China’s Film Industry: Strategic Opportunities

By Roy McCall

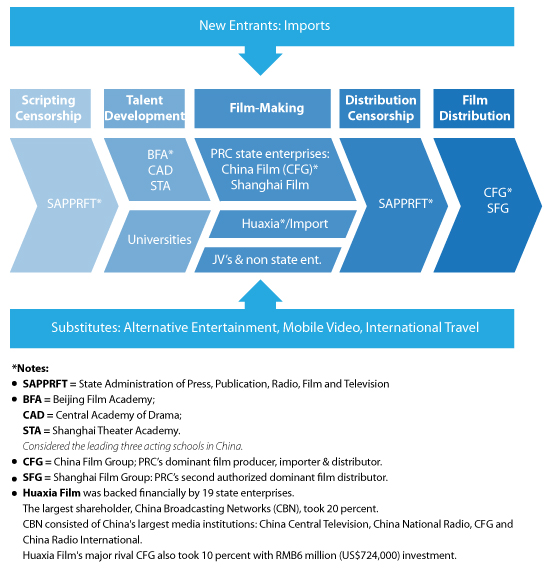

So you would like to invest in China’s film industry? Does the competitive landscape offer opportunities to the strategic investor? Here’s a view of the China film value chain:

So how would a foreign film find its way into China? The PRC has historically imposed strict regulations on foreign film imports and investments. Over the past decade, it has also cautiously relaxed its grip. In February 2013, the government increased the film import quota to 34 films per year from 20, and allowed a 25 percent box-office split – up from 13 percent. However, China retained exclusive distribution rights on imported films through two state-owned enterprises, CFG and Huaxia Film Distribution.

In addition to selective imports, foreign companies have been permitted to engage in film-making through joint ventures and minority stakes in Chinese companies, in which case foreign firms may not own over 49 percent of a Chinese company.

Co-production has been an alternative for circumventing import quotas, and for collecting a higher percentage of box office receipts (38 percent) compared to imports (25 percent). Foreign investors have not been allowed to take advantage of co-production as a means of import circumvention, except as minority stakeholders.

Hong Kong co-productions – circumventing imports – faired well under the cover of restricted imports. However, foreign investors using Hong Kong as a base have not been able to take advantage of the imported film quota exception, except as a minority investor.

To invest directly in China’s film industry has been to miss a related growth story in theater construction and operation. To find growth unimpeded by censorship and state collusion in distribution, IMAX has demonstrated a way through theater development.

Foreign ownership of Chinese cinemas was previously allowed up to 75 percent in seven pilot cities: Beijing, Shanghai, Guangzhou, Chengdu, Nanjing, Xian and Wuhan. Now, however, foreign ownership of newly established cinemas throughout China is relegated to minority stakes, while Hong Kong companies are allowed 100 percent ownership.

Beyond box office revenue, film studios’ intellectual property has continued to generate revenues through various distribution media outlets. In the U.S. and Canada, four-fifths of film studio returns are earned beyond theaters through home and mobile video, pay per view, premium view, cable, and especially TV syndication. A US$10 billion box office market became a US$50 billion movie entertainment market.

In China’s case, post theater distribution revenues were a multiple of box office revenues. Oxford Economics estimated that recent direct contribution of free TV in China was RMB 46.18 billion (US$7.6 billion), cable RMB21.48 billion (US$3.5 billion), satellite RMB24.12 billion (US$3.98 billion) and home video’s direct contribution RMB0.35 billion (US$0.06 billion). In aggregate, the post theater box office market approximated US$16 billion, or over five times the box office receipts in China. Home video piracy represented one problem area retarding even more post theater returns.

China’s film industry has generated winners and losers. China has not relinquished control over film distribution, which has benefited the spillover imports of MPAA blockbusters, and the co-productions that have filled the middle ground between the imported blockbusters and local films. As for losers, distribution controls have hindered the lower budget independent film makers.

What are the prospects for foreign investors who wish to participate in China’s film growth? While the growth story is tremendously positive, distribution has been highly concentrated – both a problem and opportunity. Managing it (through film co-production as a minority shareholder) or avoiding it (by cinema development) has been critical to profitable growth.

Roy McCall (HBS MBA 1984) is a CPA (1989), and CFA (2001). He was invited by China’s Ministry of Education to teach MBA classes at Nankai University and in 1998 became the first instructor to place a proprietary text on-line for students at Peking University. He compiles cases on Chinese firms, including those in the media industry, when not consulting on performance improvement. His grandparents came to China in 1917, where his mother was born & raised. Roy has lived in Asia for three decades.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Top 10 Chinese Films for the Chinese New Year

China Agrees to Further Open Entertainment Market to U.S.

China Releases 12th Five-Year Plan for Animation Industry

China’s Wanda Group Acquires U.S. AMC to Boost Global Exposure

- Previous Article Understanding China’s Free Trade Agreements

- Next Article Understanding China’s Double Tax Agreements