China Signs 45 Billion Euro Currency Swap Deal with EU

Oct. 15 – On October 9, a bilateral currency swap agreement (BCSA) was signed between the People’s Bank of China (PBOC) and the European Central Bank (ECB). The agreement is valid for three years and could be extended based on further consensus. The swap line signifies a maximum size of RMB350 billion or 45 billion euros (about US$57 billion), which will be used in supporting trade and other exchanges between China and the European Union (EU).

“The swap arrangement has been established in the context of rapidly growing bilateral trade and investment between the euro area and China, as well as the need to ensure the stability of financial markets,” according to the ECB.

A relevant source from the PBOC commented that the BCSA could offer further liquidity to the RMB markets in the Eurozone, encourage the use of RMB in foreign markets, provide more convenience in trade and investment between the EU and China, and also strengthen precautionary measures for a potential financial crisis. The conclusion of the arrangement is also another big step for RMB internationalization.

“It is quite significant that the PBOC signed a currency swap agreement with the second largest monetary authority,” said Zong Liang, deputy head of the Institute of International Finance for one of the country’s largest state-owned banks – Bank of China. He explains that it shows that the status of the RMB has been recognized globally, which will at the same time benefit the diversification of the international monetary system.

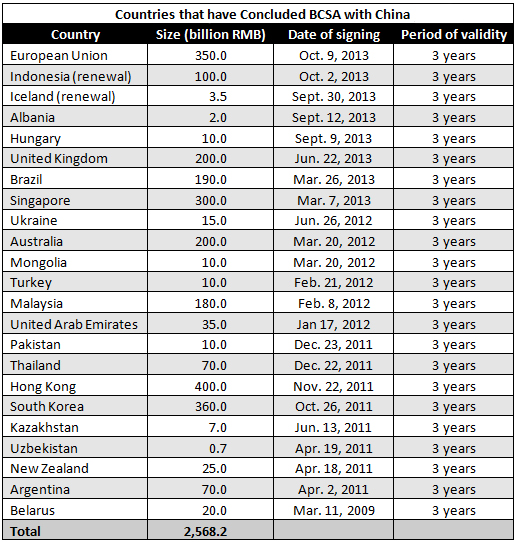

Before their agreement with the ECB, China has concluded bilateral currency swap agreements with 22 other countries or territories of the size of more than RMB2.2 trillion (about US$360 billion). Except for the U.S. Federal Reserve, most of the world’s influential central banks have agreed to currency swaps with China, including the ECB, Bank of England and Bank of Japan, and London has become a leading offshore RMB trading center outside of China.

A report by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) indicates that the current global market share of RMB has reached 1.49 percent with a growth rate of 113 percent from January 2012 to August 2013. Currently, the U.S. dollar is still the most popular currency in the world, which constitutes about 40 percent of the world’s currency trade volume. The euro ranks as the second most popular and accounts for 17 percent.

SWIFT also declared on Tuesday that the RMB had become the eighth most traded currency in the world, up from 17th in 2010 and more than tripling in exchange volume over that period.

“If China’s aim is to make the renminbi an international currency of choice, this is a good start,” said Michael Moore, a professor of finance at Warwick Business School in the United Kingdom.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Who in Asia Can Afford a U.S. Default?

PBOC Simplifies Cross-Border RMB Transactions

Singapore Launches RMB Clearing Service

People’s Bank of China to Facilitate RMB Exchange in London

China-Singapore Sign RMB Cooperation Deals

China & Singapore Implement Mutual Recognition Arrangement Program

Report: RMB to be a Globally Traded Currency by 2015

Chinese Currency Controls and the Liberalization of the Renminbi

HSBC Holds First Offshore ‘Dim Sum’ Bond Offering in London

China Allows Companies to Settle Trade in RMB

China Takes Further Steps Towards Internationalizing the Renminbi

- Previous Article China Clarifies Recognition of Resident Enterprises Under Hong Kong DTA

- Next Article New Calls for Shanghai International Stock Exchange