America’s Big Opportunity – Playing Number Two to Service China as the Number One

Shifting demographics towards China do not diminish the United States’ ability to service the world’s largest consumer market

Op-Ed Commentary: Chris Devonshire-Ellis

Oct. 21 – Much will be made over the coming years of China’s rise to displace the United States as the world’s largest economy, with this set to occur sometime around 2020. India too, will also rise to surpass the United States in the coming years, and this is not just the view of crackpot analysts, but influential bodies such as the OECD.

Oct. 21 – Much will be made over the coming years of China’s rise to displace the United States as the world’s largest economy, with this set to occur sometime around 2020. India too, will also rise to surpass the United States in the coming years, and this is not just the view of crackpot analysts, but influential bodies such as the OECD.

While these changes have long been known, all they really represent are bragging rights. Despite China possibly becoming the world’s largest economy during the next U.S. president’s first term of office, there remains much positive news for the United States in this shifting of power.

For a start, while China’s economy may grow to be larger, it also has nearly five times as many people, meaning the per capita wealth will remain in the United States. The ability for the United States and its citizens to pay for the most up-to-date lifestyle-enhancing products isn’t going to go away. India too, will follow a path similar to China’s, even if slightly less spectacular in terms of economic growth. Human capital – which both China and India have in abundance – creates a dynamic that dictates wealth measured by GDP. And although psychologically there may be some politicking to be done by the occasional anguished American politician, no one else really cares about these particular headlines except China, whose leaders want to show off to their own nationals how good a job they are doing, and newspaper owners, who need to sell trivia dressed up as urgent economic headlines.

In fact, China has already been overtaking the United States in many ways. Many of these show a China in desperate need of supplies – supplies that can be provided by other nations, and the companies and entrepreneurs that live in them. For example, 10 days ago China signed off a huge deal to buy over one million tons of rice annually from Thailand. In today’s casual use of huge figures, this didn’t garner much attention – except in Thailand where it has been considered so large that some have raised concerns. The real question to be asked, however, is why China needs to secure purchases of so much rice when it is also a major rice producer? Here lies buried a growing Chinese problem – with so much industrialization going on, much of the nation’s agricultural lands are being seriously degraded by pollutants such as cadmium, lead and mercury. China may well be the largest producer of rice in the world (see here for the top 10), yet its rise from an agricultural-based society to an industrial-based society is causing problems and stresses. China will get dirty before it becomes wealthy, just as both Europe and the United States did before it, and hence there are abundant opportunities to sell to China. Food is just one.

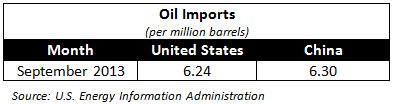

Another example of China becoming the world’s number one – again with huge significance but something that also largely flew under the radar – is that China just surpassed the United States as the world’s largest importer of oil last month. We wrote about this in some detail here.

However, the real trend is even more spectacular. The United States is able to domestically produce 12.5 million barrels of oil a day whereas China can only produce 4.6 million. Furthermore, the United States is bringing down the amount of oil that it is actually using as it takes advantage of other energy sources; particularly the discovery of vast amounts of shale gas. In China, consumption rates are rising, and fast. China’s middle class is projected to grow to a massive size over the next few years, and as its citizens become more affluent, the more goods and products they will want to consume. This has already translated into more cars on the road, and the country is already the world’s largest automobile market by units sold. Just this past August, this market grew by 11 percent, and that was a slow month. Further, the vehicles produced run almost entirely on oil, and many of the vehicles sold do not come even close to meeting Western emissions standards. The opportunities for clean energy, and for equipment that can detox China’s increasingly polluted landscape are going to be there.

Yet even the changes in agriculture and energy, huge as they may be, will not impact upon the average American business as much as the infrastructure sector. Again, China and India are taking over the top spots. The United States is currently the largest consumer of imported infrastructure for use in manufacturing facilities, as well as for developing domestic construction. According to HSBC’s October Global Connections Forecast, these number one positions will be toppled and replaced by China and India, respectively. This makes sense, as I pointed out on Asia Briefing in our piece Asia Will Boom:

“(This) underlines what we have been seeing at the recent APEC meetings – Asia will boom and will also require huge amounts of infrastructure. Foreign MNCs from Europe and the United States need to get themselves well positioned in the Asian market to take advantage of what will be a huge growth trend over the next 30 years: Developing Asia to contemporary standards. China was just the start compared to what will happen.”

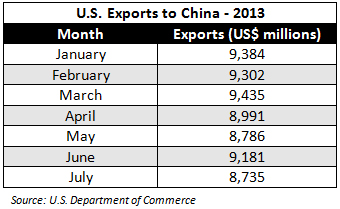

China needs to upgrade its manufacturing facilities, and this means the importation of production infrastructure – robotics, and better integrated technologies and systems. India, meanwhile, is embarking on a massive rebuild – everything from ports and airports to roads and rail. At Dezan Shira & Associates during the 1990s and early 2000s, we serviced hundreds of both American and European businesses in China with their corporate establishment, operating licenses, taxes, accounting and profitability. They were in China to assist with everything from airports to architecture to oil and gas and from interior design, to baggage handling and automotives. Most are still there, although much of the construction hardware has now relocated from Shanghai to cities such as Mumbai. Moreover, despite the general economic slowdown, U.S. exports to China have generally been on the rise. Last year saw a record breaking US$100 billion worth of exports to the country, while the U.S.-China Business Council stated last year that American corporates grew their China businesses by about 10 percent in 2012.

This year’s economic data concerning American exports to China is of course not fully complete, but it does show a trend very similar to that of 2012 in terms of exports:

The good news about these figures is that they show a high degree of consistency – indicating that China is a persistent buyer of American products and services. This means that if your business is not in the China market, and you as an executive are looking at sustainable growth and revenues, China is where you really need to be. As I have also shown, the consumables that China is now taking in stretch from agricultural goods, to energy, and to infrastructure. Incidentally, exports from the European Union to China rose 21 percent in 2012 – ahead of the United States and suggesting that some catching up is required. If the world’s largest trading partner with China (being the EU rather than the United States) is investing heavily in infrastructure in China, then there is plenty of room for expansion for American businesses in China to follow suit.

The message really then for American companies remains the same – China is becoming number one in terms of GDP and in other consumable tables. But in doing so, the United States and companies in Europe and Asia can all begin to reap the benefits of servicing what is about to be the world’s largest economy. If you’re already in China and doing well, then the additional card to play is the Indian one. U.S. Secretary of State John Kerry has already been discussing upgrading bilateral investment treaties with India, and India too will overtake the United States in terms of sheer GDP size in the coming years. Neither of these developments have ever been a threat. But they are a tremendous opportunity for American companies to show what they really can do best – sell high quality innovative products to the world’s major economies. Now that’s a challenge to relish.

Chris Devonshire-Ellis is the Founding Partner of Dezan Shira & Associates. The firm specializes in assisting MNC and mid-cap corporates establish operations throughout Asia, including China, India, Vietnam and Singapore. The practice is a member of the Leading Edge Alliance of international accountants and auditors.

Chris is currently in the United States for the next four weeks, and is visiting Seattle, San Francisco, San Diego, Miami, New York, Cincinnati, Boston and Chicago. He is available for interviews or discussions concerning matters of China, India and Asia legal, tax, operational and corporate development issues, and can be reached via Jessica Tou at jessica.tou@dezshira.com.

For further details or to contact the firm, please email asia@dezshira.com, visit www.dezshira.com, or download the company brochure.

Related Reading

Selling to China

Selling to China

In this issue of China Briefing Magazine, we demystify some complexities of conducting business in China by introducing the main certification requirements for importing goods into the country; the basics of setting up a representative office; as well as the structure and culture of State-owned enterprise in China. Finally, we also summarize some of the export incentives available in several key Western countries.

Trading With China

Trading With China

This issue of China Briefing Magazine focuses on the minutiae of trading with China – regardless of whether your business has a presence in the country or not. Of special interest to the global small and medium-sized enterprises, this issue explains in detail the myriad regulations concerning trading with the most populous nation on Earth – plus the inevitable tax, customs and administrative matters that go with this.

Trading with India

Trading with India

In this issue of India Briefing Magazine we focus on the dynamics driving India as a global trading hub. Within the magazine, you will find tips for buying and selling in India from overseas, as well as how to set up a trading company in the country.

The Letters From America Series:

- Evaluation Steps for American Companies Selling to China

- Selling to China and The Right to Review Your Sales Contracts

- Export Financing as Part of Your China Trade Strategy

- Selling American Exports to Asia’s Middle Class

- China Growth and Development for American Companies

- Previous Article China to Boost Rights of Small and Medium Investors

- Next Article The State of Domestic Coffee Production in China