Tracking China’s Preferential Policies Released Since the 2020 Two Sessions

During the annual Two Sessions meeting in May 2020, Chinese Premier Li Keqiang delivered the 2020 Government Work Report and unveiled measures to support businesses riding out the storm amid the COVID-19 outbreak.

Following his speech, China’s central government departments rolled out official announcements that confirmed and pushed the implementation of these measures.

This article explains the latest preferential policies available to businesses in China.

Extending tax and fee preferential policies to year end

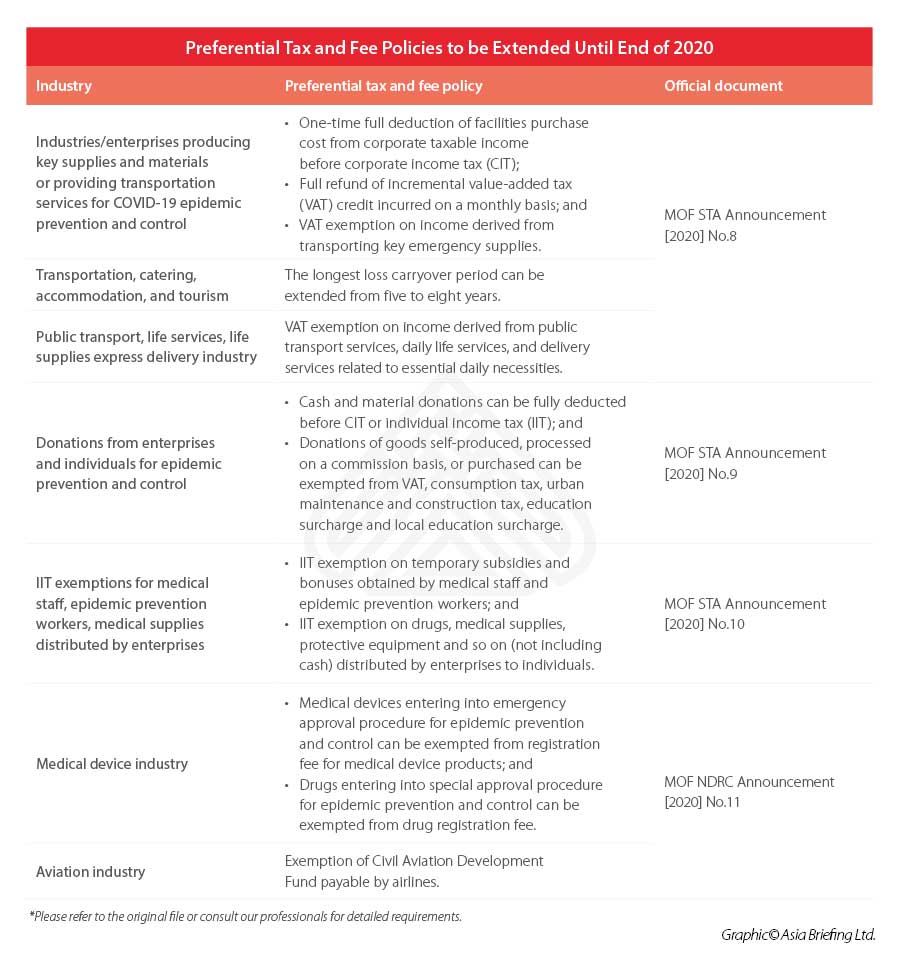

On May 29, 2020, the Ministry of Finance (MOF) and the State Taxation Administration (STA) released the Announcement on Extending the Deadline for Preferential Tax and Fee Policies to Support Epidemic Prevention and Control and to Ensure Medical Supply (MOF STA Announcement [2020] No.28).

Pursuant to this announcement, the preferential tax policies prescribed in the following four documents will be implemented until December 31, 2020:

- Announcement on Relevant Tax Policies to Support the Prevention and Control of the COVID-19 Epidemic (MOF STA Announcement [2020] No.8);

- Announcement on Relevant Tax Policies for Donations to Support Prevention and Control of the COVID-19 Epidemic (MOF STA Announcement [2020] No.9);

- Announcement on Relevant Individual Income Tax Policies to Support Prevention and Control of the Pneumonia Epidemic Caused by Novel Coronavirus (COVID-19) Infection (MOF STA Announcement [2020] No.10); and

- Announcement on the Exemption from Certain Administrative Charges and Government Funds during the COVID-19 Epidemic (MOF NDRC Announcement [2020] No.11).

Below, we summarize the major policy content.

Deferring CIT payment for small low-profit firms

On the same day, the STA also released the Announcement about Postponing the Payment of Income Tax by Small Law-Profit Enterprises and Individual Industrial and Commercial Households (STA Announcement [2020] No.10).

From May 1, 2020 to December 31, 2020, small low-profit enterprises (referring to the enterprises that meet requirements set out in STA Announcement [2019] No.2) are allowed to defer CIT payment until the first declaration period in 2021 after they make pre-payment declarations. Small low-profit enterprises can fill out the related line in the pre-payment declaration form to enjoy the CIT deferred payment policy.

Deferring loan repayment period for micro, small, and medium firms

On June 1, 2020, five authorities including the People’s Bank of China (PBC) rolled out the Circular about Further Implementation of Deferred Principal and Interest Repayment by Small, Medium, and Micro Enterprises (Yin Fa [2020] No.122).

The document requires banks to extend the repayment deadline for corporate borrowers. For loans that were granted to small and micro businesses and individual businesses, with a credit of no more than RMB 100 million (US$14 million), and are set to be due between June 1, 2020 to December 31, 2020 – the repayment deadline of loan principal and interest expense can be extended up until March 31, 2020 and default interest should not be charged.

The government is currently encouraging banks to provide more financial support like unsecured loans to businesses. Starting June 1, 2020, the PBC will use a special re-lending quota of RMB 400 billion (US$52.3 billion) to repurchase 40 percent of credit loans granted to small and micro companies by local banks from March 1, 2020 to December 31, 2020, according to the Circular about Strengthening Credit Loan Support for Small and Micro Enterprises (Yin Fa [2020] No.123).

The Guidelines about Further Strengthening Financial Services for SMEs and Micro Enterprises (Yin Fa [2020] No.120), jointly released by the PBC and eight authorities, requires that the five major state-owned banks should increase loans to small and micro firms by at least 40 percent from a year ago; large banks should offer an interest rate discount of at least 50 basis points; development and policy banks should issue special credit loans of RMB 350 billion (US$49.2 billion); and insurance companies are encouraged to develop guaranteed insurance products against the risk of loan defaults.

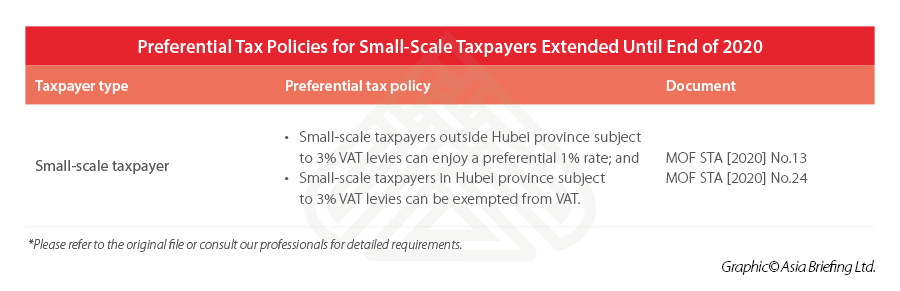

Extending preferential tax policy for small-scale taxpayers to year end

In fact, earlier on May 7, the MOF and STA had released the Announcement on the Extension of the Implementation Period of VAT Reduction and Exemption Policy for Small-Scale Taxpayers (MOF STA Announcement [2020] No.24). But on May 22, the 2020 Work Report once again confirmed the extension.

The content of this preferential policy can be found in the MOF STA Announcement [2020] No.13. You may refer to the following table or our previous article to see the main policy content.

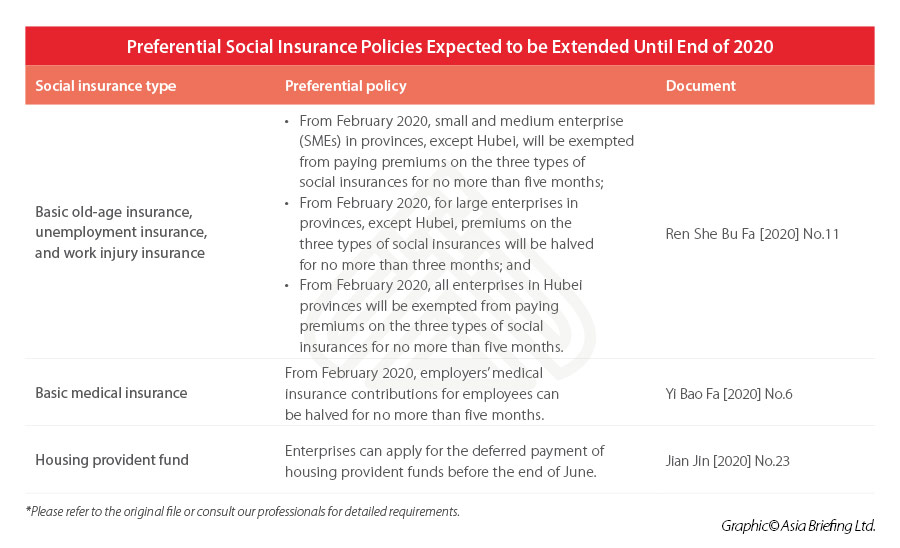

To be expected: Extending social insurance payment

What’re more, based on the Government Work Report, the preferential policies to be extended till the end of this year would also include “exempting micro, small, and medium businesses from contributions to basic old-age insurance, unemployment insurance, and work injury compensation insurance schemes”. But the official announcement from the Ministry of Human Resources and Social Security (MHRSS) has not been released yet.

We assume that the preferential social insurance policies in the following documents will have a chance to be officially extended.

- Notice on the Phased Reduction of Social Insurance Premiums for Enterprises (Ren She Bu Fa [2020] No.11)

- Guiding Opinions on the Phased Reduction of Basic Medical Insurance Contributions for Employees (Yi Bao Fa [2020] No.6)

- Notice on the Phased Support of Housing Provident Fund (Jian Jin [2020] No.23)

Interested parties should pay attention to the latest official announcements on the extension of the above preferential policies. You can also subscribe to the latest updates on the China Briefing website.

For any tax and social insurance related queries, please contact our legal, tax, and payroll professionals at China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article El sistema de crédito social durante el Covid

- Next Article Business Risk Management in China in the Era of COVID-19