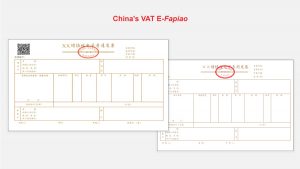

E-Fapiao Compliance Management in China and Regulatory Requirements

We explain how to ensure e-fapiao compliance management for businesses in China that purchase, obtain, transfer, and keep e-fapiao and relevant regulations.

China’s E-Fapiao System at a Glance

China’s e-fapiao system is an electronic VAT invoicing process that cuts red tape, streamlines compliance procedures, and seeks to prevent receipt abuse.

Preparing for the Coming E-Fapiao Era – New Issue of China Briefing Magazine

In this issue of China Briefing magazine, we demonstrate the opportunities and risks associated with China’s e-fapiao implementation.

China’s Position on the Digital Service Tax

Given China’s unique digital economy, the country remains more inclined to tax its booming domestic tech-conglomerates than target global technology MNCs.

Optimizing Profit by Intercompany Royalty Payments in China

We discuss the benefits and tax implications behind intercompany royalty payments as a profit repatriation strategy for MNCs in China.

Digital Expense Management in China: How Big of a Deal is it?

We analyze why transitioning to a digital expense management system can be cost effective for your business in China and assess the best options available.

More Advanced Manufacturing Taxpayers in China to Benefit from Expedited Refund of Uncredited VAT

Effective April 2021, the new VAT policy will benefit five more sectors, including pharmaceuticals.

Export Tax Rebates in China: Recent Changes and Risk Management

We discuss company best practices for utilizing China’s export tax rebates and assess the risks associated with the frequent compliance and rule changes.