Navigating Restrictions in China’s Film Industry

By Dezan Shira & Associates

Editors: Zhou Qian and Matthew Zito

China’s film industry represents one of the country’s most lucrative sub-sectors in its entertainment industry, yet a complex system of FDI prohibitions and restrictions, in addition to annual import quotas on foreign films, make the industry particularly fraught for market entry. Here we disentangle some of these issues.

Film Distribution and Movie Theaters

According to the 2011 Catalogue, foreign investors are prohibited from investing in film distribution companies and theater line companies, and the opinion-seeking draft of the 2014 Catalogue contained no change in this regard; nor were these industries liberalized by the most recent Negative List for the Shanghai Free Trade Zone. However, the construction and operation of movie theaters does permit foreign investment within certain limits.

While at present wholly-foreign owned cinemas remain prohibited (except for investment from Hong Kong and Macau), joint ventures with a Chinese party as controlling shareholder are permitted both within and without the Shanghai Free Trade Zone. Even this condition is dropped in a handful of pilot cities (Beijing, Chengdu, Guangzhou, Nanjing, Shanghai, Wuhan, Xi’an), where the proportion of registered capital invested by foreign partners is capped at 75 percent.

Additional requirements are as follows:

- Registered capital must not be below RMB 6 million;

- Having permanent business premises for screening films;

- The equity or cooperative joint venture term shall not exceed 30 years;

![]() RELATED: Business Advisory Services from Dezan Shira & Associates

RELATED: Business Advisory Services from Dezan Shira & Associates

Foreign Film Quotas

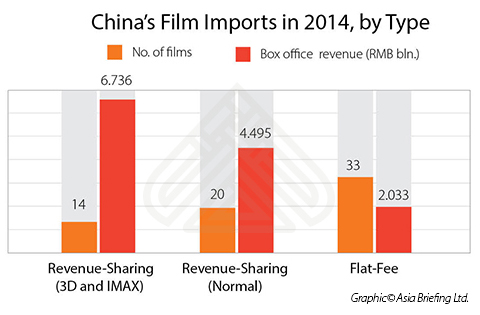

There are two types of annual quotas regulating imports of foreign films into China: a revenue-sharing quota and a flat-fee quota. A revenue-sharing film remits a set percentage of its revenue from the Chinese box office to the foreign production studio. This percentage has historically been significantly lower than similar arrangements in other countries – currently capped at 25 in China versus 50 percent in European markets. Since 1994, the size of the revenue-sharing quota has gradually expanded from 10 films annually, to 20, to 34 following the US-China Film Agreement of 2012 (with the latest expansion reserved specifically for 3D and IMAX movies).

Under the second quota, the “flat-fee quota”, a Chinese distributor (i.e. China Film Group or Huaxia Film Distribution) pays up-front a lump sum figure for a film and does not remit any box office receipts to the producing studio. Generally speaking, high-grossing blockbusters win revenue-sharing slots while lower-profile films from smaller studios or with more limited releases are allocated flat-fee slots. Annually, there are around 30-40 films imported into China this way.

One thing to be noted is that, though flat-fee slots are roughly equal to the number of revenue-sharing movies, flat-fee films comprise a virtually insignificant percentage of the Chinese market share: in 2014, revenue for the 20 “normal” revenue-sharing films and 14 “enhanced” revenue-sharing films was RMB 6.736 billion and 4.495 billion respectively, while revenue for the 33 flat-fee films was only RMB 2.033 billion in total.

In addition, there are several ways that foreign films commonly circumvent the film quotas and the FDI restrictions on the Chinese film industry noted above. These include:

- Co-productions, which has been the growth axis of the past couple of years

- Imports for TV, especially CCTV’s movie channel CCTV-6

- Imports for online video, currently unlimited in number

Censorship

China has no motion picture rating system, and films must therefore be deemed suitable by Chinese censors for all audiences in order to be shown in the country. Officially, the censorship system is designed to promote Confucian morality, political stability and social harmony. Films must be submitted to the State Administration of Press, Publication, Radio, Film and Television (SARFT) for censorship prior to being cleared for import into China. This entails a three-step process:

- The filmmakers submit their screenplay or finished film to the Censorship Board for review. The board has 30 days to offer a response, but often takes longer to do so;

- SARFT then offers comments, and often suggestions, for altering the film to meet censorship requirements. The filmmakers are given the opportunity to make modifications to comply with any requested changes;

- The script or film is re-submitted to SARFT for review of the changes and an approval decision.

If the filmmakers object to the results of the review process, they can apply for an additional review within 30 days;

Films are prohibited from containing the following contents, as stipulated in Article 25 of the Film Regulations:

- Opposing the fundamental principles laid down in the Constitution of the P.R.C.;

- Jeopardizing the unification, sovereignty and territorial integrity of the State;

- Divulging State secrets, jeopardizing the security of the State, or impairing the prestige and interests of the State;

- Inciting hatred and discrimination among ethnic groups, harming their unity, or violating their customs and habits;

- Propagating cults and superstition;

- Disrupting public order and undermining social stability;

- Propagating obscenity, gambling or violence, or abetting to commit crimes;

- Insulting or slandering others, or infringing upon the legitimate rights and interests of others;

- Jeopardizing social ethics or fine national cultural traditions.

![]() RELATED: Investing in China’s Entertainment and Media Market

RELATED: Investing in China’s Entertainment and Media Market

Film Industry Tax Incentives

As part of its “soft power” push, the Chinese government has implemented a series of tax incentives that specifically seek to promote the domestic film industry, listed as:

Notice on Economic Policies to Support the Development of the Industry (Cai Jiao [2014] No. 56)

- From 1 January 2014 to 31 December 2018, value-added tax is exempt on income derived by filmmakers on the sale of films (including digital versions) and copyright transfers; income derived for film distribution; and income derived for screening films in rural areas.

- For film-screening services provided in urban areas by general VAT taxpayers, a simplified calculation method can be adopted according to current policies.

Circular on Several Issues Concerning Tax Policies for Continuously Supporting the Development of Cultural Enterprises (Cai Shui [2014] No.85)

- Corporate income tax for film enterprises recognized as high-tech enterprises shall be levied at a reduced rate of 15 percent. Expenses incurred by cultural enterprises within the development of film-related new technologies, products and processes may be deductible from the enterprise’s tax owing.

- VAT shall be exempt on film production, distribution and screening services provided outside of China.

- VAT export rebates may be granted on the export of completed films according to relevant provisions.

- Import duties may be exempted on equipment, parts, assembled goods and replacement items that cannot be produced in China and for self-use in the production of major cultural products.

|

|

![]()

China Investment Roadmap: The Medical Device Industry

China Investment Roadmap: The Medical Device Industry

In this issue of China Briefing, we present a roadmap for investing in China’s medical device industry, from initial market research, to establishing a manufacturing or trading company in China, to obtaining the licenses needed to make or distribute your products. With our specialized knowledge and experience in the medical industry, Dezan Shira & Associates can help you to newly establish or grow your operations in China and beyond.

Double Taxation Avoidance in China: A Business Intelligence Primer

Double Taxation Avoidance in China: A Business Intelligence Primer

In our twenty-two years of experience in facilitating foreign investment into Asia, Dezan Shira & Associates has witnessed first-hand the development of China’s double taxation avoidance mechanism and established an extensive library of resources for helping foreign investors obtain DTA benefits. In this issue of China Briefing Magazine, we are proud to present the distillation of this knowledge in the form of a business intelligence primer to DTAs in China.

Strategies for Repatriating Profits from China

Strategies for Repatriating Profits from China

In this issue of China Briefing, we guide you through the different channels for repatriating profits, including via intercompany expenses (i.e., charging service fees and royalties to the Chinese subsidiary) and loans. We also cover the requirements and procedures for repatriating dividends, as well as how to take advantage of lowered tax rates under double tax avoidance treaties.

- Previous Article Investing in China’s Private Equity and Hedge Funds

- Next Article Labor Dispute Management in China – New Issue of China Briefing Magazine