Case Study: Tax Withholding for Non-Resident Foreign Enterprises in China

As part of our mission to provide business intelligence on the legal, tax and operational issues of doing business in China, China Briefing presents here the first in a series of case studies, based on the practical experience of Dezan Shira & Associates professionals.

Scenario

A non-resident foreign company without an office in China provides design services for a Chinese resident enterprise and dispatches employees to China for the handover of design work. According to Chinese law, enterprise income tax (EIT) shall be levied on income earned from commercial operations conducted within Chinese territory, by both resident and non-resident taxpayers. Therefore, the company is required to pay both EIT and value-added tax (VAT) for non-resident enterprises on the service income derived from China.

Companies unfamiliar with China’s tax declaration procedures face the risk of incurring considerable penalties. For example, failure to provide proof of the division of a project inside and outside China (such as workload, work hours, cost and expenses) can result in excessive taxation, whereby the local tax authorities deem all income to have been derived from China. To remedy this, we outline the procedure for tax declaration below.

Tax Declaration Procedure

Step 1. The company should electronically file VAT, VAT surcharges, stamp-tax and enterprise income tax (EIT) with the local tax bureau.

According to China’s Corporate Income Tax Law, the applicable EIT rate for this type of non-resident enterprise (without an office in China or deriving income unrelated to such an office) shall be 20 percent. Notably, the applicable EIT rate can be as high as 25 percent for other types of non-resident enterprises (e.g., those deriving income from an office established within China). The general formula for calculating EIT is as shown below (assuming that the relevant contract includes tax):

EIT payable = Contract price × applicable profit rate stipulated by the tax authority × applicable EIT rate (i.e., 20 or 25 percent)

The profit rate ranges from 15 percent to 50 percent, depending on the type of services provided. Specifically, the profit rate shall be:

- 15 percent to 30 percent for services such as design and consulting;

- 30 percent to 50 percent for management services; and

- Over 15 percent for other services.

![]()

China Issues Announcement on Corporate Income Tax for Non-resident Enterprises

In this case, assuming a contract price of RMB 1 million, the profit rate is 25 percent (given that design services fall within the 15 percent to 30 percent range) and the EIT rate is 20 percent. Therefore, the EIT payable should be:

EIT payable = RMB 1 million × 25%× 20% = RMB50,000

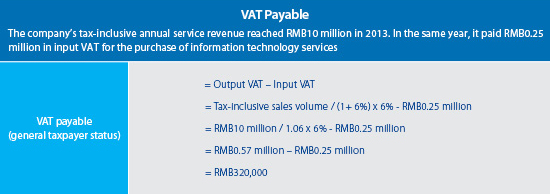

Generally, the VAT rate for such projects shall be six percent. The relevant calculation method is as shown below:

VAT payable = Sales volume × applicable VAT rate

Step 2. The company should apply to the local tax bureau for approval of foreign currency online payments .

Step 3. The company should submit the relevant documents to the local tax bureau to obtain a tax certificate and collect the approval certificate from Step 2. This requires the following:

- Contracts signed between the two parties for the provision of services

- Invoices

- Tax payment invoices

- Other relevant materials

Step 4. The company should make a bank transfer of the taxes owing.

Conclusion

Owing to the complexity of tax declaration procedures in China and the regulations governing non-resident foreign enterprises, taxpayers are encouraged to seek out the assistance of a professional services firm such as Dezan Shira & Associates, whose expertise can often succeed in negotiating a lower VAT rate with the relevant tax authorities.

|

About Us Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Double Taxation Avoidance in China: A Business Intelligence Primer

Double Taxation Avoidance in China: A Business Intelligence Primer

In our twenty-two years of experience in facilitating foreign investment into Asia, Dezan Shira & Associates has witnessed first-hand the development of China’s double taxation avoidance mechanism and established an extensive library of resources for helping foreign investors obtain DTA benefits. In this issue of China Briefing Magazine, we are proud to present the distillation of this knowledge in the form of a business intelligence primer to DTAs in China.

Strategies for Repatriating Profits from China

Strategies for Repatriating Profits from China

In this issue of China Briefing, we guide you through the different channels for repatriating profits, including via intercompany expenses (i.e., charging service fees and royalties to the Chinese subsidiary) and loans. We also cover the requirements and procedures for repatriating dividends, as well as how to take advantage of lowered tax rates under double tax avoidance treaties.

Annual Audit and Compliance in China

Annual Audit and Compliance in China

In this issue of China Briefing, we discuss annual compliance requirements for foreign-invested enterprises, including wholly-foreign owned enterprises, joint ventures and foreign-invested commercial enterprises, as well as the less demanding requirements for representative offices. We also highlight the most recent tax and legal changes that will significantly influence the way companies do business in China in 2014.

- Previous Article Double Taxation Avoidance in China: A Business Intelligence Primer – New Issue of China Briefing Magazine

- Next Article China Regulatory Brief: Guangzhou R&D Subsidies, China-Russia Agreements and Revised Dongguan Annual Inspections