Registered Capital, Company Loans, and the Timely Repatriation of Profits for WFOEs in China

By Thibaut Minot

Associate, International Business Advisory, Dezan Shira & Associates

The Wholly Foreign-Owned Enterprise (WFOE) remains the most popular investment structure of foreign investors setting up a company in China. Early on in the process of incorporating a WFOE, investors are faced with the critical task of deciding how much Registered Capital to commit to their company. Because overcommitted funds may become idle and delay profit repatriation – and running out of working capital puts the WFOE at risk of insolvency – the careful planning of Registered Capital commitments is necessary. For investors looking for the right balance between under-commitment and over-commitment of Registered Capital, the ability to fall back on company loans offers welcome flexibility, and can help speed up the much anticipated process of profit repatriation.

In this article, we discuss some key points to consider when committing Registered Capital to a WFOE in China, and shed light on the role that company loans can play in facilitating this decision.

Injecting Registered Capital – A Statutory Requirement?

Historically, as part of the requirements when incorporating a WFOE, investors were expected to inject a minimum amount of capital into their company to fund its daily operations until self-sufficiency was attained. Under the new PRC Company Law, minimum Registered Capital requirements have been eliminated as of March 2014 and investors can now propose the amount of capital to inject. Further flexibility stems from the fact that investors may choose the period of contribution of Registered Capital. Accordingly, Registered Capital can be gradually injected over the life of the WFOE, which can be thirty years in most cases. Within the Articles of Association, the investor specifies a “capital contribution plan”, which lays out the different terms according to which Registered Capital will be injected.

Nevertheless, in practice the Ministry of Commerce (MOFCOM) will scrutinize investors’ proposed Registered Capital contribution, assessing whether the future WFOE will be of adequate financial strength in the initial period of establishment. As such, and depending on the district where the WFOE will be registered, investors may be required to submit a feasibility study explaining operations and cash flow, and justifying the amount of Registered Capital suggested. The amount of Registered Capital ultimately required would vary according to MOFCOM’s particular understanding of the company’s cash flow needs, with the benchmarks for Registered Capital differing based on MOFCOM’s internal standards for the region and the industry.

![]() RELATED: Corporate Establishment Services from Dezan Shira & Associates

RELATED: Corporate Establishment Services from Dezan Shira & Associates

Making the Decision

In effect, deciding how much Registered Capital to commit to is a crucial decision. On the one hand, investors may feel reluctant to over-commit, as excess capital may sit idle in a bank account that brings no returns. Additionally, when the time comes that the WFOE is cash-flow positive and the investor wants to repatriate profits, in most cases Registered Capital will have to have been fully injected into the WFOE before dividends can be issued. However, it is vital that the WFOE has sufficient Registered Capital to fund its growth during the first 3-5 years of its life, as Registered Capital becomes the company’s working capital and running out of it can jeopardize the business. It is true that increasing Registered Capital is one option available to mitigate the risk of a cash crunch if and when working capital runs out. However, while the injection of additional Registered Capital is a tax-free transaction, the complication presented is that such a method would require that the WFOE’s business license be amended and a number of formal governmental registrations be updated. The whole process can take between eight to twelve weeks, which is a long time to wait for a company that is running out of cash.

Using Company Loans for Optimal Capital Allocation

In this context, there is an interesting option for the investor concerned about over-committing Registered Capital yet conscious of the risks associated with injecting too few funds into the WFOE. The solution may be to resort to a company loan – an attractive option in a number of respects.

Different from the increase of Registered Capital, a company loan can be returned to the shareholder (or related party) in accordance with the terms indicated in the loan agreement. There is considerable flexibility in this regard, as the loan agreement can be amended pending the approval of the relevant authorities. As such, resorting to company loans can help shareholders inject monies into their WFOE at a relatively low level of risk. Moreover, the application procedures are comparatively simpler than that of the increase of Registered Capital. It is estimated to require four weeks to register the foreign loan agreement with the State Administration of Foreign Exchange (SAFE) and open a specific foreign loan account with the bank. This is two to three times less than the time it takes to increase Registered Capital.

There is significant leeway in terms of what qualifies as a foreign loan. Most commonly, WFOEs resort to a shareholder loan or to a loan granted by a related party, such as a company that is part of the same group as the parent. Yet the WFOE is also permitted to seek out a loan from a wider range of sources, such as loans from overseas governments, loans from overseas banks and financial institutions, loans from overseas enterprises, medium- or-long term bonds issued outside of China, nonresident foreign currency deposits, international financial leases, and other kinds of international commercial loans. The underlining consideration with these financing options is the willingness of the foreign creditor to lend funds to a Chinese company. Oftentimes, the parent company abroad will be asked to provide guarantees on the loan, and as such it may become more practical for the parent company to apply for the loan itself and then lend the money to the China-based entity.

![]() RELATED: Converting from an RO to a WFOE

RELATED: Converting from an RO to a WFOE

Determining What Portion of the Investment May Be a Loan

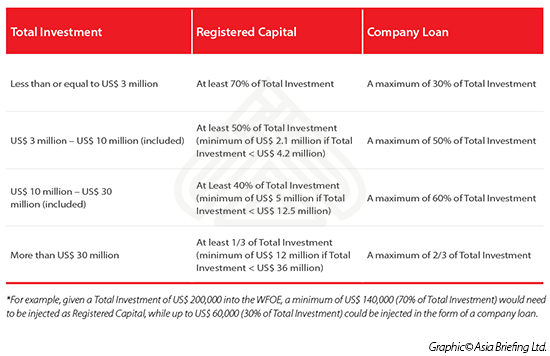

Together with Registered Capital, company loans constitute the Total Investment injected into the WFOE. Within the gap between Total Investment and Registered Capital, authorities allow for a capped loan amount to be arranged between the overseas creditor and the WFOE. The below table can be used as an example of utilizing company loans based on the statutory ratios between Registered Capital and Total Investment.

Readers can further explore the option of utilizing company loans using our online calculators.

Achieving Profitability and Repatriating Profits

Because of the difficulty to accurately foresee the amount of Registered Capital needed to fund and grow their business, investors may be faced with the need to resort to company loans at some point during the life of the WFOE. More important, however, is the role that company loans have to play in helping foreign investors work towards a common goal in China; making profit and repatriating those earnings abroad as soon as possible. Because company loans can effectively act as a substitute to some Registered Capital, they allow for a lower Registered Capital commitment and, as such, the earlier repatriation of profits. Indeed, as authorities will require that Registered Capital be injected before earnings are withdrawn, a lower Registered Capital commitment can mean the earlier completion of capital injection and thereby a timely repatriation of profits. This implication is often of particular significance, as the China WFOE is frequently just one component within a wider business organization, and earnings attained in China are commonly expected to flow elsewhere.

Discussing the issue of Registered Capital commitments with a financial advisor during the early stages of the WFOE incorporation process can allow investors to pinpoint the capital allocation strategy that works best towards the envisioned profit-making objectives. To arrange a free consultation with one of the experts at Dezan Shira & Associates, please email china@dezshira.com.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

An Introduction to Doing Business in China 2015

An Introduction to Doing Business in China 2015

Doing Business in China 2015 is designed to introduce the fundamentals of investing in China. Compiled by the professionals at Dezan Shira & Associates, this comprehensive guide is ideal not only for businesses looking to enter the Chinese market, but also for companies that already have a presence here and want to keep up-to-date with the most recent and relevant policy changes.

Establishing & Operating a Business in China 2016

Establishing & Operating a Business in China 2016, produced in collaboration with the experts at Dezan Shira & Associates, explores the establishment procedures and related considerations of the Representative Office (RO), and two types of Limited Liability Companies: the Wholly Foreign-owned Enterprise (WFOE) and the Sino-foreign Joint Venture (JV). The guide also includes issues specific to Hong Kong and Singapore holding companies, and details how foreign investors can close a foreign-invested enterprise smoothly in China.

Tax, Accounting, and Audit in China 2016

Tax, Accounting, and Audit in China 2016

This edition of Tax, Accounting, and Audit in China, updated for 2016, offers a comprehensive overview of the major taxes that foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China-based operations.

- Previous Article China Regulatory Brief: New Safety Standards for Cosmetics & Shanghai Wage Payment Measures

- Next Article Knowledge is Power: Understanding the Education Market in China