Annual Compliance Requirements in China: A Step by Step Guide

FIEs and Ros are required to go through China’s annual compliance procedures starting after the end of the fiscal year and usually take place until the end of June. Failing to carry out the procedures properly will cause a series of unwanted consequences. Especially with China’s social credit system continuously developing, companies should pay more attention to the annual compliance requirements.

With the scope and punishments of China’s social credit system established in China, legal and regulatory compliance has become more important than ever. More attention should be paid to the annual compliance procedures as mandated by various governmental departments.

Foreign invested enterprises (FIEs) and representative offices (ROs) in China are required to produce an annual audit report, conduct annual tax reconciliation, and report to relevant government bureaus in charge, though the detailed procedures and requirements are different. Failure to carry out these procedures properly or on time may result in extra expenses, penalties, downgrading of the credit of the business, or even revocation of business licenses. The company’s profits repatriation plan could also be disrupted.

In this article, we will walk you through the annual compliance requirements for FIEs and ROs in China and highlight the latest updates and trends.

Annual compliance procedures for FIE

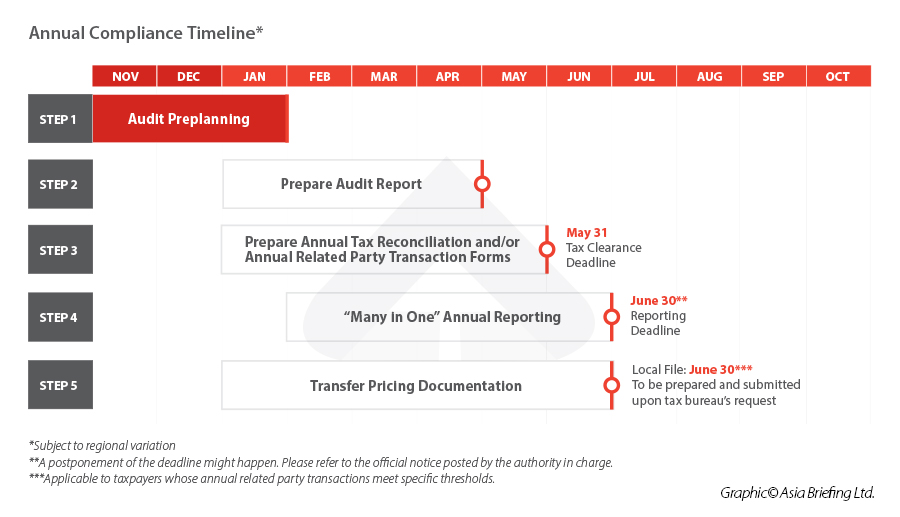

For FIEs, regardless of wholly foreign-owned enterprises (WFOE) or joint ventures (JV), the annual compliance requirements start 1-2 months before the end of the fiscal year (December 31 as China follows the calendar year) and usually take place until the end of June.

Step 1: Conduct audit preplanning (preliminary audit)

The preliminary audit is designed to plan the audit, spot the potential issues, and leave enough time for companies to make self-corrections.

Companies generally start the preliminary audit in November or December, during which auditors will do a risk assessment and internal control review by understanding the internal and external environment of the company and making inquiries to relevant personnel, both financial staff and the operational team.

A company that has completed a preliminary audit of its finances for the first nine or 10 months can significantly reduce the amount of substantive audit work to be conducted in the annual audit. They can therefore avoid the ‘rush period’ in late January and February, when businesses are scrambling to get their audit reports finished, and will therefore have ample time to conduct a more comprehensive audit and to implement changes in terms of how finances are run, or internal control is managed, as needed.

Auditors will also make audit plans and communicate the significant audit matters with the company in advance, which will help companies prepare and improve audit efficiency.

Step 2: Prepare an annual audit report

The annual compliance procedures start with the annual audit of the business. Though the preliminary audit can start as early as November or December, the annual audit report must be prepared after the end of the fiscal year to include data from the past year. To proceed with the annual tax filing in May, the audit report should be completed before the end of April.

The annual audit report for FIEs generally consists of a balance sheet, an income statement, a cash flow statement, a statement of change in equity, and a supplementary statement of financial indicators. To ensure that FIEs meet Chinese financial and accounting standards, the annual audit report should be conducted by qualified accounting firms and signed by two Certified Public Accountants (CPAs) registered in China.

Despite a requirement by the Company Law, in some cities, companies may not be required to submit the annual audit report to the local tax bureau. Rather, they may only need to disclose whether they have done an annual audit during annual reporting. Even so, companies are not suggested to take the chance. They are still advised to conduct their audit on a yearly basis for the reasons we explained in the first article.

In the case where an annual report is required, the requirements for the report may vary by region. For instance, in Shanghai, companies must include a taxable income adjustment sheet in the audit report, which is not a necessary supplement in Hangzhou, Beijing, or Shenzhen. Companies should stick to the local formalities.

Step 3: Conduct CIT reconciliation

The next step following the audit report is to conduct an annual CIT reconciliation, which is also called annual CIT filing, before May 31 every year.

Although the State Taxation Administration (STA) oversees all kinds of taxes, only CIT requires annual reconciliation with the tax bureau at the company level.

In China, CIT is paid on a monthly or quarterly basis in accordance with the figures shown in the company’s accounting books. Companies are required to file CIT returns within 15 days from the end of the month or quarter. However, due to discrepancies between China’s accounting standards and tax laws, the actual CIT taxable income is usually different from the total profits shown in the accounting books.

As such, the STA requires companies to conduct annual CIT reconciliation within five months from the previous year’s year-end to determine if all tax liabilities have been met and whether the company needs to pay supplementary tax or apply for tax reimbursement.

Generally, the Annual CIT Reconciliation Report must include adjustment sheets to bridge the discrepancies between tax laws and accounting standards among other documents. FIEs that conduct transactions with related parties should prepare an Annual Affiliated Transaction Report on transfer pricing issues as a supplementary document to the Annual CIT Reconciliation Report.

Moreover, FIEs in certain regions might be required to prepare another separate CIT audit report by meeting certain conditions, which also vary from city to city.

The CPA firm that prepares the financial audit report usually also has Certified Tax Agents (CTAs) to prepare an audit report for CIT. In the case that the CPA firm does not have CTA qualification, companies must hire another CTA firm to do the report. The CTA firm will request an annual (financial) audit report as a reference for CIT reconciliation.

In the current trend of digitalization and business reform, annual CIT reconciliation can be conducted through online channels, under which companies can conveniently submit relevant information in the appointed system. This is especially recommended in the context of the COVID-19 pandemic. However, if companies cannot make online CIT reconciliation due to certain circumstances, they can still go to the tax bureau in person to submit relevant materials as required.

The deadline for conducting annual CIT reconciliation is May 31 every year, but the investigation of the tax compliance could last until the end of the year, and companies should be prepared to provide supporting documents upon demand from the tax bureau. Besides, where companies are unable to conduct CIT reconciliation within the stipulated deadline due to a force majeure event, they may apply for an extension. However, they must submit a report to the tax bureau immediately upon cessation of the force majeure event. The tax bureaus shall investigate the facts and approve accordingly.

Every year around March, depending on the location, the local tax bureau will issue annual guidance on CIT reconciliation. FIEs are suggested to keep an eye on the guidance for any potential changes regarding the requirements and procedures.

All companies engaging in production and operation, including pilot production and operation, are required to go through annual CIT reconciliation, regardless of whether or not the company is under a tax deduction period, and whether or not the company makes a profit. For companies maintaining branch offices in multiple locations and required to pay tax on a consolidated basis, there are special rules and requirements regarding CIT reconciliation procedures. Companies should pay special attention to the matter if they fall into this scope.

Step 4: “Many-in-one” annual reporting

The fourth step of annual compliance is to conduct annual reporting to multiple government bureaus before June 30 every year, to ensure that companies are compliant and that the information related to each department is updated.

Starting in 2020, the annual reporting to multiple governments can be done by submitting all relevant information at once through the National Credit Information Publicity system (www. gsxt.gov.cn). This is the so-called “many-in-one” reporting.

Companies are no longer required to separately report to the local State Administration of Market Regulation (SAMR, which previously was called the Administration of Industry and Commerce or AIC), the commerce bureau, the finance bureau, the tax bureau, the statistical bureau, and the foreign exchange bureau. The annual report submitted should cover at least the following information:

- Basic information of the enterprise, including the contact information, the existence status of the enterprise, the business scope, the licensing situation, the staffing and salary information, the social insurance contributions, the IP situation, etc.

- Investor profile, including information regarding the subscribed and paid in amount, time, ways of contribution, the actual controller of the investor, etc.

- The name and URL of the website of the enterprise and of its online shops.

- Equity changes information of the equity transfer by the shareholders of a limited liability company.

- Information relating to any investment by the enterprise to establish companies or purchase equity rights.

- The balance sheet information of the enterprises, including total assets, total liabilities, total owner’s equity, etc.

- Warranties and guarantees provided for other entities.

- Information regarding the operation of the enterprise, including total imports and exports, total revenue, income from the main business, operational costs and expenses, R&D expenses, total tax payment, gross profit, net profit, profit distribution, etc.

- Information regarding the credit and debt.

- Tax breaks information if the enterprise enjoys preferential treatment for importing equipment.

- Customs relevant information if the enterprise is subject to the administration of the customs.

Part of the information will be synced from the statistics maintained by other government bureaus, such as the social security bureau and tax bureau, automatically. Enterprises are required to prepare and submit other information online during the period between January 1 and June 30.

Step 5: Prepare and submit transfer pricing documentation

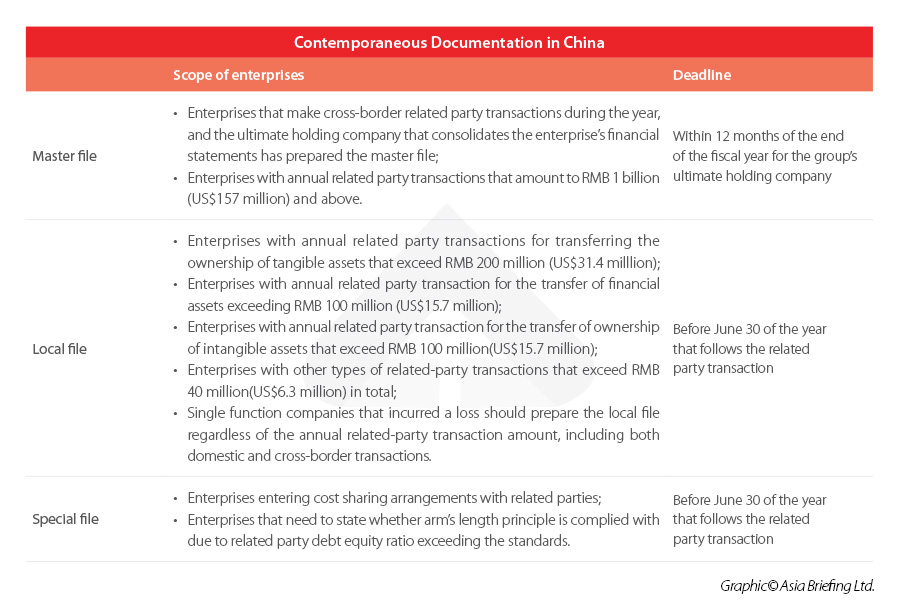

In addition to filing the related party transaction forms during the annual CIT reconciliation, enterprises exceeding the relevant transaction threshold (except those that are covered by an advance pricing agreement or that only transact with domestic related parties) should prepare and maintain contemporaneous transfer pricing documentation before the stipulated deadlines.

Under the current transfer pricing regulation, a three-tiered contemporaneous documentation framework – master file, local file, and special file – is implemented in China. For easier understanding, we summarize the three-tiered framework of contemporaneous documentation as below.

Consequences of failing to follow annual compliance requirements for FIEs

If the enterprise fails to submit the annual reporting information on time, it will be put into the Catalogue of Enterprises with Irregular Operations (Irregular Operations Catalogue), which is open to the public.

Besides, the enterprise will also be put into the Irregular Operations Catalogue if fraudulent information or serious concealment is discovered by authorities in the random check following the annual reporting.

If the enterprise is listed in this Catalogue for three years in a row, there will be more serious consequences – the enterprise will be put into the Catalogue of Enterprises with Illegal and Dishonest Behaviors, which serves as a blacklist for future operations and investments.

The legal representative and the general manager of the blacklisted enterprise will be banned from taking the legal representative or general manager role in other enterprises for three years, and the blacklisted enterprise will be in a disadvantageous position in bidding, government procurement, licensing application, obtaining land, as well as making new investment in the future.

FIEs are suggested to pay attention to the deadlines and requirements, or make timely correction where compliance happen, to avoid serious consequences.

Annual compliance requirements for ROs

RO’s annual compliance includes preparing an annual audit report, and a tax reconciliation report, and then reporting to the local SAMR in charge. While the procedure looks like that applicable for FIEs, each step has different requirements and focus.

Step 1: Prepare the annual audit report

While FIEs are only required to submit the audit report in limited scenarios, it is a mandatory requirement for an RO to do so. The annual audit report for ROs should be prepared by external licensed accounting firms and signed by two CPAs registered in China.

When doing the annual audit for ROs, auditors should pay special attention to the following factors.

- Bank statements, cash, staff, and IIT: The balance on the bank book should be the same as that stated in the bank statement. If not, a bank reconciliation should be prepared to verify the differences. The balance on the account should be the same as the cash contained in the cash box. The auditors will perform a cash count during their fieldwork. Employment of staff must be registered in accordance with the relevant regulations (local employees registered with qualified dispatch agencies and valid work permits for expatriate staff), and IIT correctly assessed and filed.

- Expenses report: Expenses include rent, transportation, telephone, salary, office purchases, entertainment, audit fees, utilities, and dispatching service fees, regardless of whether these are paid from the RO or directly from its head office. Any expenses belonging to the fiscal year should be properly accrued with contracts or agreements as support. The total salary of the chief representative, whether paid offshore or locally, must be included in the expenses. If employees are involved in overseas social security plans, these payments must be included in the expense report.

- Taxable income: According to relevant laws and regulations, ROs of foreign enterprises in mainland China must pay CIT on their deemed taxable income, as well as VAT and CT when it is applicable. The CIT liability will be assessed by the deemed profit method, cost-plus method, or actual revenue method. Among these three methods, the cost-plus method is the most used, since the other two methods require ROs to submit numerous supporting documents. Under the cost-plus method, the taxable income, that is, the deemed revenue is calculated on the basis of the expenses: DEEMED REVENUE= RO EXPENSES / (1 – DEEMED PROFIT RATE). The deemed profit rate is decided by the tax bureau, and shall be no less than 15 percent.

Step 2: Annual tax reconciliation

Like FIEs, ROs also need to submit the Annual Taxation Consolidation Report to the tax bureau by the end of May each year, though regional variations may exist. If the audited taxes due are found to be different from the taxes paid by the RO, the RO shall discuss the variation with the tax bureau.

For foreign companies that suspect this might occur, it is wise to hold preemptive discussions with tax advisors before audit submission. The annual tax reconciliation could be conducted through online filing. Offline channels are also available if online filing is unsuccessful.

Step 3: Annual reporting to local branches of SAMR

ROs are required to submit an annual report between March 1 and June 30 every year providing information on the legal status and standing information of the foreign enterprise, ongoing business activities of the RO, and an audit report. As compared to FIEs, the reporting period starts later, and the audit report is mandatory in all circumstances.

During the annual reporting process, the following documents should be provided on paper or online:

- Annual report (the template will be distributed by local authorities around March);

- Business registration certificate;

- Audit report; and

- Proof of information on the legal status and standing of the headquarters overseas.

Consequences of failing to follow the annual compliance requirements for RO

Failing to submit the annual report on time may lead to additional penalties, ranging from RMB 10,000 to RMB 30,000. An RMB 20,000 to RMB 200,000 penalty might be given if the report includes fraudulent information. Failing to make corrections as required or fraud could lead to license revocation.

Tips on managing annual compliance requirements

Tip 1: Paying attention to the procedural changes and corresponding requirements

While the essential steps remain similar, in the context of China’s business reform and opening up, the detailed procedures have been subject to frequent changes in recent years:

While the changes are designed to cut red tape in the long run, they increase compliance risks for enterprises in the short term. Companies are suggested to pay special attention to the annual compliance updates, study the new requirements, and make necessary preparations to stay compliant.

Tip 2: Paying attention to the local variations

The detailed procedures and requirements of each step may vary from one place to another. It is not always right to assume the company is compliant by solely referring to national laws and regulations. As mentioned in the early parts of the article, for example, FIEs in certain regions might be required to prepare another separate CIT audit report in the CIT reconciliation by meeting certain conditions, and these conditions also vary from city to city. Businesses are suggested to consult with a qualified service firm or contact the local government to avoid unnecessary misconduct in the annual compliance.

Tip 3: Using qualified third-party services

As there are many special details to pay attention to in the annual compliance process, it could be quite challenging and onerous for some companies to manage by themselves, especially those that do not have a strong internal financial team.

It is not uncommon to see companies getting penalized for unnecessary mistakes or negligence, with business credit being affected. Such companies are suggested to use professional third-party service firms rather than managing the matter internally.

To select qualified services, the below standards could be used as references:

- A service firm that can manage the whole annual compliance process is better than one that can only handle one or two steps of the procedures.

- A service firm that has branches in different cities and is familiar with local variances will be more suitable to provide services to FIEs that have multiple subsidiaries or branch offices in China.

- A service firm that is familiar with international accounting standards, such as IFRS and GAAP, and can do mapping or conversion among the standards, is more qualified to provide services to FIEs whose headquarters may have financial consolidation requirements.

- A service firm that can work in fluent English can have better communication with the senior management of the FIEs to make the annual compliance process smoother.

This article was adapted from our China Briefing Publication: A Quick Guide to Accounting and Audit in China 2024 (2nd Edition) and was last updated on November 1, 2024. Dezan Shira & Associates’ experienced team of tax accountants, lawyers, and auditors have a deep understanding of Asia’s complex tax environments, as well as in-depth industry knowledge and experience. We can help on a wide spectrum of tax service areas across all major industries, including ongoing tax compliance and reporting, profit repatriation, transfer pricing, etc. For more information, please email us at Tax@dezshira.com or visit our website at www.dezshira.com.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article China-Austria Trade and Investment Profile and Key Developments

- Next Article China-Singapore Economic Ties: Trade, Investment, and Opportunities