China’s New Deed Tax Law: What Does it Mean for Businesses?

Businesses should pay attention to the changes in China’s new Deed Tax Law as well as exemptions and deed tax calculation.

GBA IIT Subsidy in Shenzhen: Updated Application Rules and Deadline

Shenzhen opens its application channel from August 16, 2021, to September 30, 2021, for the GBA IIT subsidy for overseas talents. Successful applicants can lower their income tax rate to 15 percent.

What is BEPS 2.0? OECD’s Two-Pillar Plan and Possible Impact on Multinational Enterprises

We look at China’s position on the consensus around the BEPS 2.0 framework to ensure a fairer distribution of global tax rights.

Shanghai Scraps ‘Levying Upon Assessment’ for Corporate Income Tax

From August 1, 2021, Shanghai requires corporate income tax to be levied based on an audit of accounts rather than general assessment of a company’s income.

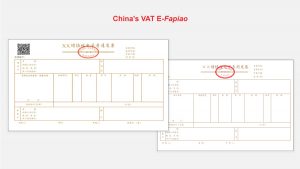

How Should Companies Prepare for the Special VAT E-Fapiao?

We discuss how CFOs in China can prepare for the impact of the wider roll-out of special VAT e-fapiao on their existing procedures and operating systems.

GBA’s Shenzhen Qianhai Extends 15% CIT for Qualified Enterprises Until End of 2025

Qualified enterprises in Shenzhen Qianhai Area can enjoy 15% CIT until December 31, 2025 – China’s national CIT rate is 25%.

China’s Latest Corporate Income Tax Update for Six Items: Q&A

China has clarified CIT treatment on six items, including COVID-19 charitable donations, convertible bonds, art assets, and cross-border hybrid investments.

E-Fapiao Compliance Management in China and Regulatory Requirements

We explain how to ensure e-fapiao compliance management for businesses in China that purchase, obtain, transfer, and keep e-fapiao and relevant regulations.