Obtaining Land-Use Rights for FIEs in China

SHANGHAI – Order No. 55, disseminated by China’s State Council in 1990 (“Order 55”), allows foreign investors to acquire land-use rights for business operations. However, China employs highly rigid rules and administrative control over the grant or transfer of land-use rights, and any change of the title or purpose of the land-use rights requires legal procedures to be carried out with government authorities. The Ministry of Land and Resources (MLR) and its local Land and Resource Bureaus (LRB) oversees land use registration and alterations. Nevertheless, all individuals or entities must utilize the land strictly in compliance with the general plan of land usage formulated by the state and local government.

Individuals and non-governmental entities in China cannot obtain land ownership, but instead must exercise land-use rights for a specified term through an up-front payment of land-use premiums. The Land Administration Law of China explicitly stipulates that all urban land in China is owned by the state (“state-owned land”), and the suburban and country areas are either owned by the state or rural collectives (“collective land”). For construction purpose, such as building manufacturing plants, warehouses, or infrastructures, individuals or entities must apply for state-owned land.

Land Registration

In China, the establishment or alteration of land-use rights requires registration with the government. According to the Property Law of China, land-use rights may only be established upon successful registration with the land administration authority, which is usually the local LRB. After the registration, the LRB will issue a land-use rights certificate to the land user as a token of title.

For a start-up FIE, the general procedure for acquiring the land-use rights certificate is to first apply for a Certificate of Approval at the Ministry of Commerce (MOFCOM) or local MOFCOM office, depending on the size and industry of the potential company. Within 30 days after obtaining the Certificate of Approval, the foreign company will need to complete the business registration process at the Administration of Industry and Commerce (AIC) to obtain a business license.

If the FIE already has a contract for obtaining the land-use rights at the moment, they should apply for the land-use rights certificate at the local LRB within 30 days following the issuance of the business license by the AIC. The Certificate of Approval and the business license will be reviewed by the local LRB before they issue the land-use rights certificate.

Acquiring Land-Use Rights

Generally, there are two ways for foreign investors to acquire land-use rights in China – directly from the government or from existing land users in the market. According to Order 55, land-use rights can be granted or allocated by the government. The rights can also be transferred, leased, or pledged by a land user who legally obtained the land-use rights from the government.

Grant of Land-Use Rights

Foreign investors can access government-granted land-use rights through agreement arrangements with the government or through a bidding and auction process. By signing a contract with the government (usually with the LRB at the municipal level), foreign investors will be granted land-use rights over a specified plot of state-owned land for a fixed period.

There are maximum terms defined for granted land-use rights based on the proposed usage of the land. For residential estates, the maximum term is 70 years. For land of industrial, educational, scientific and technological, cultural, health, sports, comprehensive or other uses, the maximum grant should be no longer than 50 years. For land of commercial, tourist and recreational uses, the maximum term is 40 years.

RELATED: Office Premise Requirements for WFOE, FICE and RO Registration in China

The land-use rights premium should be paid as a lump sum within 60 days following the conclusion of the signing of the contract. The land-use rights certificate should be obtained upon land registration within 30 days after the premium has been fully paid.

Land-use rights granted by the government are allowed to be transferred, leased, or pledged. However, these activities are still bound by the grant contract signed with the government, and government approvals should be obtained for any proposed changes in the land’s purpose, the grant period, or the land development plans. In these cases, a new government grant contract might be necessary.

Allocation of Land-Use Rights

Order 55 allows the gratuitous allocation of land-use rights by the government for the purpose of:

- Government agencies and military bases;

- Urban infrastructure and public interest;

- Energy, transportation and water irrigation infrastructures particularly supported by the state; or

- Other uses legally allowed.

Despite this free lunch, the downside of such an arrangement is that the government can retrieve the land-use rights anytime without giving any compensation. The other downside is that land-use rights allocated by the government are generally not allowed to be transferred, leased, or pledged unless permission has been granted by both the local LRB and property administration authority with the following conditions being fulfilled:

- The land user is a company, enterprise, other economic organization, or individual;

- The land user has obtained a land-use rights certificate;

- The land user owns the property ownership certificate for the buildings and other; attachments established on the land;

- A contract for granting the land-use rights has been signed between the land user; and the government and the land use premium has been paid in full.

Furthermore, although there is no fee for acquiring the allocated land-use rights, foreign investors still need to pay a yearly site use fee based on the acreage, usage, and location of the land. The rate for the site use fee varies from region to region, usually ranging from RMB5 to RMB300 per square meter.

Transfer of Land-Use Rights

Land-use rights originally obtained through a government grant are allowed to be transferred, which means foreign investors can purchase land-use rights from other land users in the market.

The Urban Real Estate Administration Law of China provides that land-use rights acquired through a government grant can be transferred if the following conditions have been fulfilled:

- The land-use rights’ premium has been paid in full and the land-use rights certificate has been obtained;

- The land must be used for the purpose agreed in the grant contract, and if the land is agreed to be used for housing construction, 25 percent of the project must be accomplished before the transfer.

The ownership of the buildings and other attachments built on the land must be transferred along with the land-use rights and vice versa. Hence, if there is housing construction that has been completed upon the transfer of the land-use rights, a Property Ownership Certificate should also have been obtained. Registration of transfer should be completed at the land administration and housing administration authorities.

RELATED: Regulations and Restrictions on Foreign Real Estate Property Purchases in China

Nevertheless, the land-use rights being transferred are still bound by the agreed upon terms in the initial government grant contract. This means the valid period of the transferred land-use rights should be less than the time calculated by deducting the period that has been used by the transferor from the fixed period designated in the initial government grant contract.

If the price of transfer is evidently lower than the market price, the local government will have the preemptive right to purchase the land-use rights. The local government may also intervene when the market price for the transfer of land-use rights is experiencing unreasonable inflation.

Lease of Land-Use Rights

Although the leasing of land-use rights to foreign investors directly from the state for construction purposes is allowed by some local governments, it is not usual and only on a trial basis in some areas in China. It is more common for foreign investors to lease land-use rights from Chinese domestic companies who have been granted land-use rights from the government.

In order to lease land-use rights, Order 55 stipulates that the foreign investor must use the land for the purposes agreed to in the original grant contract. Furthermore, the landlord should continue to perform the provisions stipulated in the government grant contract during the lease.

Registration of the newly-leased land-use rights must also be carried out at the land administration authority.

Pledge of Land-Use Rights

Land-use rights are allowed to be pledged. When the land-use rights are pledged, the buildings and other attachments on the land should be pledged altogether and vice versa. Registration of the land pledge is essential for the establishment of the creditor’s right on the collateral. If the creditor obtained the land-use rights due to the insolvency of the pledger, registration of the land-use rights transfer is also required.

Capital contribution

China’s Company Law allows land-use rights to be contributed as Shareholders’ capital as long as the land-use rights have gone through asset appraisal.

It is quite common for Chinese parties to contribute the land-use rights they own to establish a joint venture with foreign investors in China. Because using land-use rights as a capital contribution results in the transference of those rights, the rules on land-use rights transfer apply and all attachments built on the land will be transferred to the new company.

Land Appreciation Tax

Land appreciation tax is paid by enterprises, units, individual household businesses and other individuals who receive income from the transfer of state-owned land-use rights, buildings and attached facilities. The tax is based on the amount of appreciation, i.e., the balance of the proceeds received by the taxpayer on the transfer of real estate after deducting a sum of deductible items.

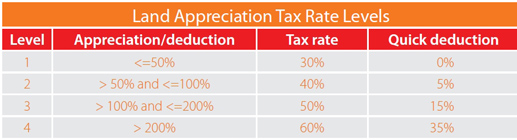

Based on the percentage of the appreciation amount over the sum of the deductible items, the tax is levied progressively according to a four-level tax rate schedule (see accompanying “Land Appreciate Tax Rate Levels” chart):

Tax payable = (Appreciation amount × Tax rate) – (Sum of deductible items × Quick deduction)

Land Use Tax

All land users, including those who obtain land-use rights through government allocation, are subject to the yearly land use tax. According to the Interim Regulation of Urban Land Use Tax, recently updated in December 2013, the land use tax is collected based on the actual acreage of the land being used. The tax rates per square meter range from RMB0.6 to RMB30 depending on the urban population of the city. For example, in Shanghai, the tax rate is RMB30 for land users in the downtown area, while the rate drops to RMB1.5 for land users in the suburban areas of Shanghai.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

China Looking Forward – Road Bumps Ahead

China Clarifies Urban Land Use Tax and Real Estate Tax Issues

Comparison: Prime ‘Grade A’ Office Rental Prices in China

Cities Across China Tighten Control Over Real Estate Market

A Guide to China’s Property Land Bank

- Previous Article China Briefing 2014 China Law & Tax Publications

- Next Article China to Lower Incorporation Requirements