China Releases Measures for Strengthening Credibility Supervision in Securities and Futures Market

By Yao Lu Aug. 2 – In order to strengthen the integrity and maintain the order of the securities and futures market, as well as protect the legitimate rights and interests of investors, China’s Securities Regulatory Commission (CSRC) issued the “Interim Measures for the Supervision and Administration of Securities and Futures Market Credibility (CSRC Order […]

Getting Paid from China – Procedural and Tax Implications

Op-Ed Commentary: Chris Devonshire-Ellis Jul. 31 – As increasing numbers of international businesses are now looking to sell products and services to the emerging China consumer market, in this article we examine the procedures for getting paid. It is not as simple as sending an invoice and expecting a wire transfer; China employs currency controls […]

China Legal Incorporations and Tax Registrations – Regional Subtleties Make All the Difference

One of the issues in dealing with legal establishment and related matters when it comes to investing in China is the sheer size of the country. Not surprisingly, many subtle differences have developed with regards to the administration of foreign investment laws and taxes depending on the region within China.

China Provides Financial Incentives for Energy-Saving Technological Transformation

To accelerate the application of advanced energy-saving technologies and increase the efficiency in energy utilization, China issued the “Circular on Preparation for Notification of Financial Incentive Projects Related to Energy-saving Technological Transformation of the Year 2013”on July 17.

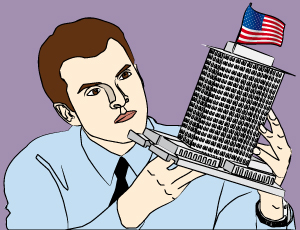

Delaware and Nevada Holding Companies for Chinese Foreign-Invested Enterprises

Investors or enterprises who seek to establish a cost and resource-efficient legal presence in a U.S. jurisdiction or who aim to ultimately repatriate their profits to a U.S. jurisdiction with the greatest tax efficiency, then Delaware and Nevada offer outstanding characteristics.

China Issues Circular Concerning the Improvement of VAT Control System

In order to alleviate the burdens on taxpayers, China released the “Circular of National Development and Reform Commission on Charging Policies Concerning the Improvement of VAT Control System” on July 18.

China Issues Provisions Regarding Penalizing Tax-Collection Related Irregularities

To strengthen the administration of tax collection and penalize tax-collection related irregularities, China issued the “Provisions on Penalizing Tax-Collection Related Irregularities (hereinafter referred to as ‘Provision’)” on June 6.

China Issues Guiding Opinions to Regulate Taxation Administrative Discretion

To standardize the enforcement of taxation law and safeguard the legitimate rights and interests of taxpayers, China issued the “Guiding Opinions on Regulating the Administrative Discretion of Taxation Authorities” on July 3