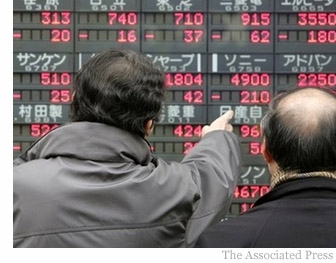

Asian stocks slide amid global recession concerns

By Andy Scott

By Andy Scott

SHANGHAI, Jan. 28 – Asian stocks tumbled Monday as traders took their cues from a faltering U.S. economy and a Wall Street that lost ground on Friday following a two-day rally.

Following last week’s ups and downs, investor sentiment remained fragile throughout the region as stocks slumped on renewed fears of a global recession.

In Tokyo, the Nikkei dropped 4.32 percent, while shares in Taiwan fell 3.28 percent. China slid down as well, reversing the slight upward trend they experienced on Friday, with the benchmark Hang Seng dropping 5.9 percent.

On the mainland, the Shanghai Composite posted a 7.19 percent loss to reach a five-month low of 4,413.154, while the Shenzhen Composite lost 6.58 percent. The economic slowdown caused by a winter storm hammering much of Eastern China throughout the day did little lift investor confidence.

Financial bookmakers in London expected the British FTSE 100 index to open between 75 and 98 points lower, or as much as 1.7 percent; the German DAX was expected to fall 121 to 146 points, or as much as 2.1 percent; and the French CAC 40 would be 78 to 117 points lower, or as much as 2.4 percent.

Poor earnings results in Japan increased fears that a slowing U.S. economy is hitting Japanese firms, prompting investors to dump shares across the board.

Nippon Steel, the world’s second-largest steel maker, said its pretax profit in the nine months to December fell 0.7 percent, sending steel shares sharply lower.

A Goldman Sachs report dated last Friday stated that the Japanese economy has either already entered a recession or will very likely do so in January-March at the latest.

Tetsufumi Yamakawa, Goldman’s Sachs’ chief Japan economist pointed to “a slump in domestic demand” in the report. Factory production will fall from a fourth-quarter peak, while consumer spending and the construction industry are both slowing, the economist said.

- Previous Article 1927 Guangzhou government war bond

- Next Article Can China and India save the world economy?