Strategies for Managing Enterprise Downsizing and Salary Reduction in China After COVID-19

We discuss the legal options and risks involved for HR managers in China when strategizing their company’s enterprise downsizing and salary reduction plans.

Hong Kong’s Employment Support Scheme: Second Tranche of Subsidies Open

Hong Kong’s Employment Support Scheme provides wage subsidies to eligible HK employers; application for the second tranche closes on September 13.

IIT Subsidy Application in the Greater Bay Area: FAQs in 2020

We answer some commonly asked questions about the IIT subsidy application process in China’s Greater Bay Area based on our on-the-ground experience.

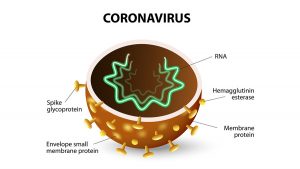

Managing Your China Business During the Coronavirus Outbreak

Our daily coverage of the coronavirus in China, together with advisory on how best to manage your China business exposure – updated till April 30, 2020.

Optimizing Your China Accounting and HR Processing with Cloud Technology – New Issue of China Briefing Magazine

In this edition of China Briefing Magazine, we explain how cloud technology solutions can bolster your back office efficiency in China.

Foreigners’ Special Visa Application and Entry into China: 3 Case Studies

As China gradually opens to international travel, we identify the types of persons who qualify as applicants for China’s M-visas or S2-visas.

Beijing Tightens Social Insurance Filing Services by Third-Party HR Agency

We discuss implications and solutions as third-party HR agencies cannot file social insurance in Beijing for employees of non-Beijing resident companies.

China Reopens Borders, Visa Channels to 36 European Countries

China is now allowing foreign nationals from 36 European countries to directly apply for new Chinese visas if they meet certain eligibility criteria.