An Introduction to Doing Business in China 2024 – New Publication Out Now

An Introduction to Doing Business in China 2024, the latest publication from Dezan Shira & Associates is out now and available for complimentary download through the Asia Briefing Publication Store.

Doing business in China has changed dramatically in the past few years. With the uneven recovery of the Chinese economy, rising geopolitical risks, increasing supply chain diversification pressure, and evolving tax data compliance regimes—both in China and globally, companies are operating in an increasingly complex environment.

Doing business in China has changed dramatically in the past few years. With the uneven recovery of the Chinese economy, rising geopolitical risks, increasing supply chain diversification pressure, and evolving tax data compliance regimes—both in China and globally, companies are operating in an increasingly complex environment.

A notable shift emerged as China’s FDI flow turned negative for the first time since 1998. In Q3 2023, China’s direct investment liabilities in its balance of payments declined by US$11.8 billion, partly reflecting the fact that more foreign firms are repatriating earnings from China instead of reinvesting them. According to the latest data from China’s Ministry of Commerce (MOFCOM), the actual use of foreign capital declined by 9.4 percent year-on-year between January and October, demonstrating foreign investors’ cautiousness in committing new capital into China.

Nevertheless, China remains among the world’s largest consumer markets, and ambitious businesses aiming for global success cannot afford to overlook it.

China’s unparalleled supply chains are also not easily replaceable in the short term. Furthermore, the Chinese government has intensified its initiatives to attract foreign investment by optimizing the business environment for international companies and investors.

This explains why despite the decline in the actual use of foreign investment amount, the number of newly registered foreign companies grew by 32.1 percent year-on-year between January and October 2023, with a total of 41,947 new foreign-invested enterprises registered.

Moreover, foreign investment has still grown in certain industries. Manufacturing, for instance, utilized US$40 billion in foreign capital over this period, an increase of 1.9 percent year-on-year. Of this, utilized foreign capital in the medical equipment and instrument manufacturing industry and in the electronics and communication equipment manufacturing grew by 34.6 percent and 14.8 percent year-on-year, respectively.

China still presents high-value opportunities for informed executives.

Under these circumstances, it is vital that foreign investors are familiar with the changes happening in China’s business landscape and explore new methods of doing business in and with China—to identify areas of risk in advance and take steps to prepare for new market opportunities. This is the only way investors can stay nimble in an otherwise difficult time.

Designed to introduce the fundamentals of investing in China, An Introduction to Doing Business in China 2024 is compiled by experts at Dezan Shira & Associates, a specialist foreign direct investment firm providing corporate establishment services, business advisory, tax advisory and compliance, accounting, payroll, due diligence, and financial review services to multinationals investing in emerging Asia.

Doing Business in China 2024 covers:

- Establishing and Running a Business

- Tax, Audit, and Accounting

- Human Resources and Payroll

- Cybersecurity and Data Protection

Within these chapters, we discuss a range of different topics that affect doing business in China, including investment models, intellectual property considerations, key taxes applicable to foreign companies, various types of employment contracts, and a chapter explaining the evolving data and cybersecurity compliance requirements in China.

What‘s new in Doing Business in China 2024?

The below changes are noticeable for your attention:

- China’s changing business landscape: A new section is added at the beginning of this guide, introducing China’s changing business landscape, laying out the challenges faced by foreign investors, yet explaining why China is a market that cannot be overlooked by foreign investors.

- Alternative options for entering the China market: A new section is added to the “What are my options for investment” chapter, introducing some emerging alternative options being adopted by foreign investors to enter the Chinese market at a lower cost and with greater flexibility. Such alternative options include professional employer organization (PEO) employer service, exporter of record (EOR) or importer of record (IOR) service, cross-border trade, and virtual office service.

- Last call for transitioning to the Foreign Investment Law: For foreign-invested enterprises established before January 1, 2020, especially for Sino-foreign joint ventures, 2024 is the last year for them to adjust their governing structure and organizational form to be in line with the requirements under the Company Law. We summarize what changes need to be implemented and explain the consequences of failing to make timely adjustments.

- Tax incentives: In a move to promote innovation, support small businesses, or attract foreign investment, China has extended multiple tax incentives to the end of 2027. These include the tax-exempt fringe benefits for expatriates as well as several tax incentives for small businesses. The “What are the major taxes in China” chapter is updated accordingly.

- Travel relaxations and visa policies: To attract more international visitors and talents, and facilitate economic development and opening up, China has been constantly relaxing its travel restrictions and visa policies throughout the year. This includes reopening the border, resuming all types of visa applications, simplifying the process, as well as adding more visa-free travel scenarios. We briefly mention this in the “How do I manage foreign employees” section.

- Cybersecurity and data protection: The year 2023 saw the implementation of several new regulations on data protection and cybersecurity in China, with a particular focus on cross-border data transfer and personal information protection. We have updated the “Cybersecurity and Data Protection” chapter with the latest developments.

Special focus: China’s changing business landscape

In light of China reopening its borders and easing COVID-19 restrictions at the beginning of 2023, the primary constraints for businesses have shifted. The pandemic is no longer the foremost challenge. However, the risk-adjusted return on investment in China is not the same as it was a few years ago.

China is adjusting its policy priorities and repositioning itself in the global supply chain. The Chinese market is undergoing significant changes, with consumers spending more on services and shifting their consumption preferences. Additionally, external factors play a crucial role, as global demand is dampened by stubbornly high inflation rates, and international relations are further complicated by regional conflicts and strained ties between China and the West. Businesses operating in China or planning to enter the market are facing considerably more challenges.

Under these circumstances, understanding the changes in China’s business landscape and their corresponding impacts is of paramount importance for the continuous success of foreign investors in China. For those confronted with tough decisions on whether to invest in China, stay, or leave, the importance of comprehending China’s comparative advantages cannot be overstated.

Implications for foreign investors

- Maturing economy: China’s economy, after three decades of ultra-fast double-digit growth, has experienced a shift. The slower growth rate could impact wealth accumulation, consumption, and market confidence. That said, China’s economy still grows faster than that of most large economies by a significant margin over the coming years. Numerous sectors within the world’s largest market are expected to far outpace growth in other markets, and present non-negligible growth opportunities for foreign investors.

- Shifting geopolitics: The US-China tension continues growing despite resumed conversations in 2023. EU released its de-risking strategy towards China. BRIC countries and Middle East countries have been increasing investment and trade in China. The impacts of these shifting geopolitical trends are twofold. On the one hand, the strained ties between China and other major economies not only directly affect investment and trade, but also make investors more cautious about committing funds to the China market. On the other hand, the increasing interactions between China and BRICS members and MEB countries have the potential to set off slowing trade with other partner countries. This is expected to broaden China’s trade portfolio, maintain the importance of its supply chain, and serve to open new markets.

- Global versus local demand: Foreign trade has become a significant challenge for China’s economy in 2023. The sluggish global demand challenges the significance of exports in fostering China’s economic growth. Businesses will need to place greater emphasis on expanding the domestic market, rather than merely using China as a production base. The “In China, for China” strategy is poised to gain further momentum in the coming years.

- Changing demographics: In 2022, China witnessed its first population decline in almost 60 years. The overall population decreased to 1.4118 billion, down from 1.4126 billion the previous year, marking a decline of 850,000 people. The changing demographics are accelerating shifts in China’s labor market, as well as transforming China’s market. The aging population creates various opportunities within the “silver economy” for early movers. This encompasses healthcare and eldercare, which remain underdeveloped in many fields in China, as well as consumer goods and services tailored to the needs of the elderly demographic. Furthermore, with China actively seeking to upskill its labor force for the future, vocational training has emerged as a crucial sector for government development initiatives and the encouragement of foreign investment.

- New policy priorities: After decades of rapid economic growth, China is now prioritizing the development of a green, low-carbon, and circular economy in the coming decades. This shift in policy is anticipated to have far-reaching effects on socioeconomic, industrial, and business landscapes, as economic and consumption behaviors become directly tied to the country’s efforts to address climate change and environmental degradation. Beyond sustainability, China’s growing emphasis on “security” raises concerns among foreign investors.

- Emerging consumer trends: Last but not least, certain emerging consumer trends have prompted foreign investors to reassess their interests in the market. Firstly, the concept of “Guochao”—the preference among consumers for domestic brands—has gained popularity. Against this backdrop, it becomes increasingly important for foreign investors to conduct thorough research on their target consumers and Chinese competitors before entering the market or maintaining their comparative advantages. Secondly, Chinese consumers have been directing more of their spending towards services in the post-COVID era. he consumption pattern is shifting from being primarily goods-oriented to a mix of goods and services. Promoting service consumption is thus a key strategy for increasing domestic demand and contributing to high-quality macroeconomic development.

The continued appeal of the Chinese market

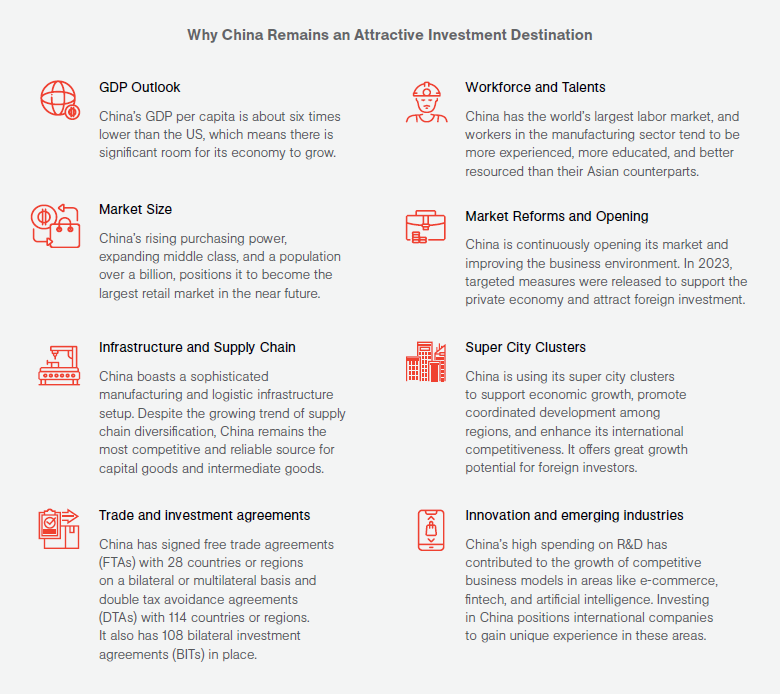

Despite these challenges, China remains an attractive market for many organizations. The country offers unparalleled access to one of the world’s largest markets and a highly competitive global supply chain. Informed executives can leverage these opportunities to retain and build on their comparative advantages by optimizing their operations in the country.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, Dubai (UAE), and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Navigating Hong Kong’s ESG Landscape: Regulations, Trends, and Opportunities

- Next Article Key Points in the Application of Chinese Labor Laws to Foreign Employees