China-Belgium Trade Profile: Key Developments and Opportunities

- The China-Belgium partnership has steadily grown over the past five years, focusing on economic cooperation, cultural exchange, and technological advancement.

- Belgium was China’s seventh-largest trading partner within the EU, while China was Belgium’s third-largest trading partner outside the EU.

- In 2023, the trade volume between China and Belgium reached US$40.16 billion, with China’s exports accounting for US$32.55 billion and imports totaling US$7.61 billion. From January to April 2024, the bilateral trade volume was US$12.81 billion.

Belgium and China have cultivated strong bilateral relations since the formal establishment of diplomatic ties on October 25, 1971. The partnership has steadily grown over the past five decades, focusing on economic cooperation, cultural exchange, and technological advancement.

Notably, 2021 marked the 50th anniversary of diplomatic relations, catalyzing expanding trade and investment cooperation. Both countries have committed to fostering open markets and strengthening intellectual property rights (IPR), driving collaboration in key pharmaceuticals, technology, and agriculture sectors.

According to CGTN, Belgium was China’s seventh-largest trading partner within the European Union in both 2022 and 2023. As of 2022, China was Belgium’s third-largest trading partner outside the EU. Their economic ties have flourished despite global challenges, with bilateral trade rebounding and two-way investment on the rise. Both Chinese and Belgian businesses are pursuing closer ties.

High-level visits, such as the China Entrepreneur Club delegation’s meeting with the Belgian Prime Minister and Queen Mathilde’s participation in Hong Kong’s Business of Design Week, reflect the significance of these efforts. Collaboration has expanded beyond trade into fields such as science, technology, and cultural exchange. Initiatives like the China-Belgium Cultural Center and partnerships in wildlife conservation exemplify the broadening scope of their relationship.

Delegations from several provinces in China, including Henan and Tianjin, are engaging with Belgian counterparts, creating opportunities for regional collaboration. With trade and investment cooperation at the heart of their partnership, Belgium and China are positioned to leverage their complementary strengths. The evolving economic landscape presents exciting prospects in advanced sectors, including microelectronics, biomedicine, and sustainable transport.

This article provides a comprehensive analysis of the latest trade dynamics between Belgium and China. By examining emerging trends and identifying high-potential sectors, we gain insights into the areas that are best positioned to drive future growth and foster deeper bilateral cooperation.

China-Belgium trade at a glance

From 2018 to 2022, goods trade between China and Belgium saw continuous growth. According to Chinese customs statistics, the trade volume between China and Belgium reached US$44.36 billion in 2022, marking a 14.1 percent year-on-year increase. China’s exports to Belgium amounted to US$35.64 billion, a 17.6 percent increase, while imports from Belgium stood at US$8.73 billion, up by 1.8 percent. According to Belgium’s foreign trade agency, China was Belgium’s 12th largest export destination and 4th largest import source in 2022.

|

China-Belgium Trade, 2018-2022 |

|||

| Year | Total import & export (US$ billion) | China exports to Belgium (US$ billion) | China imports from Belgium (US$ billion) |

| 2018 | 240.3 | 170.61 | 69.69 |

| 2019 | 250.95 | 182.33 | 68.62 |

| 2020 | 285.97 | 207.57 | 78.39 |

| 2021 | 389.51 | 303.82 | 85.69 |

| 2022 | 443.63 | 356.35 | 87.27 |

Source: General Administration of Customs, China

However, due to geopolitical factors, bilateral trade between China and Belgium began to decline in 2023. That year, the trade volume fell to US$40.16 billion, an 8.5 percent year-on-year decrease. China’s exports to Belgium dropped by 7.8 percent to US$32.55 billion, while imports from Belgium fell by 11.2 percent to US$7.61 billion. From January to April 2024, the bilateral trade volume was US$12.81 billion, down 11.2 percent year-on-year. China’s exports totaled US$10.64 billion (down 9.8 percent), and imports were US$2.17 billion (down 17.5 percent).

Meanwhile, a report by the National Bank of Belgium highlighted significant changes in the trade relationship. In September 2023, Belgium reported a robust trade surplus of approximately €15.9 billion, showcasing strong export performance, particularly in key sectors such as machinery, chemicals, and pharmaceuticals.

Composition of China-Belgium trade in goods

Belgium’s main exports to China are chemical products, machinery and equipment, and plastics. China’s main exports to Belgium are machinery and equipment, transportation equipment, and chemical products.

China exports to Belgium

In 2023, machinery and equipment emerged as the largest category of Belgian imports from China, valued at nearly €11.1 billion, accounting for 35.9 percent of total imports. This category included essential products like lithium-ion accumulators and photovoltaic cells. Transport equipment followed, totaling approximately €5.8 billion (18.8% share), with a significant portion comprised of electric vehicles and hybrid models. Notably, electric cars imported from China surged to 19 percent of total imports.

Conversely, the chemical products sector faced a substantial decline, decreasing by €1.2 billion (-31.9%) to around €2.5 billion, primarily due to reduced imports of biodiesel and aniline. Overall, Belgian imports from China decreased by 12.8 percent, with notable declines in categories such as optical instruments and footwear.

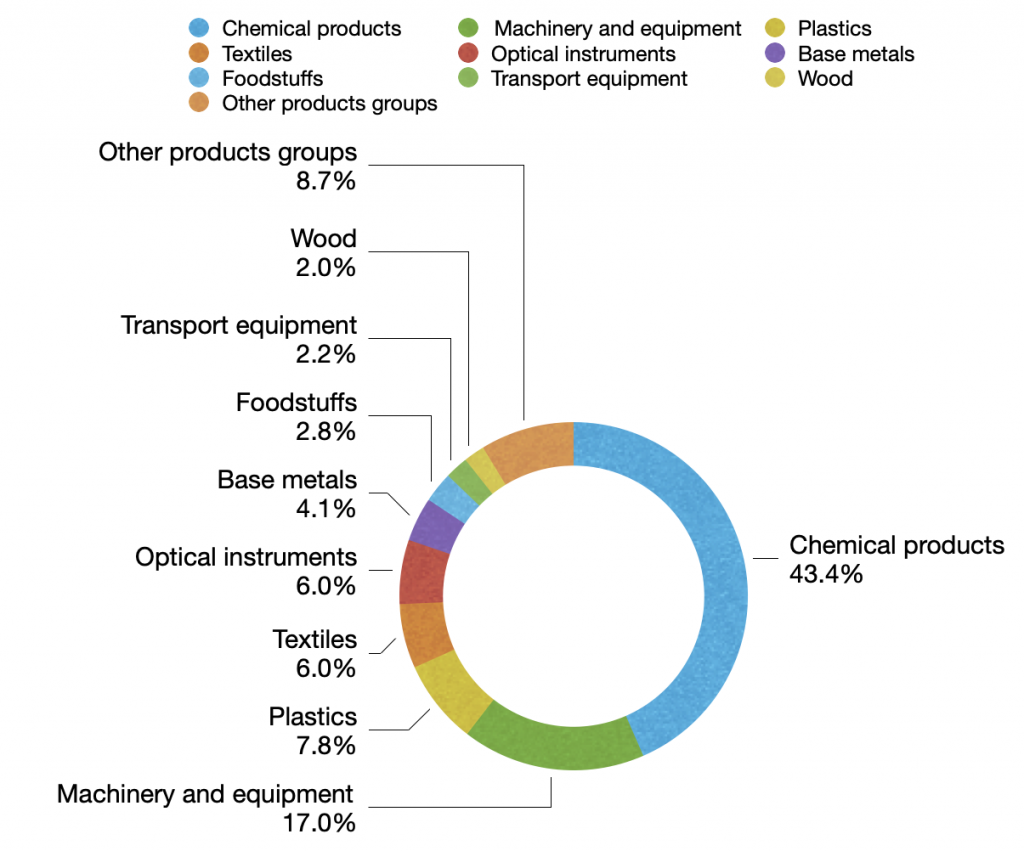

Figure 1: BREAKDOWN OF BELGIAN IMPORTS FROM CHINA BY PRINCIPAL COMMODITIES (IN %) – 2023  This trend reflects a broader EU shift toward advanced products, including electronics like lithium-ion batteries and semiconductor chips, while lower-value imports, such as textiles and toys, saw significant declines. This indicates a transition towards higher-value goods in the Belgian market.

This trend reflects a broader EU shift toward advanced products, including electronics like lithium-ion batteries and semiconductor chips, while lower-value imports, such as textiles and toys, saw significant declines. This indicates a transition towards higher-value goods in the Belgian market.

Belgium exports to China

In 2023, chemical products were the largest segment of Belgian exports to China, valued at approximately €3.7 billion, representing 44.4 percent of total exports. This category primarily includes medicaments, particularly those for therapeutic and prophylactic uses, as well as vaccines for human medicine.

The overall value of Belgian exports to China grew by 7.8 percent in 2023, driven by substantial increases in several key sectors. Machinery and equipment exports rose by 18.3 percent, while textiles saw a significant boost of 29.4 percent, largely due to increased demand for flax products. Additionally, plastics contributed an 8.0 percent share of exports.

However, some categories faced declines, notably wood, which plummeted by 58.8 percent, primarily due to lower exports of fir, spruce, and oak wood. Precious metals also saw a decrease, with a drop of 32.5 percent attributed to reduced diamond exports.

Figure 2: BREAKDOWN OF BELGIAN exPORTS To CHINA BY PRINCIPAL COMMODITIES (IN %) – 2023

China-Belgium trade in services

In 2023, Belgium’s trade in services with China showcased both challenges and opportunities, reflecting a complex and evolving relationship. Although exports of trade in services to China experienced a 13 percent decline, resulting in total exports of around €1.5 billion, Belgium maintained a robust trade surplus of €569.6 million. This marked the highest surplus in five years, indicating that exports consistently outpaced imports during this period.

Key categories within this trade reveal significant trends: “Other business services” emerged as the leading export segment, highlighting Belgium’s strengths in operational leasing and legal consulting. Conversely, transportation services dominated imports but saw a substantial decrease, contributing to an overall decline in service imports from China.

This nuanced landscape underscores the shifting dynamics in Belgium’s service trade, as the country navigates fluctuations in demand and supply while striving to strengthen its economic ties with China.

Belgium exports to China

In 2023, “other business services” accounted for 39.3 percent of total Belgian exports to China, totaling €603.1 million. This category encompasses services such as operational leasing, legal consulting, and market research. The export communication and government services also increased.

However, overall Belgian exports of services to China decreased by 13.0 percent in 2023, primarily driven by a significant 32.0 percent decline in transportation services and a 15.6 percent decline in royalties and license fees.

China exports to Belgium

In 2023, transportation services constituted 39.4 percent of total Belgian imports from China, valued at €381 million. This category includes various transport modes such as sea, air, rail, and road transport.

Overall, Belgian imports of services from China fell by 39.3 percent in 2023, primarily due to a 52.3 percent decrease in transportation services and a 31.3 percent decline in other business services, overshadowing the significant rise in financial services imports.

China-Belgium comparative advantage

In the context of China and Belgium’s trade cooperation, their comparative advantages highlight distinct strengths that shape their economic interactions. China, as a global manufacturing powerhouse, benefits from extensive production capabilities and economies of scale, allowing it to offer competitive pricing and a diverse range of goods. This manufacturing strength is reflected in its significant trade surplus, which reached approximately US$99.05 billion by June 2024, as reported by the Belgian Foreign Trade Agency.

Conversely, Belgium excels in exporting high-value products, particularly in the chemical, pharmaceutical, and machinery sectors. Its strategic location in Europe further enhances its logistics capabilities, facilitating trade with neighboring countries. This is evident in Belgium’s trade surplus in 2023, although recent fluctuations have shown challenges in maintaining this position against China’s robust export strength. Together, these comparative advantages illustrate the intricate balance of cooperation and competition that characterizes the trade relationship between the two nations.

Key developments in Belgium-China trade in 2024

In the first quarter of 2024, below trends are observed in China-Belgium trade. Belgium exports to China:

- Chemical products: Maintained the top position, representing 49.4 percent of exports (€1.1 billion), despite a 14.2 percent drop (€179.1 million) year on year.

- Machinery & equipment: Experienced a significant decline (20.3%), with exports totaling €340.9 million (15.5% share).

- Plastics: Ranked third with €180.9 million (8.2% share), showing modest growth of 2.2 percent.

- Overall export trend: Belgian exports to China decreased by 11.5 percent in Q1 2024 (€2.2 billion), impacted by declines in major sectors like chemicals and machinery.

China exports to Belgium:

- Machinery & equipment: Remained the largest import category, though it fell by 18.3 percent to €2.4 billion (32.6% share).

- Transport equipment: Saw slight growth of 0.4 percent, reaching nearly €1.9 billion (25.3% share), with electric vehicles continuing to surge.

- Chemical products: Ranked third in Belgium’s imports from China, but declined by 28.2 percent, to €566.4 million.

- Mineral products: Faced the steepest drop, down 72.2 percent, to €160.3 million.

- Overall import trend: Belgian imports from China decreased by 17.3 percent to €7.5 billion, reflecting weakened demand across several sectors, except for modest growth in transport equipment.

Promising growth potential between Belgium and China

Pharmaceuticals and chemical products

Belgium’s strong pharmaceutical sector, which already accounts for nearly 50 percent of its exports to China, presents further growth potential. Despite a minor decline in early 2024, global demand for high-quality medicines and vaccines remains strong, particularly in China, where health expenditures continue to rise due to an aging population and healthcare reforms. Collaborative research in biotech and pharmaceuticals could further strengthen ties.

Electric vehicles and transport equipment

In the first months of 2024, Belgium’s imports of electric vehicles from China surged from one percent to 19 percent of total imports, reflecting the EU’s shift towards sustainable mobility. As demand for green technology grows, opportunities for joint ventures and supply chain cooperation in battery manufacturing and vehicle production (including hybrid technologies) are likely to expand.

Advanced electronics and machinery

Lithium-ion batteries and semiconductor imports highlight China’s role in Belgium’s industrial ecosystem. As Europe accelerates its technological transformation, there is potential for both countries to cooperate on next-generation manufacturing technologies, robotics, and renewable energy infrastructure. Belgium’s expertise in precision instruments and China’s production capabilities complement each other.

Logistics and transportation services

With transportation services accounting for a significant share of Belgium’s trade in services with China, further investments in logistics infrastructure (such as ports and railways) could enhance trade efficiency. Belgium’s strategic location as a gateway to Europe positions it as an ideal hub for Chinese goods and services entering the EU.

Sustainable and circular economy sectors

With Belgium focusing on circular economy models and China implementing green policies, there is room for partnerships in environmental technologies, waste management, and renewable energy. Collaborative projects in carbon reduction and sustainable supply chains could align with the EU’s Green Deal initiatives and China’s ecological goals.

Conclusion

Building on these promising sectors, it is essential to examine how they can foster future trade and deepen bilateral relations. A thorough analysis will highlight how pharmaceuticals, sustainable transport, advanced machinery, and high-value services can serve as key drivers of economic collaboration, further strengthening the partnership between Belgium and China. The trade relationship between Belgium and China is ripe with potential for deeper collaboration across key sectors.

As Belgium emerges as China’s sixth-largest trading partner in the EU, both nations are positioned to leverage their strengths—Belgium’s prowess in pharmaceuticals and high-value services alongside China’s manufacturing capabilities. Despite recent challenges in trade balances, opportunities abound in sustainable transport, advanced machinery, and green technologies.

By fostering continued dialogue and investment, Belgium and China can strengthen their partnership, paving the way for sustainable growth. The next chapter of their bilateral relations holds promise, with both countries poised to benefit from shared goals and innovations.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Understanding China’s Key Economy Indicators for Q3 2024

- Next Article Leveraging Chinese Social Media for E-Commerce Growth on Shopify