghai | <1 kV | 0.85 | / | 0.98 | 0.85 | 0.49 | / |

| 1-10 kV | 0.8 | / | 0.93 | 0.8 | 0.46 | / | |

| 35 kV | 0.76 | / | 0.88 | 0.76 | 0.44 | / | |

| Chongqing | <1 kV | 0.78 | / | / | / | / | / |

| 1-10 kV | 0.76 | / | 1.16 | 0.76 | 0.35 | / | |

| 35 kV | 0.74 | / | 1.12 | 0.74 | 0.35 | / | |

| Sichuan | <1 kV | 0.82 | / | 1.27 | 0.82 | 0.37 | / |

| 1-10 kV | 0.8 | / | 1.23 | 0.8 | 0.36 | / | |

| 35 kV | 0.77 | / | 1.18 | 0.77 | 0.35 | / | |

| Heilongjiang | <1 kV | 0.77 | / | 1.13 | 0.77 | 0.42 | / |

| 1-10 kV | 0.76 | / | 1.12 | 0.76 | 0.41 | / | |

| 35 kV | 0.75 | / | 1.11 | 0.75 | 0.41 | / | |

| Liaoning | <1 kV | 0.76 | / | 1.09 | 0.76 | 0.43 | / |

| 1-10 kV | 0.74 | / | 1.06 | 0.74 | 0.42 | / | |

| 35 kV | 0.72 | / | 1.03 | 0.72 | 0.4 | / | |

| Jilin | <1 kV | 0.84 | 1.44 | 1.22 | 0.84 | 0.47 | / |

| 1-10 kV | 0.81 | 1.4 | 1.17 | 0.81 | 0.45 | / | |

| 35 kV | 0.8 | 1.37 | 1.16 | 0.8 | 0.45 | / | |

| Inner Mongolia (East) | <1 kV | 0.67 | / | 0.83 | 0.67 | 0.56 | / |

| 1-10 kV | 0.64 | / | 0.79 | 0.64 | 0.52 | / | |

| 35 kV | 0.55 | / | 0.7 | 0.55 | 0.44 | / | |

| Jiangxi | <1 kV | 0.75 | / | 1.07 | 0.75 | 0.43 | / |

| 1-10 kV | 0.73 | / | 1.04 | 0.73 | 0.42 | / | |

| 35 kV | 0.72 | / | 1.02 | 0.72 | 0.41 | / | |

| Hunan | <1 kV | 0.78 | / | 1.22 | 0.78 | 0.34 | / |

| 1-10 kV | 0.76 | / | 1.19 | 0.76 | 0.33 | / | |

| 35 kV | 0.74 | / | 1.16 | 0.74 | 0.32 | / | |

| Shaanxi | <1 kV | 0.7 | / | 1.02 | 0.7 | 0.39 | / |

| 1-10 kV | 0.69 | / | 0.99 | 0.69 | 0.38 | / | |

| 35 kV | 0.67 | / | 0.96 | 0.67 | 0.37 | / | |

| Xinjiang | <1 kV | 0.4 | / | 0.6 | 0.4 | 0.24 | 0.06 |

| 1-10 kV | 0.4 | / | 0.59 | 0.4 | 0.24 | 0.06 | |

| 35 kV | 0.4 | / | 0.59 | 0.4 | 0.24 | 0.06 | |

| Guangxi | <1 kV | 0.8 | / | 0.99 | 0.8 | 0.61 | / |

| 1-10 kV | 0.79 | / | 0.97 | 0.79 | 0.59 | / | |

| 35 kV | 0.77 | / | 0.95 | 0.77 | 0.58 | / | |

| Hainan | <1 kV | 0.87 | / | 1.41 | 0.87 | 0.41 | / |

| 1-10 kV | 0.85 | / | 1.37 | 0.85 | 0.4 | / | |

| 35 kV | 0.75 | / | 1.2 | 0.75 | 0.36 | / | |

Two-part pricing in major provinces/cities

| Power Rates under Two-Part Pricing by Region | |||||||||

| Region | Transformer capacity | Cost per unit (RMB/kWh) | Basic charges | ||||||

| Non-TOU procing | TOU pricing | By maximum demand (RMB/kW/mon) | By transformer capacity (RMB/kVA/mon) | ||||||

| Critical Peak | Peak | Off-Peak | Valley | Deep-Valley | |||||

| Jiangsu | 1-10 kV | 0.66 | / | 1.16 | 0.66 | 0.28 | / | 51.2 | 32 |

| 35 kV | 0.65 | / | 1.11 | 0.65 | 0.27 | / | 48 | 30 | |

| 110 kV | 0.63 | / | 1.1 | 0.63 | 0.26 | / | 44.8 | 28 | |

| ≥ 220 kV | 0.61 | / | 1.03 | 0.61 | 0.25 | / | 41.6 | 26 | |

| Anhui | 1-10 kV | 0.70 | 1.2 | 1.13 | 0.70 | 0.34 | / | 48 | 30 |

| 35 kV | 0.67 | 1.15 | 1.09 | 0.67 | 0.33 | / | 45.6 | 28.5 | |

| 110 kV | 0.65 | 1.1 | 1.04 | 0.65 | 0.32 | / | 44 | 27.5 | |

| ≥ 220 kV | 0.63 | 1.05 | 1 | 0.63 | 0.31 | / | 40.8 | 25.5 | |

| Guangdong (Pearl River Delta) | 1-10 kV | 0.71 | 1.48 | 1.19 | 0.71 | 0.29 | / | 36.1 | 22.6 |

| 35 kV | 0.68 | 1.42 | 1.14 | 0.68 | 0.28 | / | 31 | 19.4 | |

| 110 kV | 0.68 | 1.42 | 1.14 | 0.68 | 0.28 | / | 31 | 19.4 | |

| ≥ 220 kV | 0.66 | 1.36 | 1.1 | 0.66 | 0.27 | / | 26.1 | 16.3 | |

| Guangdong (Huizhou) | 1-10 kV | 0.68 | 1.42 | 1.14 | 0.68 | 0.28 | / | 36.1 | 22.6 |

| 35 kV | 0.66 | 1.37 | 1.1 | 0.66 | 0.27 | / | 31 | 19.4 | |

| 110 kV | 0.66 | 1.37 | 1.1 | 0.66 | 0.27 | / | 31 | 19.4 | |

| ≥ 220 kV | 0.63 | 1.31 | 1.05 | 0.63 | 0.26 | / | 26.1 | 16.3 | |

| Guangdong (Jiangmen) | 1-10 kV | 0.71 | 1.47 | 1.18 | 0.71 | 0.29 | / | 36.1 | 22.6 |

| 35 kV | 0.68 | 1.41 | 1.14 | 0.68 | 0.28 | / | 31 | 19.4 | |

| 110 kV | 0.68 | 1.41 | 1.14 | 0.68 | 0.28 | / | 31 | 19.4 | |

| ≥ 220 kV | 0.65 | 1.36 | 1.09 | 0.65 | 0.27 | / | 26.1 | 16.3 | |

| Guangdong (East and West region) | 1-10 kV | 0.62 | 1.29 | 1.04 | 0.62 | 0.25 | / | 36.1 | 22.6 |

| 35 kV | 0.6 | 1.24 | 0.99 | 0.6 | 0.24 | / | 31 | 19.4 | |

| 110 kV | 0.6 | 1.24 | 0.99 | 0.6 | 0.24 | / | 31 | 19.4 | |

| ≥ 220 kV | 0.57 | 1.18 | 0.95 | 0.57 | 0.23 | / | 26.1 | 16.3 | |

| Shandong | 1-10 kV | 0.70 | 1.21 | 1.05 | 0.70 | 0.34 | 0.24 | 38.4 | 24 |

| 35 kV | 0.68 | 1.19 | 1.04 | 0.68 | 0.32 | 0.22 | 35.2 | 22 | |

| 110 kV | 0.67 | 1.18 | 1.02 | 0.67 | 0.31 | 0.21 | 35.2 | 22 | |

| ≥ 220 kV | 0.65 | 1.12 | 1 | 0.65 | 0.29 | 0.19 | 32 | 20 | |

| Shanxi | 1-10 kV | 0.54 | / | 0.75 | 0.54 | 0.35 | / | 36 | 22.5 |

| 35 kV | 0.51 | / | 0.72 | 0.51 | 0.32 | / | 36 | 22.5 | |

| 110 kV | 0.49 | / | 0.69 | 0.49 | 0.3 | / | 33.6 | 21 | |

| ≥ 220 kV | 0.47 | / | 0.67 | 0.47 | 0.28 | / | 33.6 | 21 | |

| Beijing | 1-10 kV | 0.68 | / | 0.92 | 0.68 | 0.44 | / | 51 | 32 |

| 35 kV | 0.64 | / | 0.88 | 0.64 | 0.4 | / | 48 | 30 | |

| 110 kV | 0.64 | / | 0.88 | 0.64 | 0.40 | / | 48 | 30 | |

| ≥ 220 kV | 0.62 | / | 0.86 | 0.62 | 0.38 | / | 45 | 28 | |

| Hebei | 1-10 kV | 0.7 | 1.13 | 0.99 | 0.7 | 0.41 | / | 35 | 21.9 |

| 35 kV | 0.68 | 1.11 | 0.97 | 0.68 | 0.39 | / | 35 | 21.9 | |

| 110 kV | 0.66 | 1.09 | 0.95 | 0.66 | 0.37 | / | 32 | 20 | |

| ≥ 220 kV | 0.64 | 1.07 | 0.93 | 0.64 | 0.35 | / | 32 | 20 | |

| Hebei (North) | 1-10 kV | 0.62 | 1.05 | 0.91 | 0.62 | 0.33 | / | 37.3 | 23.3 |

| 35 kV | 0.6 | 1.04 | 0.90 | 0.6 | 0.31 | / | 37.3 | 23.3 | |

| 110 kV | 0.59 | 1.02 | 0.88 | 0.59 | 0.3 | / | 34.6 | 21.6 | |

| ≥ 220 kV | 0.58 | 1.01 | 0.87 | 0.58 | 0.29 | / | 34.6 | 21.6 | |

| Henan | 1-10 kV | 0.68 | / | 1.05 | 0.68 | 0.34 | / | 40 | 25 |

| 35 kV | 0.66 | / | 1.01 | 0.66 | 0.33 | / | 36.9 | 23 | |

| 110 kV | 0.63 | / | 0.97 | 0.63 | 0.32 | / | 33.7 | 21 | |

| ≥ 220 kV | 0.62 | / | 0.94 | 0.62 | 0.31 | / | 30.5 | 19 | |

| Zhejiang | 1-10 kV | 0.72 | / | 1.19 | 0.72 | 0.33 | / | 48 | 30 |

| 35 kV | 0.69 | / | 1.14 | 0.69 | 0.31 | / | 44.8 | 28 | |

| 110 kV | 0.68 | / | 1.12 | 0.68 | 0.3 | / | 41.6 | 26 | |

| ≥ 220 kV | 0.67 | / | 1.1 | 0.67 | 0.30 | / | 38.3 | 24 | |

| Shanghai | 1-10 kV | 0.72 | / | 1.12 | 0.72 | 0.38 | / | 40.8 | 25.5 |

| 35 kV | 0.7 | / | 1.09 | 0.7 | 0.37 | / | 40.8 | 25.5 | |

| 110 kV | 0.67 | / | 1.04 | 0.67 | 0.36 | / | 40.8 | 25.5 | |

| ≥ 220 kV | 0.64 | / | 0.99 | 0.64 | 0.34 | / | 38.4 | 24 | |

| Chongqing | 1-10 kV | 0.70 | / | 1.06 | 0.70 | 0.33 | / | 35.2 | 22 |

| 35 kV | 0.68 | / | 1.02 | 0.68 | 0.32 | / | 35.2 | 22 | |

| 110 kV | 0.66 | / | 0.99 | 0.66 | 0.31 | / | 32 | 20 | |

| ≥ 220 kV | 0.64 | / | 0.96 | 0.64 | 0.31 | / | 32 | 20 | |

| Sichuan | 1-10 kV | 0.71 | / | 1.09 | 0.71 | 0.33 | / | 35 | 22 |

| 35 kV | 0.68 | / | 1.04 | 0.68 | 0.32 | / | 32 | 20 | |

| 110 kV | 0.63 | / | 0.97 | 0.63 | 0.3 | / | 27 | 17 | |

| ≥ 220 kV | 0.62 | / | 0.94 | 0.62 | 0.29 | / | 24 | 15 | |

| Heilongjiang | 1-10 kV | 0.62 | / | 0.91 | 0.62 | 0.34 | / | 36.8 | 23 |

| 35 kV | 0.6 | / | 0.88 | 0.6 | 0.33 | / | 36.8 | 23 | |

| 110 kV | 0.59 | / | 0.86 | 0.59 | 0.33 | / | 35.2 | 22 | |

| ≥ 220 kV | 0.56 | / | 0.82 | 0.56 | 0.31 | / | 35.2 | 22 | |

| Liaoning | 1-10 kV | 0.63 | / | 0.9 | 0.63 | 0.36 | / | 36.8 | 23 |

| 35 kV | 0.63 | / | 0.9 | 0.63 | 0.36 | / | 36.8 | 23 | |

| 110 kV | 0.61 | / | 0.87 | 0.61 | 0.35 | / | 35.2 | 22 | |

| ≥ 220 kV | 0.56 | / | 0.83 | 0.56 | 0.34 | / | 33.6 | 21 | |

| Jilin | 1-10 kV | 0.71 | 1.2 | 1.01 | 0.71 | 0.4 | / | 36.8 | 23 |

| 35 kV | 0.71 | 1.14 | 0.97 | 0.71 | 0.39 | / | 36.8 | 23 | |

| 110 kV | 0.68 | 1.14 | 0.97 | 0.68 | 0.39 | / | 35.2 | 22 | |

| ≥ 220 kV | 0.67 | 1.13 | 0.95 | 0.67 | 0.38 | / | 35.2 | 22 | |

| Inner Mongolia (East) | 1-10 kV | 0.45 | / | 0.6 | 0.45 | 0.33 | / | 32.8 | 20.5 |

| 35 kV | 0.44 | / | 0.59 | 0.44 | 0.33 | / | 32.8 | 20.5 | |

| 110 kV | 0.4 | / | 0.56 | 0.4 | 0.29 | / | 31.2 | 19.5 | |

| ≥ 220 kV | 0.38 | / | 0.53 | 0.38 | 0.26 | / | 31.2 | 19.5 | |

| Jiangxi | 1-10 kV | 0.72 | / | 1.03 | 0.72 | 0.41 | / | 42.3 | 26.4 |

| 35 kV | 0.7 | / | 1 | 0.7 | 0.4 | / | 40.6 | 25.4 | |

| 110 kV | 0.69 | / | 0.98 | 0.69 | 0.4 | / | 39.1 | 24.4 | |

| ≥ 220 kV | 0.68 | / | 0.97 | 0.68 | 0.39 | / | 37.5 | 23.4 | |

| Hunan | 1-10 kV | 0.7 | / | 1.09 | 0.7 | 0.3 | / | 33.8 | 21.1 |

| 35 kV | 0.69 | / | 1.04 | 0.67 | 0.29 | / | 33.8 | 21.1 | |

| 110 kV | 0.67 | / | 0.99 | 0.64 | 0.28 | / | 30.6 | 19.1 | |

| ≥ 220 kV | 0.64 | / | 0.95 | 0.61 | 0.27 | / | 30.6 | 19.1 | |

| Shaanxi | 1-10 kV | 0.61 | / | 0.94 | 0.61 | 0.28 | / | 35.2 | 22 |

| 35 kV | 0.59 | / | 0.91 | 0.59 | 0.27 | / | 35.2 | 22 | |

| 110 kV | 0.57 | / | 0.88 | 0.57 | 0.26 | / | 32 | 20 | |

| ≥ 220 kV | 0.57 | / | 0.86 | 0.57 | 0.26 | / | 32 | 20 | |

| Xinjiang | 1-10 kV | 0.36 | / | 0.55 | 0.36 | 0.2 | 0.06 | 32 | 20 |

| 35 kV | 0.35 | / | 0.54 | 0.35 | 0.19 | 0.06 | 32 | 20 | |

| 110 kV | 0.32 | / | 0.51 | 0.32 | 0.16 | 0.06 | 30.4 | 19 | |

| ≥ 220 kV | 0.29 | / | 0.48 | 0.29 | 0.13 | 0.06 | 30.4 | 19 | |

| Guangxi | 1-10 kV | 0.75 | / | 0.98 | 0.75 | 0.53 | / | 38.7 | 24.2 |

| 35 kV | 0.71 | / | 0.93 | 0.71 | 0.49 | / | 37.3 | 23.3 | |

| 110 kV | 0.68 | / | 0.91 | 0.68 | 0.46 | / | 34.2 | 21.4 | |

| ≥ 220 kV | 0.63 | / | 0.86 | 0.63 | 0.41 | / | 32 | 20 | |

| Hainan | 1-10 kV | 0.87 | / | 1.37 | 0.87 | 0.4 | / | 35.2 | 22 |

| 35 kV | 0.7 | / | 1.11 | 0.7 | 0.34 | / | 35.2 | 22 | |

| 110 kV | 0.69 | / | 1.1 | 0.69 | 0.34 | / | 35.2 | 22 | |

| ≥ 220 kV | 0.68 | / | 1.1 | 0.68 | 0.34 | / | 35.2 | 22 | |

A closer look

Based on the analysis of electricity pricing across various regions, it is evident that there are significant differences in cost per unit (RMB/kWh) for two-part electricity prices. The two cheapest regions are Xinjiang and Inner Mongolia (East), with costs of 0.36 RMB/kWh and 0.42 RMB/kWh, respectively. This affordability can be particularly advantageous for energy-intensive industries operating in these regions, potentially attracting more investment and fostering economic growth. Conversely, the most expensive regions, Hunan and Chongqing, have costs per unit of 0.77 RMB/kWh and 0.73 RMB/kWh, respectively.

Conclusion

The Chinese government is aware of the importance of controlling the cost of electricity and has been making efforts to improve transparency in the state-controlled power industry and cutting industrial power rates to lower costs for small and middle-sized enterprises.

The expanded scope of two-part pricing and adjustments in time-of-use rates reflect a strategic shift to provide businesses with greater flexibility and potential cost efficiencies. These changes encourage off-peak energy consumption, support more efficient energy use, and help businesses manage their electricity costs effectively.

At the same time, China’s electricity grid is reliable and does not require the backup power generation needed in other lower-cost manufacturing destinations in Asia like India, Vietnam, Myanmar, and Cambodia.

For foreign investors, these updated policies highlight the need for strategic planning in selecting locations and arranging business operation plans. Regions offering lower electricity rates present opportunities for significant cost savings, especially for energy-intensive industries. Operating during off-peak hours will also be cost-efficient.

Staying abreast of these policy changes and understanding regional price variations are essential for optimizing operational expenses and maintaining a competitive advantage in China’s evolving energy market.

The information provided is for general purposes only. No liability is assumed for the completeness or accuracy of the information. For personalized advice on specific business queries, consult our experts at Dezan Shira & Associates by emailing China@dezshira.com.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article China’s Export Surge: A Closer Look at H1 2024 Trade Expansion

- Next Article China’s 72/144-Hour Visa-Free Transit Policy Expanded To 54 Countries, Norway Added