China Reforms Foreign Exchange Administration for Trade in Goods

To better facilitate trade and further enhance the foreign exchange services and administration of trade in goods, China released an announcement concerning the reform of the forex administration system for trade in goods on June 29, which is scheduled to take effect on August 1, 2012.

China Clarifies the Determination of Beneficial Owners under Double Taxation Agreements

China recently released Circular 30, aiming to avoid double-taxation and appropriately reduce tax burdens by clarifying the determination of beneficial ownership.

China Clarifies Export Refund Policies

In an attempt to clean up the multitude of regulations and clarify China’s export refund policies, two regulations have been issued recently.

The China Alternative – Singapore

The China Alternative is our series on other foreign investment destinations in emerging Asia that may soon be competing with China in terms of labor costs, infrastructure and operational capacity. In this issue we look at Singapore.

China-Hong Kong to Promote Further Liberalization under CEPA

To enhance cooperation in the services sector, and to facilitate mutual economic development, China and Hong Kong signed the “Ninth Supplement to the Mainland and Hong Kong Closer Economic Partnership Arrangement on June 29.

Shenzhen Adjusts Housing Fund Base and Work-Related Injury Insurance Rates

Shenzhen released a supplementary notice adjusting the 2012 housing fund contribution base on June 26.

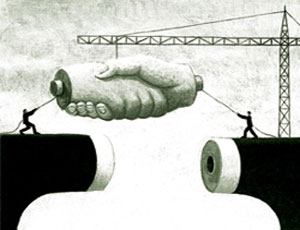

Co-Investing in China with Chinese Partners

Foreign investors and domestic Chinese investors have traditionally been unable to co-invest in mainland business ventures, except by means of the joint venture or unofficially sanctioned structures. With the introduction of several new legal entities, this restriction has been lifted and foreign and domestic investors may now freely co-mingle their resources in one enterprise.

China Reforms Foreign Exchange Administration in Goods Trade

Jul. 4 – The relevant Chinese governmental departments have issued an announcement to reform the system for administering foreign exchange with regards to trade in goods, as well as to adjust the relevant export declaration procedure. Along these lines, the information-sharing mechanism between export proceed collections and export tax refunds will also be improved. The […]