Granting Restricted Stock Units to Your Employees in China

By Jake Liddle and James Zheng, Senior Tax Specialist at Dezan Shira & Associates

A restricted stock unit (RSU) is a form of compensation offered by an employer to an employee in the form of company stock. These are bestowed to an employee over a set period of time according to a planned schedule, usually based on performance or time milestones. An employer will choose RSUs over monetary bonuses for many reasons, including lower tax rates, incentives for an employee to stay with the company, and to encourage better performance from employees interested in obtaining such shares.

In China, failure to follow the country’s strict regulations related to RSUs can in fact result in a tax hike for employees. In order for their employees to be granted a preferential tax rate, employers must go through the application and registration procedures with the tax bureau and the China Securities Regulatory Commission (CSRC) before they grant RSUs.

Eligibility and Requirements

To enjoy the preferential IIT tax plan on RSU income, the following requirements must be met:

- Plans must be implemented by a public listed company (pre-IPO plans do not apply);

- A public listed company must hold at least a 30 percent interest in the shares of the individual’s employer;

- The plan must meet all the reporting and registration requirements.

Importantly, the preferential rate is not exclusive to Chinese nationals; foreign employees are also eligible.

RELATED: Tax and Compliance Services from Dezan Shira & Associates

RELATED: Tax and Compliance Services from Dezan Shira & Associates

Application Procedure

In addition to submitting materials to the relevant tax authorities, listed companies have to follow the below registration procedures :

- Share the RSU scheme or implementation scheme of the enterprise;

- Register the stocks with China Securities Depository and Clearing Corporation Limited (or overseas securities depository and custody institution) and, within 15 days of announcement, submit its restricted stock plan or execution plan, agreement, authorization notice, date of stock registration and the closing price on the current day (lockup period). You must also name a list of people to whom the equity incentives are granted, and other materials to the competent tax authority for archival purposes;

- Domestic companies listed abroad must submit materials relevant to the equity incentive plan to the relevant tax authority.

Importance of Registration

If the company fails to register their RSU plan in proper fashion with the tax bureau, the preferential tax computation methods will not apply to the income from equity incentives. Additionally, income from RSUs which fail to meet the required registration standards will be directly added to the income of the current month and will be subject to IIT.

IIT Calculation Method

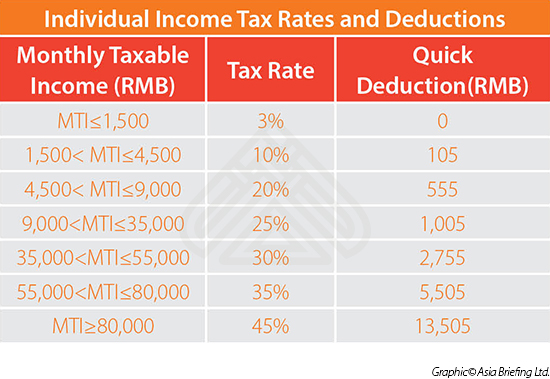

According to the Guoshuihan No. 461 [2009] and the Caishui (2005) No. 35, employers can calculate the IIT levied on income deriving from equity incentives based on the following calculation method:

IIT liability = {(Taxable income from the equity incentives/Months of income (limited to 12) x Applicable IIT Rate – Quick Deduction} x Months of income (limited to 12)

Note:

- “Months of income” refers to the number of months in which the employee has worked in PRC to derive the income from wages and salaries sourced in PRC in the form of equity incentives;

- Equity incentive benefits attributable to employment services rendered outside of China are not taxable for non-domicile citizens.

The applicable tax rate and quick deduction amount can be found in the table below:

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Tax, Accounting, and Audit in China 2015

Tax, Accounting, and Audit in China 2015

This edition of Tax, Accounting, and Audit in China, updated for 2015, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

Annual Audit and Compliance in China 2016

Annual Audit and Compliance in China 2016

In this issue of China Briefing, we provide a comprehensive analysis of the various annual compliance procedures that foreign invested enterprises in China will have to follow, including wholly-foreign owned enterprises, joint ventures, foreign-invested commercial enterprises, and representative offices. We include a step-by-step guide to these procedures, list out the annual compliance timeline, detail the latest changes to China’s standards, and finally explain why China’s audit should be started as early as possible.

Managing Your Accounting and Bookkeeping in China

Managing Your Accounting and Bookkeeping in China

In this issue of China Briefing, we discuss the difference between the International Financial Reporting Standards, and the accounting standards mandated by China’s Ministry of Finance. We also pay special attention to the role of foreign currency in accounting, both in remitting funds, and conversion. In an interview with Jenny Liao, Dezan Shira & Associates’ Senior Manager of Corporate Accounting Services in Shanghai, we outline some of the pros and cons of outsourcing one’s accounting function.

- Previous Article The Annual Audit Compliance Process for FIEs in China

- Next Article Transfer Pricing in China – New Report from Dezan Shira & Associates