Accounting Records in China: Keeping up to Date with the New Regulations

By Dezan Shira & Associates

Editor: Jake Liddle

China’s Ministry of Finance (MOF) and the National Archives Bureau have jointly adopted a revised “Administrative Measures on Accounting Records”. In effect since the beginning of the year, the new measures are significantly different to the previous 1999 legislation and are important for all enterprises with operations in China.

The new measures have been formulated in accordance with China’s Accounting Law, Archives Law and other related laws and administrative regulations. They primarily aim to consolidate the administration of accounting records and amend regulations of record retention periods and electronic filing systems.

RELATED: Tax and Compliance Services from Dezan Shira & Associates

RELATED: Tax and Compliance Services from Dezan Shira & Associates

Electronic Filing

The new measures explain that companies may utilize information technology, such as computer and network communication, as a means of managing accounting records. Electronic accounting materials formed internally within a company, which fall under the scope of archiving, may be kept solely in electronic form if the following criteria are satisfied:

- The source of electronic accounting materials formed are true and valid, and are formed and transmitted via electronic equipment;

- The accounting system used is able to receive and read electronic accounting materials accurately, completely and effectively; able to create output of accounting materials such as accounting vouchers, account books and financial accounting statements which comply with the national standard archive format; and has set up the necessary audit and signing procedures such as handling, examination and approval;

- The electronic records management system used is able to receive, manage and utilize electronic accounting records effectively, satisfies the long-term retention requirements of electronic records, and has established the referencing relationship between the electronic accounting records and related hard copy accounting records;

- Effective measures are adopted to prevent electronic accounting records from being tampered with;

- Backup system for electronic accounting records is established for effective protection against natural disasters, accidents and vandalism; and

- The electronic accounting materials formed are not accounting records which are worthy of permanent preservation or possess significant preservation value.

Previously, all units utilizing computing for accounting purposes were required to retain all printed paper copies of account materials. Particularly, companies using tape, magnetic disk, CD, microfilm or other forms of magnetic media for saving account records needed to report to the MOF and National Archives.

Retention Period

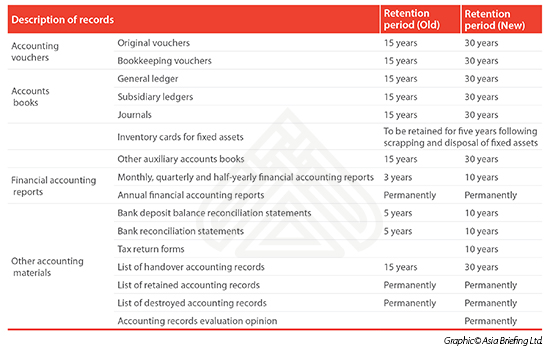

The retention period of accounting records shall start on the first day following the end of the accounting year. Below is a table comparing the retention period for required accounting records of enterprises and other types of organizations according to the old and new measures:

Violation of the terms of the new measures could result in penalties imposed by the finance authorities and archive administrative authorities.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Tax, Accounting, and Audit in China 2016

Tax, Accounting, and Audit in China 2016

This edition of Tax, Accounting, and Audit in China, updated for 2016, offers a comprehensive overview of the major taxes that foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China-based operations.

Annual Audit and Compliance in China 2016

Annual Audit and Compliance in China 2016

In this issue of China Briefing, we provide a comprehensive analysis of the various annual compliance procedures that foreign invested enterprises in China will have to follow, including wholly-foreign owned enterprises, joint ventures, foreign-invested commercial enterprises, and representative offices. We include a step-by-step guide to these procedures, list out the annual compliance timeline, detail the latest changes to China’s standards, and finally explain why China’s audit should be started as early as possible.

Managing Your Accounting and Bookkeeping in China

Managing Your Accounting and Bookkeeping in China

In this issue of China Briefing, we discuss the difference between the International Financial Reporting Standards, and the accounting standards mandated by China’s Ministry of Finance. We also pay special attention to the role of foreign currency in accounting, both in remitting funds, and conversion. In an interview with Jenny Liao, Dezan Shira & Associates’ Senior Manager of Corporate Accounting Services in Shanghai, we outline some of the pros and cons of outsourcing one’s accounting function.

- Previous Article Handling Mass Layoffs in China’s Manufacturing Sector

- Next Article China Launches New “Three-in-One” Business License