A Step by Step Guide to Remitting Dividends Overseas

A key aspect of doing business in China is sending dividends to the overseas parent company. However, due to the capital controls China has in place, companies must go through several procedures before being able to send the funds abroad.

Step 1: Annual audit

Every year, companies in China must undergo the annual audit, during which companies must submit a number of documents and reports to various government agencies to show compliance. The precise documentation required varies per city. Companies need to be audited by an external accounting firm, which approves the company’s financial reports. A company may not issue a dividend before having passed the annual audit.

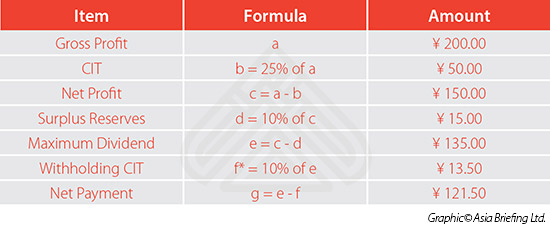

Step 2: Tax payment and calculation of net profits

The annual audit also ensures the company has fully met its tax obligations, including corporate income tax (CIT), value-added tax (VAT) and business tax (BT), if applicable. Without having first paid all outstanding taxes, a dividend issuance will not be approved.

After having paid tax, there are still several conditions that need to be met before dividends can be issued:

- Companies that plan to issue dividends need to make sure their losses in the previous years have been made up.

- If the balance is positive, the company will need to keep 10 percent of its after-tax profits as a statutory reserve. Companies need to do this until the reserve has reach 50 percent of registered capital.

- A company may only issue dividends if it is on schedule with registered capital injections.

Step 3: Board Resolution

Step 3: Board Resolution

Under the China’s Company Law, the board of directors or the executive directors of a company are responsible for decisions relating to profits distribution. Its shareholders have the power to examine and approve the board’s decision. The articles of association of a company often outline the way such a decision is to be made in further detail.

Step 4: Applying for preferential tax rate under the Double Tax Agreement

When dividends are remitted abroad, the company receiving them is subject to dividend tax. The tax is to be withheld by the company issuing the dividends.

![]() RELATED: Offshore Status of Hong Kong Companies

RELATED: Offshore Status of Hong Kong Companies

These days, China has tax treaties with most countries in the world. Depending on the tax treaty, there may be a preferential lower dividend tax rate. However, the company will have to apply for such special treatment with the tax bureau.

Note preferential treatment is not automatically granted. The tax bureau will consider whether the company receiving the dividends is the ‘beneficial owner’ of these.

Factors that may deny the company beneficial ownership status include:

- Obligations of the recipient to distribute over 60 percent of its income within twelve months

- The recipient having little or no business activities other than holding property or rights

- Assets, scale of operations and staff being relatively small

- The recipient having little or no control over the disposal of income and bearing little to no risk

- The jurisdiction in which the recipient is incorporated levies little or no tax on dividends

Step 5: Obtain Approval from State Administration of Foreign Exchange

The State Administration of Foreign Exchange (SAFE), under the supervision of the Central Bank of China, controls all foreign exchange transactions into and out of China. While previously, the investor would have to apply separately with SAFE for approval to remit dividends, as of June 30, 2015 this is now handled by eligible banks. The investor can simply go to the bank and make the transaction without having to go through SAFE first.

Step 6: Remit dividends

After the above steps have been completed, the company can wire the funds abroad.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Tax, Accounting, and Audit in China 2015

Tax, Accounting, and Audit in China 2015

This edition of Tax, Accounting, and Audit in China, updated for 2015, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

An Introduction to Doing Business in China 2015

An Introduction to Doing Business in China 2015

Doing Business in China 2015 is designed to introduce the fundamentals of investing in China. Compiled by the professionals at Dezan Shira & Associates, this comprehensive guide is ideal not only for businesses looking to enter the Chinese market, but also for companies that already have a presence here and want to keep up-to-date with the most recent and relevant policy changes.

Strategies for Repatriating Profits from China

Strategies for Repatriating Profits from China

In this issue of China Briefing, we guide you through the different channels for repatriating profits, including via intercompany expenses (i.e., charging service fees and royalties to the Chinese subsidiary) and loans. We also cover the requirements and procedures for repatriating dividends, as well as how to take advantage of lowered tax rates under double tax avoidance treaties.

- Previous Article Options Available when Restructuring a China Business

- Next Article China’s VAT Reform Moving Forward