China, ASEAN, and OBOR Trade Picks Up: How to Take Advantage

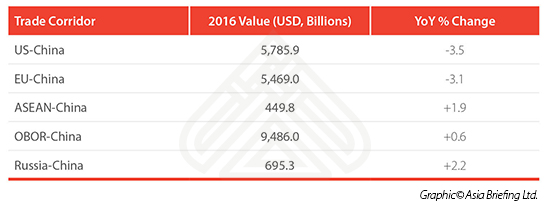

The recently released 2016 China bilateral trade figures may not yet herald a shifting trade dynamic for global procurement, but there are warning signs that China’s traditional trade partners in the US and EU may be coming under increasing pressure. The figures, released by the Ministry of Commerce (MOFCOM), show significant reductions in both US and EU trade figures, with a counter-balance being provided by ASEAN and the OBOR routes, which both increased.

The decline in US and EU trade is significant, and is one reason why Western governments have been calling for Beijing to allow more market access to Chinese consumers. To date, Beijing is not really playing ball. It should be noted that China does not have free trade agreements (FTA) with either the US or EU. A decline in trade is therefore not entirely unexpected – negotiations have been dragging on for years. There are a number of pertinent questions that come to mind when reviewing the current US and EU trade position with China:

- How well are US and EU manufacturing really geared towards China’s needs?

- How competitive are US and EU manufacturers compared with alternative sources in Russia, India, and Southeast Asia?

- China wants “win-win” situations – does such trade provide this?

In terms of China, there are a number of basic parameters that need to be understood when it comes to its need for trade. These are directly linked to government stability and the need for the CCP to deliver. These basics are:

- Energy;

- Food;

- Security;

- Inexpensive consumer products.

The bad news for the West is that China has been very busy over the past decade in securing energy supplies. Very little comes from the West. Instead, China has been making inroads with increasing supplies from Russia (much of Russian bilateral trade with China is in energy), Central Asia, the Gulf States, and Iran, as well as exploring – often controversially – in the South China Sea.

In terms of agricultural products, food is an on-going and pressing concern for China; the country has 20 percent of the global population yet only five percent of its arable land. Russia, long a massive agricultural giant in the Soviet era, is now starting to recover this position and is experiencing a resurgence in agricultural development as it seeks to diversify its economy. Russia, in contrast, has about two percent of the global population and 13 percent of globally available arable land. Put simply, China needs Russian agricultural exports. The Russia-China agricultural space is an obvious match and investment opportunity, and especially so given the US and EU sanctions placed on the country. This also impacts on new Agro technologies. China is sourcing these from Russia and Asia, not the West. This means that two of China’s key critical needs are increasingly being serviced via Moscow. China also buys significant quantities of food from its ASEAN neighbors.

In terms of consumer products, Chinese consumers need to be kept happy and entertained. Although China-India trade still lags far behind where it ought to be, the reality is that only India has the workforce able to match China’s rising middle class demands. China needs India’s manufacturing capacity, and certainly at a juncture when Indian wages are a third of those payable in China.

Both the US and EU are pointing at high-tech and innovation solutions to woo Chinese buyers. However, India and Russia are also fast moving IT driven economies, and have a great deal of talent at their disposal, as does China itself. The hard question then starts to arise – what can the US and EU sell to China that it cannot either develop itself or buy elsewhere?

This issue is further compounded when one starts to analyze China’s longer term trade intentions. These can be measured against the FTAs China is actively putting into place in the absence of any such deals with the US and EU.

These include an already implemented, proven, and successful FTA with the ASEAN bloc of nations (for a full overview of this, please click here), as well as ongoing FTA negotiations with the Eurasian Economic Union (EAEU) – which includes Russia, Kazakhstan, and Belarus, amongst others – in essence opening up the entire overland OBOR routes to free trade all the way from China to the EU borders with Poland and Lithuania. India is also negotiating an FTA with the EAEU. It should be noted that the recent trains journeying through to various European rail freight terminals have transversed this exact route. Those goods will become a lot more attractive once an FTA is signed off, with zero duties payable until they reach EU borders.

If anything, it suggests that the trade deficit between China and the EU is going to get worse, and that EU manufacturers currently competing with China are going to be in for a very tough time.

The options for US and EU manufacturers then are stark. Unless you are in a business that the Chinese absolutely need, competition from China, India, and Russia in particular is going to heat up. So what are the options?

Relocation to China

Given that neither the US or EU have, or are likely to have, any FTA with China soon, the option when faced with competition is the old adage – “if you can’t beat them – join them.” It is going to be very tough to compete with China while paying American and European overheads. It’s worth bearing in mind that Indian and some ASEAN nations’ wages are far lower still.

If selling to China is your game, then now more than ever foreign manufacturers need to consider doing this directly in China. After all, the China success story is obvious and most US and EU based manufacturers will know someone who already conducts such business in the country. China, however, is a huge country, and both overheads and deliverables can differ depending upon location. But there are options, and while China may be an obvious choice, it makes sense to have operational costs and deliverables compared with other potential locations.

Relocation to ASEAN

China has an FTA with ASEAN, as does India. The ASEAN trade bloc, as concerns business activities, is essentially manageable from Singapore, already home to several thousand US and EU businesses who conduct trade throughout the region. Singapore has a British common law system and is in compliance with US FCPA banking and financial standards.

ASEAN includes the six Asian tigers of Singapore, Indonesia, Malaysia, Philippines, Thailand, and Vietnam, in addition to less developed nations such as Cambodia, Laos and Myanmar. Brunei, the tiny Sultanate, makes up the ten, yet is essentially an oil play. That spread of ASEAN wealth means the region will be competitive for some time to come as lower overheads are available in less developed members, and the use of intra-ASEAN labour is permitted. Setting up a manufacturing base in ASEAN allows free trade access to ASEAN itself as well as to China and India.

Relocation to India

As mentioned, India has an FTA with ASEAN and is also negotiating with the EAEU. It is the only Asian country that can compete with China in terms of available labour. India also has a dynamic middle class consumer market worth about US$500 billion per annum, set to grow 50 percent by 2020. The country offers huge potential, like China, both for export manufacturing to ASEAN as well as domestic sales.

Relocation to Russia

Given the current political stresses between Russia and the West, this may appear a long shot, but sanctions have moved the Russian economy to put greater emphasis on trade with Asia. Russia is also a huge energy and agricultural power, and has a significant IT and e-commerce market.

Businesses wishing to be involved in the development of China’s OBOR plans, for example, and especially the overland routes may wish to consider Moscow, as China is pumping billions of investment dollars into the country. It is not without significance that the China-Europe freight rail services are managed by a Russian-German joint venture, nor that the Chinese want to extend the High Speed Rail service from Moscow to Kazan all the way to Beijing. Russia also wants to develop its Arctic Ports and open up the Northern Sea Passage, which would link Asia and Europe. These are multi-billion dollar investments. Russia may not be a fashionable play right now, but when sanctions are lifted the demand for Russian expertise and market access will increase dramatically.

Accessing OBOR Projects

At present this is a China play; by definition, OBOR projects involve Chinese businesses. Beijing is specifically pushing this; over 700 Chinese companies signed OBOR related projects in Q1 this year. Tax guidelines have been issued by China’s Ministry of Commerce to support this.

While tax incentives are more likely to manifest themselves via the upcoming China-EAEU FTA, at present the most likely route to OBOR project participation – construction, transportation, energy, communications – are likely to be via a Chinese or Russian joint venture partner. It makes good commercial practice to be aware of which companies would be potentially suitable partners should your business have relevant equipment or technologies to offer.

Summary

The lack of any FTA between the US and EU with China is beginning to manifest itself as China has taken steps to actively compete anyway. The China-ASEAN FTA, has had a dramatic impact on trade flows, something the now dead TPP was geared to take advantage of but has been effectively killed off, leaving US businesses out of this loop. Meanwhile, the still under negotiation China-EAEU FTA, which will open up free trade from China all the way to EU borders, will have a huge impact on EU manufacturers.

Unless domestic US and EU manufacturers can cope, this means competition is going to steadily increase, and not just from China. Given the dearth of free trade deals – the current Washington administration is not exactly friendly towards them, and the EU has its own political problems – a strategy for survival needs to be planned out. Geography here is key. Even though a company may be US or EU invested, it can still take advantage of an FTA such as the ASEAN and EAEU agreements as long as it is domiciled in one of the pertinent locations. The message is simple: it is time to join them, and if that means relocating, that’s what will need to be done to survive.

|

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates and has overseen a 25 years practice development throughout China, India, ASEAN and the OBOR routes. The firms clients are typically US or EU based manufacturers. For further information please email asia@dezshira.com or visit www.dezshira.com

|

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

An Introduction to Doing Business in ASEAN 2017

Doing Business in ASEAN introduces the fundamentals of investing in the 10-nation ASEAN bloc, concentrating on economics, trade, corporate establishment and taxation. We also include the latest development news in our “Important Updates” section for each country, with the intent to provide an executive assessment of the varying component parts of ASEAN, assessing each member state and providing the most up-to-date economic and demographic data on each.

An Introduction to Doing Business in Singapore 2017

An Introduction to Doing Business in Singapore 2017

An Introduction to Doing Business in Singapore 2017 provides readers with an overview of the fundamentals of investing and conducting business in Singapore and outlines the city’s role as a trading hub within ASEAN. The guide explains the basics of company establishment, annual compliance, taxation, human resources, and social insurance in the city-state.

An Introduction to Doing Business in India 2017

An Introduction to Doing Business in India 2017 is designed to introduce the fundamentals of investing in India. As such, this comprehensive guide is ideal not only for businesses looking to enter the Indian market, but also for companies who already have a presence here and want to stay up-to-date with the most recent and relevant policy changes.

- Previous Article Asia Investment Brief: Thailand’s Eastern Economic Corridor, India’s Social Security System, and China’s OBOR Tax Guidelines

- Next Article China’s Labor Law on Salary Reduction