Accounting Digitalization in China: Managing the Impact of Fully Digitalized E-Fapiao and the New Accounting Law

The digitalization of accounting in China, driven by fully digitalized e-fapiao and the amended Accounting Law, is transforming financial processes, enhancing efficiency, and requiring enterprises to adapt to new compliance standards. Companies must adopt digital tools and strategies to ensure accurate financial management and regulatory adherence.

The landscape of accounting in China is undergoing a significant transformation with the advent of digitalization. One of the most notable changes is the implementation of fully digitalized e-fapiao (electronic invoices), which is revolutionizing how financial transactions are recorded and managed. Alongside this technological shift, new accounting requirements are being introduced in the amended Accounting Law of the People’s Republic of China (the “new Accounting Law”), to ensure compliance and streamline financial processes.

For financial staff, these changes present both opportunities and challenges. The move towards digitalization promises greater efficiency, accuracy, and transparency in financial reporting. However, it also requires a thorough understanding of new systems and regulations, as well as the ability to adapt to rapidly evolving technologies.

In this article, we will explore the impact of fully digitalized e-fapiao and the new Accounting Law on financial staff in China. We will provide insights into best practices for managing these changes, ensuring compliance, and leveraging digital tools to enhance financial operations.

Accounting digitalization in China: Trend and development

Accounting systems, as a crucial foundation of economic operations, are continuously evolving to meet the demands of the times. With the rapid development of the digital economy, the construction of accounting information systems has been elevated to a national strategy and has become an essential issue for enterprises.

On June 28, 2024, the 10th meeting of the Standing Committee of the 14th National People’s Congress of the People’s Republic of China reviewed and passed the “Decision of the Standing Committee of the National People’s Congress on Amending the Accounting Law of the People’s Republic of China,” which came into effect on July 1, 2024. The newly revised Accounting Law incorporates accounting digitalization (or “accounting informatization”) into the legal framework for the first time, explicitly stating that “the state strengthens the construction of accounting informatization and encourages the use of modern information technology to carry out accounting work.” This provides a solid legal foundation for the development of accounting informatization.

Additionally, as China’s digital economy continues to grow, tax supervision is transitioning from “invoice-based tax management” to “data-based tax management.” The digitalization of invoices imposes higher requirements on the financial and tax standardization and system intelligence of small and micro enterprises, driving the rapid development of the financial and tax digital intelligence market for these businesses.

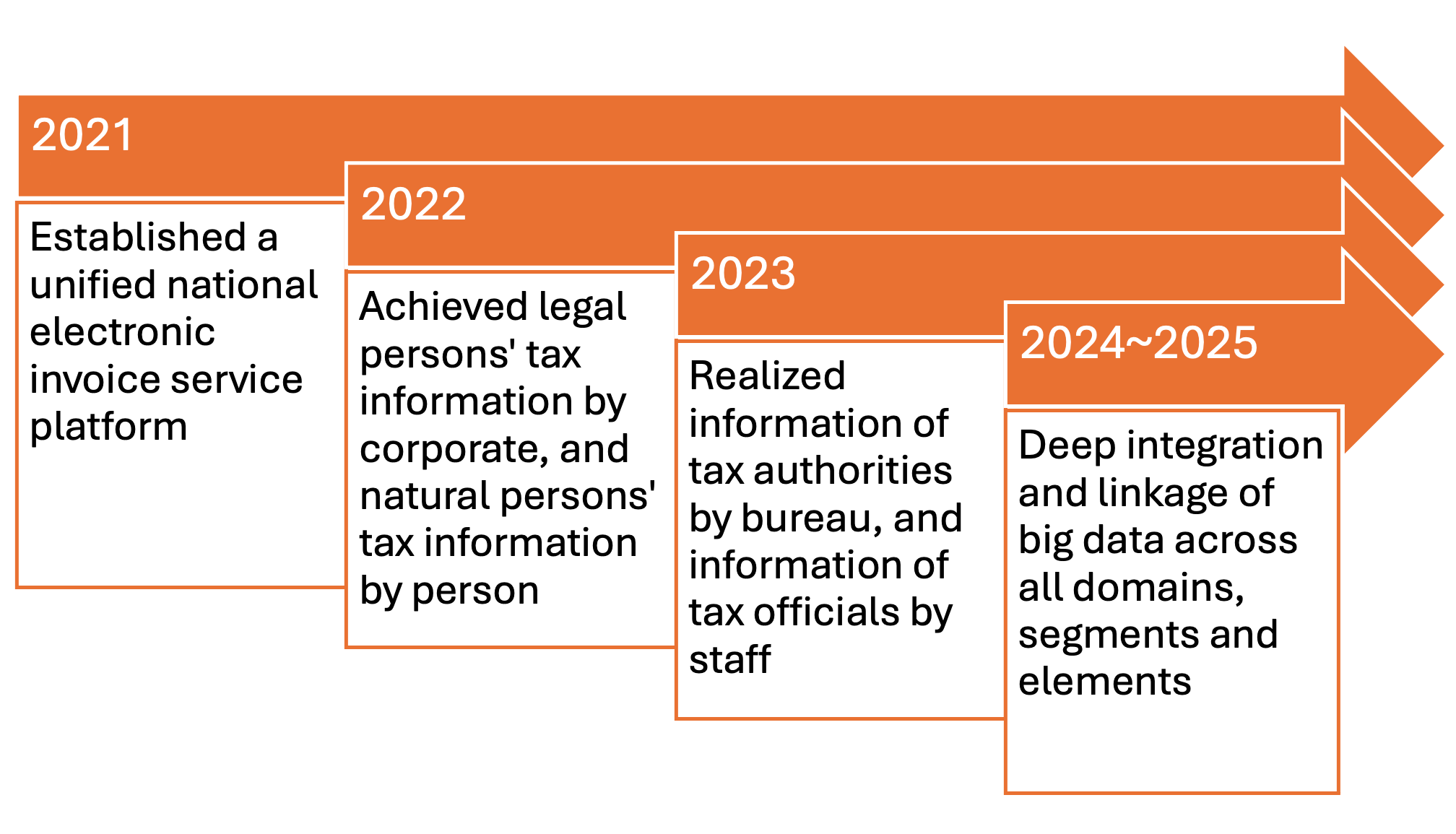

Fully digitalized e-fapiao, which are electronic invoices, serves as a key tool in the digital transformation of accounting. The pilot program of fully digitalized e-fapiao kicked off on December 1, 2021, when selected taxpayers in Shanghai, Guangdong (Guangzhou, Foshan, Guangdong-Macao Intensive Cooperation Zone), and Inner Mongolia (Hohhot) started to issue and accept fully digitalized e-fapiao.

In 2022 and 2023, the pilot program of fully digitalized e-fapiao kept expanding, with a broader scope of taxpayers being able to issue and accept fully digitalized e-fapiao. As of December 1, 2023, the pilot program of fully digitalized e-fapiao was rolled out nationwide, with Tibet being added to the scope of issuance.

The promotion and application of fully digitalized e-fapiao provide strong support for the digital transformation of enterprise accounting. By adopting modern information technology tools such as digital e-invoices, enterprises can gradually achieve the digitalization, intelligence, and automation of accounting, financial management, and tax management.

In this context, it is crucial for enterprises to clearly understand the impact of accounting digitalization on financial accounting management and to promptly formulate corresponding measures. This is essential for the healthy and stable operation of the enterprise’s financial accounting system.

Understanding these trends and developments will help financial staff navigate the complexities of accounting digitalization in China and leverage new technologies to enhance their operations.

Impact of the fully digitalized e-fapiao

The fully digitalized e-fapiao system represents a significant step forward in the digital transformation of accounting in China. It offers numerous benefits in terms of efficiency and accuracy but also requires enterprises to adapt to new regulatory and operational standards.

Centralization and digitalization of invoice data

Through the centralization of all invoice data, the electronic tax system provides taxpayers with various services, such as invoice usage confirmation, invoice delivery, invoice verification, and invoice book notes. This digitalization and informatization of tax supervision mean that the control of national business transaction flows has entered an electronic and data-oriented era. This shift enhances the efficiency and accuracy of tax management, reducing the likelihood of errors and fraud.

Enhanced tax supervision

China’s tax supervision is transitioning from “invoice-governance” to “digital-governance.” By strengthening data sharing and verifying data flows, information exchange and sharing across regions and companies are being more optimally achieved. The new tax law enforcement system, which emphasizes “no disturbance in case of no risks, investigation of illegal activities, and strong and intelligent control throughout the whole process,” is now largely established. This system aims to create a more transparent, efficient, and fair tax environment.

The tax bureau can now acquire comprehensive information about an enterprise’s upstream and downstream invoices, as well as its operational data such as utilities and capital. For enterprises under close scrutiny, the tax bureau will also monitor their upstream and downstream partners, affiliated companies, and even the affiliates of those partners. This transformation from fragmented information to comprehensive big data control ensures a more holistic approach to tax supervision, akin to the butterfly effect where a small change can have widespread consequences.

Impact on enterprises

For enterprises, the adoption of fully digitalized e-fapiao means they must adapt to new standards of financial and tax management. This includes ensuring their systems are capable of handling digital invoices and that their staff are trained to use these new tools effectively. The shift towards digital governance also means that enterprises need to be more diligent in their financial reporting and compliance efforts, as the tax authorities now have more sophisticated tools to monitor and enforce regulations.

Changes introduced by the new Accounting Law

The new Accounting Law includes multiple adjustments and improvements, covering areas such as accounting records management and the accounting supervision system. These changes aim to make accounting processes more rigorous and standardized. One of the key highlights of this revision is the inclusion of accounting digitalization and informatization in the law for the first time, providing a clear direction for the transformation of accounting practices.

Enhanced accounting supervision

The new Accounting Law maintains the current basic system but focuses on addressing prominent issues in accounting practices. It aims to strengthen accounting supervision and curb financial fraud, thereby improving the quality of accounting information and ensuring the authenticity and completeness of financial data.

Clarity on types of violations and increased penalties

The new Accounting Law provides detailed regulations on illegal activities such as forging or altering accounting vouchers and books and providing false financial reports. It significantly increases the penalties for these violations, meaning that future penalties for financial fraud will grow exponentially with the amount of illicit gains.

Clarified responsibilities of accounting institutions and personnel

The new Accounting Law emphasizes that the person in charge of an entity is responsible for the authenticity and completeness of the accounting information. This highlights the importance of financial work within an organization. Additionally, it protects accounting personnel from retaliation when they perform their duties according to the law or oppose illegal acts, safeguarding their legitimate rights and interests.

Promoted development of accounting informatization

With the advancement of information technology, data digitalization has become an inevitable trend. The new Accounting Law promotes the development of accounting informatization, making accounting data clearer and more transparent. This not only improves the efficiency of accounting personnel but also enhances the accuracy of financial results.

Enterprise solutions in the digital era and navigating the new Accounting Law

As enterprises navigate the digital era and the implementation of the new Accounting Law, it is crucial to adopt comprehensive strategies to ensure compliance and efficiency.

Increase oversight of invoice management workflow

- Implementation of “three-flow consistency”: Ensure that the flow of cash, invoices, and goods is consistent and aligned.

- Standardization of invoice processes: Standardize the procedures for obtaining and issuing invoices and conduct regular compliance checks.

- Enhance risk prevention: Strengthen the prevention of risks related to invoice management and pre-corporate income tax (CIT) deductions.

Penetrated inspection on authenticity and reasonability of business activities

- Authenticity checks: Conduct thorough checks on the authenticity of purchase and sales orders.

- Information penetration tests: Perform tests to ensure the transparency and accuracy of information from individual behavior to enterprise behavior. This helps in pre-estimating potential tax-related risks and enables proactive risk identification and analysis.

- Compliance with the arm’s length principle: Ensure that transactions comply with the Arm’s Length Principle to maintain fairness and legality.

Compliance management

- Comparative analysis: Conduct horizontal and vertical comparisons to identify the causes of abnormal changes in tax-bearing rates and take timely corrective actions.

- Ensure compliance with tax regulations: Verify that tax strategies and filings comply with the latest tax laws. This includes reasonably enjoying tax benefits, fully utilizing available tax incentives, and maintaining good communication with tax officers.

- Accuracy and completeness of financial data: Test the accuracy and completeness of financial data by ensuring the acquisition of valid and compliant evidence, checking the accuracy of chosen accounting policies, and identifying and addressing any instances of income omission, concealment, or false recording.

By implementing these measures, enterprises can effectively manage the transition to digital accounting and ensure compliance with the new Accounting Law. This proactive approach will help maintain the integrity and efficiency of financial operations in the digital era.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Navigating China’s F&B Market: Key Growth Trends and Opportunities

- Next Article China-Thailand Economic Ties: Trade and Investment Opportunities