China-Canada Relations: Boosting Economic Dynamics Amid Challenges

- Despite recent tensions, trade and investment between China and Canada remain vital, supporting economic growth on both sides.

- China’s expanding manufacturing sector and global investments significantly impact Canada’s economy.

- Meanwhile, Canadian exports to China, including oil seeds, minerals, cereals, copper, and pharmaceuticals, have grown rapidly over the past five years. Canadian investments in China, including finance and insurance, clean energy, high-end metal materials, services sectors, and agriculture and food processing, also see positive developments.

China and Canada share a robust history of bilateral cooperation, with trade serving as a cornerstone of their economic relationship. As Canada’s second-largest trading partner after the United States, the impact of bilateral trade and investment with China to Canada’s economy is significant. The manufacturing sector plays a crucial role in this trade relationship, with over 97 percent of Canada’s imports from China and around 40 percent of Canada’s exports to China consisting of manufactured products.

Although diplomatic tensions and the global pandemic have tested the resilience of this partnership, creating periods of uncertainty, it is important for businesses from both countries to navigate the trade and investment dynamics between China and Canada for sustainable growth and opportunities.

China-Canada trade landscape

In 2023, the total value of Canadian imports from China reached CA$89.0 billion (US$64.0 billion), constituting 11.8 percent of Canada’s total imports. During the same period, Canadian exports to China amounted to CA$30.5 billion (US$21.9 billion), making up 3.9 percent of Canada’s total exports.

From January 2024 to July 2024, Canadian imports from China reached CA$49.2 billion (US$36.16 billion), and Canadian exports to China amounted to CA$16.4 billion (US$12.05 billion). While the trade volume remains below the historic peak seen in 2022, these figures surpass the pre-pandemic levels recorded in 2019, underscoring the resilience of this bilateral trade relationship.

The trade flows between the two nations have remained relatively stable, driven largely by the critical components of their economic exchange, with certain product categories seeing robust growth.

China exports to Canada

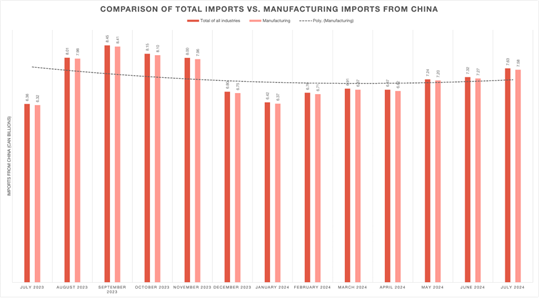

Manufactured goods dominate Canadian imports from China, accounting for nearly 97 percent of the total import value (chart below).

Chart 1: Comparison of total imports vs. manufacturing imports from China

Source: Statistics Canada

In 2023, the largest category of imports was mobile phones, valued at CA$9.22 billion (US$6.78 billion), which represented 10.34 percent of the total goods imported from China. It is important to note that although these phones are manufactured in China, they are predominantly from non-Chinese brands.

The second-largest import category was automatic data processing machines (e.g., computers), totaling CA$6.56 billion (US$4.82 billion), accounting for 7.35 percent of the total imported value from China. This sector is seeing a slight decline compared to previous years.

| Main Canada Imports from China, 2023 | |

| Category | Imports value in 2023 (in CA$) |

| Mobile phones | 9.22 billion |

| Automatic data processing machines | 6.56 billion |

| Passenger vehicles | 2.64 billion |

| Vehicle parts | 2.39 billion |

| Heaters | 1.84 billion |

Source: Statistics Canada

Canada exports to China

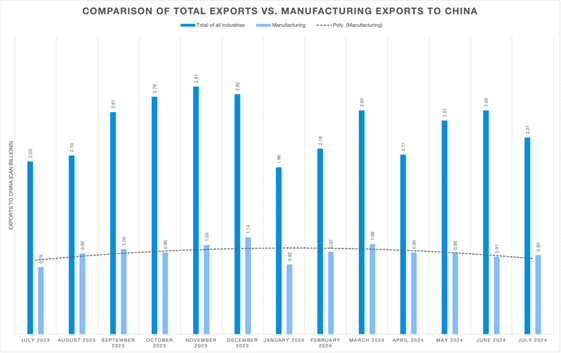

In contrast, Canada’s exports to China are more diversified, with manufacturing representing a smaller proportion of the total export value (chart below).

Chart 2: Comparison of total exports vs. manufacturing exports to China

Source: Statistics Canada

Resource-based sectors, such as mining and quarrying, are essential to Canadian exports and, by 2023, have surpassed manufacturing to become Canada’s largest export category to China (see Chart 3). Between 2019 and 2023, exports of mineral fuels and copper from Canada to China experienced substantial growth, increasing by 36 percent and 33 percent, respectively .

Chart 3: Exports industries and volumes from Canada to China

Source: Statistics Canada

At the same time, the food and agriculture products witnessed growing exports. Among others, oil seeds and oleaginous fruits (i.e., almonds, walnuts, hazelnuts, pistachios, etc.) saw the highest growth, with an annual growth in value of around 46 percent between 2019 and 2023, making them one of the leading contributors to Canada’s export portfolio. In 2023, canola alone reached a total export value of CA$3.84 billion (US$2.85 billion), an impressive growth rate of 75.21 percent year-on-year. Cereals and prepared animal fodder exports experienced an annual growth of 19 percent and 14 percent, respectively, between 2019 and 2023.

China’s evolving food culture and the increasing diversity in domestic demand create new opportunities for foreign products to enter the market. Additionally, natural disasters affecting China’s agricultural production have exacerbated the pressure on domestic food stocks, presenting further prospects for Canadian food and agricultural exports. The rising demand for secure and diverse food supplies positions Canada to capitalize on these market dynamics in the coming years.

In addition to food and agricultural products, pharmaceutical products have shown notable growth, expanding by an annual growth rate of 20 percent from 2019 to 2023. This growth can partly be attributed to China’s demographic shifts and Chinese consumers’ upgrading preferences. Apparel and clothing accessories also saw decent growth between 2019 and 2023, with an annual growth rate of 18 percent over the past five years.

Looking forward, while the traditional mining sector will remain a cornerstone of Canada’s exports to China in the near future, sectors such as pharmaceuticals, oil seeds, apparel, and cereals are emerging as promising areas for trade expansion. This highlights potential areas for strategic investment and collaboration that can enhance long-term trade relations between the two nations.

|

Main Canada Exports to China, 2023 |

|

| Category | Exports value in 2023 (in CA$) |

| Minerals and metals | 11.3 billion |

| Wood, paper | 2.95 billion |

| Oilseeds, fat, and oils | 2.77 billion |

| Petroleum | 2.54 billion |

| Cereals and preparations | 1.45 billion |

Source: Statistics Canada

China-Canada bilateral investment

Canada’s investment in China

The Chinese mainland is Canada’s second largest foreign direct investment destination (FDI) in Asia, with US$11.29 billion in direct investment as of 2023. This is second only to Hong Kong, where Canadian direct investment has reached US$30 billion. Canada’s investment in the Chinese mainland has seen relatively flat growth over the past few years. In 2019, the investment stood at US$10.59 billion in 2019 and has since stabilized at US$11.29 billion in 2023.

By contrast, direct investment in Hong Kong has surged dramatically, rising from US$9.58 billion in 2019 to US$30 billion in 2023 – a more than threefold increase. This shift likely reflects increasing diplomatic tensions between Canada and the Chinese mainland, encouraging Canadian investors to view Hong Kong as a more favorable alternative for capital allocation.

A closer examination of investment in the Chinese mainland reveals that key players include Canadian financial institutions such as banks, insurance companies, and pension funds. Scotiabank, a major player in China, held assets valued at CA$4.48 billion (US$3.32 billion) in 2020, although this marked a 13.5 percent decrease from CA$5.18 billion (US$3.83 billion) in 2019. A significant portion of this investment was concentrated in shares of Xi’an Bank.

With China’s aging population and ongoing pension reforms, Canadian insurance companies have capitalized on opportunities in the Chinese market. Large Canadian pension funds have also adopted global diversification strategies, seeking higher investment returns and risk-adjusted growth in China as part of their global expansion.

The investment in China, while flat, is significant in sectors like finance, where Canadian institutions have long-standing ties. Scotiabank’s decreased investment in 2020 could signal a more cautious approach amid geopolitical tensions and market volatility, but the fact that pension funds and insurers are still active indicates the long-term potential that Canadian investors see in China’s evolving market dynamics, particularly in areas like pensions and insurance, where demand is expected to rise due to demographic changes.

Meanwhile, China’s recent pilot programs in the medical field present more opportunities for Canadian companies. China allows the establishment of wholly foreign-owned hospitals (excluding traditional Chinese medicine and the acquisition of public hospitals) in Beijing, Tianjin, Shanghai, Nanjing, Suzhou, Fuzhou, Guangzhou, Shenzhen, and the entire island of Hainan. This provides Canadian medical institutions with the opportunity to set up wholly-owned hospitals in the Chinese market, enabling them to directly compete in China’s healthcare services market.

In the China (Beijing) Pilot Free Trade Zone, China (Shanghai) Pilot Free Trade Zone, China (Guangdong) Pilot Free Trade Zone, and Hainan Free Trade Port, foreign-invested enterprises are permitted to engage in the development and application of human stem cell, gene diagnosis, and treatment technologies. This offers Canadian companies with strengths in high-tech medical fields new avenues to enter the Chinese market, facilitating the promotion and application of advanced technologies.

Canadian companies possess advanced technology and management experience in the medical field. By establishing wholly-owned hospitals or participating in the development and application of high-tech medical fields in China, they can introduce their advanced technology and management experience into the Chinese market and secure new growth opportunities.

China’s investment in Canada

As of 2023, China is within the Top 5 investing countries in Canada, with a current FDI stock of CA$37 billion (approximately US$27.4 billion), after the US, the UK, Japan, and Germany. Chinese investments have been spread across various sectors in Canada, including energy, mining, real estate, and technology.

Nevertheless, from 2016 to 2023, China’s FDI in Canada experienced constant fluctuations. Multiple factors contribute to this trend, including China’s capital outflow restrictions introduced in 2017, the US-China trade tension since 2018, the COVID-19 pandemic from 2019 to 2022, as well as China’s uneven recovery after it reopened its border. Additionally, Canadian policies and public opinion have sometimes posed challenges to Chinese investors, especially for some high-profile investments.

Despite recent declines, the long-term outlook remains positive, with both countries recognizing the mutual benefits of continued economic collaboration.

|

FDI in Canada by Ultimate Investor Country – China |

||||||||

| Year | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Total book value (CA$, million) | 25,058 | 31,887 | 36,213 | 49,867 | 49,812 | 40,101 | 37,377 | 36,960 |

Source: Statistic Canada

China-Canada trade policies and agreements

China-Canada Bilateral Investment Agreement

China and Canada signed a bilateral investment agreement (BIT) in 1973 to intensify economic cooperation based on equality and mutual benefit. The agreement recognized the need to promote investment based on the principles of sustainable development.

Key promotions and reciprocal protections include:

- Investment protection: The treaty guarantees fair and equitable investment treatment, ensuring protection against unfair practices. Investors are granted full protection and security according to international legal standards, although the agreement does not impose additional obligations beyond those required by customary international law.

- Most-Favored-Nation (MFN) and National Treatment: Investors from each country are entitled to treatment no less favorable than that given to investors from third countries and domestic investors, particularly with respect to the establishment, management, and operation of investments. This creates a level playing field for foreign investors.

- Exceptions and sector-specific regulations: Certain sectors, such as aviation, fisheries, and government procurement, are exempt from these protections. Additionally, the agreement allows for the continuation of non-conforming measures and specific restrictions regarding the nationality of senior management or board members under certain conditions.

The BIT supports a stable and secure investment environment while allowing for exceptions in areas critical to national interests, ensuring a balance between foreign investor rights and domestic policy considerations.

China-Canada Double Taxation Avoidance Agreement

China and Canada signed the double taxation agreement (DTA) on May 12, 1986. Some key aspects of the agreement include:

- Residency and tax jurisdiction: The DTA defines the tax residency status of individuals and companies, determining which country has primary tax jurisdiction over income.

- Tax rates: The agreement sets limits on the tax rates that can be imposed on various forms of income, such as dividends, interest, and royalties, ensuring fair taxation levels in both countries.

- Exchange of information: The DTA facilitates cooperation between tax authorities in China and Canada by enabling the exchange of information to combat tax evasion.

- Dispute resolution: The agreement establishes mechanisms for resolving disputes that may arise regarding the application of the treaty.

Under the DTA between China and Canada, the withholding tax rates on certain types of income are reduced from domestic rates, promoting smoother cross-border investment and trade. The key withholding tax rates are as follows:

- Dividends: The withholding tax rate on dividends is reduced to 10 percent if the recipient holds at least 10 percent of the shares in the company paying the dividends. For other dividends, the withholding tax rate is 15 percent.

- Interest: The withholding tax on interest is generally capped at 10 percent of the gross amount.

- Royalties: 10 percent.

China-Canada relations: Challenges and future prospects

The trade relationship between China and Canada has recently come under significant strain, largely due to Canada’s imposition of tariffs on Chinese imports of electric vehicles and steel-aluminum products. On September 3, 2024, the Canadian government announced these measures, including a 100 percent tariff on electric vehicles, set to take effect on October 1, 2024. These actions have sparked strong condemnation from China, with the Chinese Ministry of Commerce responding by initiating several countermeasures. Among these, China has launched a “discrimination investigation,” filed a complaint with the World Trade Organization (WTO), and started anti-dumping investigations on Canadian canola seeds and specific chemical products. These escalating actions suggest a deepening rift between the two nations over trade policies.

Nevertheless, despite these challenges, on September 18, 2024, Ambassador Cong Peiwu highlighted the 50-year history of China-Canada diplomatic relations, emphasizing their strong economic complementarity and mutual prosperity.

According to him, the two countries have maintained substantial trade ties, with bilateral trade expanding from CA$150 million (US$110.29 million) to CA$74 billion (US$54.46 billion) since their relationship began. Ambassador Cong noted the importance of resolving current disputes to fully unlock trade potential and expressed optimism about future collaboration. He identified new opportunities in sectors such as infrastructure and finance, driven by China’s ongoing economic reforms and market openings. The relationship, though challenged by geopolitical issues, remains robust due to shared economic interests and a commitment to mutual benefits.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article China-Spain Relations: Trade, Investment, and Industry Opportunities

- Next Article Stay Alert: Guide to Preventing New Types of Fraud for Financial Staff